Call it a BEAD hangover, which some did, but at this year’s Mountain Connect conference, the broadband industry was noticeably different from last year.

The gathering was still hosted at the Sheraton in downtown Denver. And there was still plenty of buzz for the Broadband Equity, Access and Deployment Program, aka BEAD, the federal government’s $42.5 billion investment to give every state enough funding to get every last American household high-speed internet once and for all.

But enthusiasm for BEAD had turned into exasperation. The program was upended June 6, after more than three years of strategizing and work completed by many states. The Trump administration changed the rules, saying it wanted to cut down on possible waste of taxpayer money, and set a 90-day deadline to redo eligible locations, contract guidelines, the awards process and other things.

A panel of state broadband officials discuss what happened after the federal Broadband Access, Equity and Deployment program, or BEAD, had a rules change as the process was nearly completed. From left to right is Eric Frederick from Michigan, Bree Maki from Minnesota and Peter Voderberg from Ohio. Ashley Travers with KGPCo moderated. (Tamara Chuang, The Colorado Sun)

A panel of state broadband officials discuss what happened after the federal Broadband Access, Equity and Deployment program, or BEAD, had a rules change as the process was nearly completed. From left to right is Eric Frederick from Michigan, Bree Maki from Minnesota and Peter Voderberg from Ohio. Ashley Travers with KGPCo moderated. (Tamara Chuang, The Colorado Sun)

“This is exhausting,” Bree Maki, executive director of the Minnesota Office of Broadband Development, said Tuesday during a panel. “Somebody actually said last night … we kind of feel like we have a BEAD hangover after 3½ years of this.”

Fiber internet, considered the fastest and most futureproof — and most expensive — was not a priority in the so-called Benefit of the Bargain round. Wireless and satellite internet are now equal players as long as they meet minimum bandwidth speeds (100 mbps up and 20 down) and show their technology can handle the future. Funding must focus on infrastructure and little else. Households waiting on broadband to finally arrive must wait even longer.

“So I get to go to all my Appalachian regions and say, ‘Hey, guess what? You’ve got the cheapest thing I could possibly get for you. Aren’t you happy,’ when they’ve been left behind for years,” Peter Voderberg, chief of BroadbandOhio, said during a session on BEAD.

When a program gets rebooted midway

Nevada and Louisiana were so far along in the process, they’d already publicly announced the contracts awarded to internet providers to build fiber to the unserved households.

“We didn’t want to be in line behind California when it comes to trying to attract talent and workforce to come in and build our networks in Nevada,” said Brian Mitchell, Nevada’s state broadband officer, who was joined on a panel with state directors from Louisiana and Arkansas.

“We kept going and we tried to move quickly,” said Glen Howie, Arkansas’ state broadband director in the same panel. “We made it basically to the end.”

The three states had to ask winners to reapply.

Colorado, too, had to rescind its preliminary awards and ask internet providers to reapply. By the end of the two week re-application period, which closed July 21, some of the original applicants had dropped out. But 29 new ones completed the process.

“We looked at how we could be competitive (and) it wasn’t 100% fiber,” said Paul Colasuonno, associate project manager for Ditesco, a project management service that helped Southern Colorado Economic Development District redo their applications for the southeastern part of the state. “Any technology that could provide the minimum speed was used, so generally that meant wireless. If you can mix the technologies in the same application, you can bring the total cost down.”

The result in Colorado’s revised round saw the technology split flip-flopped, with nearly 60% from wireless and satellite providers applying in the revised round. Previously, fiber carried 60%.

A packed room at the Mountain Connect Broadband Development conference to hear how state broadband leaders are dealing with changes to the $42.5 billion Broadband Equity, Access and Deployment Program on August 6, 2025 at the Sheraton Denver Downtown Hotel. The panel included Brandy Reitter, executive director of the Colorado Broadband Office. (Tamara Chuang, The Colorado Sun)

A packed room at the Mountain Connect Broadband Development conference to hear how state broadband leaders are dealing with changes to the $42.5 billion Broadband Equity, Access and Deployment Program on August 6, 2025 at the Sheraton Denver Downtown Hotel. The panel included Brandy Reitter, executive director of the Colorado Broadband Office. (Tamara Chuang, The Colorado Sun)

“We’ve spent a lot of time and money,” said Brandy Reitter, executive director of Colorado Broadband Office. But she added the state is on track to meet the Sept. 4 deadline to get final picks to the National Telecommunications and Information Administration, which oversees the BEAD program. She wants to “really just try to preserve the work that had already gone into our program.”

