Origin Energy, Australia’s biggest energy retailer, appears to have hit the go-slow button on the rollout of new renewable energy projects, and is still mulling options on the already extended Eraring coal generator, the country’s biggest, which is officially due to close in 2027.

Origin on Thursday revealed that it had reaped the dividends of its investment in the LNG industry, which helped boost its underlying profits to $1.49 billion in 2024/25, from $1.18 billion a year earlier.

Underlying earnings from its energy division came in ahead of guidance at $1.40 billion, albeit down from $1.65 billion a year earlier due to lower electricity and gas gross profits.

However, what was striking about the latest annual report, and the results presentation from senior management, was the discussion over the Eraring closure timing, and the lack of any commitments to new wind and solar projects.

Both – because of the size of Origin and the scale of Eraring – have significant implications for the pace of Australia’s energy transition, and the meeting of near term renewable and emissions targets.

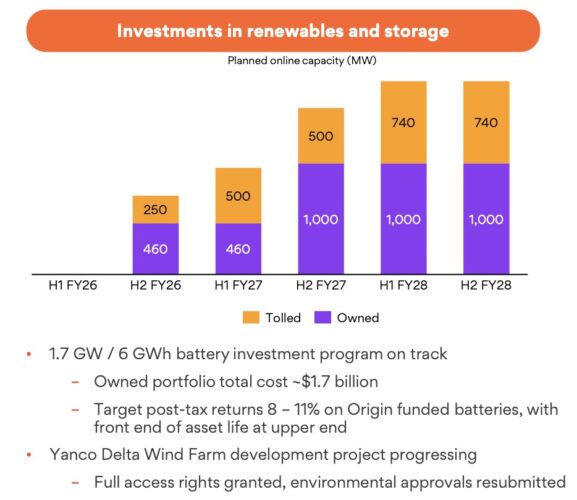

Like its “big three peers” EnergyAustralia and AGL, Origin Energy’s near term investment focus is almost entirely dedicated to big batteries.

Its earnings presentation mentions 1.7 GW of investments in “renewables and storage” target until the end of the 2028 fiscal year.

But this is made up entirely of big batteries, including the giant 700 MW, 2,800 MWh Eraring battery being next to the coal generator, a smaller 300 MW, 650 MWh battery next to its gas plant at Mortlake and a series of “virtual” off take deals with the Supernode and Summerville batteries.

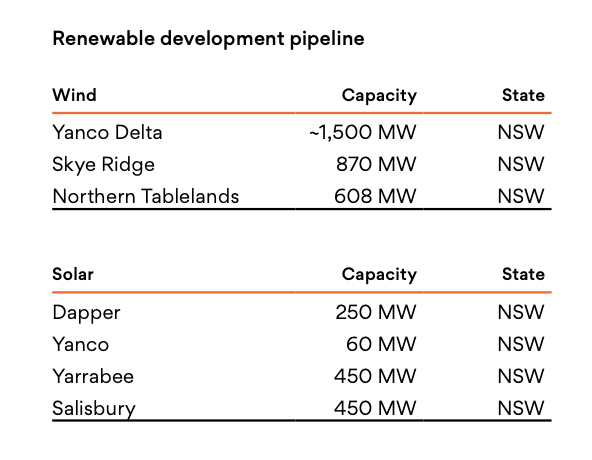

It includes no wind or solar projects. The technologies did not even rate a mention in the results presentation, apart from the giant 1.45 gigawatt (GW) Yanco Delta wind project in the south-west of NSW, which has gained grid access rights but is still to complete environmental approvals.

Origin does not expect to make a final investment decision on Yanco Delta before the end of calendar 2026, and it is not likely to be complete until the early 2030s.

The only reference to new wind and solar projects is made in the accompanying Climate Transition Action Plan, and this makes reference to the Skye Ridge and Northern Tablelands wind projects in the New England REZ, with a planned capacity of more than 1,350 MW, and the Dapper, Yarrabee and Salisbury solar projects in NSW.

“We acknowledge that it is a competitive time for renewable energy development, and the delivery of its supporting transmission and distribution infrastructure is taking longer than expected,” the report says.

Australia needs more than 40 gigawatts of new wind and solar capacity by 2030 to meet its renewable energy target of 82 per cent renewables, but the big three energy gentailers – Origin, AGL and EnergyAustralia – are doing little in the way of construction or contracting.

Origin says it has a 4 GW pipeline of wind and solar, primarily those mentioned above. That outlook contrasts to the ambition of spurned suitor Brookfield, which wanted to build 12 GW of new wind, solar and storage over a decade, but has since bought Neoen after its Origin bid was rejected by an Australian super fund more interested in fossil fuels.

Curiously, in its annual report, the company says: “With the Eraring Power Station’s closure planned for August 2027, failure to deliver our major renewable generation projects may affect Origin’s future supply capacity, financial prospects and reputation.” Yet it has made no commitment to build those projects in that timeframe.

Origin last year secured an underwriting agreement with the NSW state government to delay the closure of Eraring from August, 2025, to at least August 2027, which is now the “official” closing date, although it has the option to keep it open longer, until early 2029.

CEO Frank Calabria says the company is yet to decide on its closure options, which may include shutting one or two units down, closing the whole lot in August, 2027, or keeping some or all of them open until later.

Any decision is unlikely before the first half of next year, when Origin would need to commit to another bid spending program to keep the units in operation. The 720 MW units have already been modified to allow them to flex down to 210 MW, so avoiding much of the impact of the solar duck curve in the middle of the day.

Origin has chosen not to activate the NSW underwriting offer yet, largely because it is satisfied it is making enough money from the coal generator under its own steam. Origin’s average margin on its generation portfolio remains a healthy $40/MWh.

“We are preparing for a variety of scenarios and will be ready to execute on those, but the final decisions of both timing and choice will be determined by a range of factors,” Calabria told analysts at a briefing on Thursday.

The company has been mostly focused on its investments in the UK-based retailer Octopus, although its returns there were hit by the heat wave that crunched its margins, and the Kraken platform.

It has also built up its “virtual power plant” resource to 1.5 GW (up from 1.4 GW a year ago), and says it is less impacted than its peers from retail “churn) and has gained an extra 104,000 customers over the past year to take its total to 4.7 million.

Giles Parkinson is founder and editor-in-chief of Renew Economy, and founder and editor of its EV-focused sister site The Driven. He is the co-host of the weekly Energy Insiders Podcast. Giles has been a journalist for more than 40 years and is a former deputy editor of the Australian Financial Review. You can find him on LinkedIn and on Twitter.