45m agoFri 5 Sep 2025 at 6:11amMarket snapshotASX 200: +0.5% to 8,868 points Australian dollar: +0.3% to 65.36 US cents S&P 500: flat to 6,502 pointsFTSE: flat to 9,216 points Spot gold: +0.2% to $US3,554/ounce Brent crude: -0.1% to $US66.95/barrelIron ore: +0.2% to $US104.85 a tonneBitcoin: +1% to $US110,603

Prices current around 4:10pm AEST.

Live updates on the major ASX indices:

26m agoFri 5 Sep 2025 at 6:30am

It’s time to end today’s live blog

Well, that’s all from us today and we will see you back on Monday.

Until then, you can catch up on today’s developments below, or download the ABC News app and subscribe to our range of news alerts for the latest news.

And remember, you can catch a wrap of the week that was with Close of Business on ABC News tonight at 9:30pm AEST, or anytime on ABC iview.

Have a great weekend and take care!

Loading

32m agoFri 5 Sep 2025 at 6:24am

Today’s market wrap up

The Australian share market has finished the day higher, up 0.5% at 8,868 points.

Overall, the market had 151 stocks gaining, eight unchanged and 41 stocks in the red.

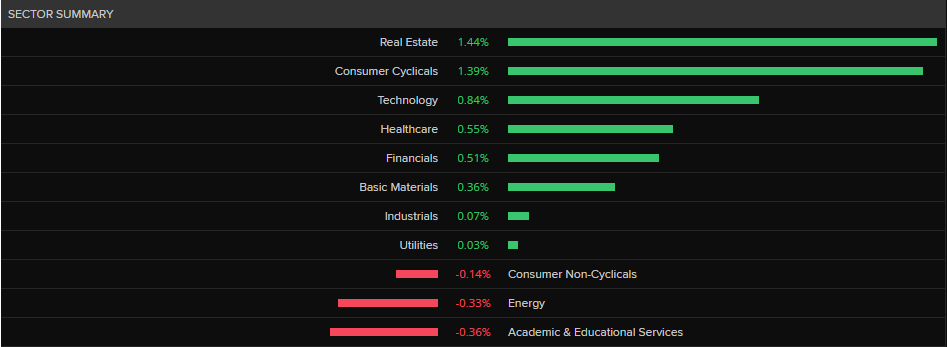

When looking at the sectors, Real Estate at the top; up 1.4%, followed by Consumer Cyclicals; up 1.3% and then Technology; up 0.8%.

Academic & Educational Services finished at the bottom; down 0.4%, followed by Energy; down 0.3%, and then Consumer Non-Cyclicals; down 1.4%.

(LSEG)

(LSEG)

Among companies, the top mover was HMC Capital; up 10%, followed by Polynovo; up 7.8%.

It wasn’t a good day for Lynas Rare Earths; down 3.2%, followed by Boss Energy; down 2.5%.

The Australian dollar is pretty flat, up 0.3% at 65.36 US cents.

49m agoFri 5 Sep 2025 at 6:07amJim Chalmers feels optimistic about economic outlook

Treasurer Jim Chalmers has told the ABC that the resilience of Australia’s labour market is one of its best buffers against the global economic uncertainty and volatility.

“We’ve overseen the creation of more than 1.1 million jobs since we came to office, stronger job growth than any major advanced economy,” he said

“Today’s Labour Account data confirms the vast majority of those 1.1 million new jobs have been created in the private sector.”

The Australian Labour Account data, published quarterly by the ABS, consists of four quadrants: Jobs, Persons, Hours, and Payments.

“The GDP figures on Wednesday showed private demand is now the primary driver of growth in our economy,” Mr Chalmers added.

“The very welcome economic data released on Wednesday and Friday this week confirms the private sector recovery we’ve been planning and preparing for is gathering pace.”

1h agoFri 5 Sep 2025 at 5:56am

Mid-tier Canadian gold miner to debut on ASX

A mid-tier Canadian gold miner is set to join the ASX next week as the yellow metal continues to soar.

