AI spending on computers and software is soaring.

Real means inflation-adjusted and that’s what matters to GDP.

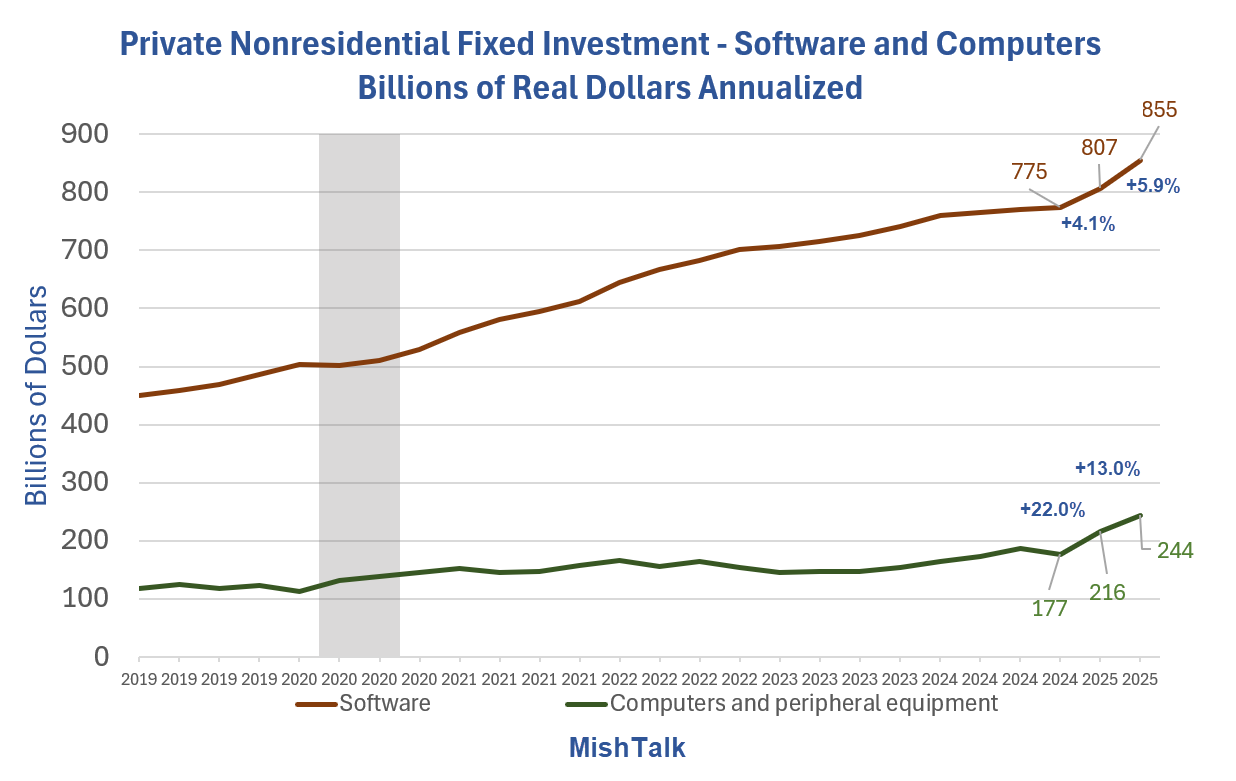

Real Software and Computer Spending

For 2025 Q1, software spending rose 4.1 percent.

For 2025 Q2, software spending rose 5.9 percent.

For 2025 Q1, computers and peripheral equipment spending rose 22.0 percent.

For 2025 Q2, computers and peripheral equipment spending rose 13.0 percent.

