Canada has two of the world’s biggest gold miners in Agnico and Barrick, but neither are likely to venture into a high-stakes battle for Teck.The Globe and Mail

Institutional investors have been delivering a strong message to a pair of domestic gold miners with the heft to bid for copper producer Teck Resources Ltd. TECK-B-T: Don’t you dare.

Shareholders in Agnico Eagle Mines Ltd. AEM-T and Barrick Mining Corp. ABX-T started to fret last week after analysts highlighted the two Toronto-based companies as potential interlopers in Teck’s friendly merger with Anglo American PLC AAUKF. This merger of equals, with no share-price premium for Teck’s owners, is vulnerable to a better bid.

Industry experts say global mining giants such as BHP Group Ltd. BHPLF and Glencore PLC GLCNF are the rivals most likely to take a shot at busting up the Anglo-Teck union.

However, there is a case for a made-in-Canada deal. A foreign buyer such as London-based Anglo needs the federal government’s approval to win Teck. A domestic bidder avoids that regulatory hurdle in Ottawa. And that is a high hurdle when the target is the largest domestic producer of a strategically critical mineral.

Carney told Anglo American to move headquarters to Canada for Teck deal approval, sources say

Agnico and Barrick draw attention as potential Teck suitors because both have flirted with moving from their roots in precious metals into copper – universally regarded as the metal of the future. The concept gained traction in 2023, when the world’s largest gold producer, Newmont Corp., spent US$17.8-billion to buy Newcrest Mining Ltd., in part because Newcrest had massive copper reserves.

In 2022, Agnico paid US$580-million for a 50-per-cent stake in Teck’s San Nicolás copper and zinc project in Mexico. At the time, Agnico chief executive officer Ammar Al-Joundi said: “This is a unique opportunity to create a long-term partnership between two high-quality mining companies.”

And more than a decade back, in 2011, Barrick spent US$7.3-billion to buy copper producer Equinox Minerals, with then-chairman Peter Munk taking pride in outbidding one of China’s largest miners for the prize.

In what’s shaping up to be the world’s biggest mining deal of the past decade, Vancouver-based Teck Resources Ltd. and London-headquartered Anglo American PLC have agreed to join together, creating a copper-focused giant worth about $70-billion.

The Canadian Press

Now, with Teck in play, fund managers are reaching out to remind Barrick CEO Mark Bristow – who has never lacked ambition – and Agnico’s Mr. Al-Joundi of what Mr. Munk said in 2013, shortly after his company took a US$3.8-billion writedown largely tied to an Equinox project in Africa.

“We bought Equinox to increase our copper. And that was my first major mistake – entirely attributed to hubris,” Mr. Munk said in an interview with The Globe and Mail. Fourteen years after the Equinox takeover, Barrick is still finding its way back into investors’ good books.

Agnico and Barrick declined to comment on Teck and Anglo. However, investment bankers and asset managers who have talked to both companies say neither will wrap itself in the flag and bid for Teck. Boards at both companies recognize being a Canadian champion doesn’t boost their stock price, while a poorly executed takeover is a recipe for value destruction.

Both gold companies could afford to make offers. Agnico’s $106-billion market capitalization is roughly four times Teck’s value, while Barrick is twice as large as the copper miner. However, what makes strategic sense is more important than what is possible.

The CEOs at Agnico and Barrick rightly fear losing the premium valuation that comes with being a major gold producer. Agnico’s enterprise value, its equity plus debt, is an industry-leading 9.6 times its forecast 2025 earnings before interest, taxes, depreciation and amortization (EBITDA). At Teck, the ratio was 6.7 times EBITDA prior to announcing the tie-up with Anglo.