Toronto-headquartered Dundee Precious Metals will debut under its new name of DPM Metals, following its $2 billion acquisition of ASX-listed Adriatic Metals.

It’ll be a secondary listing for DPM, whose primary listing is the Toronto Stock Exchange.

Reporting with AAP

1h agoFri 5 Sep 2025 at 5:38amHow markets are looking

The ASX 200 is up today, gaining 43.90 points or 0.5% to 8,870.40.

The top-performing stocks are HMC Capital and Polynovo, which are up 8.2% and 6.9%, respectively.

The index has lost 1.1% for the last five days, but sits 2% below its 52-week high.

The All Ordinaries is also up today, gaining 47.80 points or 0.53% to 9,139.20.

The top-performing stocks are FBR Ltd and 4DMedical Limited, up 25% and 14.5%, respectively.

The All Ords has lost 1.1% over the last five days, but sits 1.9% below its 52-week high.

Finally, the global market has seen the Hang Seng up 0.7% and the FTSE 100 up 0.4% today.

1h agoFri 5 Sep 2025 at 5:03am

Putin plans to develop rare earths to reduce reliance on Chinese imports

Russian President Vladimir Putin has directed his government to present a development plan for rare earth metals no later than November.

Mr Putin made the comments in his opening remarks at the plenary session of the Eastern Economic Forum in Vladivostok.

His latest move aims to boost their output to reduce reliance on Chinese imports.

Russia has the world’s fifth-largest reserves of rare earth metals, used in lasers and military equipment.

Reporting with Reuters

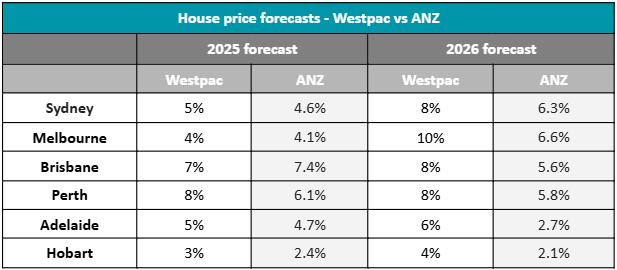

2h agoFri 5 Sep 2025 at 4:41amSydney’s median house price could rise over $150k by end of 2026

Sydney’s median house price could climb by more than $150,000 by the end of next year if Westpac’s latest property price forecast is realised.

According to Canstar and Westpac’s property price forecast, released this week, it estimates that Sydney dwelling prices will rise by a total of 5% this year and a further 8% in 2026.

The increase could see the median price rise to $1,675,827 by December 2026, based on Cotality’s Home Value Index tables. This would be the largest increase across all capital cities, in dollar terms.

Median house prices in Australian capital cities (Canstar.com.au)

Median house prices in Australian capital cities (Canstar.com.au)

In Melbourne, Westpac forecasts estimate dwelling prices will rise by 4% this year and 10% next year.

If this unfolds for houses in Melbourne, the median price could rise by over $100,000 from now until the end of next year to $1,059,810.

Which cities will see the biggest price growth?

Westpac sees Perth leading the charge this year, with an 8% gain, in percentage terms, whereas ANZ has Brisbane out in front, with prices climbing 7.4% in the 12 months to December 2025.

Looking ahead to 2026, the banks are divided on how steep the climb will be in each capital city.

Both banks’ forecasts predict Melbourne will post the biggest growth in 2026, with Westpac estimating a substantial 10% rise, while ANZ expects a solid 6.6% gain next year.