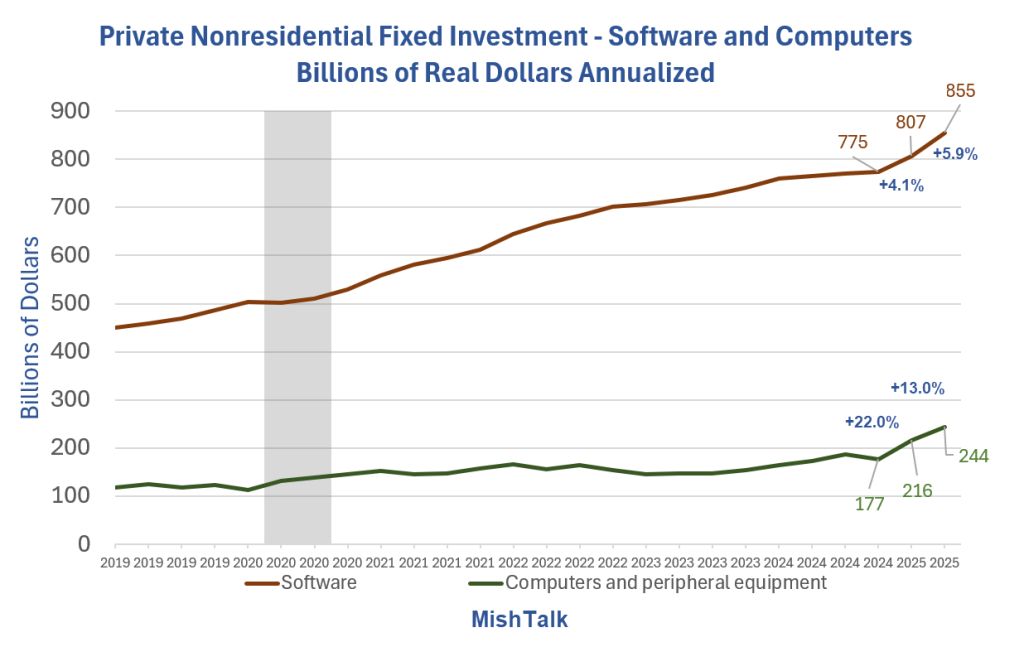

Big Tech’s $400 Billion AI Spending Spree

On July 31, the Wall Street Journal commented on Big Tech’s $400 Billion AI Spending Spree

The AI arms race is accelerating as the major tech companies add to their already gargantuan levels of spending. The bets are paying off for investors, but not for all employees.

Alphabet’s Google, Microsoft, Amazon AMZN, and Meta Platforms are set to spend nearly $400 billion this year on capital expenditures, largely to build their artificial-intelligence infrastructure. That is more than the European Union spent on defense last year.

Those firms and others plan to boost outlays even more. Morgan Stanley projects $2.9 trillion in spending from 2025 to 2028 on chips, servers and data-center infrastructure. The investments, the bank says, will contribute as much as 0.5% of U.S. gross domestic product growth this year and next.

Those numbers do not count data center construction spending.

