Broker Pulse, conducted monthly by Agile Market Intelligence, surveys residential mortgage brokers about their experiences with lenders. The latest edition is based on responses from 282 residential brokers collected between July 1 and 16.

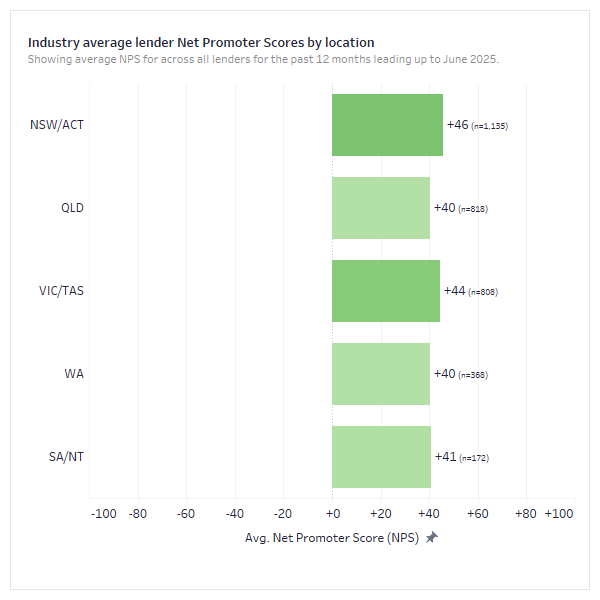

“An NPS above +40 means brokers are generally getting good results,” said Michael Johnson, director at Agile Market Intelligence. “The challenge for lenders is to keep that up while fixing weaker areas like credit access and communication, because those issues can quickly reduce broker support.”

Western Australia led in overall broker experience, achieving a 70% satisfaction rate, followed by Victoria/Tasmania at 68% and both New South Wales/Australian Capital Territory and Queensland at 67%. Application stage satisfaction was highest in WA at 74%.

Queensland topped settlement satisfaction at 71%, narrowly ahead of NSW/ACT and WA at 70%. WA also posted the highest BDM interaction satisfaction at 70%, while South Australia/Northern Territory had the lowest overall broker experience score at 64%.