Baht Surge Worries Thai Economic Managers

Currency at five-year high threatens exports, tourism

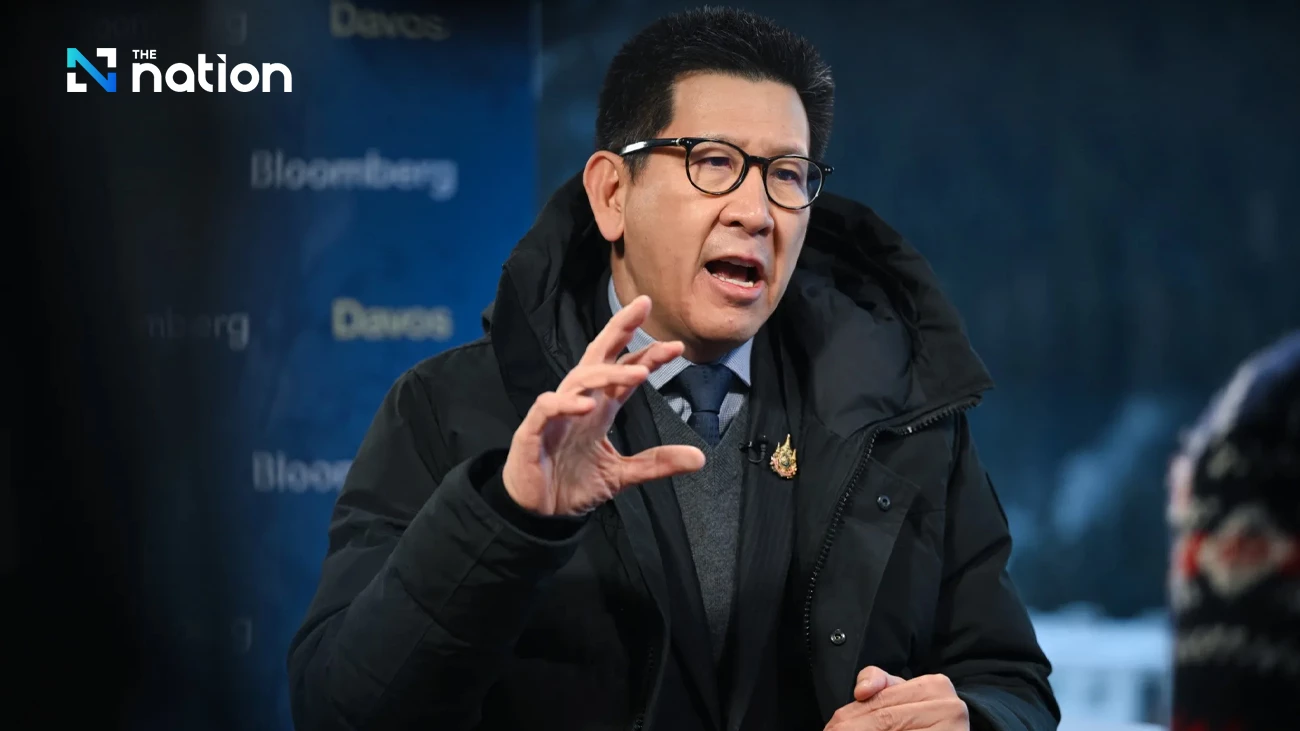

The finance chief said the baht’s strength was due to a weaker dollar, Thailand’s large current-account surplus and “speculative flows.” He said officials are trying to ease the pressures by boosting foreign investment and curbing speculative activity linked to gold trading.

Separately on Wednesday, Bank of Thailand Governor Vitai Ratanakorn told reporters in Bangkok that the central bank’s intervention in foreign exchange market has had only minimal impact on the baht, citing the market’s size and the limits of its influence beyond onshore activities.

“We don’t have enough power to set the baht level, to make baht weaken like others want,” he said.

The baht retreated from its highest level since 2021 after his comments.

The Thai currency gained about 8% last year as broad dollar weakness and gold’s roughly 65% surge to a series of records helped offset weak domestic economic fundamentals. Thai authorities have warned of a punitive tax and greater scrutiny of bullion trading as a stronger baht hurts the nation’s exporters and tourism.

Ekniti has worked with the Bank of Thailand to give the central bank clearer authority to oversee online gold trading in baht, a segment officials say has had an outsized impact on the local currency.

The central bank is set to unveil a set of new rules for online trading of baht-denominated gold on Jan. 29 to help cool the currency’s rally, Vitai said, adding that a daily trading limit of 50 million to 100 million baht for individuals was under consideration.