Key Takeaways

Bitcoin is showing structural fragility. Binance is front-running a potential volatile move. Is $111k really holding as a confirmed floor?

Bitcoin [BTC] looked like it’s trying to lock in a base.

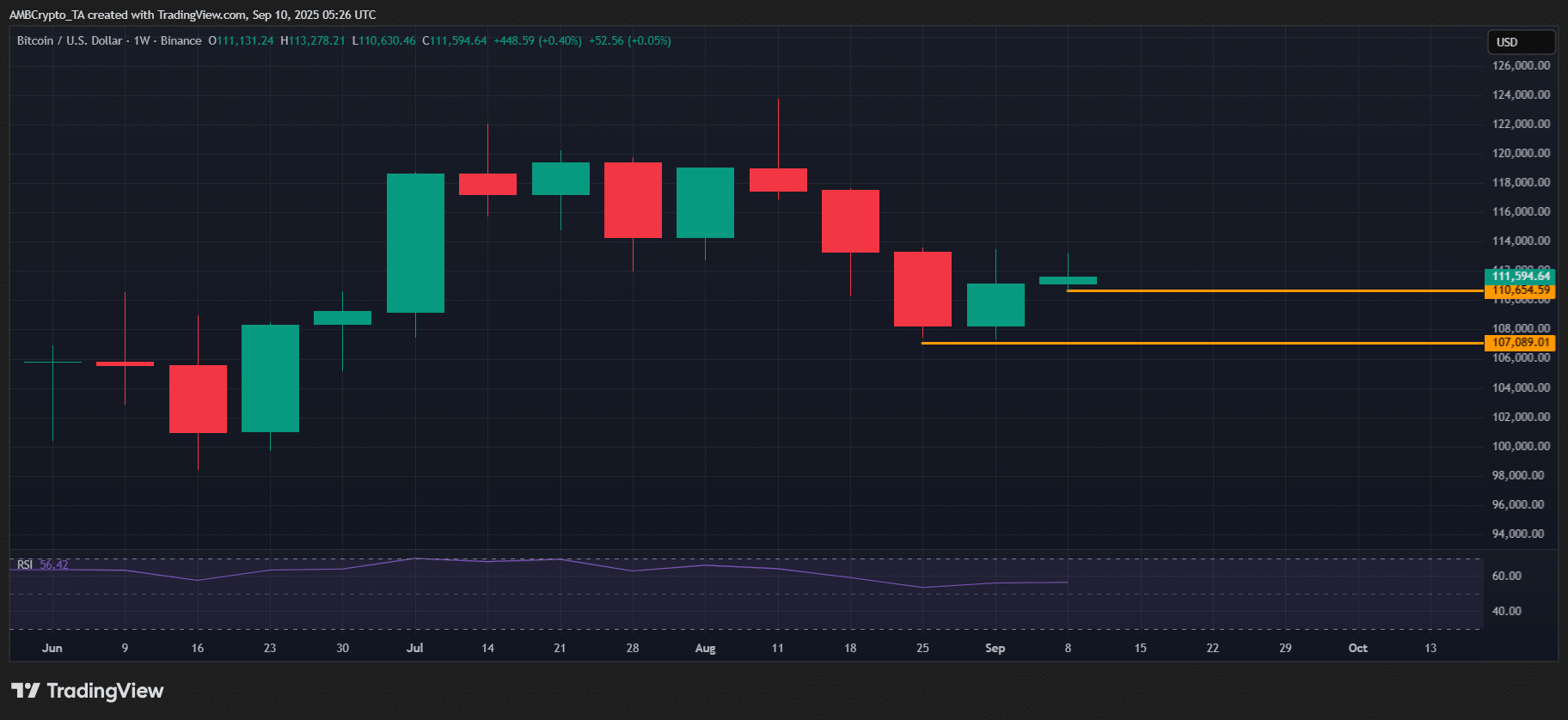

Technically, price has been chopping in a tight $107k–$113k range for two weeks. In fact, BTC kicked off the week with a higher high at $111k, signaling bulls are keeping control of the structure.

Even so, momentum hasn’t really picked up. RSI only nudged from 55 to 56.12, at press time.

In other words, bulls defended the floor, but unless RSI can break above 65, it’s too early to call a clean breakout.

Source: TradingView (BTC/USDT)

CPI data and FOMC ahead

According to AMBCrypto, the setup showed Bitcoin’s structural fragility.

Against this backdrop, markets have been eyeing key inflation data, starting with CPI on the 11th of September.

In fact, economists are pricing in a 0.3% Month-on-Month move, which would lift headline CPI to 2.9%, marking its highest since January. And, Core CPI was projected to hold steady at 3.1%.

In short, BTC is carving out a cautious base, while macro headwinds are creeping back in.

With the FOMC next week, it’s a crucial setup. In fact, the tape already looked like it’s front-running a directional move.

