8m agoFri 30 Jan 2026 at 5:38amMarket snapshotASX 200: -0.6% at 8,869 points

Australian dollar: -0.1% at 69.99 US centsWall Street: Dow Jones (+0.1%), S&P 500 (-0.1%), Nasdaq (-0.7%)Europe: FTSE (+0.17%), DAX (-2.07%), Stoxx 600 (-0.7%)Spot gold: -1.6% to $US5,267/ounce

Oil (Brent crude): -1.4% to $US69.70/barrel

Iron ore: -0.6% at $US104.81/tonne

Bitcoin: -1.6% to $US83,192

Prices current at around 4.30pm AEDT

36m agoFri 30 Jan 2026 at 5:09am

What’s the Arafura mine?

It’s been backed by President Trump and Gina Rinehart – but where is the Arafura mine?

Arafura’s rare earths project in the NT has received hundreds of millions of dollars in public funding, and was central to a deal inked in the United States last year, but it’s yet to get off the ground.

The company previously said it could reach a final investment decision for the mine by 2025, then early 2026, and has now pushed that timeline back again.

You can read more on this story here:

1h agoFri 30 Jan 2026 at 4:40am

Market snapshotASX 200: -0.7% at 8,866 points

Australian dollar: -0.1% at 70.05 US centsWall Street: Dow Jones (+0.1%), S&P 500 (-0.1%), Nasdaq (-0.7%)Europe: FTSE (+0.17%), DAX (-2.07%), Stoxx 600 (-0.7%)Spot gold: -3.2% to $US5,207/ounce

Oil (Brent crude): -1.4% to $US69.70/barrel

Iron ore: -0.6% at $US104.81/tonne

Bitcoin: -1.8% to $US83,086

Prices current at around 3.30pm AEDT.

You can see live values here:

1h agoFri 30 Jan 2026 at 4:31am

Asian stocks down, bond yields up in Friday trading

The fall of the ASX today has been mirrored in early Asian trade.

Stocks in Asia slumped while the US dollar and bond yields shot up on Friday.

That was after US President Donald Trump said he had firmed up his choice for new Federal Reserve boss, with reports zeroing in on Kevin Warsh as the likely pick.

While Warsh, a former Fed governor, is seen as an advocate of lower interest rates, he is also considered to be one of the less radical choices among the various names that have been raised.

He is also perhaps more cautious on heavy monetary stimulus than others.

MSCI’s broadest index of Asia-Pacific shares outside Japan tumbled as much as 1.3%, extending the previous day’s declines with the biggest one-day slump of the past month.

Asian stocks were led lower by declines in China, with a gauge of Chinese companies with listings in Hong Kong off 2.1%.

MSCI’s broadest gauge of equities outside of Japan remains on track for its best monthly performance in more than three years. In Tokyo, the Nikkei slipped 0.1%.

Stocks in Jakarta rallied 1% after the head of Indonesia’s stock exchange resigned, taking responsibility for a selloff triggered by a warning of a potential downgrade from index provider MSCI.

It was the country’s biggest stock rout since the 1998 Asian Financial Crisis.

The yield on the US 10-year Treasury bond was last up 4.0 basis points at 4.265%.

Fed funds futures are pricing an implied 86.6% probability that the US central bank will hold steady on rates at its next two-day meeting on March 18, compared with a 87.5% chance a day earlier, according to the CME Group’s FedWatch tool.

With reporting by Reuters

1h agoFri 30 Jan 2026 at 3:59am

AstraZeneca grows interest in China’s obesity sector

Remember when AstraZeneca was front and centre in the news?

Without wanting to relive the unpleasantness of the pandemic, the British-Swedish multinational company provided one of the vaccines when COVID-19 reared its ugly head from 2020 onwards.

Now there’s news that AstraZeneca will license experimental drugs for obesity and weight-related conditions from CSPC Pharmaceutical Group and collaborate on additional projects.

It is paying $US1.2 billion upfront and up to $US17.3 billion more if development and sales milestones are met, the Chinese drugmaker said on Friday.

