Australia’s wind energy industry is facing a crisis as new data confirms no new project commitments in the first half of 2025, and following a week when the country’s three biggest utilities showed no interest in buying, building or contracting new capacity.

The lack of investment in new wind projects is not news – it was highlighted by BloombergNEF at the Australian Clean Energy Summit last month, and confirmed in that company’s first half assessment released earlier this week.

See our stories: A massive week for battery storage, but where are the financiers for wind and solar? and Renewables investment falls off cliff as no new wind projects reach financial close in first half of 2025

But the issue has reached crisis point ahead of the state energy minister’s meeting at Sydney’s Taronga Zoo on Friday, prompting the Clean Energy Council to rush out its own, still incomplete data, which confirmed that no new wind projects reached financial close in the first six months of the years.

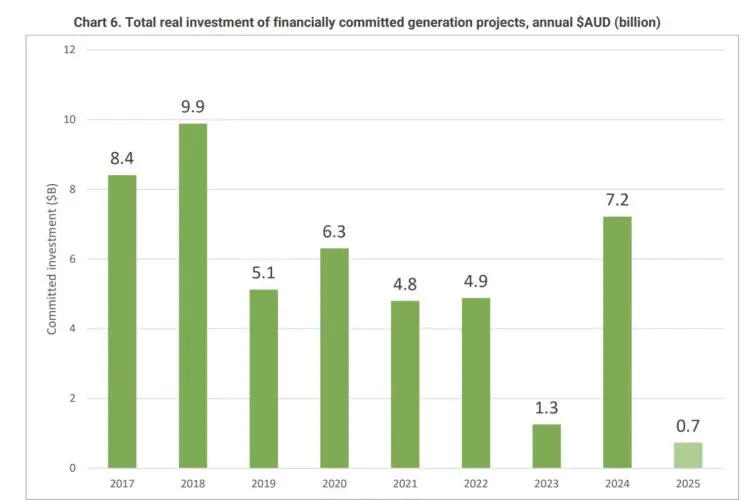

It says total financial commitments in the first half of 2025 has fallen to a paltry $700 million, with just over 1.1 GW of new capacity committed, well short of what is needed.

Federal and state governments have sought to address the issue by agreeing to fast-track and expand their flagship policies and auctions to try and ensure the 2030 target of 82 per cent renewables gets back on track.

Federal energy minister Chris Bowen has announced that the Capacity Investment Scheme auctions will be expanded to more than 40 gigawatts, while in NSW – the biggest grid and with ageing coal fired generators – the target has been ramped up to 16 GW of new wind and solar capacity by 2030, instead of 12 GW.

The CIS and NSW auctions are important because they provide a form of underwriting agreement that can help projects get finance, but few developers – even the huge multinationals such as Acciona and Iberdrola that now dominate the CEC – are prepared to commit without a solid off-take agreement.

Corporate buyers have also dried up. Developers say the only major corporate with any interest in signing off take agreements is Rio Tinto, which is looking to repower its giant smelters and refineries, and has already signed some large contracts.

The biggest blockage, however, is from the energy industry itself. Those with their hands on the biggest financial levers – the three giant utilities (AGL, Origin and EnergyAustralia) that account for 80 per cent of all customer demand, and who own most of the remaining coal generators – are not coming to the party.

They are all investing billions in battery storage, largely because the flexibility and dispatchability of big batteries ensures that the big three retain their market power over wholesale electricity prices.

But they show little interest in new wind and solar. Origin Energy, for instance, has won grid access for the biggest wind project in Australia, the 1.45 GW Yanco Delta wind project in south-west NSW, but will not make a financial commitment on that project for another 18 months.

All mention of other wind and solar projects in its pipeline were excluded from the latest financial results, even though the company conceded in its own annual report that “reputational damage” that could ensue if it didn’t get cracking on building the new capacity needed to ensure the coal generator – in Origin’s case Eraring – can close as scheduled.

“With the Eraring Power Station’s closure planned for August 2027, failure to deliver our major renewable generation projects may affect Origin’s future supply capacity, financial prospects and reputation,” the report says. And yet Origin freely discussed with analysts its options on Eraring, including investing to keep at least some units open.

As ITK principal David Leitch says in the latest episode of Renew Economy’s Energy Insiders podcast, this is all about market power – an issue that has been left to fester for decades, and which – to Leitch’s frustration – is not addressed in the newly released Nelson review draft recommendations.

