44m agoThu 15 Jan 2026 at 9:36pmUpdate

Market snapshot

ASX 200 futures: +0.1%

Australian dollar: +0.2% to 69.97 US centsWall Street: Dow Jones (+0.6%), S&P 500 (+0.3%) Nasdaq (+0.3%)Europe: FTSE (+0.5%) DAX (+0.3%) Spot gold: -0.4% to $US4,618/ounceOil (Brent crude): -4.1% at $US63.80/barrelBitcoin: -2.2% to $US95,425

Price current around 8:30am AEDT

Live updates on the major ASX indices:

6m agoThu 15 Jan 2026 at 10:13pm

Coles and Woolworths suppliers accused of tax fraud

“Heartbroken” workers at a company that supplies Coles and Woolworths say they have not been paid for 100 hours of work they did in the 2023 pre-Christmas rush.

Liquidators are investigating large cash withdrawals from the group of companies and allege systemic tax fraud.

You can watch the story from our very own, Ben Butler.

Loading…

39m agoThu 15 Jan 2026 at 9:40pm

Oil prices dive as traders reassess Iran

Oil prices settled down around 4% overnight, ending a five-day streak of gains.

Prices dropped after US President Donald Trump said the crackdown on protesters in Iran was easing, allaying concerns over potential military action against Iran and oil supply disruptions.

The comments reduced the risk premium that had built up in recent days, analysts said. On Wednesday, Brent reached a high of $US66.82, its highest since September.

“We went from a high likelihood that Trump was going to hit Iran to a low likelihood, and that is the bulk of the downward pressure today on prices,” said Phil Flynn, senior analyst with Price Futures Group.

Further weighing on prices, US crude and gasoline inventories rose last week by more than analysts had estimated, the Energy Information Administration said on Wednesday.

Reporting by Reuters.

1h agoThu 15 Jan 2026 at 9:12pm

US, Taiwan strike ‘massive’ semiconductor deal

More on that AI chip deal we mentioned earlier.

The US and Taiwan have a reached a trade deal the US Commerce Department says will drive a “massive reshoring of America’s semiconductor sector”.

Under the deal, the US reciprocal tariff rate on Taiwanese goods would be capped at 15%, according to the Commerce Department.

The US will also apply a zero percent tariff for generic pharmaceuticals and their ingredients, aircraft components and “unavailable natural resources”.

Taiwanese semiconductor and technology companies will also make investments totalling at least $250 billion to increase production in the United States, according to a fact sheet.

Reporting by Reuters.

1h agoThu 15 Jan 2026 at 8:58pm

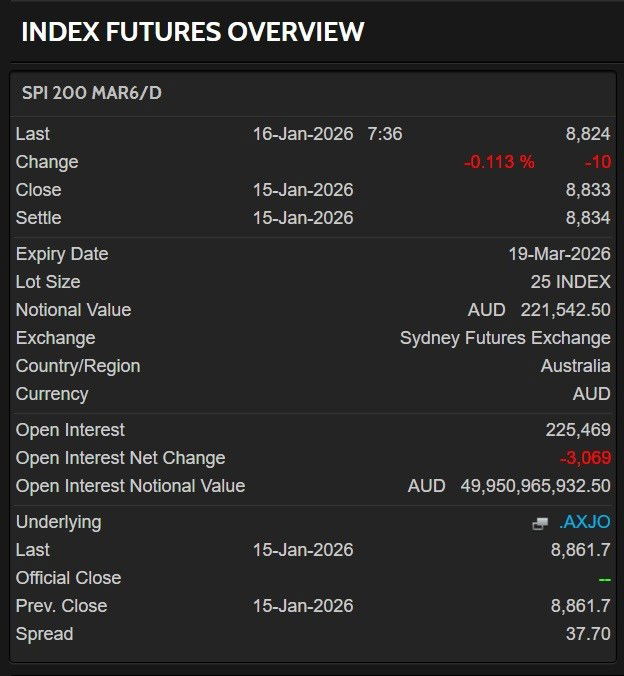

ASX expected to trade down on Friday

ASX futures are currently showing a slight touch of negativity, despite Wall Street trading a little higher overnight. Currently, traders are pricing in about a 0.1% loss on the ASX 200.

(Refinitiv)1h agoThu 15 Jan 2026 at 8:55pmAussie dollar nears 67 US cents on rate expectations

(Refinitiv)1h agoThu 15 Jan 2026 at 8:55pmAussie dollar nears 67 US cents on rate expectations

The Australian dollar is almost touching US 67 cents again. The local currency is currently at 66.97 US cents (so close!) with a 0.25% gain.

CBA’s currency analysts have just put out their morning note. Firstly, They think currency traders reacting to “lower expected market volatility, as measured by the VIX index, is a positive for AUD/USD”.

There’s also a bit going on with data and rate expectations for both the US and Australian economies.

Fresh data’s just come out in the US, which CBA notes might support a more “dovish” rate agenda on the horizon, or less need to raise interest rates or keep them higher. Markets generally bet down on a currency if they wind back rate hike expectations. Or as CBA explains it: “A dovish repricing of FOMC policy can weigh on the USD.”

Meanwhile, Australia’s economists are anticipating fresh data out here in coming weeks, ahead of the RBA’s next rate meeting in early February. The quarterly inflation data will be especially closely watched, along with the labour force survey.

“Both data releases can lead to a hawkish repricing of RBA policy and support AUD/USD. We continue to expect a 25bp rate hike from the Reserve Bank of Australia (RBA) in February,” CBA notes.

So there you go!

1h agoThu 15 Jan 2026 at 8:38pm

Taiwan chip maker helps push up Wall Street

Wall Street has rallied again overnight after several days of losses, with the tech-heavy Nasdaq up around 0.3%.

One of the big performers was the world’s main producer of advanced artificial intelligence chips, Taiwan-based TSMC, which is listed in the US and gained 5.1% on its latest results.

Meanwhile, in more chips news, the US and Taiwan have a reached a trade deal aimed at driving a “massive reshoring of America’s semiconductor sector”.

We’ll bring you more updates soon.