The deal is the latest tie-up between the two pharmaceutical giants, following collaboration in areas such as artificial intelligence.

It expands AstraZeneca’s investment in the growing Chinese obesity market led by Western rivals.

The British-Swedish drugmaker has also licensed an experimental weight-loss pill from China’s EccoGene.

CSPC shares were down about 12% in Hong Kong following the announcement.

“This reflects the classic ‘buy the rumour, sell the news’ phenomenon,” said Tony Ren, head of Asia healthcare research at Macquarie Capital, adding that investors seemed to be offloading the stock after its 26% surge since January 2.

The agreement covers the development, manufacturing and commercialisation of the candidates. AstraZeneca has been granted a global licence, excluding Taiwan, Hong Kong, Macau, and mainland China.

AstraZeneca will also collaborate on four additional new programmes with CSPC, using CSPC’s proprietary platforms for sustained-release delivery technology and AI-driven peptide drug discovery.

A spokesperson for AstraZeneca said in a statement the new CSPC Pharmaceutical deal was in addition to a previous $US15 billion investment in China that it announced on Thursday.

With reporting by Reuters

1h agoFri 30 Jan 2026 at 3:52am

Gold price plummets

The price of gold has turned down sharply in Asian trade today.

It follows steep overnight falls.

The precious metal reached a record high of $US5,594.82 earlier this week.

At 3pm AEDT is trading at $US5,154, down 9% from its high.

A technical correction is a fall of 10% or more from a recent peak.

Analysts say the sell-off has been sparked by reports US President Donald Trump will announce the official to replace Jerome Powell as US Federal Reserve chair tomorrow morning (Australian time).

2h agoFri 30 Jan 2026 at 3:11am

London Metal Exchange: Update

The London Metal Exchange has resumed trading after a one-hour delay due to technical issues.

Trading resumed at 0200 GMT or 2pm AEDT.

Reporting with Reuters

2h agoFri 30 Jan 2026 at 3:11am

Bitcoin falls to two-month low

It’s been a rough few weeks for Bitcoin.

Earlier on Friday, it had fallen by 3.7% to $US81,287, its lowest price since November 21 last year.

Over the last 24 hours it had shed almost $US10,000, with more than $US1.75 billion liquidated by investors.

Sentiment continues to sour around the world’s largest cryptocurrency as investors look for safer options, like gold and other precious metals.

The likely appointment of Kevin Warsh as the next Fed Chair by US president Donald Trump hasn’t helped sentiment around Bitcoin.

In most recent trading, Bitcoin has recovered to $US82,065, but still down 2.95% today.

2h agoFri 30 Jan 2026 at 2:50am

Want to know more about the Nine Radio sale?

As we reported this morning, Nine Radio, which includes Melbourne’s top-rating talk station 3AW and Sydney’s 2GB, has been sold to pub baron Arthur Laundy.

It’s been sold for just $56 million, having been valued at $275 million just seven years ago.

Nine also spent $850 million on outdoor advertising company QMS.

My colleague Ben Butler explains the deal here:

2h agoFri 30 Jan 2026 at 2:47am

Kevin Warsh to be next Fed chair: Bloomberg

US President Donald Trump says he intends to announce his pick to replace Federal Reserve Chair Jerome Powell on Friday, local time, with speculation intensifying that the nod will go to former Fed governor Kevin Warsh.

“I’ll be announcing the Fed chair tomorrow morning,” Trump said at the Kennedy Center.

Bloomberg News later reported that the White House was preparing for Trump to nominate Warsh as the next Fed chair, citing people familiar with the matter.

Warsh, on the shortlist of candidates to lead the central bank when Powell’s leadership term ends in May, went to the White House for a meeting with Trump on Thursday, according to one source familiar with the matter.

A second source, briefed on the discussion, said the former Fed governor impressed Trump, adding that nothing was final until Trump announced his pick.

