Sourcing used vehicles in Canada remains a challenge as the market has been impacted by significant changes over the past few years — including a chaotic political and trade situation, according to DesRosiers Automotive Consultants.

“The automotive industry is notably exposed within the North American political landscape, and this is certainly true of used vehicles,” said Andrew King, Managing Partner at DAC, in a statement. “To date, the used vehicle market has remained fairly stable in the face of these forces, although it is questionable whether this pattern will continue.”

DAC worked with colleagues at the Used Car Dealers Association and reached out to both independent used vehicle dealers and the used vehicle arms of franchised new vehicle dealers. UCDA members were surveyed on their used vehicle sales in the first half of the year.

Franchised new vehicle dealers noted a sales average of 201 units for the first six months of 2025, which is somewhat above the 194 units in the first half of 2024. And independent used vehicle dealers noted a small decrease, from 69 units to 63 units on average. DAC asked about their expected sales for 2025, overall. To this, franchised new vehicle dealers forecasted an average of 413 units, compared to independents at 134 units.

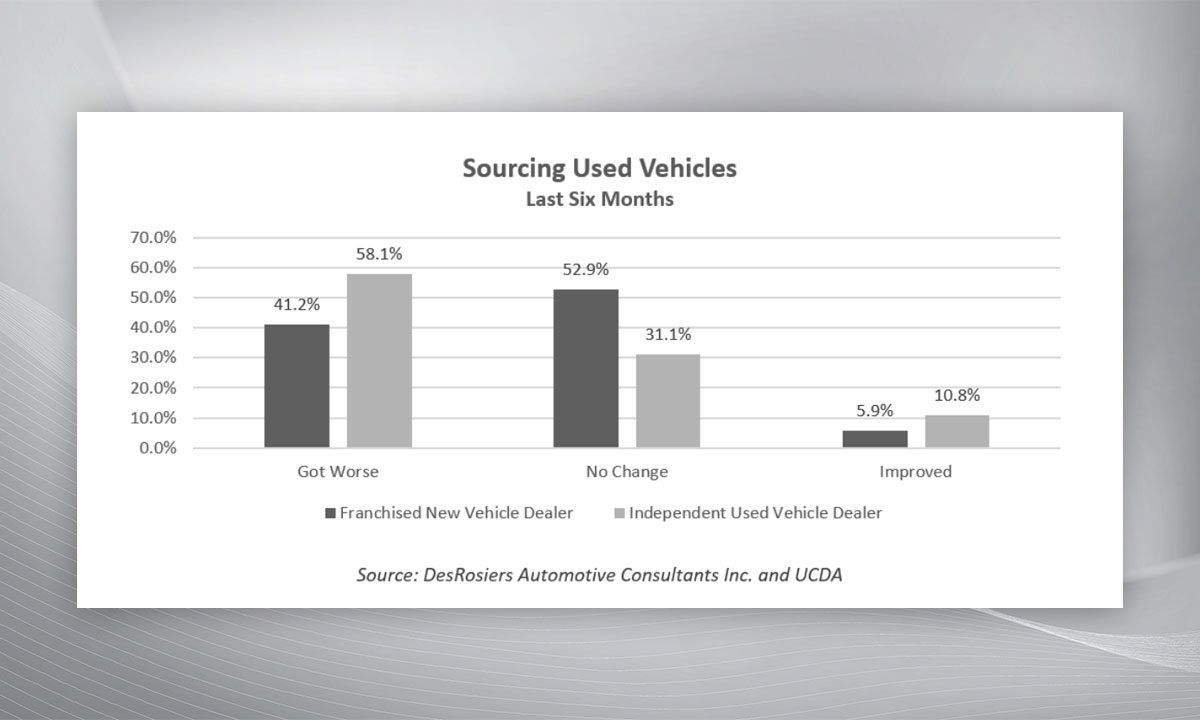

“While the massive sourcing difficulties of the past few years have in large part abated, challenges do remain,” said DAC in its update. “When asked about used vehicle sourcing in the first half of 2025, the majority of independents, at 58.1%, cited a worsening situation. A further 31.1% noted no change while 10.8% saw improvements.”

However, they also noted a slim majority (52.9%) of franchised new vehicle dealers pointing to no change in used vehicle sourcing, while 41.2% highlighted growing difficulties. And only 5.9% saw improvements. DAC said the “extremely low” volumes of off-lease vehicles coming back into the market “clearly remains an issue that is impacting all players.”

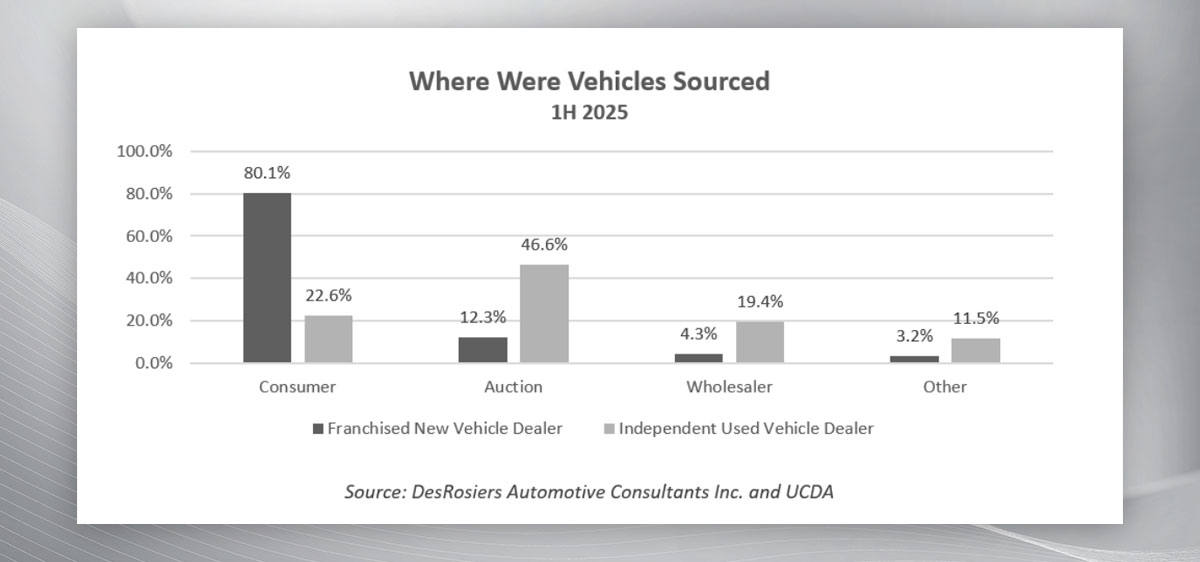

During the first half of the year, franchised new vehicle dealers pointed to a very strong majority of their vehicles as being sourced from consumers at 80.1%. Auctions were in second place at 12.3%. For independent used vehicle dealers, auctions were the most likely source at 46.6%, consumers at 22.6%, and wholesale at 19.4%.