2h agoFri 5 Sep 2025 at 4:21amASX 200 best and worst performers so far

Among the top movers on the ASX 200 were:

Polynovo: up $0.09, +6.2%, to $1.49HMC Capital: up $0.19, +5.6%, to $3.59Mesoblast: up $0.1, +5%, to $2.09

Among the worst performers were:

Fletcher Building: down $0.06, -2.2%, to $2.86Lynas Rare Earths: down $0.3, -2.1%, to $14.48Boss Energy: down $0.04, -2%, to $1.97

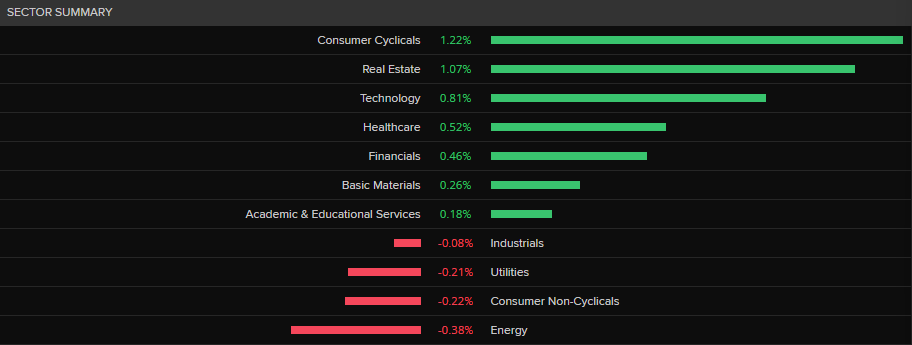

And, last but not least, here’s the sector summary, with the Consumer Cyclicals

sector on top and Energy at the bottom.

(LSEG)2h agoFri 5 Sep 2025 at 3:59amTrump signs order to bring lower Japanese auto tariffs into effect

(LSEG)2h agoFri 5 Sep 2025 at 3:59amTrump signs order to bring lower Japanese auto tariffs into effect

Donald Trump has signed an order to implement lower tariffs on Japanese automobile imports and other products, providing some relief to Japan’s export-heavy economy.

The lower tariffs on Japanese autos — down to 15% from the current 27.5% — are set to take effect seven days after the official publication of the order.

Mr Trump’s levies on global shipments have dragged down Japan’s exports and hit Japanese carmakers hard.

Last month, Toyota announced that it expected a nearly $10 billion hit from Trump’s tariffs on cars imported into the US.

“Finally,” Ryosei Akazawa, Japan’s top trade negotiator, posted to X, in a nod to the months-long trade talks that had frustrated lawmakers in Tokyo.

Thursday marked his 10th trip to the US for the negotiations.

Speaking to reporters in Washington, Mr Akazawa said Japan welcomed the executive order as “a steady implementation of the agreement reached on July 22.”

Reporting with Reuters

3h agoFri 5 Sep 2025 at 3:45am

Market snapshotASX 200: +0.3% to 8,854 points Australian dollar: +0.2% to 65.28 US cents S&P 500: +0.8% to 6,502 pointsNasdaq: +1% to 21,707 pointsFTSE: +0.4% to 9,216 points EuroStoxx: flat to 550 points Spot gold: +0.3% to $US3,557/ounce Brent crude: -0.2% to $US66.89/barrelIron ore: -0.2% to $US104.45 a tonneBitcoin: +0.7% to $US110,207

Prices current around 1:40pm AEST.

Live updates on the major ASX indices:

3h agoFri 5 Sep 2025 at 3:36am

Consumer revival to temper RBA rate-cut outlook: analyst

The Australian economy bounced back strongly last quarter, driven by a sharp rise in consumer spending, said Abhijit Surya, Senior APAC economist at Capital Economics.

“With households’ real incomes growing strongly and housing wealth increasing in tandem, we expect consumption growth to remain healthy going forward.”

Mr Surya added that he expected the RBA to deliver only two more 25 basis points rate cuts, rather than three.

“Moreover, the risk of an even shorter easing cycle cannot be ruled out.”

3h agoFri 5 Sep 2025 at 3:18amPublicly funded industries still dominating jobs growth

Also in today’s ABS release were figures on which sectors were creating jobs over the year to June.

“The growth in filled jobs was driven by the non-market sector, which comprises three industries — public administration and safety, education and training and health care and social assistance.

