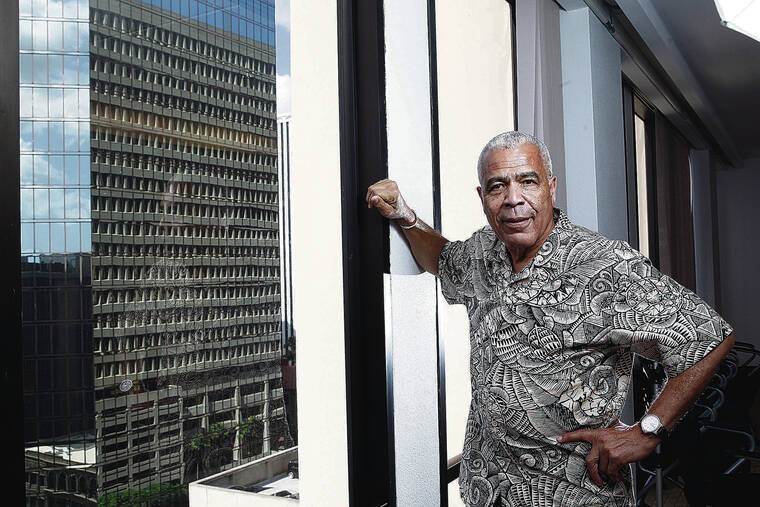

The head of Hawaii’s local government pension fund, Thom Williams, will retire at the end of this year after leading the organization for over a decade.

Williams has overseen an investment portfolio for the Employees’ Retirement System of the State of Hawaii that grew from $14.4 billion when he was hired as executive director in 2015 to about $24.3 billion today.

ERS announced the scheduled retirement of

Williams earlier this month.

Williams in a statement said his job at ERS began as “merely another professional pursuit” but turned into a labor of love that resulted in enormous progress for the 100-year-old organization to benefit current beneficiaries and future

generations.

“With guidance from our Board and support of managerial staff, we have built a program and accompanying organizational structure which is designed to last well beyond the tenure of any single executive,” he said. “I am confident that the talent pool for my successor is deep and that the strategic plan we developed will not only provide direction but make for a seamless

transition to new leadership.”

During his tenure, there have been ups and downs for the fund during good and bad times for financial markets affecting the long-term ability of ERS to cover its retirement, disability and survivor benefit obligations to more than 130,000 state and county employees and

former employees.

Don’t miss out on what’s happening!

Stay in touch with breaking news, as it happens, conveniently in your email inbox. It’s FREE!

Emmit Kane, chair of the ERS Board of Trustees, expressed deep gratitude to Williams for what Kane called steadfast leadership and unwavering commitment of Williams to the

organization.

“Thom’s vision and dedication have left a lasting, positive impact on the lives of our members and the future of ERS,” Kane said in a statement. “His legacy is one of integrity, innovation, and service, and we wish him all the best as he embarks on this well-earned retirement.”

Williams, who led the Wyoming Retirement System before he joined ERS, also was praised for improving the organization’s long-term fiscal sustainability, member services and investment performance.

In the most recent

ERS actuarial report for the fiscal year ended June 30, 2024, ERS experienced an actuarial loss as a result of investment returns not achieving an assumed 7% target in 2023 and 2024 after accounting for employee contributions and benefit payments.

However, the funding ratio for ERS — what is needed to meet financial obligations — improved to 63% in the 2024 fiscal year from 62.2% in the prior year.

The total unfunded liability for ERS in the same comparable period rose to $14.01 billion from $13.71 billion, according to the report by Texas- based actuary Gabriel, Roeder, Smith &Co.

Based on estimates for employee contributions and beneficiary payments, the report said ERS can achieve full funding in 2046 if its 7% investment return target is met.

For the nine months through March 31, ERS reported a 3.1% return on its investment

portfolio.

The ERS board has initiated a search for a new executive director, and anticipates announcing a successor later this year.