Trump wants the Fed to cut interest rates deeply. His escalating pressure on Powell and the Fed for cuts has given rise to the possibility that Powell might remain at the Fed beyond May to try to safeguard the Fed from further political pressure. Powell’s separate term as a member of the Board of Governors runs to 2028.

The Fed, which cut rates three times in 2025, left its benchmark interest rate unchanged in the 3.50%-3.75% range after the end of a two-day policy meeting on Wednesday. Trump says the rate should be two to three percentage points lower, a level historically consistent with a stalled or faltering economy.

Warsh has called for regime change at the central bank and wants, among other things, a smaller Fed balance sheet, a goal seemingly at odds with Trump’s preference for looser monetary policy.

Trump almost picked Warsh in 2018 for the top Fed job, but chose Powell instead, a decision the president has publicly and loudly regretted for much of the time since then, including high tariffs and an immigration crackdown.

Reporting by Reuters

3h agoFri 30 Jan 2026 at 2:34am

More pause for thought for RBA as credit spikes

The old credit card got a workout late last year, according to the latest data from the ABS.

Private-sector credit rose 0.8%m/m in December.

This was 0.2% above both J.P. Morgan and consensus forecasts (+0.6%m/m).

The data point lifts the annual rate to 7.7% — another new cycle high.

“The strength primarily reflects momentum from the 2025 easing cycle and the ongoing cyclical upswing, with the tightening of financial conditions in late 2025 yet to be reflected in the data,” JPMorgan said in a note.

3h agoFri 30 Jan 2026 at 2:24am

Delayed start to London Metal Exchange trading: Update

The London Metal Exchange (LME) delayed the start of trading on Friday due to technical issues, according to a notice to brokers seen by Bloomberg News.

The glitch follows days of heightened global volatility and record prices.

A pause has been applied to the LME’s electronic trading platform while a technical issue is being investigated, according to the notice, and there is no estimated time for a restart.

Trading on the LME, which sets global prices for all major base metals, usually starts at 1:00 a.m. London time or GMT.

At 1:25pm AEDT, it’s 2:25am GMT.

It means trading has been disrupted now for 90 minutes.

The LME predominantly is a place of trade for base metals, like copper and aluminium,

Gold is mostly traded on the London Bullion Market Association (LBMA).

Reporting with Reuters, Bloomberg.

3h agoFri 30 Jan 2026 at 2:07amLocal share markets down at lunchtime trade

Local markets have reversed their positive gains this morning, heading into negative territory this afternoon.

The ASX200 is down -0.2% to 8,910 points (as at 1pm AEDT), while the broader All Ordinaries is down -0.3% to 9,208 points.

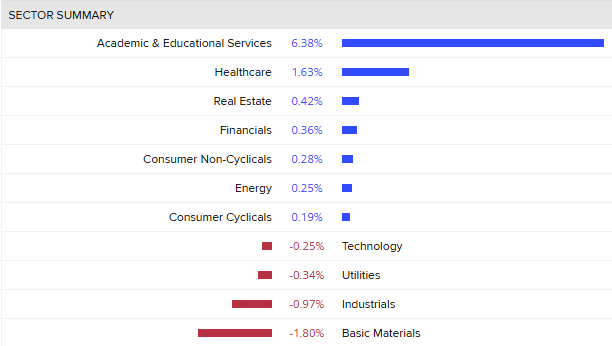

Technology, basic materials, industrials and utilities are all in the red, while academic services, health care, real estate and financials are up.

ASX Sector summary (LSEG)

ASX Sector summary (LSEG)

In terms of individual stocks, IDP Education is up almost 7%, while Nine Entertainment is up 4.8% after it announced it has sold its radio division to the Laundy family.

Mining companies make up most of the bottom ten movers today, led by Ora Banda Mining.

DroneShield and Perpetual are also down.

Top and bottom movers (LSEG)3h agoFri 30 Jan 2026 at 1:57am’Technical glitch’ delays opening of London Metal Exchange

Top and bottom movers (LSEG)3h agoFri 30 Jan 2026 at 1:57am’Technical glitch’ delays opening of London Metal Exchange

The London Metal Exchange (LME) has delayed the start of trading on Friday.