When the massive pot of money was approved by Congress in 2021, states began dreaming big. Unserved locations, about 10% of Colorado’s population at the time, had been ignored by private internet companies for years because they were too costly to build service to them. Now, it was not only possible to connect those users, but states felt their share of the $42.5 billion program could extend fiber internet to unserved locations and keep them connected for years.

Even so, many state broadband officials said they still took a technology neutral approach, depending on what made sense, and picked a mix of wireless, fiber and even satellite internet.

“It does come down to cost,” said Eric Frederick, Michigan’s chief connectivity officer. “There are some places that are extremely high cost. … I’ve got six (locations) on Isle Royale National Park in the middle of Lake Superior. They’re probably not going to get fiber. It’s just not going to happen.”

Wireless opportunities, but where was satellite?

Not everyone at the conference was glum.

Wireless companies were elated since some had services that weren’t considered legitimate, even if they offered gigabit speeds. Their existing territory was considered underserved so competitors could bid on it, said Steve Schwerbel, state advocacy manager for the Association for Broadband without Boundaries that represents wireless providers.

“For our members, this is an incredible opportunity to play defense and no longer have a competitor get paid by the federal government through the state to come in and overbuild their territory where they have happy customers and are serving absolutely reliable and dependable speeds across their customer base,” Schwerbel said.

Wireless was “absolutely unfairly judged,” said Dan McVaugh, a consultant for the wireless industry and past president of the Colorado Wireless Association. Mobile wireless speeds have improved dramatically in the past two decades with 5G technology speeds around 100 mbps, according to Ookla speed tests. And other wireless technologies, like aerial fiber (“like lasers through the air,” he said) are getting better.

“If we could get fiber everywhere, I would put fiber everywhere. It’s going to be the most secure. It’s going to be the fastest,” he said. “But when you take into account the time to market (and) the cost of the project … very quickly you start to realize the trade offs.”

Fixed wireless options could be much cheaper to build and offer “10 times the bandwidth that the customer has today,” he said.

In this time exposure taken from Westgate Cocoa Beach Pier in Cocoa Beach, Fla., a SpaceX Falcon 9 rocket lifts off from Pad 40 at Cape Canaveral Air Force Station, Fla., Tuesday, Nov. 24, 2020. The rocket is carrying the 16th batch of Starlink communications satellites. (Malcolm Denemark/Florida Today via AP)

In this time exposure taken from Westgate Cocoa Beach Pier in Cocoa Beach, Fla., a SpaceX Falcon 9 rocket lifts off from Pad 40 at Cape Canaveral Air Force Station, Fla., Tuesday, Nov. 24, 2020. The rocket is carrying the 16th batch of Starlink communications satellites. (Malcolm Denemark/Florida Today via AP)

Meanwhile, satellite internet, the talk of last year’s conference, seemed strangely absent. At last year’s show, there was a push to explore wireless and satellite technologies. Gwynne Shotwell, president of SpaceX, was the lunch keynote speaker. But internet satellite service Starlink, a division of SpaceX, was nowhere to be found at the show. Both were founded by billionaire Elon Musk.

Starlink is widely available in Colorado. The company wasn’t part of Colorado’s earlier BEAD rounds but it submitted eight applications in the revised round, according to the Colorado Broadband Office.