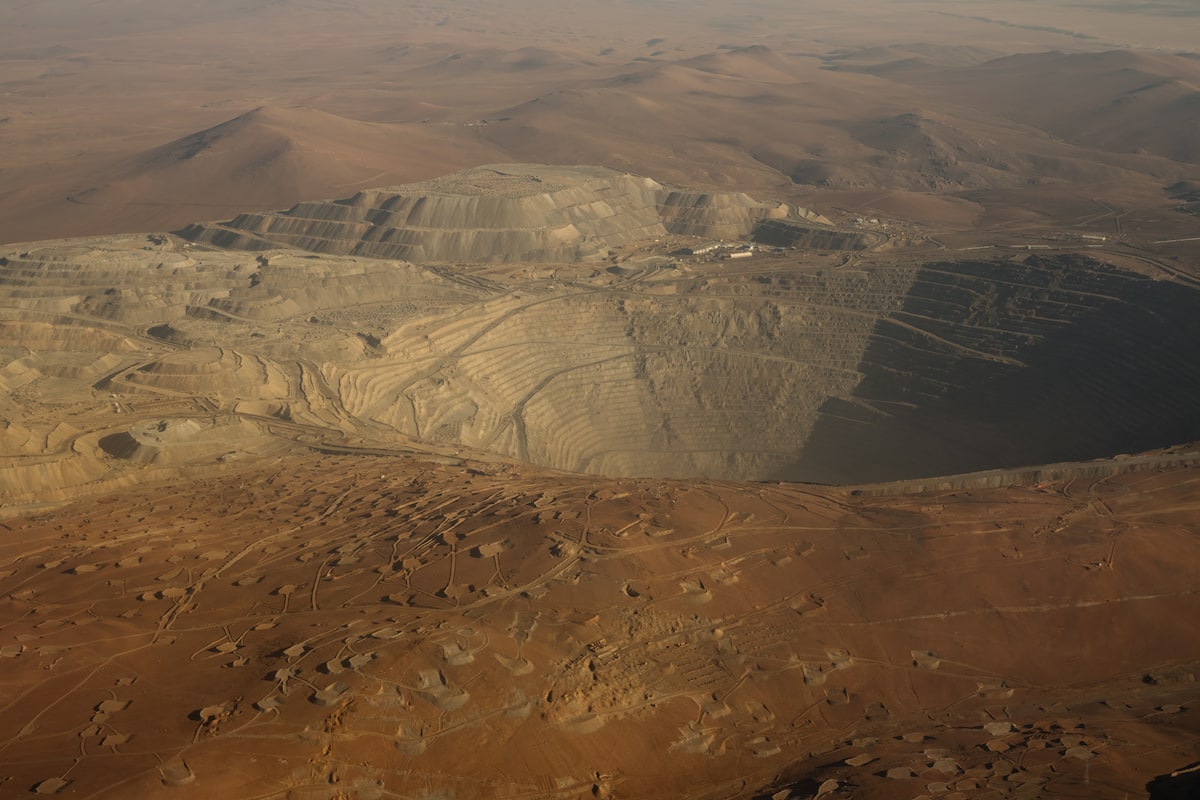

The gold miners also lack any overlap with Teck. The key to the proposed merger with Anglo is joining forces on neighbouring mines in Chile, known as Quebrada Blanca and Collahuasi. The multibillion-dollar projects have been plagued by cost overruns and technical challenges. BHP also runs massive copper mines in Chile, while Glencore owns a stake in Collahuasi.

Teck and Anglo estimate combining their two developments will translate into US$1.4-billion in annual synergies. The gold miners have no way to match those savings.

Agnico struck a partnership on the San Nicolás project because it has hard-won expertise in developing properties in northern Mexico. It has no such experience in South America.

In August, Barrick sold a gold mine in Chile, raising US$50-million. Mr. Bristow said the company only remains interested in Chilean properties that produce both gold and copper. Barrick’s largest remaining project in the country is the Zaldívar copper mine, operated by partner Antofagasta PLC.

In Agnico and Barrick, Canada can claim two of the world’s biggest gold miners. Investor pressure to stay focused on what these companies do best, rather then venturing into a high-stakes battle for copper producer Teck, has been heard loud and clear in both head offices.