The year is barely underway but already there’s a power struggle between our biggest corporations as they battle it out for line honours.

Back in June, the Commonwealth Bank held a seemingly unassailable lead as the nation’s biggest company by market value. Investors just couldn’t get enough of it, pushing the company’s share price into the stratosphere.

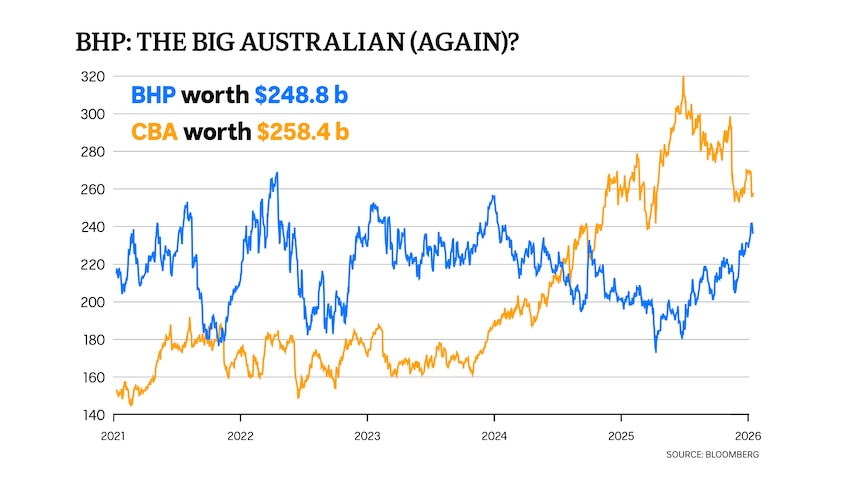

Commonwealth Bank premium has been gradually chipped away. (ABC News: Margaret Burin)

On some measures, it was the world’s most expensive bank stock and certainly the globe’s most overvalued.

BHP, by contrast, was worth around half the nation’s biggest bank.

Market reward CBA

But the baton is about to change hands.

CBA’s premium has been gradually chipped away in the past six months, while BHP has found itself in hot demand and is now just days away from once again dominating the local bourse.

Australia often is laughingly referred to as a nation of houses and holes.

Our banks are largely building societies providing funds for housing construction and a pyramid scheme of ongoing purchases at ever higher prices. As the biggest player in the mortgage market, CBA has profited handsomely.

Record gold prices driving exploration

Meanwhile, most of our export income is derived from digging up raw minerals and shipping it offshore.

In many respects, the homegrown battle represents a glimpse into a much broader shift underway across the world of global finance.

The smart money is moving towards commodities, hard assets, and away from financials as geopolitical instability and over-indebted governments crash head-on into a wall of demand for materials needed to power the energy transition.

Seeking out safety

Gold has led the way.

Since the beginning of the decade there’s been an unmistakable trend. Governments, and particularly their central banks which for years had utmost faith in the US dollar, have begun to lighten their exposure to America.

US government treasuries, long considered the ultimate safe haven, are losing their appeal.

US President Donald Trump’s policies, which have steered America away from its global role with an inward-looking approach, have played a leading role in the change.

China — the red line in the graph below and which became the biggest owner of American government debt in 2008 — has now relinquished that position.

BHP has once again found itself in hot demand as CBA slips. (Supplied: Bloomberg)

While it remains the third biggest owner after Japan and the UK, it has been actively selling down its US government debt since 2020, almost halving its exposure from its 2014 peak.

Instead, China has loaded up on gold to boost its reserves. And it isn’t the only country to do so.

Loading

Since the pandemic, central banks globally have more than doubled their gold purchases to more than one thousand tonnes a year.

That has lit a fire under the gold price, which last year surged more than 65 per cent and has more than doubled in the past two years.

Australian gold miners have been among the market’s best performers.