“We need some commitment, and that’s why it was so incredibly disappointing to see the results from AGL and Origin this week, where the discussion of wind and solar development was next to nothing,” Leitch says.

“And it’s where I think myself that the Nelson review completely misdiagnosed the problem … they may proposed swapping the capacity investment scheme for these long, dated contracts, that’s great, but the reality is none of them want to talk about wind or solar at all.”

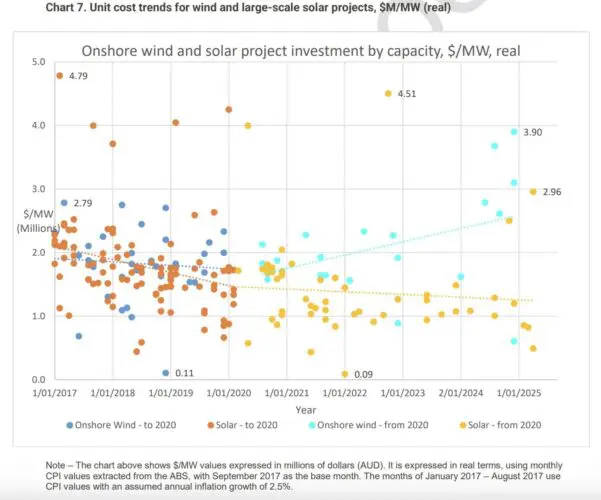

The wind industry is facing multiple issues. Turbine costs have not fallen much from the spike of a couple of years ago, and the likes of the CSIRO have increased their most recent cost estimates, largely because of the need for workers accommodation in remote areas and the rise in civil construction costs.

Wind also requires transmission, and this has been slow and costly to roll out, and the technology has run into planning issues.

It is often the victim of misinformation, astroturfing and the like, but some sections suffer from their own hubris – Renew Economy is often asked by project developers not to write about their projects for fear it may attract “unwanted” attention (We ignore these requests).

It is not surprising that the few projects that have reached financial close in the first half of 2025 are standalone batteries, and solar-battery hybrids, which are more easily deployable, can find space on local grids, and are now more than competitive with the combined price of wind and transmission.

The CEC report notes that the capital costs of onshore wind increased by 8 per cent in 2023-24 and 6 per cent in 2024-25, as economies of scale are offset by local increases in land and installation costs, and construction timelines have doubled to 90 weeks since 2022.

Screenshot

Screenshot

Meanwhile, the CEC says, manufacturing scale and a rapid rate of technological development in solar PV have seen a continued downward trend in the capital costs for solar projects. Battery storage costs have also plunged.

Many solar projects are now having a rethink and adding behind the meter batteries – to ensure they can dodge negative prices in the middle of the day and cash in on higher prices in the evening peak.

Frustratingly, in those areas where local community support is strong development is being held up by poor decisions about grid capacity made years ago. The south-west renewable zone has attracted some 40 gigawatts of project proposals, but only 3.5 GW may get built because of the lack of capacity.

Which is a shame, because the region wants the development to happen.

“Renewable energy … has really started to change how we view the economy and the opportunities that are going to come our way,” says Alison McLean, the senior economic development officer for the Hay Shire council, also in the latest episode of Energy Insiders.

“We can either have this done to us, or it will be done with us in terms of the transition. We decided to respect our community, and that was the difference.

“We we understood that our topography suits renewable energy development. We understand that our sparse population suits renewable energy development. We understand that renewable energy is a very contentious topic for people in rural communities.

“And so we thought, why not show the respect that these people deserve, give them all of the information and let the community feel informed enough and empowered enough to make a decision about whether this was something our community would support or not support.

“And in doing that, we were able to really bring the community along in this discussion.”

tThe interview with Alison McLean is worth a listen. You can read more of that interview here, and listen to the podcast here: Energy Insiders Podcast: Regional communities and the renewable gold rush

See also: “We set the rules of engagement:” How one community took control when wind and solar came to town

And: “Straight answers and high standards:” Bowen presses go on renewable developer rating scheme

Giles Parkinson is founder and editor-in-chief of Renew Economy, and founder and editor of its EV-focused sister site The Driven. He is the co-host of the weekly Energy Insiders Podcast. Giles has been a journalist for more than 40 years and is a former deputy editor of the Australian Financial Review. You can find him on LinkedIn and on Twitter.