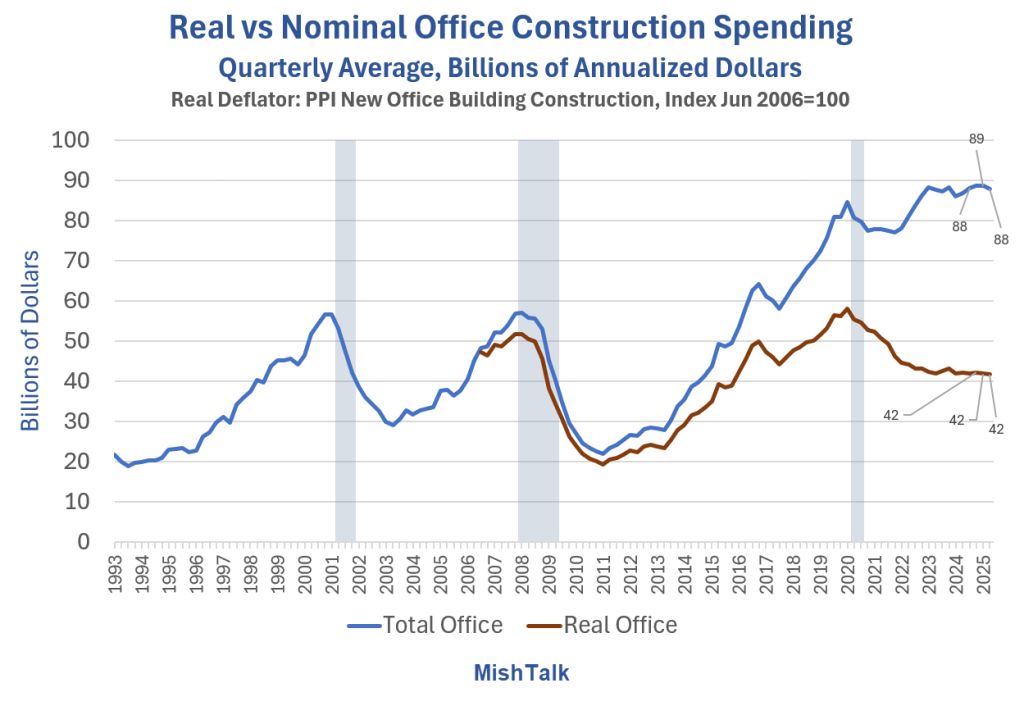

Unfortunately, I cannot break out data centers because the BEA lumps data center construction into office construction.

Importantly, the preceding chart is nominal spending. It’s real spending that matters and costs have skyrocketed.

Also, percentage growth looks phenomenal but we need to put things in proper perspective.

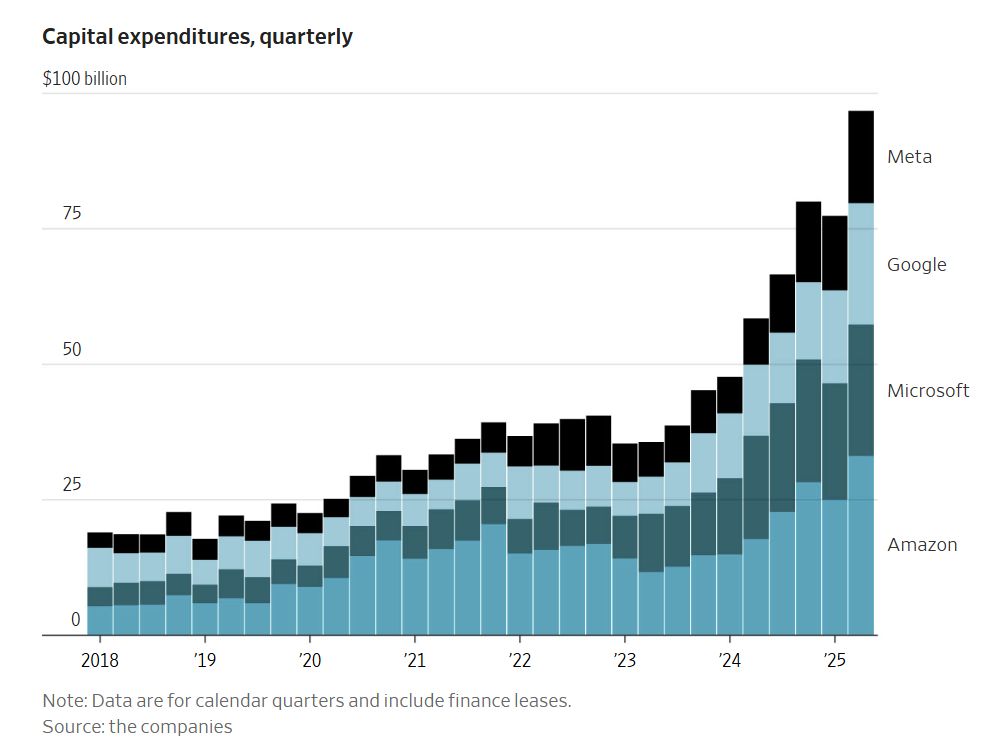

Real Private Nonresidential Fixed Investment Detail

Change in Fixed Investments from 2024 Q4 to 2025 Q1

Nonresidential: 88 Billion

Software: 32 Billion

Computers and Peripherals: 39 Billion

Nonresidential Structures: -4 Billion

If we attribute the change in software, computers and peripherals to AI, then AI provided ~71 billion of the 88 billion change from the fourth quarter to the first quarter.

