The US National Football League has struck a landmark deal with ESPN that will see the broadcaster acquire the NFL Network and other NFL media assets, in exchange for a 10% stake in the sports network. The unusual meeting of a major sports rights holder and media company may be a taste of things to come in medialand.

ESPN is 80% owned by Disney, with the remaining 20% being owned by Hearst.

ESPN will also acquire NFL Fantasy, the league’s fantasy football platform, and wrap it into its existing ESPN Fantasy Football product, which will become the official NFL fantasy league.

A separate deal also sees the NFL license other league content and intellectual property to ESPN, for use on the NFL Network, which will be owned and operated by ESPN.

ADVERTISEMENT

The NFL Network will be included in ESPN’s forthcoming direct-to-consumer streaming platform, which launches in the US on August 21. ESPN will also license the linear and digital rights for the channel to other traditional cable operators.

In addition, ESPN will license three additional NFL games per season, bringing its total to 28 matches per season, which will be broadcast across the NFL Network, plus on ESPN’s linear and streaming services.

To complicate the deal further, ESPN will own “broad rights” to RedZone — an ad-free channel which broadcasts a live seven-hour feed each Sunday, bouncing between the various matches around the country — meaning it will distribute the product to various pay TV operators. However, the NFL will continue to own, operate, and produce the channel’s content, as well as owning the digital distribution rights.

The NFL will also retain its NFL Films division, as well as NFL.com.

No monetary value has been placed on the deal, which is subject to regulatory approval, as well as the green light from NFL team owners.

“By combining these NFL media assets with ESPN’s reach and innovation, we’re creating a premier destination for football fans,” ESPN chairman Jimmy Pitaro said in a statement.

“Together, ESPN and the NFL are redefining how fans engage with the game — anytime, anywhere. This deal helps fuel ESPN’s digital future, laying the foundation for an even more robust offering as we prepare to launch our new direct-to-consumer service.”

Disney’s CEO Robert Iger said the deal “paves the way for the world’s leading sports media brand and America’s most popular sport to deliver an even more compelling experience for NFL fans, in a way that only ESPN and Disney can.”

Iger praised the “outstanding media assets” the league has built, claiming this deal “will add to consumer choice, provide viewers with even greater convenience and quality, and expand the breadth and value proposition of Disney’s streaming ecosystem.”

It’s a complicated deal, to say the least. It also throws up a lot of potential conflicts of interest.

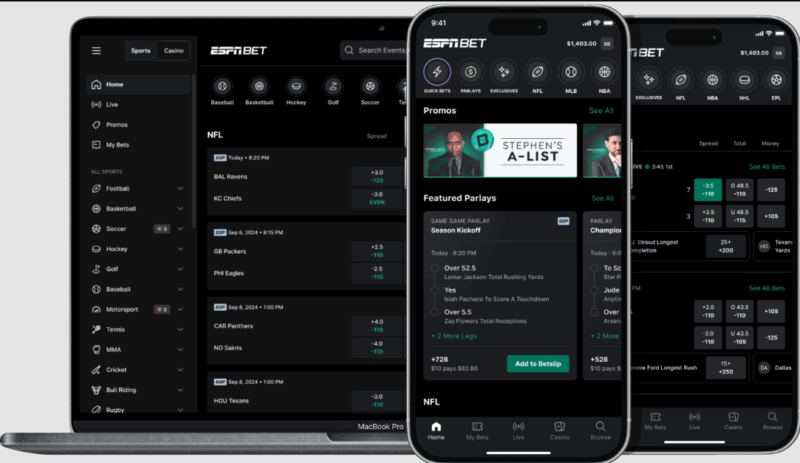

ESPN is currently in a A$3 billion, ten-year deal with casino operator Penn to license its name for a sports betting product, ESPN Bet.

As former ESPN journalist Joon Lee pointed out: “The NFL will directly profit from sports gambling.” Lee also noted NFL commissioner Roger Goodell’s previous hardline on sports betting. In 2017, Goodell told reporters, “We still strongly oppose legalised sports gambling. The integrity of our game is No. 1. We will not compromise on that.”

