Commonwealth Bank of Australia (CBA) posted the largest dollar gain, adding $4.71 billion in loans over the month. Westpac and National Australia Bank (NAB) each expanded their lending by more than $2.4 billion, while Australia and New Zealand Banking Group (ANZ) grew its portfolio by $1.55 billion.

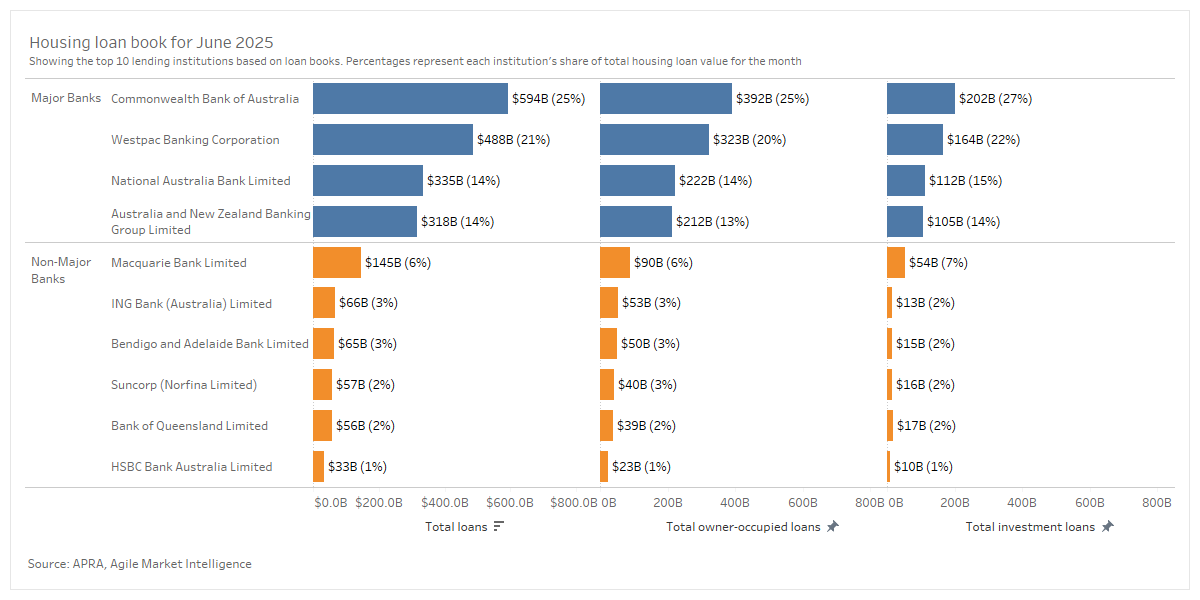

CBA now holds the largest share of housing loans at 25%, followed by Westpac at 21%. NAB and ANZ each account for approximately 14% of total housing loans.

“The big four are still setting the tone for the market,” said Michael Johnson, director at Agile Market Intelligence. “Their capacity to grow in both housing and business lending, even in a flat economic cycle, reinforces their competitive moat.”

Among non-major lenders, Macquarie Bank led in percentage growth, while ING followed with a 1.57% increase, adding over $1 billion to its loan book. Suncorp and HSBC each reported gains of about 0.65%, maintaining steady growth over the past year.