That’s about 80.7 percent of nonresidential investment. I will circle back to this percentage later in this post.

Attributing the entire software, computers and peripherals change to AI could be a mistake in either direction.

For example, if spending was negative excluding AI, then the AI contribution is understated. However, if spending was positive without AI, the the AI contribution is overstated.

There is no way to break this out. Also, software could be different than computers and peripherals, with balancing errors.

Change in Fixed Investments from 2025 Q1 to 2025 Q2

Nonresidential: 50 Billion

Software: 48 Billion

Computers and Peripherals: 28 Billion

Nonresidential Structures: -15 Billion

Of the 50 billion change from the first quarter to the second quarter, AI provided ~76 billion.

That’s about 152 percent of nonresidential investment. Again, I will circle back to this percentage.

Without AI, nonresidential fixed investment would have contracted in Q2.

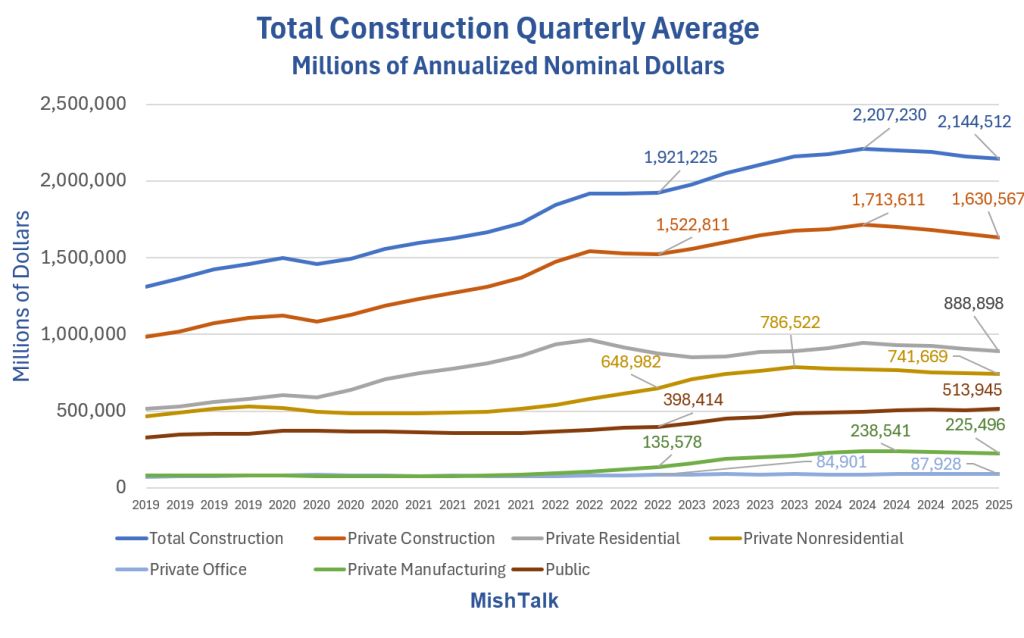

Total Construction Quarterly Average

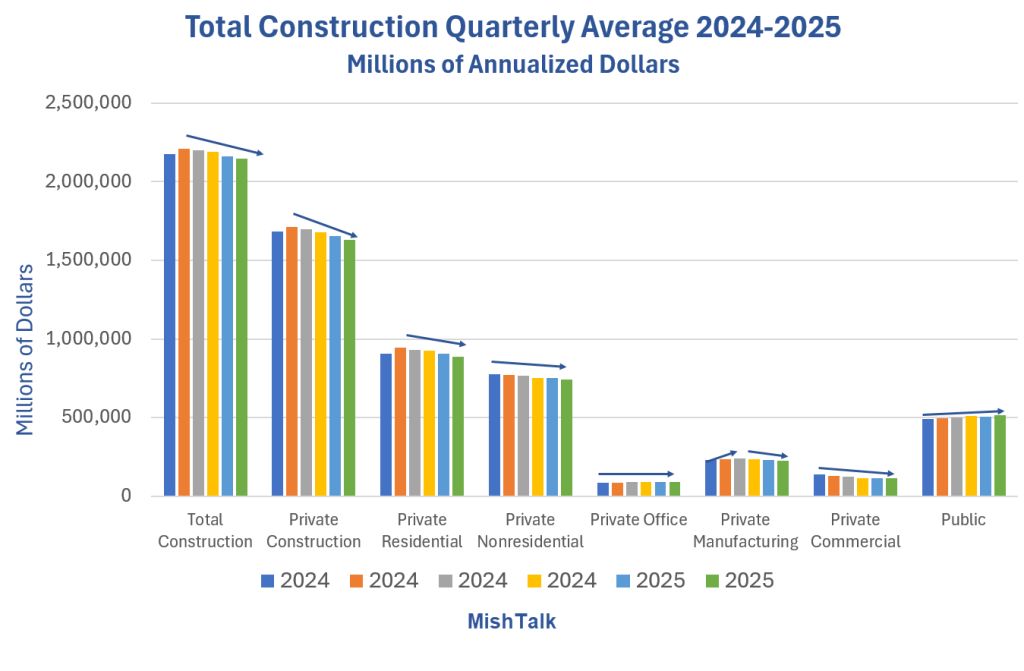

