Hyatt Hotels Corporation recently expanded its sports footprint by making World of Hyatt the official hospitality partner of the new Audi Revolut Formula 1 team, offering members race‑weekend perks such as paddock access, driver meet‑and‑greets, private lounges, and customized travel packages. This tie-up deepens the link between Hyatt’s loyalty ecosystem and premium live experiences, potentially increasing member engagement by aligning the brand with high-end global motorsport events. We’ll now explore how this new Formula 1 hospitality partnership may influence Hyatt’s existing investment narrative around asset-light growth and loyalty.

Find companies with promising cash flow potential yet trading below their fair value.

Hyatt Hotels Investment Narrative Recap

To own Hyatt, you need to be comfortable with a premium-valued, still-unprofitable hotel group that leans heavily on loyalty, asset-light growth and a large development pipeline. The new Formula 1 tie-up looks additive to World of Hyatt engagement, but it does not materially change nearer term questions around U.S. booking momentum or execution risk on the Playa acquisition.

Recent analyst actions frame this news in a supportive context, with firms such as Mizuho and Morgan Stanley lifting price targets on Hyatt after assessing its portfolio mix, pipeline and asset-light transition. Against that backdrop, the Formula 1 hospitality partnership fits most clearly with the existing catalyst around growing World of Hyatt’s 56 million member base and encouraging more direct, higher margin bookings.

Yet despite this appealing loyalty story, investors should be aware of how shifts in short term leisure and business booking behavior could…

Read the full narrative on Hyatt Hotels (it’s free!)

Hyatt Hotels’ narrative projects $8.4 billion revenue and $551.3 million earnings by 2028.

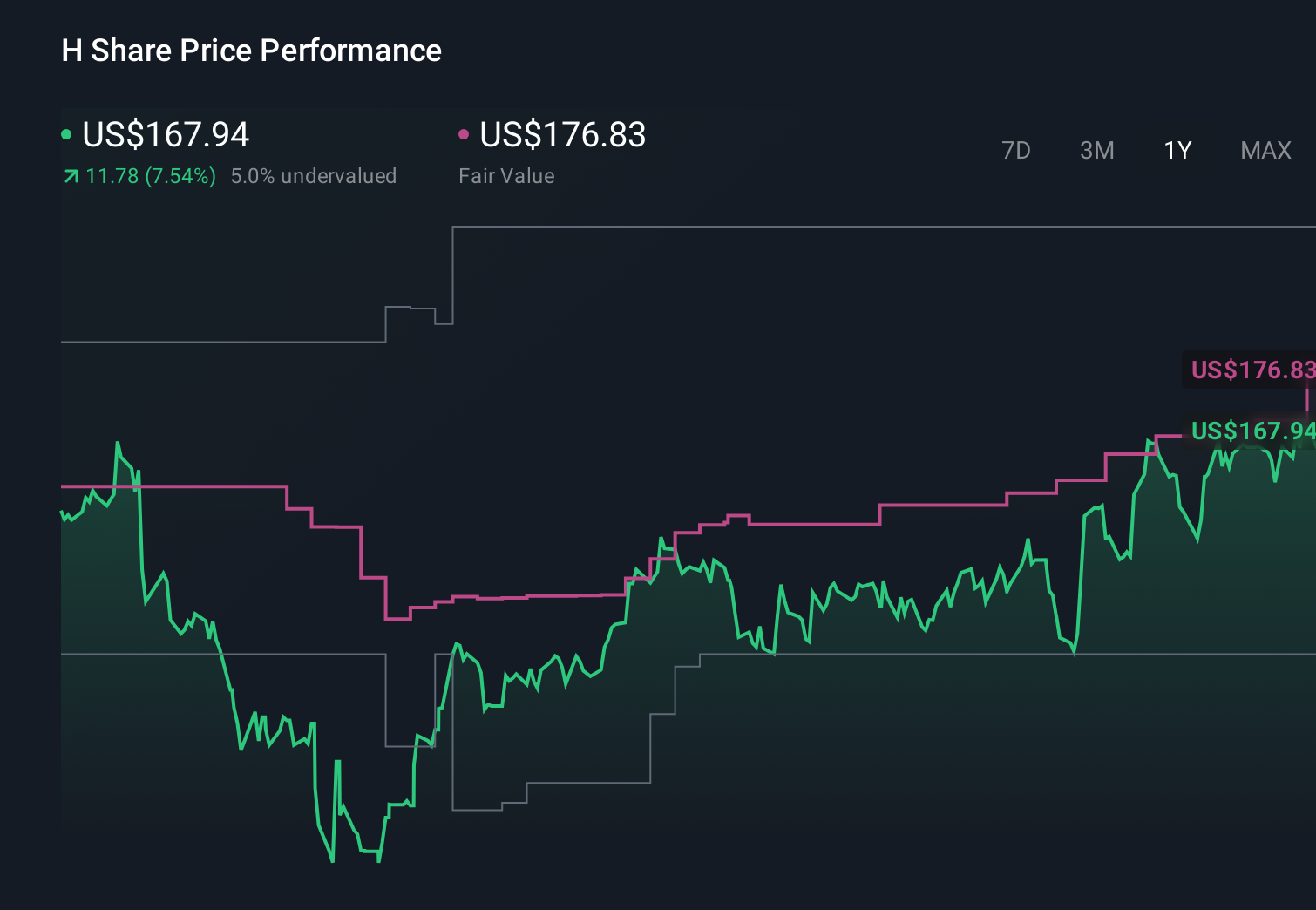

Uncover how Hyatt Hotels’ forecasts yield a $176.83 fair value, a 5% upside to its current price.

Exploring Other Perspectives H 1-Year Stock Price Chart

H 1-Year Stock Price Chart

Five fair value estimates from the Simply Wall St Community range from about US$71 to extremely high outliers above US$159,000 per share, underscoring how far apart individual views can be. When you set those against Hyatt’s asset light plans and reliance on a large development pipeline, it becomes even more important to compare several contrasting opinions before forming your own view.

Explore 5 other fair value estimates on Hyatt Hotels – why the stock might be worth less than half the current price!

Build Your Own Hyatt Hotels Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don’t delay:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Hyatt Hotels might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com