USA Today’s sports writer Bryan Kalbrosky similarly asked: “How can the league suspend players for gambling when it also owns 10% of a sportsbook?”

ESPN Bet is likely to cause a problem

Another issue is ESPN’s editorial independence.

The Wall Street Journal put it to Iger that “one potential wrinkle” is the conflict of ESPN’s journalists and commentators covering a league that owns a stake in the company. The Disney boss rejected this idea, telling the publication that “nothing in this deal in any way changes ESPN’s approach when it comes to journalism.”

Still, such a murky ownership structure may cause journalists and wary editors to think twice before launching the types of investigations seen from ESPN in the past. Will they feel free to launch deep dives into domestic violence incidents by NFL players without fear or favour? Will they report stories with headlines like 2017’s “CTE found in nearly 90 percent of brains donated by football players”?

It seems unlikely, regardless of what Iger claims.

Interestingly, a precedent to this type of deal exists in New Zealand.

In late 2022, World Rugby acquired direct-to-consumer streaming service RugbyPass from Sky New Zealand, as part of a wide-ranging rights deal that saw the pay TV outfit secure exclusive rights for every World Rugby major event through to 2029, including Rugby World Cups, WXV and Sevens.

At the time, World Rugby CEO Alan Gilpin said he was “excited by this deal and its potential to unify a very fragmented rights environment.”

Could a similar thing happen in Australia? Let’s look at the numbers of the major players.

Seven West Media is currently valued at $223 million. Nine is valued at $2.7 billion. Foxtel was just sold to international sporting giant DAZN in a deal that values the company at $3.4 billion.

The AFL currently has the biggest sporting rights deal in the land, with Foxtel and Seven paying a combined $4.5 billion for seven years. The NRL is seeking a similarly sized deal at the moment, and is currently playing out a five-year $2 billion deal with Nine and Foxtel, set to expire after the 2027 season. Cricket Australia has a $1.5 billion, seven-year deal, again with Foxtel and Seven.

Foxtel pays billions to broadcast the AFL.

So, which organisation would such a deal make sense for?

Foxtel declined to speculate, when contacted by Mumbrella. At any rate, DAZN isn’t likely to give away a chunk of its newly purchased media company, especially seeing its recent history (DAZN bought out European sports broadcaster Eleven Sports in 2022) showed it to be in the acquisitions game, and not the shedding of assets.

Nine, on the other hand, is in full shedding season. This week, the company’s shareholders voted in favour of selling its 60% stake in Domain. It has also recently divided its publishing from its television from its radio, suggesting it may be going to market for its radio assets. It could trade off a slice of the company in exchange for NRL assets and a long term rights deal.

The network also has $1.4 billion from the Domain sale jingling in its pockets, and could free up more spare cash if it does offload its AM radio network. Could it enter a reverse ESPN/NFL deal, where it takes a portion of the NRL, in exchange for guaranteed TV rights at a reduced rate (or at least, with a portion of the rights deal money boomeranging back)?

According to Nine’s own masthead, the five-year deal with the NRL is worth $650 million over the five years, which is paid in $115 million cash, with a further $15 million in contra. This suggests that Foxtel makes up the remaining $1.35 billion over the five years.

Given the AFL and NRL broadcast deals are very similar in style — Foxtel gets exclusive Saturday matches, broadcasts the entire season live; Nine gets less games but has exclusive Grand Final rights — it can be assumed that Seven is paying a similar percentage for its rights deal with the AFL. This equates to just under a third, or roughly $1.5 billion for the seven years.

At ‘just’ $223 million in total market cap currently, the AFL could afford to buy Seven outright — more or less what Seven is giving it every year in AFL licensing fees.

There’s a lot of room for speculation on possible deals, but sports/media co-ownership is untested in the smaller, less fragmented Australian broadcasting market. It’s possible we could see a smaller deal in line with the Sky New Zealand/Rugby play, but it remains unlikely.

It’s possible it could benefit the leagues, the networks, and the fans. After all, it was Disney that taught us all to believe in happy endings.

Keep up to date with the latest in media and marketing