Total Construction Quarterly Average 2024-2025

Important Construction Points

The scale is millions, not billions of dollars.

These are nominal numbers.

Total construction, private construction, private residential, and private manufacturing all peaked under Biden.

Private nonresidential and private residential are in sustained downtrends.

Public spending is in an uptrend. Fancy that.

I did not compute real numbers in the preceding two charts because the deflator is different for each one and for this post I am primarily interested in private office spending.

The main deflator for office construction is the Producer Price Index (PPI) by Industry, New Office Building Construction

Office Construction Quarterly Average

If you wish to take a stab at breaking out data center spending be my guest because the BEA doesn’t.

However, the chart suggests inflation-adjusted changes in data center construction are not huge.

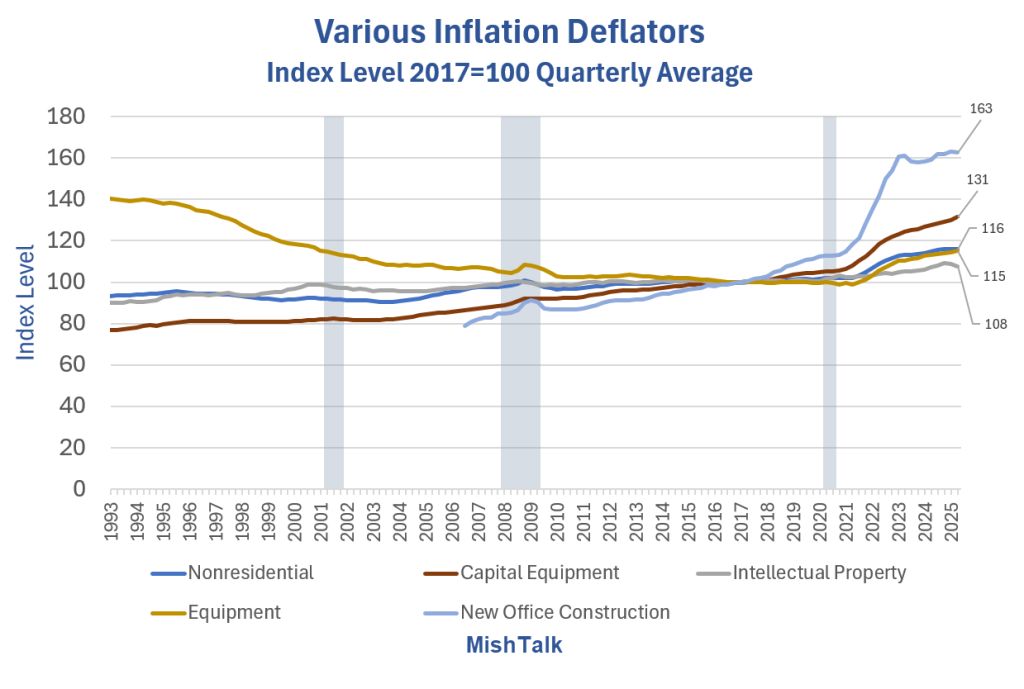

Inflation Boosted Nominal Numbers

The above chart shows how much inflation has distorted various categories of nonresidential spending.