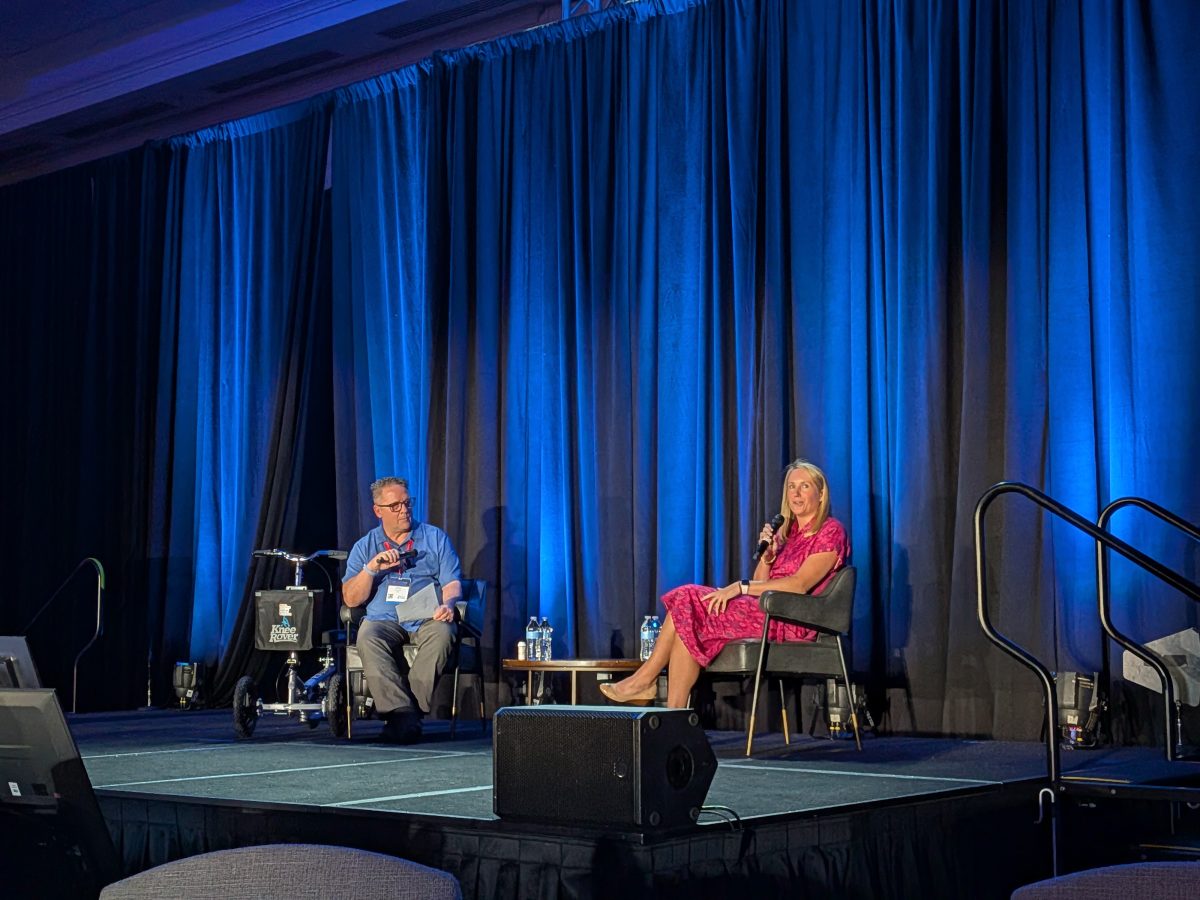

Jeff Gavlinski, CEO of Mountain Connect, brought up satellite during the lunchtime chat with Brooke Donilon, chief of staff at the NTIA. In an earlier federal broadband funding push, called the Rural Digital Opportunity Fund, Starlink prevailed because it put in the lowest-cost bid to offer service in rural areas. The government later rejected Starlink’s bid for public funding.

“So some critics have said that focusing on the low-cost option will repeat the mistakes of RDOF. And that upfront cost doesn’t account for fiber’s longevity and potential sustainability issues with other technologies like satellite. What’s your response to that,” Gavlinski asked.

Jeff Gavlinski, CEO of Mountain Connect, interviews Brooke Donilon, chief of staff at the National Telecommunications and Information Administration, which oversees the BEAD program, at the Mountain Connect Broadband Development Conference, held August 4-6 in Denver. (Tamara Chuang, The Colorado Sun)

Jeff Gavlinski, CEO of Mountain Connect, interviews Brooke Donilon, chief of staff at the National Telecommunications and Information Administration, which oversees the BEAD program, at the Mountain Connect Broadband Development Conference, held August 4-6 in Denver. (Tamara Chuang, The Colorado Sun)

Donilon said lessons were learned from RDOF. But by requiring a technology-neutral approach, she said she’s hearing good things from companies that are changing their bids from pure fiber to wireless or a mix of technologies.

“In the long run, we’re injecting competition into the program with all very reliable broadband projects,” she said.

There was also at least one person representing a satellite internet company at the show. Chris Cook, legal compliance lead for Amazon Project Kuiper, sat on a panel to talk about all technologies eligible for BEAD funding.

Cook said Amazon is sending another 24 satellites to low-Earth orbit on Thursday, joining 78 already in orbit. The goal is to have a “constellation of 3,200 satellites,” he said.

“The reason Amazon pursued this initiative is they saw a gap in the marketplace where there was a number of folks that were unserved or underserved in the U.S. and on a global basis, ” Cook said. “So they invested heavily in this initiative to connect those across the world to give them access to education and other media, things that are of Amazon’s interest.”

Project Kuiper bid on Colorado’s BEAD program in both rounds. The company has said it expects consumer internet service to launch later this year, with download speeds around 400 mbps. Pricing has not been announced.

“We’re looking forward to participating and happy to be back in Colorado,” said Cook, a University of Colorado law school grad.

Type of Story: News

Based on facts, either observed and verified directly by the reporter, or reported and verified from knowledgeable sources.