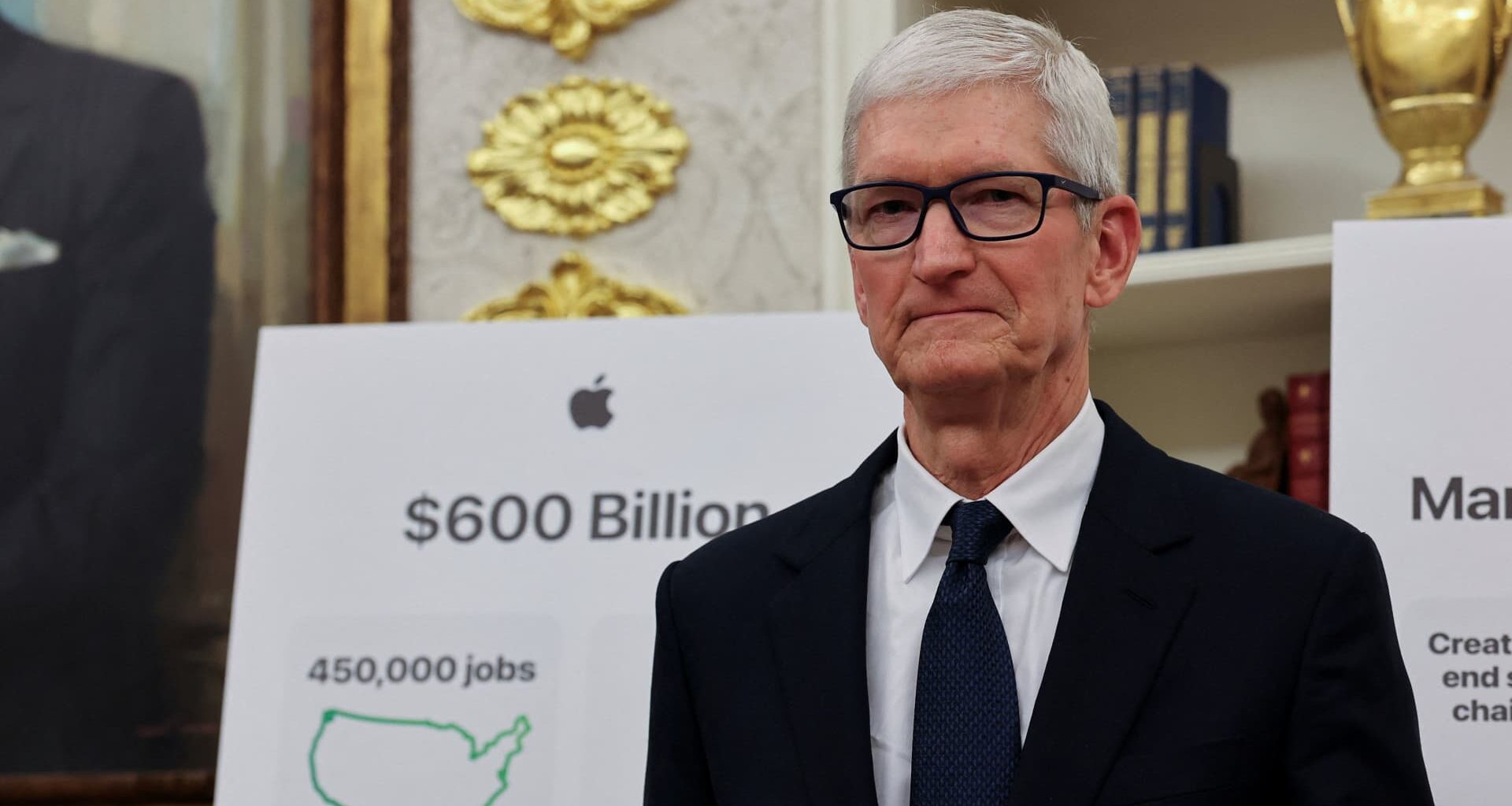

My top 10 things to watch Thursday, Aug. 7 1. Club name Apple shares are up again this morning, building on yesterday’s 5.1% jump after announcing an additional $100 billion investment into the U.S. and the creation of the American Manufacturing Program. Bank of America suggested iPhones could gain market share if competitors face tariffs and Apple is exempt. 2. Nvidia and other chipmakers like AMD also traded higher this morning despite President Donald Trump’s threat of 100% tariffs on semiconductors unless companies are building in the U.S. That caveat has investors betting these sector-specific tariffs will be more bark than bite. Club name Nvidia is investing in the U.S. 3. Is Eli Lilly becoming the gang that couldn’t shoot straight? Shares are tumbling after its much-hyped GLP-1 pill helped patients on the highest dose lose an average of 12% of their body weight in late-stage trial. The Street was looking for 13% to 15%. Glad we sold some stock for the Club last week. 4. Lilly CEO David Ricks said on “Squawk Box” that the company is pleased with the trial results and plans to apply for FDA approval later this year. Lilly also reported better-than-expected earnings today and upped its full-year guidance on the strength of its injectable GLP-1s, Zepbound and Mounjaro. The stock cut its losses but was still down almost 8%. 5. Intel shares dropped 5% this morning after President Donald Trump called on CEO Lip-Bu Tan to resign immediately, saying that he was “highly CONFLICTED.” Sen. Tom Cotton has questioned Tan’s ties to Chinese companies. Tan was named Intel CEO in March to turn around the struggling American chipmaker 6. Drive-thru coffee chain Dutch Bros reported a great quarter last night with no flies on it. Full speed ahead. No wonder the stock is up almost 20% this morning to around $69 a share. Barclays raised its price target to $92 from $84 and kept its overweight buy rating on the name. Morgan Stanley went to $84 from $80. 7. Looks like the short story for Duolingo — those betting the stock would go down — was a bad one. Shares are rocketing higher by 25% to around $430 after the language learning app delivered better-than-expected revenues and paid subscribers. Barclays, which has a hold-equivalent rating, took its PT to $390 from $375. I think that’s way too negative. 8. Morgan Stanley downgraded Caterpillar to a sell-equivalent underweight from equal weight, with analysts saying they’re worried about a “steady deterioration” in the machinery giant’s fundamentals. I think many people are buying Caterpillar’s stock to play the reshoring and an American manufacturing renaissance. 9. Shares of Airbnb dropped 7% after last night’s earnings showed some slippage despite beating revenue and earnings estimates. Don’t really get it. Its incremental investments aren’t driving material upside. The post-pandemic travel bull market had been a powerful force. 10. E.l.f. Beauty’s results were a little weaker than expected but still not bad. Tariffs are eating into profits. I’m talking to CEO Tarang Amin on “Mad Money” tonight. Meanwhile, over at DoorDash, CEO Tony Xu orchestrated perfection with a big earnings beat. Shares popped 7%. Sign up for my Top 10 Morning Thoughts on the Market email newsletter for free (See here for a full list of the stocks at Jim Cramer’s Charitable Trust.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.