Report Overview

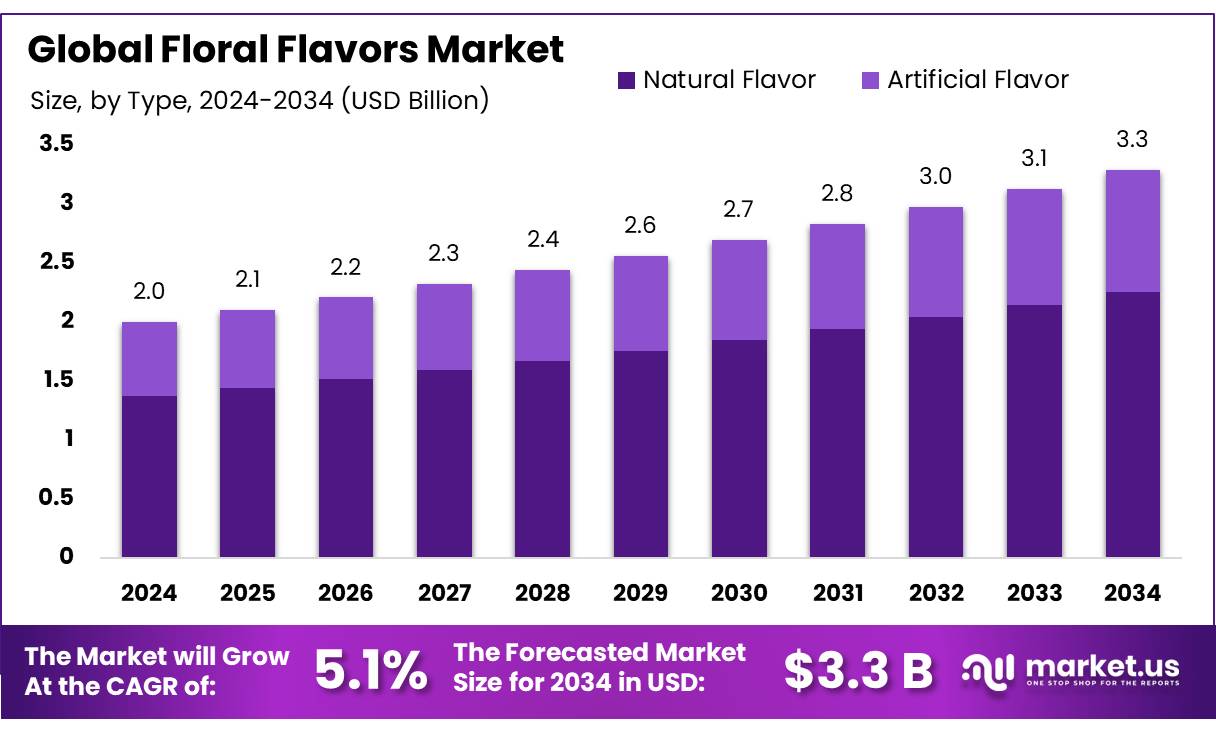

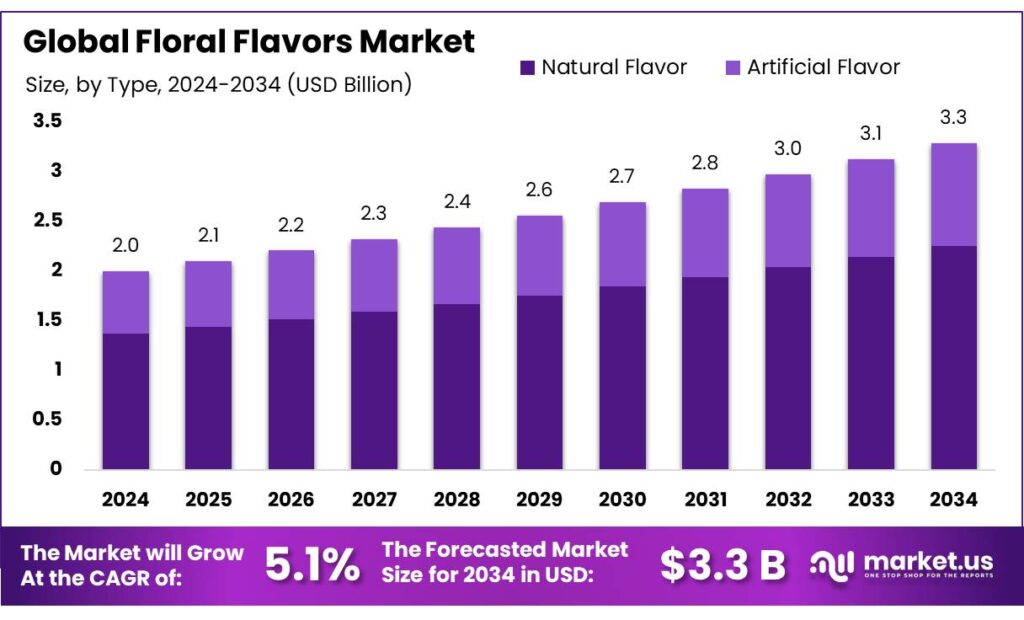

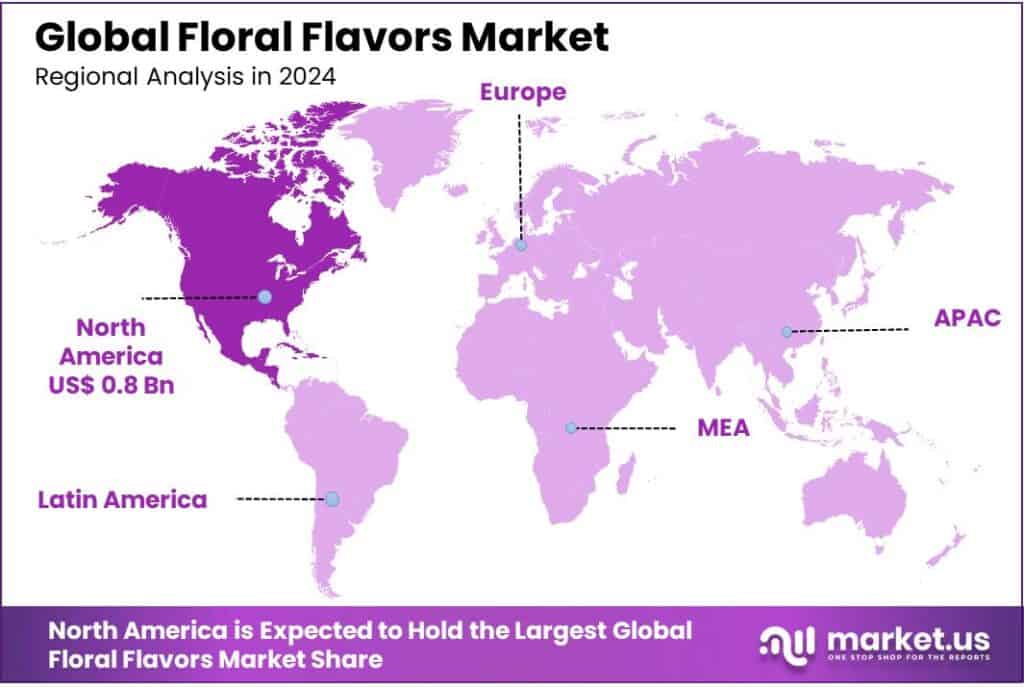

The Global Floral Flavors Market size is expected to be worth around USD 3.3 Billion by 2034, from USD 2.0 Billion in 2024, growing at a CAGR of 5.1% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 43.90% share, holding USD 0.8 Billion in revenue.

The floral flavors industry in India is a significant segment within the broader fragrance and flavor sector, deeply rooted in the country’s rich biodiversity and cultural heritage. India’s diverse climatic zones and extensive flora provide a vast array of natural aromatic raw materials, positioning the country as a global leader in the production of essential oils and floral extracts. The Fragrance & Flavour Development Centre (FFDC) in Kannauj, established in 1991 with assistance from UNDP/UNIDO and the Government of Uttar Pradesh, serves as a pivotal institution in this domain, bridging research and industry needs.

In the Northeast, the Meghalaya government launched Floriculture Mission 1.0 in March 2024, with an investment of ₹240 crore over three years, aiming to transform the state into a leading floriculture hub. The mission targets over 3,000 farmers, offering subsidies for inputs, infrastructure, and training, and focuses on cultivating high-demand flowers like orchids and oriental lilies.

The government has implemented several schemes to support the growth of the MSME sector, which is integral to the floral flavors industry. The Prime Minister’s Employment Generation Programme (PMEGP) has sanctioned over 28,500 projects, with an expenditure of approximately ₹1,160 crore, fostering entrepreneurship and employment in rural areas. Additionally, the PM Vishwakarma Scheme has benefited over 18 lakh artisans and MSMEs, providing financial assistance and skill development opportunities.

The government’s focus on promoting digitalization, enhancing access to credit, and fostering innovation through initiatives like the Self-Reliant India Fund (SRI Fund), which has mobilized approximately ₹10,000 crore in equity investments, is expected to bolster the sector’s growth.

Key Takeaways

Floral Flavors Market size is expected to be worth around USD 3.3 Billion by 2034, from USD 2.0 Billion in 2024, growing at a CAGR of 5.1%.

Natural Flavor held a dominant market position, capturing more than a 68.5% share of the global floral flavors market.

Rose held a dominant market position, capturing more than a 29.3% share of the global floral flavors market.

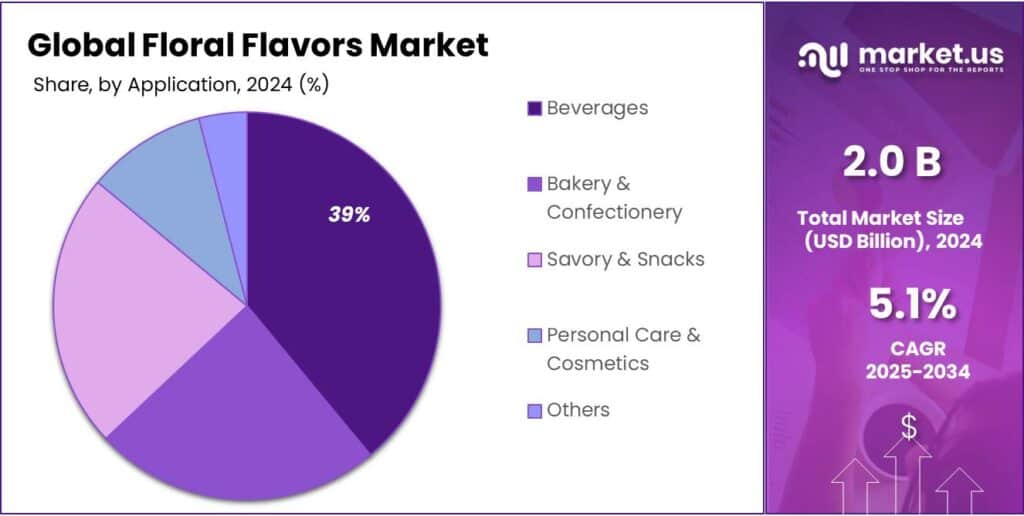

Beverages held a dominant market position, capturing more than a 39.8% share of the global floral flavors market.

Supermarkets and Hypermarkets held a dominant market position, capturing more than a 37.9% share of the global floral flavors market.

North America held a dominant market position in the global floral flavors market, capturing 43.90% of the share, valued at approximately USD 0.8 billion.

By Type Analysis

Natural Flavor Dominates with 68.5% Share Due to Rising Demand for Clean Label Products

In 2024, Natural Flavor held a dominant market position, capturing more than a 68.5% share of the global floral flavors market. The growing consumer preference for natural ingredients, driven by increasing health awareness and the demand for clean-label products, is the primary factor propelling the demand for natural floral flavors. As consumers become more conscious of the ingredients in their food and beverages, they are shifting away from artificial flavors in favor of naturally sourced alternatives.

The popularity of natural floral flavors can be attributed to their perceived health benefits and the growing trend of incorporating more organic and sustainable ingredients into food and beverage products. Natural floral flavors, derived from flowers like jasmine, rose, lavender, and chamomile, are widely used in the fragrance, food, and beverage sectors. These flavors are known for their authenticity and ability to deliver a premium, high-quality taste experience.

By Source Analysis

Rose Dominates the Floral Flavors Market with 29.3% Share Due to Its Versatility and Popularity

In 2024, Rose held a dominant market position, capturing more than a 29.3% share of the global floral flavors market. Known for its distinct, sweet, and aromatic profile, rose has long been a staple in both the fragrance and flavor industries. Its versatile flavor profile makes it a popular choice in a wide range of applications, from beverages to desserts and even in savory dishes.

The continued dominance of rose in the floral flavors market can be attributed to its timeless appeal and wide consumer recognition. It is commonly used in a variety of food and beverage products, such as teas, jams, confectioneries, and chocolates, as well as in cosmetics and perfumery. Additionally, rose-based flavors are highly sought after in premium and artisanal product lines, where natural, high-quality ingredients are prioritized.

By Application Analysis

Beverages Lead the Floral Flavors Market with 39.8% Share Due to Consumer Demand for Unique Drink Experiences

In 2024, Beverages held a dominant market position, capturing more than a 39.8% share of the global floral flavors market. The increasing consumer interest in innovative, refreshing, and health-conscious drink options has driven this growth. Floral flavors, such as rose, lavender, and hibiscus, are gaining traction in beverages due to their delicate and aromatic profiles, which provide a premium, sophisticated twist to traditional drinks.

Floral flavors are being incorporated into a variety of beverages, ranging from teas and flavored waters to cocktails and non-alcoholic drinks. As consumers become more adventurous in their taste preferences, floral-infused beverages are increasingly viewed as a unique and premium option. Additionally, the growing trend of wellness-focused products has further boosted the demand for floral-flavored drinks, especially those with added health benefits such as antioxidants and calming properties.

By Distribution Channel Analysis

Supermarkets and Hypermarkets Lead the Floral Flavors Market with 37.9% Share Due to Convenience and Accessibility

In 2024, Supermarkets and Hypermarkets held a dominant market position, capturing more than a 37.9% share of the global floral flavors market. This distribution channel benefits from its wide reach and the ability to offer consumers a one-stop shopping experience for both essential and premium products. Supermarkets and hypermarkets are often the primary choice for customers seeking convenience, product variety, and the opportunity to explore new and innovative flavor options, including floral flavors.

The growing popularity of floral flavors in food and beverages, combined with consumer preferences for accessible shopping experiences, has driven the significant market share of this distribution channel. These retail outlets not only carry a broad selection of products but also enable customers to easily compare different brands and flavors, making them an attractive option for consumers looking for floral-flavored products. Additionally, the presence of floral flavors in both mainstream and specialized products on supermarket shelves has helped boost their visibility and accessibility.

Key Market Segments

By Type

Natural Flavor

Artificial Flavor

By Source

Hibiscus

Lavender

Rose

Jasmine

Chamomile

Others

By Application

Beverages

Bakery & Confectionery

Savory & Snacks

Personal Care & Cosmetics

Others

By Distribution Channel

Supermarkets and Hypermarkets

Convenience Stores

Specialty Stores

Online

Others

Emerging Trends

A Blossoming Trend in the Food & Beverage Industry

Floral flavors are experiencing a remarkable resurgence in the food and beverage industry, captivating consumers with their delicate and aromatic profiles. From hibiscus to lavender, these flavors are no longer confined to niche markets but have blossomed into mainstream offerings.

In 2024, floral flavors have emerged as a significant trend, with a notable increase in consumer interest. According to data from Innova Market Insights, floral flavors, including chamomile, honeysuckle, and rose, are leading the charge as the fastest-growing botanical flavor trends in packaged foods. Nearly half of global consumers surveyed by Innova reported that healthy flavors, such as floral notes, most influence their food and beverage choices. Furthermore, these consumers perceive products with herbal or floral botanical flavors to be healthful, aligning with the growing demand for wellness-oriented products

Consumers are increasingly associating floral flavors with health benefits, particularly as they are often perceived as natural and botanical. For instance, hibiscus and elderflower are both high in antioxidants, which makes them attractive options for those looking to boost their immune systems.

According to recent studies, 57% of consumers report that botanical ingredients influence their food and beverage choices. This shift towards health-conscious consumption is prompting manufacturers to incorporate floral flavors into their products to meet consumer demand.

The popularity of floral flavors is also influenced by cultural and regional culinary traditions. In many cultures, flowers have long been used in culinary practices for their aromatic and therapeutic properties. For instance, rose and jasmine, which have been traditionally used in Middle Eastern and Asian cuisines, are now being incorporated into modern products, appealing to consumers seeking authentic and culturally rich experiences

Drivers

Consumer Shift Toward Natural and Organic Ingredients

The floral flavors industry in India is experiencing robust growth, largely driven by a significant consumer shift toward natural and organic ingredients. This trend is reshaping the market dynamics, influencing product development, and aligning with global consumer preferences for clean-label, health-conscious products.

In 2023, the Indian fragrance and flavor industry was valued at approximately USD 4.8 billion, contributing nearly 10–15% to the global market share. This growth trajectory is expected to continue, with projections indicating a rise to over USD 5 billion in the next three to four years. A significant portion of this growth can be attributed to the increasing demand for natural and organic products.

In 2023, the import value of natural essential oils reached nearly USD 255 million, reflecting a 12% increase from the previous year. This surge is driven by consumer preferences for clean-label, alcohol-free, and eco-conscious products. Notably, 65% of urban consumers expressed a preference for products free from synthetic additives.

The government’s support plays a pivotal role in fostering industry growth. The Ministry of MSME has established 18 Technology Centres (TCs) across various sectors, including fragrance and flavors, to provide MSMEs with access to relevant technologies and skill development. Additionally, the Fragrance & Flavour Development Centre (FFDC) in Kannauj, set up in 1991, serves as an interface between the essential oil, fragrance, and flavor industry and research institutions, aiming to sustain and upgrade the status of farmers and industry engaged in aromatic cultivation and processing.

Financially, the government has introduced several schemes to bolster MSMEs. The Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) provides collateral-free loans up to ₹5 crore, facilitating easier access to credit for small enterprises. Furthermore, the MSE-GIFT and MSE-SPICE schemes, launched in December 2023, offer subsidies for adopting green technologies and promoting circular economy practices, with funds sanctioned amounting to ₹478 crore and ₹472.5 crore, respectively, for the years 2023–26 and 2023–27.

Restraints

Regulatory Complexities and Compliance Challenges

The floral flavors industry in India faces significant challenges due to stringent regulatory frameworks and complex compliance requirements. These regulations, while essential for ensuring product safety and quality, can pose substantial hurdles for manufacturers, particularly small and medium-sized enterprises (SMEs).

In India, flavors are categorized as food additives under the Food Safety and Standards (Food Products Standards and Food Additives) Regulations, 2011, as stipulated by the Food Safety and Standards Authority of India (FSSAI). This classification mandates that all flavoring agents comply with specific safety standards, undergo rigorous testing, and adhere to prescribed usage levels in food products

One of the primary challenges arising from these regulations is the complexity and cost of compliance. Manufacturers must invest in quality control systems, maintain detailed documentation, and conduct regular testing to meet the stringent requirements. For SMEs, these obligations can be financially burdensome and operationally demanding, potentially diverting resources from innovation and growth initiatives.

The impact of these regulatory challenges is reflected in the industry’s performance. Despite India’s rich biodiversity and traditional expertise in floral flavor production, the sector’s growth is tempered by these compliance-related obstacles. Manufacturers often face delays in product approvals, increased operational costs, and limitations in scaling production to meet domestic and international demand.

Opportunity

Government Support and Infrastructure Development

The Indian floral flavors industry is experiencing significant growth, driven by a combination of consumer preferences for natural ingredients and robust government support. This synergy is creating a conducive environment for the sector’s expansion, offering numerous opportunities for stakeholders across the value chain.

India’s diverse agro-climatic zones provide an ideal setting for cultivating a wide variety of aromatic flowers. The country’s floriculture sector is considered a sunrise industry, with the government offering 100% export unit status to floriculture units. This status includes tax exemptions for new Export Oriented Units (EOUs), tax holidays on income from floriculture, and substantial duty exemptions for imports on cut flowers, flower seeds, and tissue-cultured plants.

Additionally, the establishment of the International Flower Auction Bangalore (IFAB), one of the three main flower auction centers globally, facilitates the efficient sale and export of flowers. IFAB’s live online auctioning system connects growers with international buyers, enhancing the global reach of Indian floral products.

The government’s initiatives extend to infrastructure development, with subsidies offered for establishing supply chain facilities such as cold storages, pre-cooling units, refrigerated vans, greenhouses, and packaging material. These investments aim to reduce post-harvest losses and ensure the quality of floral products during transportation, thereby increasing their competitiveness in international markets.

Regional Insights

North America Dominates the Floral Flavors Market with 43.90% Share, Valued at USD 0.8 Billion

In 2024, North America held a dominant market position in the global floral flavors market, capturing 43.90% of the share, valued at approximately USD 0.8 billion. The region’s dominance can be attributed to the strong consumer demand for natural and premium products, which has led to a surge in the use of floral flavors across food and beverages, perfumes, and cosmetics. The increasing trend towards clean-label products and growing awareness of the health benefits of floral ingredients, such as lavender and rose, further support the region’s leadership in this market.

In the food and beverage sector, North America has witnessed a significant rise in floral-infused drinks, especially in specialty teas, non-alcoholic beverages, and even in the wellness industry. The region’s well-established retail infrastructure, including supermarkets, hypermarkets, and online platforms, makes floral flavors widely accessible to consumers. This, combined with the growing preference for unique and exotic flavors, ensures a steady market demand.

Key Regions and Countries Insights

North America

Europe

Germany

France

The UK

Spain

Italy

Rest of Europe

Asia Pacific

China

Japan

South Korea

India

Australia

Rest of APAC

Latin America

Brazil

Mexico

Rest of Latin America

Middle East & Africa

GCC

South Africa

Rest of MEA

Key Players Analysis

BASF SE is a leading player in the floral flavors market, known for its extensive portfolio of flavor and fragrance solutions. The company’s commitment to sustainability and innovation is evident in its range of natural floral flavors, which are incorporated into food, beverage, and cosmetic products. BASF leverages cutting-edge technologies to produce high-quality floral extracts, meeting the growing consumer demand for clean-label and natural ingredients.

Firmenich SA, one of the world’s largest privately-owned fragrance and flavor companies, is a prominent player in the floral flavors market. Known for its expertise in natural floral extracts, Firmenich’s floral flavors are used across a wide array of products, including perfumes, beverages, and confectioneries. The company’s focus on innovation and sustainable sourcing practices positions it as a leader in the floral flavor segment, driving growth in the global market.

Synergy Flavours specializes in providing high-quality floral flavors that enhance the taste profiles of food and beverage products. With a strong emphasis on natural ingredients, Synergy caters to the rising consumer demand for authentic and clean-label products. The company combines science and creativity to produce distinctive floral flavors, such as lavender and jasmine, and is recognized for its ability to develop custom solutions that meet diverse market needs across different industries.

Top Key Players Outlook

BASF SE

Firmenich SA

Synergy Flavours

Sensient Technologies Corporation

International Flavors & Fragrances Inc. (IFF)

Abelei Inc.

Mane SA

Döhler GmbH

Blue Pacific Flavors

Fona International, Inc.

Recent Industry Developments

In 2024, BASF reported total sales revenue of €65.3 billion, a slight decrease from €68.9 billion in 2023, primarily due to lower sales prices and currency effects.

In 2024 Firmenich SA, reported net sales of €6.3 billion, with the Perfumery & Beauty (P&B) segment, which includes floral flavors, contributing €2.0 billion.

Report Scope