SUMMARY

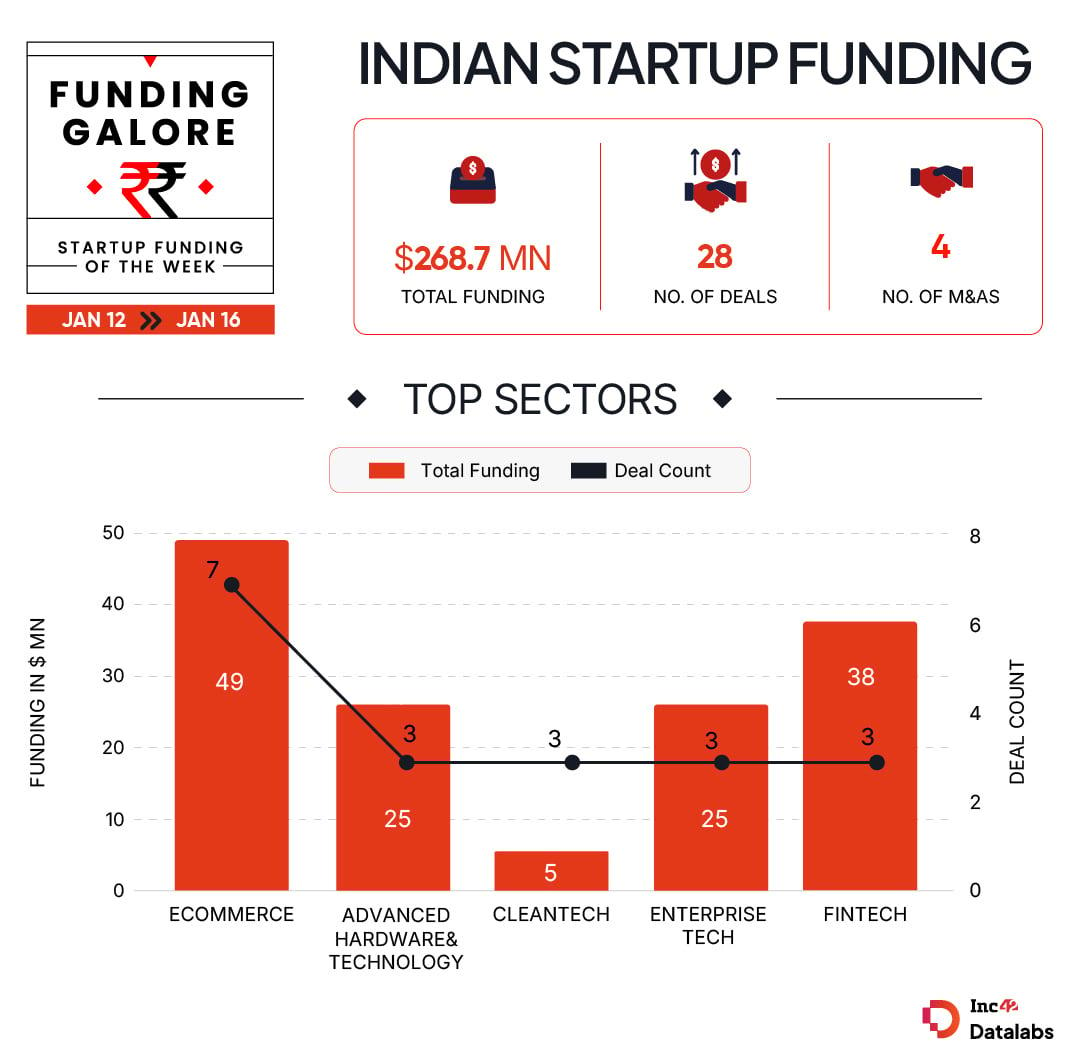

Indian startups cumulatively raised $268.6 Mn across 28 deals between January 12- 16, marking a 293% jump from $68.4 Mn worth funds deployed in the Indian startup last week across 19 deals

Ecommerce continued to be investors’ favourite sector with 7 startups raising a total of $49 Mn

Zerodha’s investment arm Rainmatter and Stellaris Venture Partners were the most active investors this week, backing two startups apiece

After weeks of lull in startup investor activity, funding momentum gathered steam in the second week of January. Indian startups cumulatively raised $268.6 Mn across 28 deals between January 12- 16, marking a 293% jump from $68.4 Mn worth funds deployed in the Indian startup last week across 19 deals.

