Australia’s biggest bank has introduced an artificial intelligence (AI) scam detection tool and a fresh in-app security feature it hopes will combat the rise of bank fraud.

Commonwealth Bank has been capitalising on the AI boom, which it says has become a key frontier in scam protection after also pushing the technology in its customer service division.

The banking giant has now released a generative AI scam checker, an Australian-first tool that will let customers test out suspicious text messages in the Truyu app.

Commonwealth Bank has been capitalising on the AI boom. (Supplied)

Commonwealth Bank has been capitalising on the AI boom. (Supplied)

Truyu is a Commbank-backed app which alerts users when their name, date of birth and driver’s licence or passport details are being used online at 60 per cent of Australian vendors.

Customers can then confirm via the app whether it’s a legitimate or fraudulent use of these credentials.

Now, Commbank customers can grab a screenshot of a suspicious-looking text, upload it into the app, and check if it is a scam or not using the Scam Checker tool.

Truyu managing director Melanie Hayden told 9news.com.au that AI and human intervention need to work in tandem to effectively stop scammers in their tracks.

“It’s important to stress that AI doesn’t replace human judgement. Scam protection is most effective when AI tools support people in making informed decisions,” she said.

The Truyu app uses generative AI to identify a scam text. (Supplied)

The Truyu app uses generative AI to identify a scam text. (Supplied)

“Scam Checker is designed to help customers pause and assess a message before acting – empowering them with insights, not replacing their role in staying safe.”

General manager for group fraud James Roberts said the bank knows AI is not a “silver bullet” and is investing in people power to make it a true force for fighting scammers.

“Human oversight, responsible design, and customer awareness are all important for making AI work well and be reliable,” he said.

Truyu, which was created with CBA’s venture scaling arm x15ventures, has helped thousands of people by alerting them in near real-time when their identity is used at major merchants.

It also knows when a person’s private data is exposed in a data breach.

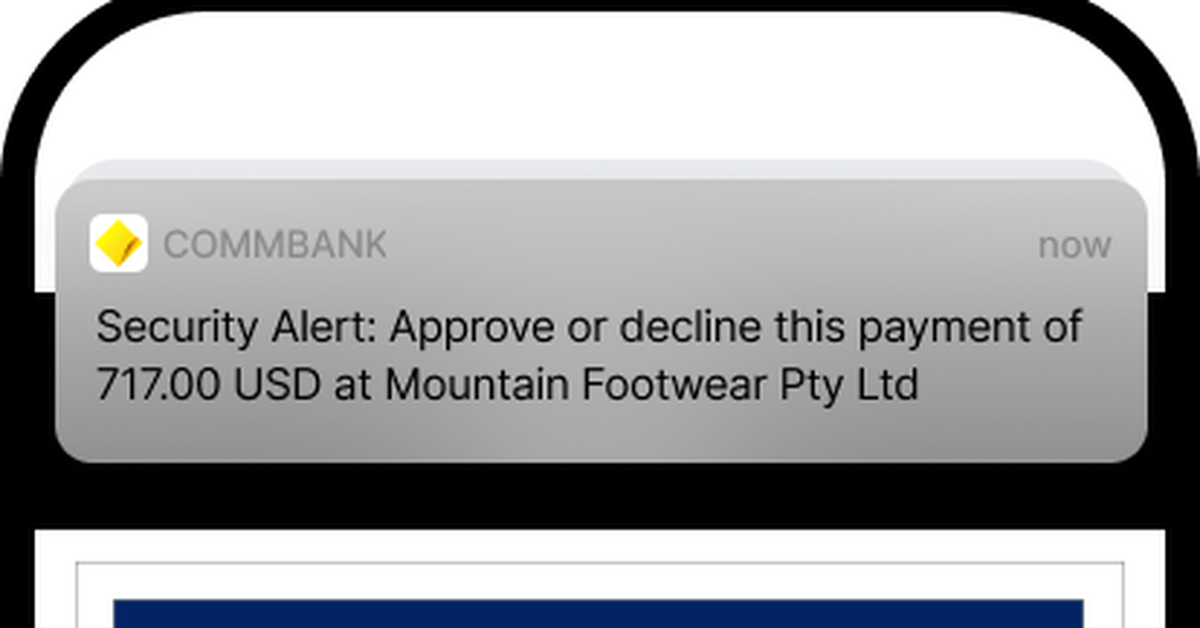

A new layer of anti-scam defence has been added to the Commonwealth Bank app. (Supplied)

A new layer of anti-scam defence has been added to the Commonwealth Bank app. (Supplied)

The bank has also launched a new security layer in its app which will ask customers to verify card transactions in real-time.

It will allow users to verify the transaction before it is authorised within the app without the need for a one-time passcode.

Roberts said this aims to stop scammers from impersonating legitimate businesses with fake texts.

Instead of sending an authorisation code via text, CBA customers will need to have access to their banking app to approve transactions.

“We’re now asking those customers who use the CommBank app to verify some online card transactions directly in the app instead of sending them a code,” Roberts said.

“We are able to give clearer guidance and warnings in the app than in a text message.

“The goal is to create a safer banking experience by combining the best of human insight and machine intelligence.”

The in-app verification is slated to be available within the Commbank app later this month.

Commbank said it has invested $900 million in the past financial year to fight against fraud, scams, financial crime and cyberthreats.