“Non-market sector filled jobs rose 0.3 per cent for the quarter and 3.6 per cent (168,400 jobs) through the year. This accounted for around 62 per cent of the growth in filled jobs through the year to June 2025.

“Market sector, the combined grouping of the remaining industries, rose 0.2 per cent for the quarter and 0.9 per cent (103,100 jobs) through the year. This accounted for around 38 per cent of the growth in filled jobs through the year to June 2025.

“Through the year to June 2025, hours worked grew 1.6 per cent, driven by the 3.5 per cent rise in the non-market sector industries that accounted for 60 per cent of the growth in hours worked. The market sector rose 0.9 per cent, accounting for the remaining 40 per cent of growth in hours worked.

“When comparing filled jobs by private and public sector, private sector jobs accounted for three-quarters of the growth in filled jobs over the past 12 months. Private sector filled jobs rose 1.5 per cent (205,300 jobs) and public sector filled jobs rose 2.8 per cent (66,600 jobs) over this period.”

So, at least up to the end of June, the public sector and industries largely underwritten by public money were accounting for the bulk of job creation.

Will the private sector step up as publicly funded employment growth drops off?

That’s probably the key question for the Australian economy over the coming year.

3h agoFri 5 Sep 2025 at 3:03am

If we know, you know

Is there more to woolies and coles story

– chrisso

Hello chrisso,

We all want to know more about what is going on with Woolies and Coles.

Our reporters are working hard on it as we speak.

Stay tuned!

4h agoFri 5 Sep 2025 at 2:55am

Trump warns of imposing tariffs on semiconductor imports

US President Donald Trump has said his administration will impose tariffs on semiconductor imports from companies that do not shift production to America.

“We will be putting a tariff very shortly,” Mr Trump said without giving an exact time, when speaking ahead of a dinner with major technology company CEOs on Thursday.

“Chips and semiconductors — we will be putting tariffs on companies that aren’t coming in.

“We will be putting a very substantial tariff, not that high, but fairly substantial tariff with the understanding that if they come into the country, if they are coming in, building, planning to come in, there will not be a tariff.”

Since returning to office in January, Mr Trump’s threat of tariffs has alienated trading partners, stirred volatility in financial markets and fueled global economic uncertainty.

He has made tariffs a pillar of US foreign policy, using them to exert political pressure and renegotiate trade deals and extract concessions from countries and companies that export goods to the US.

“If they are not coming in, there is a tariff,” Trump said in his comments on semiconductors,” the president said.

“Like, I would say Tim Cook [Apple CEO] would be in pretty good shape,” he added, as Cook sat across the table.

Apple, the iPhone maker, recently increased its total domestic investment commitment in the US to $600 billion over the next four years.

Taiwanese chip giant TSMC and South Korea’s Samsung Electronics and SK Hynix have announced investments in chip manufacturing in America.

Reporting with Reuters

4h agoFri 5 Sep 2025 at 2:37am

Perth businessman found guilty of fraud over $34 million

Perth businessman Chris Marco has been found guilty of more than 40 counts of fraud of more than $34 million after a five-week trial.

Marco had taken money from clients, telling them he would invest in schemes that promised high interest rates.

The corporate watchdog alleged that between July 2013 and October 2018, Marco obtained over $36.5 million from nine investors with the intention of defrauding them.

ASIC Deputy chair Sarah Court said the result delivered justice to investors who Marco defrauded.

Marco has been remanded in custody for sentencing on October 30.

My colleague David Weber has more.

4h agoFri 5 Sep 2025 at 2:20amFewer Australians working two or more jobs

As flagged by Dan earlier today, the Australian Bureau of Statistics has just released data about the number of Australians working multiple jobs.

The data show a 1.2% drop in multiple job holders to around a million people in the June quarter.

“Secondary jobs fell by 12,200 in the June quarter, and fell 1.9% or 20,500 jobs through the year to June,” said Sean Crick, the ABS head of labour statistics.

“June quarter 2025 was the first time we have seen two consecutive quarterly declines in secondary jobs in the six years since June quarter 2019. As a result, there are now 40,100 less multiple job-holders compared to six months ago in December quarter 2024.