Funding Galore: Indian Startup Funding Of The Week [ Jan 12 – 16]

Date

Name

Sector

Subsector

Business Model

Funding Round Size

Funding Round Type

Investors

Lead Investor

14 Jan 2026

Pee Safe

Ecommerce

D2C

B2C

$32 Mn

Series C

OrbiMed

OrbiMed

13 Jan 2026

Sukino

Health Tech

Personalised Care Services

B2C

$31 Mn

Series B

Bessemer Venture Partners, Rainmatter

Bessemer Venture Partners

15 Jan 2026

Emversity

Edtech

Digital Learning Platform

B2B

$30 Mn

Series A

Premji Invest, Lightspeed, Z47

Premji Invest

14 Jan 2026

Wint Wealth

Fintech

Investment tech

B2C

$27.7 Mn

Series B

Vertex Ventures SEA & India, 3one4 Capital, Eight Roads Ventures, Arkam Ventures, Rainmatter

Vertex Ventures SEA & India

13 Jan 2026

BillionE Mobility

Traveltech

Electric MaaS

B2C

$25 Mn*

–

SBI

–

15 Jan 2026

EtherealX

Advanced Hardware & Technology

Spacetech

B2B

$20.5 Mn

Series A

TDK Ventures, BIG Capital, Accel, Prosus, YourNest Venture Capital, BlueHill Capital, Campus Fund, Riceberg Ventures

TDK Ventures

13 Jan 2026

Liquidnitro Games

Media & Entertainment

Gaming

B2B

$19.1 Mn

Series A

Northpoint Capital, Nexus Venture Partners

Northpoint Capital

14 Jan 2026

RISA Labs

AI

Application Layer

B2B

$11.1 Mn

Series A

Cencora Ventures, Optum Ventures, Oncology Ventures, z21 Ventures, John Simon (General Catalyst)

Cencora Ventures, Optum Ventures

14 Jan 2026

CloudSEK

Enterprise tech

Horizontal SaaS

B2B

$10 Mn

Series B

Connecticut Innovations

Connecticut Innovations

15 Jan 2026

Truva

Real Estate Tech

Property Listing & Discovery

B2C

$9 Mn*

–

Stellaris Venture Partners, Stride Ventures, Orios Venture Partners, Ramakant Sharma (LivSpace), Mukesh Bansal (Cult.fit), Aakrit Vaish (Activate VC), Miten Sampat (CRED), Natasha Malpani Oswal (The Boundless VC), Ram Raheja (Raheja Realty)

–

12 Jan 2026

Bluecopa

AI

Application Layer

B2B

$7.5 Mn

Series A

Analog Partners, Blume Ventures, Dallas Venture Capital

Analog Partners

13 Jan 2026

Carrum

Travel Tech

Transpor Tech

B2B-B2C

$7 Mn

Series A

Uber

Uber

13 Jan 2026

Atomgrid

Ecommerce

B2B Ecommerce

B2B

$7 Mn*

Pre-Series A

a99 VC, Sadev Ventures, CDM Capital, Merak Ventures

a99 VC

13 Jan 2026

Hexalog

Enterprise tech

Horizontal SaaS

B2B

$4 Mn

Seed

Enrission India Capital, Mount Judi Ventures, Action Tesa Family Office, Bajaj Ventures, Nandan Growth Fund

Enrission India Capital

12 Jan 2026

Neeman’s

Ecommerce

D2C

B2C

$4 Mn

Series B

SNAM Group, Anicut Capital, ENAM Investments, Sharrp Ventures

SNAM Group

13 Jan 2026

GreenTech

Cleantech

Climate Tech

B2B

$3.3 Mn

–

Transition VC

Transition VC

13 Jan 2026

Dazzl

Consumer Services

Quick Commercce

B2C

$3.2 Mn

Seed

Stellaris Venture Partners, Ritesh Agarwal (OYO), Maninder Gulati (OYO), Abhinav Sinha (Kluisz AI), Sameer Brij Verma (Northpoint Capital), Abhishek Bansal (Shadowfax)

Stellaris Venture Partners

13 Jan 2026

Secret Alchemist

Ecommerce

D2C

B2C

$3 Mn

Seed

Unilever Ventures, DSG Consumer Partners

Unilever Ventures

15 Jan 2026

GrowthPal

Fintech

Fintech SaaS

B2B

$2.6 Mn

–

Ideaspring Capital

Ideaspring Capital

12 Jan 2026

PumPumPum

Travel Tech

Listing & Discovery

B2C

$2 Mn

Pre-Series A

LC Nueva, Mufin Green Finance, Anupam Finserv

LC Nueva

15 Jan 2026

Aule

Advanced Hardware & Technology

Spacetech

B2B

$2 Mn

Pre-Seed

pi Ventures, Arvind Lakshmikumar (Tonbo Imaging), Eash Sundaram (Utpata Ventures)

pi Ventures

13 Jan 2026

Misochain Technologies

Advanced Hardware & Technology

Aerial Vehicles

B2B

$2 Mn

Seed

Capital-A

Capital-A

12 Jan 2026

Good Farmer Food Concepts

Ecommerce

D2C

B2C

$1.5 Mn

Pre-Series A

CreedCap, Rohan Bopanna (Athlete), Rahul Dravid (Athlete), Meraki Sport & Entertainment