The delay is due to a technical glitch, according to a note sent to brokers from the LME.

It coincides with heightened levels of volatility in the price of gold.

More to come.

Reporting with Reuters

3h agoFri 30 Jan 2026 at 1:50am

Market snapshotASX 200: -0.2% at 8,913 points

Australian dollar: -0.5% at 70.11 US centsWall Street: Dow Jones (+0.1%), S&P 500 (-0.1%), Nasdaq (-0.7%)Europe: FTSE (+0.17%), DAX (-2.07%), Stoxx 600 (-0.7%)Spot gold: +0.7% to $US5,431/ounce Oil (Brent crude): +3.6% to $US70.86/barrelIron ore: +1.5% at $US104.60/tonneBitcoin: -2.9% to $US81,947

Prices current at around 12.59pm AEDT.

You can see live values here:

4h agoFri 30 Jan 2026 at 1:20amUpdate: Fed Reserve chair to be announced tomorrow

US President Donald Trump says he will soon name the replacement for Federal Reserve chair Jerome Powell.

“I’ll be announcing the Fed chair tomorrow [Saturday AEDT] morning,” Trump said at the Kennedy Center.

Earlier, at his first cabinet meeting for 2026, President Trump said he would announce his pick for the top job next week.

Mr Powell’s term as Fed leader ends in May but his membership on the board expires in 2028.

The Fed left interest rates unchanged in the 3.5-3.75% range this week (after cutting three times in 2025).

Mr Trump has been critical of the board, saying rates should be lower.

He attempted to fire a governor (in a case now before the Supreme Court) and the Justice Department has opened a criminal investigation into Mr Powell for statements he made about building renovations.

-Reporting with Reuters

4h agoFri 30 Jan 2026 at 1:05am

New US Federal Reserve chair to be announced next week

US President Donald Trump has told a cabinet meeting he will announce the replacement for Federal Reserve chair Jerome Powell next week.

Mr Trump has repeatedly criticised the board for refusing to lower interest rates.

“It’ll be a person that will, I think, do a good job,” he said. “We’re paying far too much interest in the Fed. The Fed rate’s too high, unacceptably high.”

One of the key candidates in the running for the top job is Federal Reserve governor Christopher Waller, along with White House economic adviser Kevin Hassett, Rick Rider and Kevin Warsh.

Jerome Powell’s term as chairman ends in May but he could remain a member of the board until 2028.

4h agoFri 30 Jan 2026 at 12:46am

Bluey tops US streaming charts for second year running

Americans watched 45.2 billion minutes of hit Aussie show Bluey last year, beating fan-favourite Grey’s Anatomy.

It is the second year running that Bluey has won the title in Nielsen’s ARTEY awards.

You can read more about this story here (or tune in to watch Bluey on ABC iview):

5h agoFri 30 Jan 2026 at 12:27am

Why are ResMed’s shares on the rise today?

Medical devices company ResMed’s shares are gaining in today’s trade after a strong quarterly update.

Revenue was up 11% to $US1.42 billion , driven by increasing demand for its portfolio of sleep devices, masks and accessories.

CEO and chairman Mick Farrell said the results demonstrated the “strength and resilience of our global business”.

“As we move into the second half of fiscal year 2026, we will continue to invest in innovation to scale out digital health capabilities and expand global access to life-saving care, while delivering sustainable, profitable growth,” he said.

Shares in ResMed were up as much as 5.2 per cent in morning trade.

5h agoFri 30 Jan 2026 at 12:07am

A rate rise next week will be a ‘bitter pill’ for middle Australia

Consumer advocates fear a rate hike when the RBA board meets next week could be the “straw that breaks the camel’s back” for borrowers in mortgage stress.

Financial Counselling Australia’s CEO says calls to the National Debt Helpline are already on the rise, and many callers are employed, middle-income Australians.

You can read more on this story here:

ASX 200: -0.6% at 8,869 points

ASX 200: -0.6% at 8,869 points