Artificial intelligence (AI) infrastructure provider Vertiv Holdings (VRT) is experiencing solid demand for its offerings, driven by continued market penetration and robust growth in data centers. VRT stock has risen 10.6% year-to-date despite some pullback over the past month. Most Wall Street analysts covering Vertiv stock are bullish on its long-term prospects and see strong upside potential from current levels.

Elevate Your Investing Strategy: Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Vertiv offers power, cooling, and IT infrastructure solutions for data centers.

VRT’s Solid Growth Potential

Vertiv delivered market-beating earnings for the second quarter, backed by 35% year-over-year growth in revenue. The company also raised its full-year guidance, as demand continues to be robust amid the ongoing AI boom. Vertiv ended Q2 2025 with an impressive backlog of $8.5 billion.

The company is expanding its AI infrastructure offerings both organically and through strategic acquisitions. Vertiv recently announced the acquisition of Waylay NV, a Belgium-based provider of hyperautomation and generative AI software platforms.

Following the Q2 print, Oppenheimer analyst Noah Kaye increased his price target for Vertiv Holdings stock to $151 from $140 and reaffirmed a Buy rating. The 5-star analyst noted record quarterly orders and stated that the company’s results and outlook indicate “clear share gains.” Kaye highlighted the company’s efforts to ensure speed-to-market through capacity expansion, modular/prefab solutions, and portfolio alignment with AI infrastructure requirements.

Commenting on concerns about VRT’s margins, Kaye thinks that Vertiv’s initiatives, like supply chain/footprint rebalancing and capacity liberation, could drive improvement in Fiscal 2026.

Is Vertiv Stock a Good Buy?

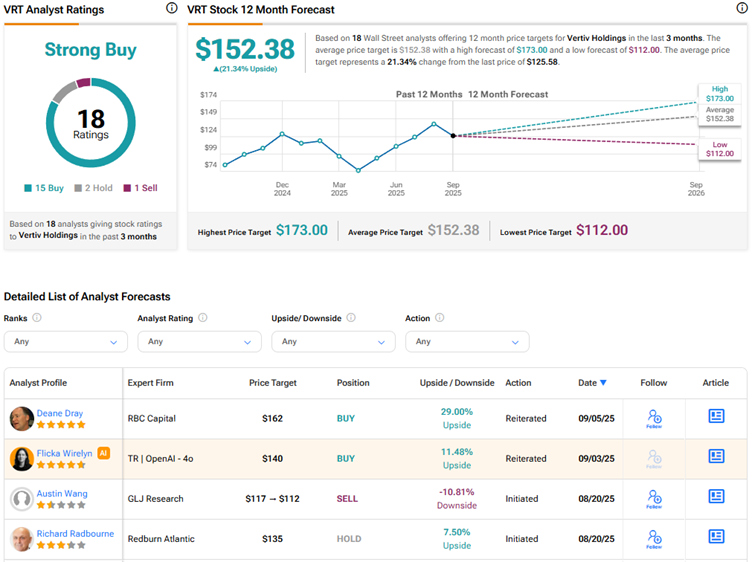

Overall, Vertiv stock scores Wall Street’s Strong Buy consensus rating based on 15 Buys, two Holds, and one Sell recommendation. The average VRT stock price target of $152.38 indicates 21.3% upside potential.