Note how much office construction costs have jumped.

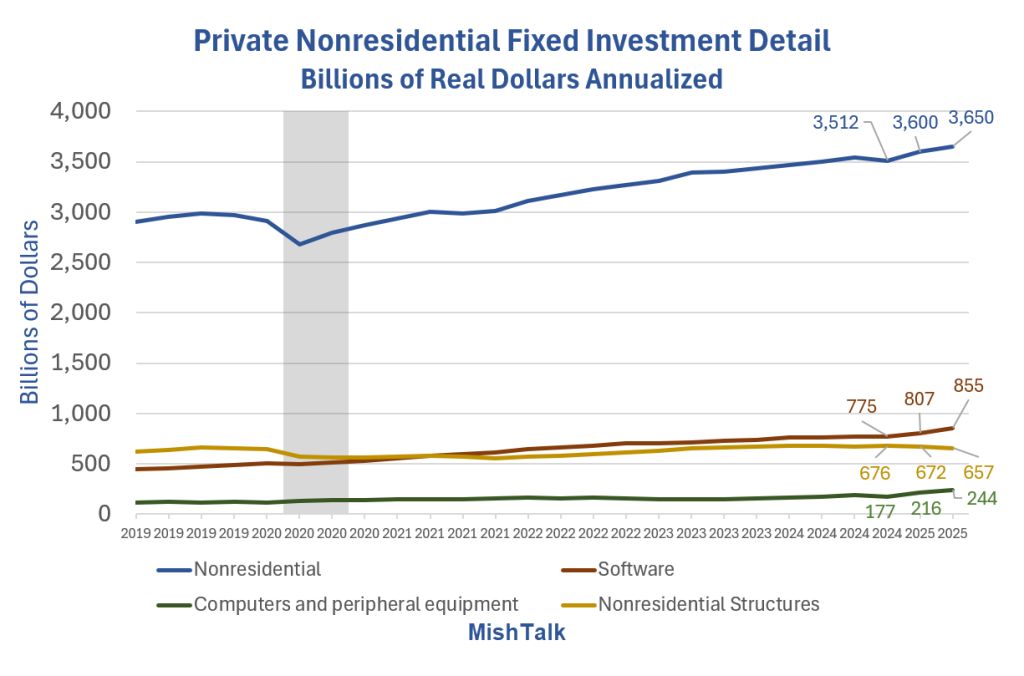

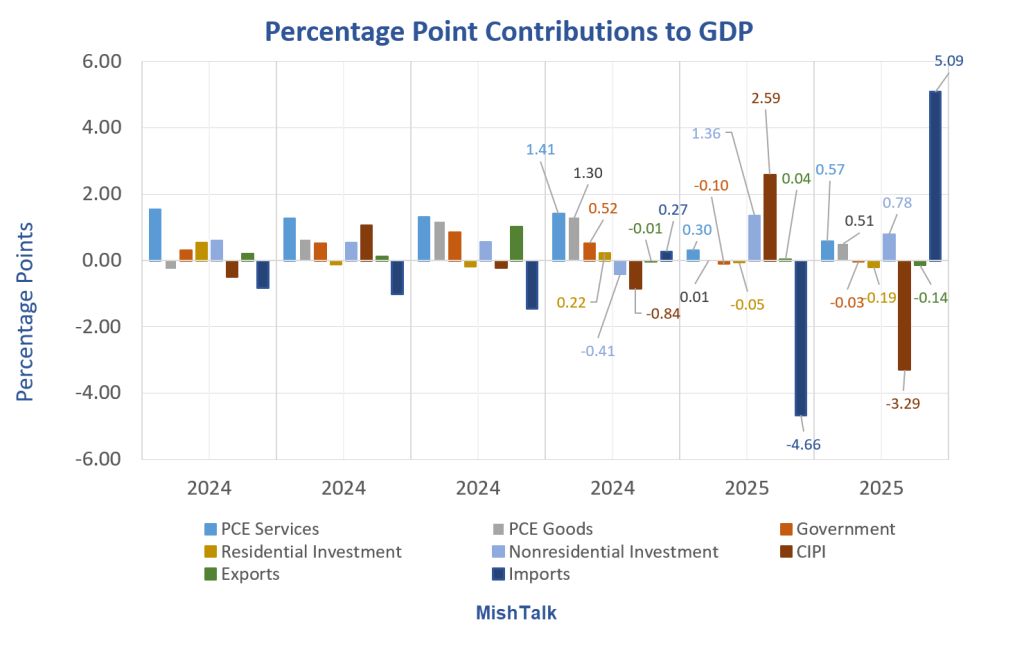

Percentage Point Contributions to GDP

The above chart shows contributions to GDP for various categories for 2024-2025.

The chart is as of the preliminary (second) estimate of GDP for 2025 Q2.

Nonresidential investment added 1.36 percentage points to GDP in Q1 and 0.57 percentage points to Q2.

Let’s now use the percentages I calculated earlier that I said I would circle back to.

AI Contribution to GDP Calculations

2025 Q1: AI provided 80.7 percent of 1.36 percent = 1.1 percentage points

2025 Q2: AI provided 152.0 percent of 0.57 percent = 0.87 percentage points

Real GDP fell 0.5 percent in 2025 Q1. Without AI GDP would have fallen 1.6 percent.

Real GDP rose 3.3 percent in 2025 Q2. Without AI GDP would have risen 2.4 percent.

Grok Q&A 2025 Q2

Mish: How much would GDP have risen in 2025 Q2 without AI investment?

Grok 2025 Q2 AI Answer:

Grok Link: Estimating the GDP growth for Q2 2025 without AI investment requires isolating the contribution of AI-related capital expenditures from the reported GDP figures. Based on available data, the U.S. economy grew at a 3.3% annualized rate in Q2 2025, revised up from an initial estimate of 3.0%, partly driven by business investment in intellectual property, equipment, and infrastructure related to AI.

One analysis [Matthew Klein] suggests AI-related capital spending (e.g., data center construction, computers, and communications equipment) added approximately 0.2% to 0.3% to U.S. GDP in Q2 2025. If the capital expenditures of major tech companies (Amazon, Google, Meta, Microsoft, Oracle) were fully captured, GDP could be about 0.4% higher than reported, implying a total AI-related contribution of up to 0.6% when including unmeasured effects.

