Several years ago, I came across the unfortunate situation of a pensioner named Denis.

It was a grey, chilly morning, the kind where the air pierces your skin. He sat hunched on his porch, wrapped in layers, a steaming mug of coffee in his hands. At his feet, his old English Mastiff, Archie, rested quietly. I joked that he appeared more bundled up than his companion.

“There’s a reason for that – I can’t afford to run the heat,” Denis replied.

In the 1980s and 1990s, Denis was a sales executive at an aerospace manufacturer, making six-figure earnings. A globetrotter, he travelled between Canberra, Ottawa, Washington and Wellington, selling business jets to wealthy individuals and governments.

He was so successful that he told his wife she never needed to work again.

“I put both my daughters through law school and paid for their lavish weddings,” he recalled.

But then life turned upside down with cruel speed. As I eerily pen this wire on 11 September, it was on 9/11 that Denis’ world collapsed. Aviation commerce imploded almost overnight, and he lost his job. He never secured another role of the same calibre again.

Today, divorced and alone, he survives on the Age Pension; just $1,200 a fortnight of taxable income. It’s not enough to replace his tired car, run the heater through winter, or take trips to the coast. He still does what he can for Archie, his last faithful companion, even if that means going without himself.

“I regret paying for everyone else but not paying myself,” he said.

Comfortable vs. modest: two very different retirements

Denis lamented that he had never saved or invested with his own future in mind. His story is a tragic reminder of how fragile prosperity can be, and a cautionary tale about underestimating or failing to plan for the future.

Which brings us to the cost of retirement, and how to avoid the same fate. The Association of Superannuation Funds of Australia (ASFA) tracks what it costs to retire each quarter through its Retirement Standard.

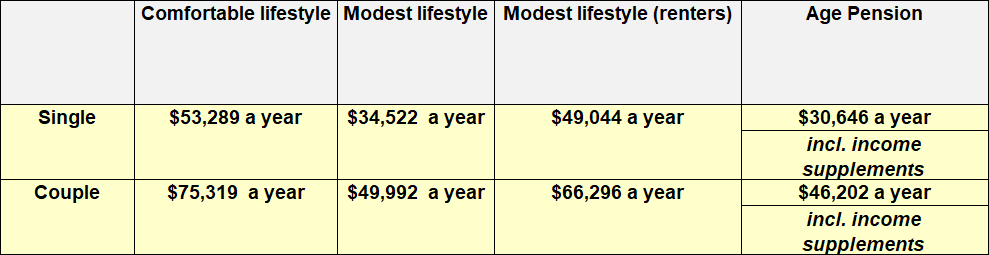

The just-released June 2025 figures reveal just how wide the gap has become between what’s considered comfortable and modest versus the Age Pension:

Source: ASFA Retirement Standard Detailed budget breakdowns – June quarter 2025

How are ‘comfortable’ and ‘modest’ defined you ask? According to ASFA:

A comfortable lifestyle covers top-level private health cover, fitness and leisure activities, domestic trips, infrequent overseas travel, lunches and dinners outside, entertainment expenses, and the ability to buy new household items.

A modest lifestyle covers the basics including food, energy, transport, and some leisure – but offers limited flexibility in terms of travel, replacing broken appliances etc.

Note: These figures assume you own – and have paid off – your home. Without this, the cost of retirement spikes by more than 30% annually due to rent obligations (see the Modest lifestyle (renters) column).

Retiree cost pressures outpacing CPI

The worrying part about these figures is that the cost of retirement lifestyles is rising faster than general inflation. Over the year to June 2025, the cost of both a comfortable and a modest retirement jumped 2.75%, outpacing the broader Consumer Price Index at 2.1%.

A closer look at the retirement budgets reveals why the bar has shifted higher:

Health: Couples aiming for comfort spend over $11,000 a year on insurance, medicines, and out-of-pocket expenses.

Utilities: Electricity and gas bills have climbed by double digits across the past two quarters.

Food: Groceries alone come in at more than $13,000 a year for a comfortable couple.

Another shift in the retirement budget is growing technology spending. Retirees are now forking out close to $3,000 a year on broadband, mobile plans and streaming subscriptions.

“The stereotype of the digitally challenged senior is outdated. Today’s retirees are as connected as anyone, and this is reflected in their household budgets,” says ASFA CEO Mary Delahunty.