CreedCap

12 Jan 2026

Edgistify

Logistics

Shipping & Delivery

B2B

$1.4 Mn

Pre-Series A

NB Ventures, Rajesh Ranavat (LF Logistics), Prateek Maheshwari (PhysicsWallah), Vivek Gaur (Angel), Vikram Tandon (Angel)

NB Ventures, Rajesh Ranavat

15 Jan 2026

Roadgrid

Cleantech

Electric Vehicles

B2B

$1.3 Mn

Pre-Series A

Inflection Point Ventures, Venture Catalysts, FAAD Network, LetsVenture, Kamal Puri (Skyline Group) Vrinda Goyal (Pace Group), Haresh Patel (Arthanomics), Maneesh Shrivastav (Alpha Value)

Inflection Point Ventures

13 Jan 2026

Drickle

Ecommerce

D2C

B2C

$720K

Seed

Param Kandhari, Naresh Krishnaswamy, Abhinav Mathur, Hemanshu Jain, Vinay Bhopatkar, Vaibhav Sisinty, Dalvir Suri, and Rishit Jhunjhunwala, Shaili Chopra

–

16 Jan 2026

RenewCred

Cleantech

Climate Tech

B2B

$510K

Seed

Campus Angels Network, Kairos Early Opportunity Fund, build3 Startup Studio, VentureStudio Ahmedabad University, Ideashacks Investor Network, ACT Capital Foundation, IIT Kanpur

Campus Angels Network

14 Jan 2026

HandyPanda

Ecommerce

D2C

B2C

$240K

Seed

ajvc, Sankalp Kathuria (Broadway)

ajvc

Source: Inc42

*Mix of equity and debt

**Part of larger round

span {

margin: 0;

padding: 3px 8px !important;

font-size: 10px !important;

line-height: 20px !important;

border-radius: 4px !important;

font-weight: 400 !important;

font-style: normal;

font-family: noto sans, sans-serif;

color: #fff;

letter-spacing: 0 !important;

}

.code-block.code-block-55 .tagged {

margin: -4px 0 1px;

padding: 0;

line-height: normal;

}

@media only screen and (max-width: 767px){

.code-block.code-block-55 {

padding:20px 10px;

}

.code-block.code-block-55 .recomended-title {

font-size: 16px;

line-height: 20px;

margin-bottom: 10px;

}

.code-block.code-block-55 .card-content {

padding: 10px !important;

}

.code-block.code-block-55 {

border-radius: 12px;

padding-bottom: 0;

}

.large-4.medium-4.small-6.column {

padding: 3px;

}

.code-block.code-block-55 .card-wrapper.common-card figure img {

width: 100%;

min-height: 120px !important;

max-height: 120px !important;

object-fit: cover;

}

.code-block.code-block-55 .card-wrapper .taxonomy-wrap .post-category {

padding: 0px 5px !important;

font-size: 8px !important;

height: auto !important;

line-height:15px;

}

.single .code-block.code-block-55 .entry-title.recommended-block-head a {

font-size: 10px !important;

line-height: 12px !important;

}

.code-block.code-block-55 .card-wrapper.common-card .meta-wrapper .meta .author a, .card-wrapper.common-card .meta-wrapper span {

font-size: 8px;

}

.code-block.code-block-55 .row.recomended-slider {

overflow-x: auto;

flex-wrap: nowrap;

padding-bottom: 20px

}

.code-block.code-block-55 .type-post .card-wrapper .card-content .entry-title.recommended-block-head {

line-height: 14px !important;

margin: 5px 0 10px !important;

}

.code-block.code-block-55 .card-wrapper.common-card .meta-wrapper span {

font-size: 6px;

margin: 0;

}

.code-block.code-block-55 .large-4.medium-4.small-6.column {

max-width: 48%;

}

.code-block.code-block-55 .sponsor-tag-v2>span {

padding: 2px 5px !important;

font-size: 8px !important;

font-weight: 400;

border-radius: 4px;

font-weight: 400;

font-style: normal;

font-family: noto sans, sans-serif;

color: #fff;

letter-spacing: 0;

height: auto !important;

}

.code-block.code-block-55 .tagged {

margin: 0 0 -4px;

line-height: 22px;

padding: 0;

}

.code-block.code-block-55 a.sponsor-tag-v2 {

margin: 0;

}

}

]]]]>]]>

Key Startup Funding Highlights Of The Week

Ecommerce continued to be investors’ favourite sector with 7 startups raising a total of $49 Mn. Other sectors including advanced hardware & technology, cleantech, enterprise tech and fintech raised capital across 3 deals each.

Fintech trailed ecommerce with $38 Mn raised across two deals this week.

Zerodha’s investment arm Rainmatter and Stellaris Venture Partners were the most active investors this week, backing two startups apiece.

Seed funding surged to $16.4 Mn this week across eight deals this week, down slightly from the $16.8 Mn raised by startups this week.

Startup IPO Updates This Week

M&A Activities This Week

Other Developments

]]>