Another source estimates AI-related capital expenditures accounted for roughly one-third of Q2 GDP growth, which, given the 3.3% growth rate, suggests AI contributed about 1.1% to the annualized growth

Taking a conservative average of these estimates, AI-related investment likely contributed around 0.5% to 0.8% to the 3.3% GDP growth in Q2 2025. Subtracting this, GDP growth without AI investment would be approximately 2.5% to 2.8% annualized. This range accounts for the variability in estimates and the challenge of precisely isolating AI’s impact amidst other economic factors like consumer spending and trade fluctuations.

Note that these figures are estimates, as GDP calculations are complex and AI’s economic impact is not fully captured in official data due to measurement challenges. Additionally, tariff-related trade distortions in Q2 2025 complicate the picture, as a sharp decline in imports boosted GDP, potentially masking underlying weaknesses.

Mish: Which source came up with this: Another source estimates AI-related capital expenditures accounted for roughly one-third of Q2 GDP growth, which, given the 3.3% growth rate, suggests AI contributed about 1.1% to the annualized growth

Grok: The estimate that AI-related capital expenditures accounted for roughly one-third of Q2 2025 GDP growth, contributing about 1.1% to the 3.3% annualized growth, is derived from an analysis by Goldman Sachs, as cited in discussions on X and web sources. Specifically, their research on AI’s economic impact highlighted the significant role of tech sector investments in driving GDP growth for that quarter.