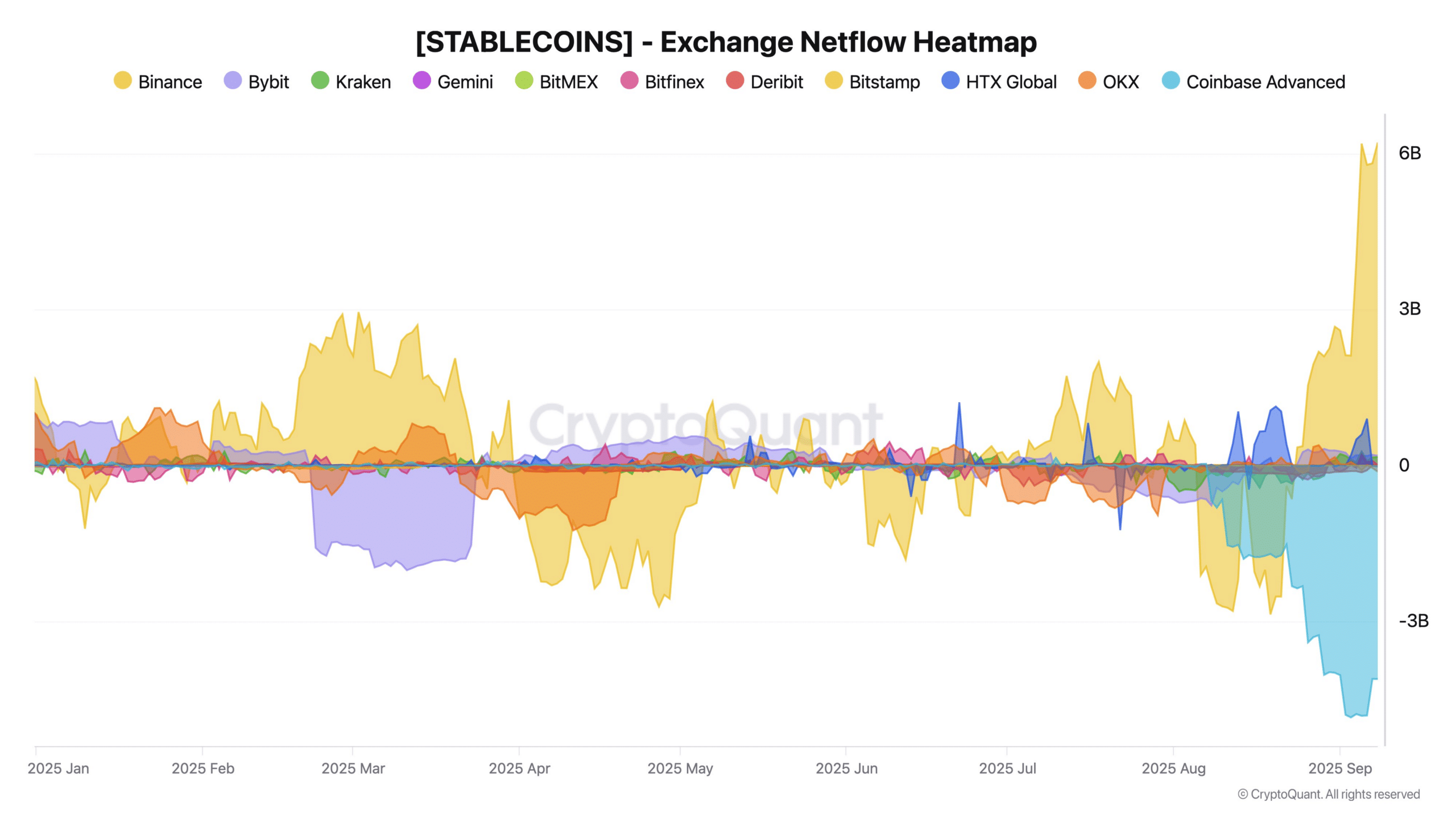

Bitcoin liquidity grows as Binance stablecoins surge

With sticky inflation, eyes are on U.S. labor data for BTC’s next move.

The recent payroll revision slammed expectations after the Bureau of Labor Statistics (BLS) cut last year’s job growth by 911k. And that basically flat lined job creation.

The result? Unemployment is now 4.3%, the highest since 2021.

At the same time, Binance saw its biggest Net Stablecoin Inflow of 2025, with $6.2 billion hitting the platform on the 8th of September. It gave us a hint of fresh liquidity waiting on the sidelines.

Source: CryptoQuant

In short, Binance is now pre-positioned for Bitcoin’s next volatile swing.

However, whether this strategy pays off or backfires is still up in the air.

One thing’s clear though – Bitcoin is in a delicate spot. Momentum’s soft, traders are moving cautiously, and macro volatility is still very much in play.

A Fed rate cut on weak labor data could trigger a short-term pop, but the tape could flip fast if the macro setup shifts. In this context, Bitcoin’s $111k is still an unconfirmed floor.

Previous: CWD stock rockets 2,500%! Nasdaq firm Caliber launches LINK digital asset treasury