“The fall in secondary jobs saw the proportion of people working multiple jobs decrease by 0.1 percentage points to 6.4%.”

With inflation easing and interest rates on the way down, it’s quite possible that fewer people have felt the need to top up their incomes with a second (third or fourth) job.

It’s also possible that as the jobs market has loosened it is becoming a bit harder to find extra work.

Interestingly, healthcare and social assistance have the largest number of people working in it as their secondary job, even more than retail or hospitality.

However, Australians are working more hours in the jobs they do have.

The growth in hours worked and main jobs drove an increase of 0.1 per cent in average hours worked per filled job, according to the ABS.

4h agoFri 5 Sep 2025 at 2:09amQantas’ former CEO Alan Joyce receives final bonus worth $3.8 million

Former Qantas chief executive Alan Joyce will take home his final bonus of $3.8 million in shares, according to the airline’s remuneration report, which was filed at the ASX today.

Mr Joyce’s bonus caps off a multi-year payment that has ballooned — along with the company’s share price which has soared to near record highs.

Meanwhile, the current CEO Vanessa Hudson’s bonus has been docked by $250,000 for the airline’s cybersecurity breach.

But overall, her total pay package has jumped to $6.3 million (an increase of 44% since last year).

Qantas also says it will not reduce executive bonuses in response to a Federal Court decision, which imposed a record fine of $90 million on the airline for illegally sacking 1,800 ground workers during the COVID-19 pandemic.

The company’s share price was up 1.4% to $11.94 (close to its highest levels ever) by around 12:05pm AEST.

5h agoFri 5 Sep 2025 at 1:50am

RBA hold in November cannot be ruled out: ANZ

Adam Boyton, head of Australian Economics at ANZ, has said he believes a rate cut in November is more likely than not, but the GDP figure increases the chances of a rate hold.

“If evidence of consumer spending momentum continues and weakness does not emerge in the CPI or labour market data, the RBA may assess the cash rate as broadly neutral with no further cuts needed,” he said.

“Rising housing prices could add to consumer momentum, with capital city housing prices up 0.8% m/m in August, the largest monthly increase since May 2024.”

With solid GDP growth of 0.6% q/q despite no growth in public demand in Q2, the private sector recovery is underway, according to an ANZ report.

The report noted that the RBA would likely interpret the strong increase in private demand as a sign of economic momentum.

Just bear in mind that the data does not capture the August rate cut or the full impact of the May rate cut.

5h agoFri 5 Sep 2025 at 1:32amSupermarket wage theft class action continues

The Federal Court has ruled that Coles and Woolworths need to work directly with underpaid workers in a long-awaited industrial relations case.

The ABC’s Bronwyn Herbert reports that Justice Nye Perram delivered a 198-page judgement on Friday concerning four separate legal cases against the major supermarkets.

These include two cases initiated by the Fair Work Ombudsman and two class actions led by former Coles and Woolworths managers.

The dispute involves the interpretation of retail award clauses, annualised salaries, and overtime calculations and the consequences of failing to maintain records.

Justice Perram has ordered that the proceedings go to case management in October before compensation, or the number of employees entitled to payouts is determined.

ASX 200: +0.5% to 8,868 points Australian dollar: +0.3% to 65.36 US cents S&P 500: flat to 6,502 pointsFTSE: flat to 9,216 points Spot gold: +0.2% to $US3,554/ounce Brent crude: -0.1% to $US66.95/barrelIron ore: +0.2% to $US104.85 a tonneBitcoin: +1% to $US110,603

ASX 200: +0.5% to 8,868 points Australian dollar: +0.3% to 65.36 US cents S&P 500: flat to 6,502 pointsFTSE: flat to 9,216 points Spot gold: +0.2% to $US3,554/ounce Brent crude: -0.1% to $US66.95/barrelIron ore: +0.2% to $US104.85 a tonneBitcoin: +1% to $US110,603