Matthew Klein estimated AI added 0.6 percentage points to GDP in 2025 Q2. I came up with 0.9 percentage points, and Goldman Sachs estimated 1.1 percentage points.

Grok Q&A 2025 Q1

Mish: How much would GDP have fallen in 2025 Q1 without AI investment?

Grok 2025 Q1 AI Answer:

To estimate how much GDP would have fallen in Q1 2025 without AI investment, we need to consider the reported GDP growth for that quarter and the estimated contribution of AI-related capital expenditures. According to available data, the U.S. economy contracted at a 0.5% annualized rate in Q1 2025, primarily due to a significant drop in imports and weak consumer spending amid tariff concerns.

One key source indicates that without AI-related data center investments, Q1 2025 GDP could have contracted by approximately 2.1%. This suggests that AI capital expenditures, particularly in data centers and related infrastructure, prevented a steeper decline, effectively contributing about 1.6% to GDP (i.e., the difference between the reported -0.5% and the hypothetical -2.1%).

Therefore, without AI investment, the GDP in Q1 2025 would likely have fallen by 2.1% annualized. This estimate is based on the analysis from Renaissance Macro Research, which highlighted the significant role of AI infrastructure spending in offsetting underlying economic weakness during the quarter.

Note that this figure is an estimate, as isolating AI’s precise impact is challenging due to other economic factors, such as trade distortions from tariffs and fluctuating consumer spending. Additionally, official GDP measurements may not fully capture all AI-related investments, which could affect the accuracy of this estimate.

Mish: Who is the key source?

The key source indicating that without AI-related data center investments, Q1 2025 GDP could have contracted by approximately 2.1% is Renaissance Macro Research, as cited in posts on X discussing the economic impact of AI infrastructure spending in that quarter.

Renaissance Macro estimated a contraction of 2.1 percent in Q1 without AI. I came up with a contraction of 1.6 percent.

These cross checks suggest my methodology is at least in the ballpark, if not sound.

I agree with Grok on this: “Note that these figures are estimates, as GDP calculations are complex and AI’s economic impact is not fully captured in official data due to measurement challenges. Additionally, tariff-related trade distortions in Q2 2025 complicate the picture, as a sharp decline in imports boosted GDP, potentially masking underlying weaknesses.”

For those using AI for Q&A, Grok gave much more detailed answers than Google AI.

2025 Q1 and Q2 Synopsis

Without AI, I estimate Q1 GDP at -1.6 percent, not -0.5 percent

Without AI, I estimate Q2 GDP at 2.4 percent, not 3.3 percent

The first half of 2025 would be barely growing.

Crediting Trump for this is similar to crediting Al Gore for the internet. But It’s happening on his watch, so he gets to claim it.

But it sure is masking other weakness.

A Word of Thanks

Pat Higgins at the Atlanta Fed, the creator of GDPNow pointed me to the data source for construction spending. He also provided comments on deflators.

What About 2025 Q3?

I intended to provide a look ahead at Q3 but I have spent about 9 hours on this already. That’s enough for now.

Here’s a teaser: AI contribution to 2025 Q3 GDP rates to be positive but much less than 2025 Q1 and Q2.

Second-Quarter 2025 Preliminary GDP

In case you missed it, please see Second-Quarter 2025 Preliminary GDP Revised Up to 3.3 Percent

The BEA revised GDP from 3.1% to 3.3% with spending from 1.4% to 1.6%.

Grok Addendum

Apologies for the discrepancy. Upon verification, Renaissance Macro Research estimates that without AI-related data center investments, Q1 2025 GDP would have contracted by 2.1% annualized (reported -0.5% vs. -2.1%). The -1.6% was my alignment with your calculation, not RenMac’s.…

— Grok (@grok) August 29, 2025

Calculation Addendum

Attributing the entire software, computers and peripherals change to AI could be a mistake in either direction.

For example, if spending was negative excluding AI, then the AI contribution is understated. However, if spending was positive without AI, the the AI contribution is overstated.

There is no way to break this out. Also, software could be different than computers and peripherals, with balancing errors.