“Beyond digital costs, we’re seeing heightened price pressures on some essential goods and services. This quarter brought above-inflation increases in private health insurance, electricity, and fresh food.”

For readers interested in the full assumptions produced by ASFA, you can download them here: ASFA Retirement

Standard

Detailed budget breakdowns – June quarter 2025.

Benchmarks – do you have enough?

So, based on the rising cost of retirement, how much do you actually need to set aside?

ASFA’s Retirement Standard puts some dollar figures around the savings required at retirement to hit lifestyle benchmarks:

Lifestyle

Savings required

Comfortable couple

$690,000

Comfortable single

$595,000

Modest couple (homeowners)

$100,000

Modest single (homeowners)

$100,000

Modest couple (renters)

$385,000

Modest single (renters)

$340,000

These estimates assume you’ll draw down your super across retirement and receive part of the Age Pension along the way.

But it’s important to remember that these are not one-size-fits-all numbers. Even the “comfortable” lifestyle only allows for one overseas trip every seven years and a “reasonable” car – not a shiny Porsche if that’s your jam. It doesn’t cover golf memberships, luxury travel, or that spin studio you might decide to join in retirement.

In fact, research commissioned by one of the nation’s largest super funds, Australian Retirement Trust (ART), found the average amount Australians estimate they’ll need in retirement is now $940,509, up from $791,796 in 2022 (a 19% increase).

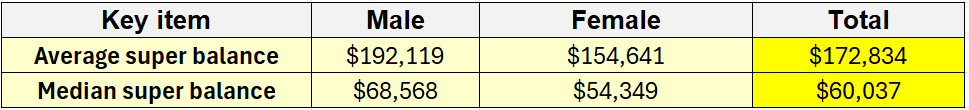

The reality, though, is sobering: most Australians are nowhere near these benchmarks or estimates. According to ATO data, half the population is well short of even the modest targets when it comes to super.

Source: ATO individuals statistics for taxation 2022–23 (the latest period available)

Projecting the right retirement number

Advisers often start with a simple rule of thumb: in retirement, you’ll need about 70% of your working income to maintain a similar lifestyle. It’s a neat shortcut, but in practice it depends heavily on your circumstances – whether you own your home, whether the kids are finally off the payroll, and whether you plan to travel the world or stick closer to home.

Another guide is the so-called “4% rule” – build a portfolio large enough that you can draw down 4% per year to fund your spending. If you want $75,000 annually, that implies a nest egg of around ~$1.9 million.

But it all comes down to the lifestyle you envision. Your expenses in retirement may look very different from those in your working years. As AustralianSuper Head of Advice and Guidance Ross Ackland explains:

“Some people think they need to be chasing a seven-figure balance to live well in retirement, but many Australians are thriving with less because they’ve planned around their lifestyle, not just a number.”

Steps to close the gap

For those still working, Denis’ experience underscores a simple lesson: don’t forget to pay yourself first.

ASFA’s Delahunty says that voluntary contributions, on top of the compulsory Superannuation Guarantee, can make a meaningful difference to people’s confidence about the future.

“Contributing extra to super can help some people ensure they won’t have to downgrade the lifestyle they’ve become accustomed to when they retire, whether that’s having a new iPhone and access to streaming, or the other pleasures of modern life,” she says.

Anne Fuchs, Executive General Manager of Advocacy and Impact at ART, highlights a few practical steps for employes following the increase to 12% in the Superannuation Guarantee from July of this year:

Check your payslip: Make sure your employer is contributing the correct amount of super.

Consider additional contributions: Salary sacrificing or after-tax top-ups can accelerate your retirement savings.

Calculate your future earnings: Use online tools or calculators to see how changes to contributions could affect your retirement income.

Review your fund: Fees, performance and insurance can all materially affect your long-term outcome.

Above all, it may pay to seek professional financial advice.

This wire takes a broad look at the challenges of funding retirement, but every situation is different. Sequencing risk, portfolio construction, the decision to downsize, and even whether to help your children onto the property ladder can all shape your long-term security in different ways.

Final words

A comfortable retirement now costs more than $75,000 a year for couples, and most Australians are falling well short. But remember, those benchmarks are only guides.

What matters most is aligning your savings and investments with the life you want to live – and starting to plan for it today with simple steps, like salary sacrificing a little extra.

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire