(Bloomberg) — A gauge of Australia’s monthly inflation accelerated in August to the top of the Reserve Bank’s 2-3% target, supporting the case for interest rates to remain on hold and sending the currency higher.

The Consumer Price Index indicator climbed 3% from a year earlier, the highest reading in a year, driven largely by housing costs, official data showed Wednesday. That compared with economists’ forecast for a 2.9% gain.

Most Read from Bloomberg

The RBA’s favored trimmed mean measure, which smooths out volatile items such as food and energy, slowed to 2.6% in August from 2.7% in the prior month.

The data, together with last week’s employment report showing ongoing tightness in the labor market, are likely to encourage RBA policymakers to stand pat at next week’s meeting and maintain a cautious outlook.

The currency erased losses to rise 0.3% and policy-sensitive three-year government bond yields climbed as traders pared expectations for the next rate cut. RBA meeting-linked swaps indicate the central bank will pause borrowing costs at its Sept. 29-30 meeting, with a 55% chance of a reduction in November.

The result “is flashing warning signals for the RBA, showing broad-based re-acceleration in inflationary pressures,” Barrenjoey Markets Pty Ltd. economists including Jo Masters said, scrapping their call for a November rate cut.

“There is now considerable uncertainty about the path to future rate cuts,” Masters said. “On balance, we think it likely that the RBA will have room to deliver a 25bp cut in H1-26, although the timing is uncertain.”

Wednesday’s data showed that housing was among the largest contributors to the annual movement, driven by power prices. Others were food and alcohol.

What Bloomberg Economics Says…

“A second unexpectedly-strong monthly inflation reading won’t derail the RBA’s easing cycle, but it should douse expectations of a rate cut at the Sept. 30 meeting. It reinforces our view that the pace of cuts will be gradual.”

— James McIntyre, economist.

Read the full note here.

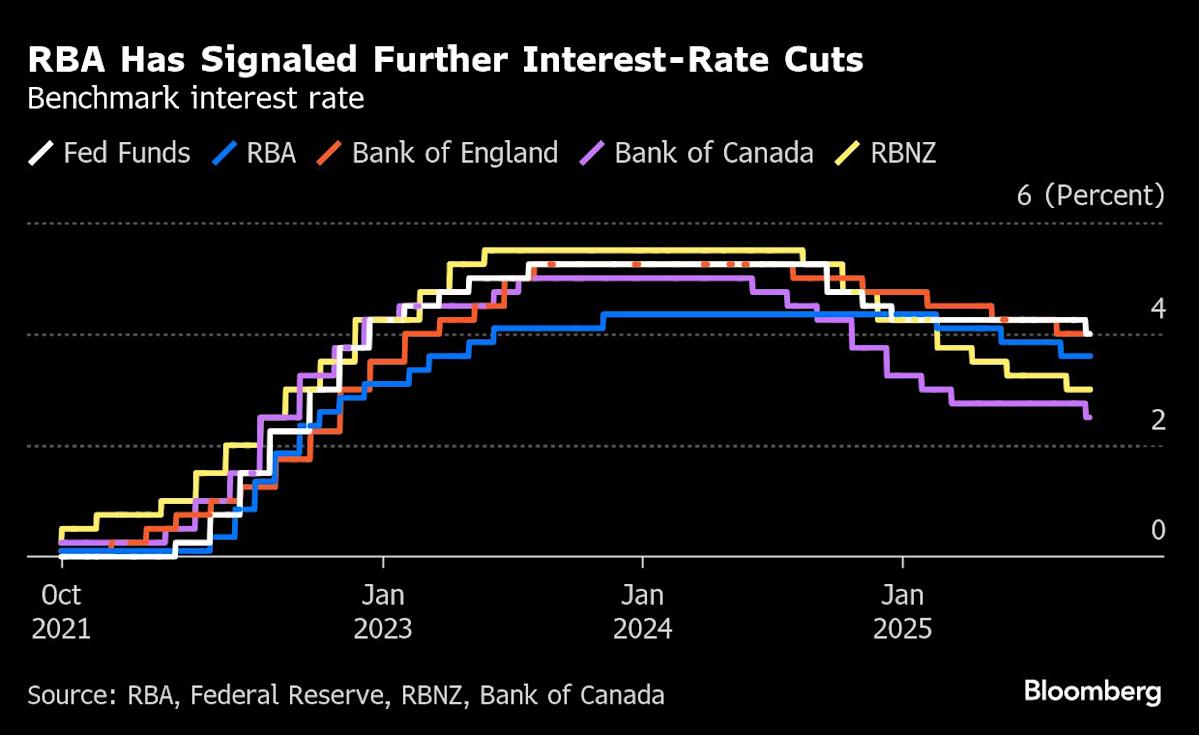

The RBA cut its cash rate by a quarter-percentage point to 3.6% last month, its third reduction of the year. On Monday, Governor Michele Bullock said the rate-setting board will weigh recent evidence showing the economy has been performing in line with or slightly stronger than anticipated at next week’s policy meeting.

Bullock said that inflation has eased substantially to be inside the RBA’s target and reiterated that the monthly CPI indicator is volatile and doesn’t provide a clean signal. She has expressed greater confidence in the comprehensive quarterly inflation report.

on

Wednesday’s figures also showed:

Electricity costs rose 24.6% in the 12 months to August, driven by households in Queensland, Western Australia and Tasmania having higher out-of-pocket costs

Rents rose 3.7% in August, the weakest annual growth since November 2022

New dwelling prices, which capture new builds and major renovations, rose 0.7% in the 12 months to August compared with a 0.4% rise in July as builders increased prices and reduced discounts and promotional offers in some cities

Meals out and takeaway rose 3.3%, the strongest annual rise in the past year, led by higher costs of labor and ingredients

Inflation in holiday travel and accommodation prices eased after a drop in demand following the July school holidays

Insurance prices recorded the smallest annual growth in over four years

“Headline topped expectations and details such as housing and services remain a source of upside risk for the outlook,” said Rodrigo Catril, a strategist at National Australia Bank in Sydney. Today’s figures provide some “food for thought for the RBA to consider a pause at its November meeting.”

The ABS will begin publishing a complete monthly measure of inflation from Nov. 26, addressing a long-standing gap in Australia’s economic data. The development will bring the nation in line with most of its developed-world peers.

Still, it’s expected there will be a transition period for the complete monthly inflation data, suggesting the quarterly figure will remain the benchmark for some time yet.

–With assistance from Matthew Burgess and Garfield Reynolds.

(Updates market reaction, adds comment from analyst.)

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.