EQ Economics managing director Warren Hogan has warned Australia is at risk of a “pretty bad recession” as inflation trends upward and the Albanese government struggles to rein in spending.

A number of economists have expressed growing concerns over the state of Australia’s economy in recent months, with sluggish growth threatening to spark a fresh cost of living crisis.

An uptick in consumer prices and spiraling government debt are adding to concerns – the latter prompting a warning from former finance minister and current Organisation for Economic Co-operation and Development boss Mathias Cormann.

Addressing the state of the nation’s economy, Mr Hogan laid blame at the feet of the Reserve Bank, as well as the government, for not doing enough to tackle inflation.

“The reality is that we could well have quite a grim period ahead of us. We could be in for a bad economic adjustment or downturn at some stage if the current trends keep going,” he told Sky News Australia.

“We have government spending which is as close to out of control as we’ve seen in the modern era and that’s largely because the government and the RBA are not taking inflation seriously enough.

“The size of government’s growing, the incentive to innovate and to invest is somewhat diminished. That’s hurting productivity and income. So all of these trends are going in the wrong direction… but the problem really, the main one, is that we are not getting inflation under control and government is not playing their role by keeping spending under control.”

While inflation fell marginally in the 12 months to November it remains outside the RBA’s two to three per cent target range.

Trimmed mean inflation – the central bank’s preferred measure which strips out price changes from the most volatile items – has only fallen below three per cent twice since 2022, prompting economists, including Mr Hogan, to claim the RBA has not done enough to relieve price pressures.

Consumer prices are likely to rise further over the coming months, with state and federal energy rebates set to expire, placing more pressure on the RBA and the economy.

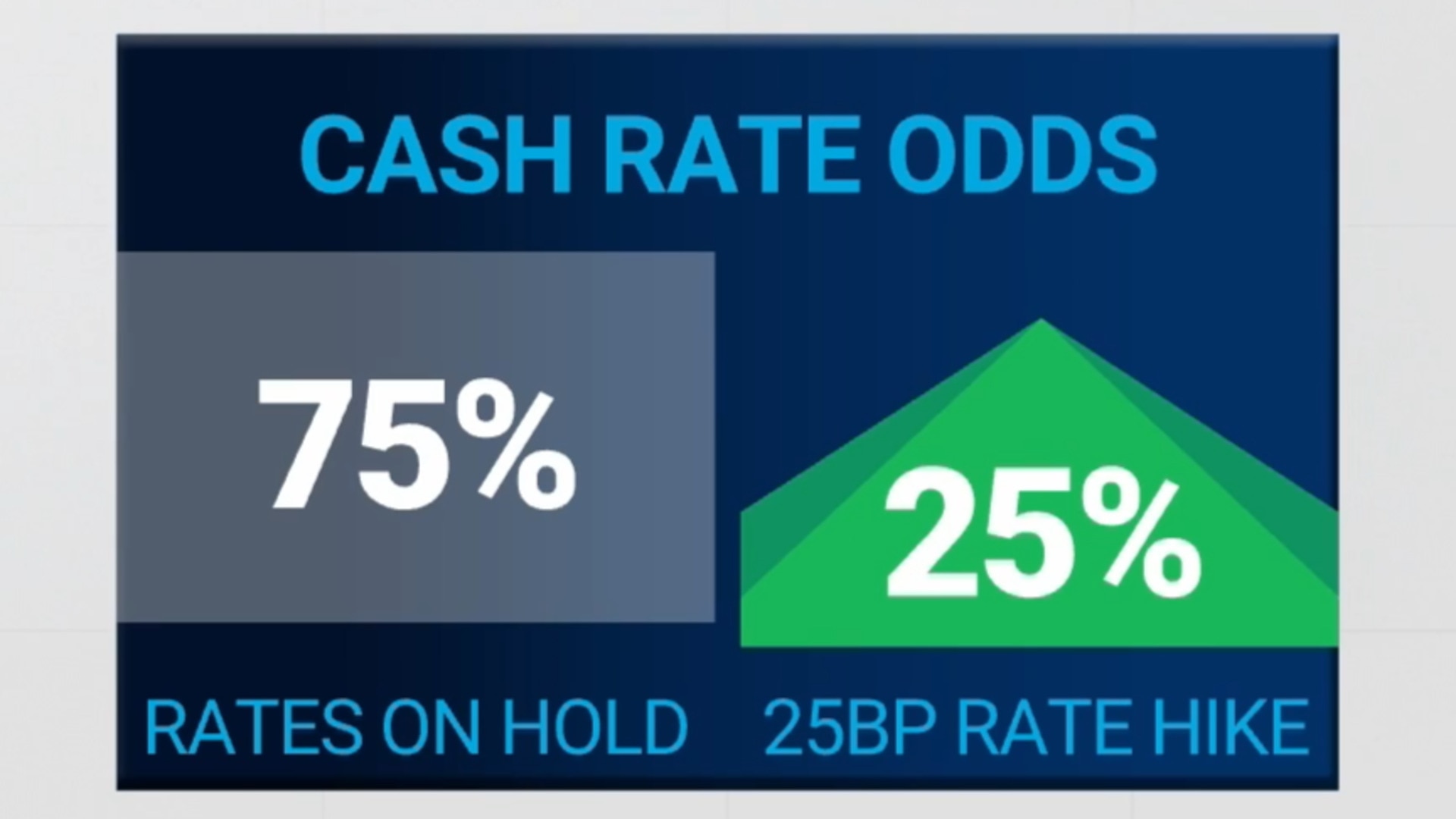

Mr Hogan was adamant Australians would “see interest rates go up”, possibly as early as the RBA’s February meeting, but warned the real challenge would be reining in government spending.

Despite Treasurer Jim Chalmers having insisted the government would work to implement “advice” form the OECD on reducing spending, the economist expressed scepticism the government would go far enough.

“The government may make sounds and noises in the lead up to the budget, but they will not do enough to take the pressure off the RBA,” he said.

As a result, Mr Hogan claimed Australia was now at risk of a “pretty bad recession” due to the likelihood the RBA would be forced to “raise rates a lot more aggressively” in the absence of government support.