Report Overview

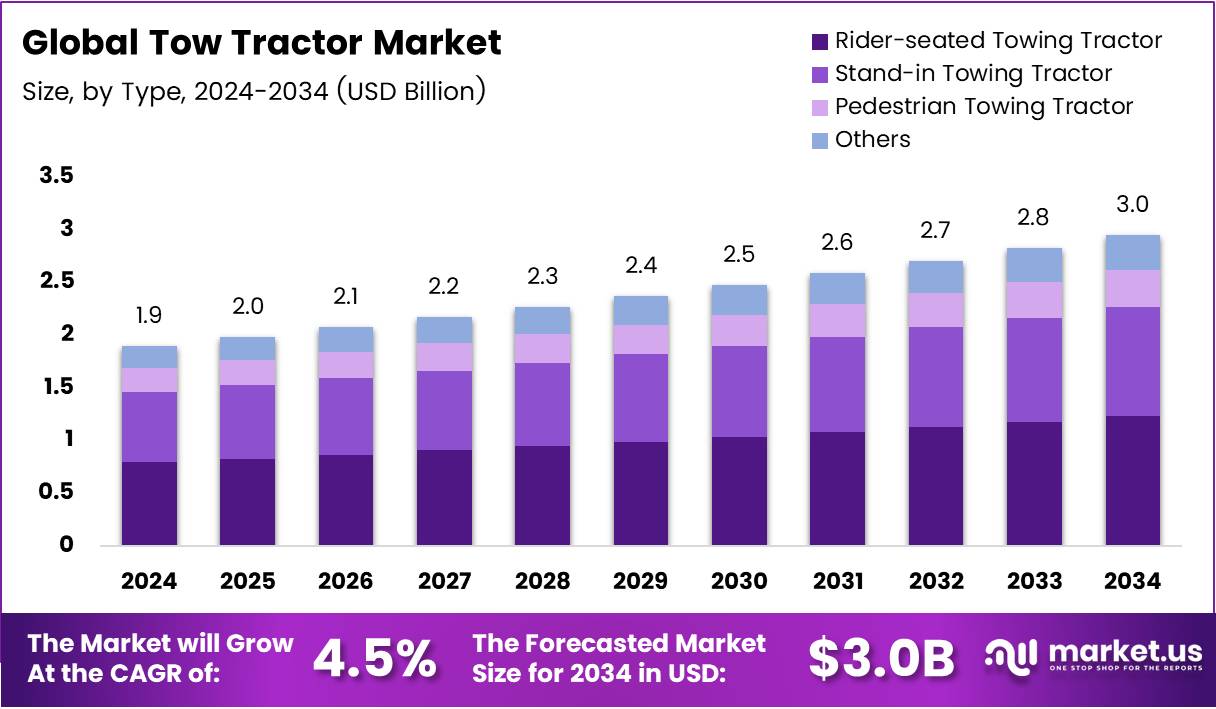

The Global Tow Tractor Market size is expected to be worth around USD 3.0 Billion by 2034, from USD 1.9 Billion in 2024, growing at a CAGR of 4.5% during the forecast period from 2025 to 2034.

The Tow Tractor market is a significant part of the material handling industry, primarily used to move heavy loads across various sectors, including manufacturing, warehousing, and logistics. These vehicles are designed to tow trailers or carts, making them essential in environments where efficient internal transportation is key to operational success.

The market is experiencing steady growth, driven by increasing demand for automation in industries like airports, ports, and warehouses. As businesses expand their operations, the need for robust and efficient towing solutions continues to rise. Tow tractors enhance operational efficiency and reduce labor costs by automating material handling tasks.

Opportunities in the Tow Tractor market are expanding as e-commerce and manufacturing industries grow. The demand for logistics and distribution centers is expected to fuel further growth. Additionally, as industries push towards sustainability, electric tow tractors are gaining traction. This presents an opportunity for manufacturers to innovate and meet evolving environmental standards.

Government investments and regulations are also playing a pivotal role in shaping the market. Regulatory requirements surrounding safety and emissions are leading companies to adopt more environmentally friendly solutions. For instance, the push for electric and low-emission vehicles is being driven by both government incentives and global environmental policies, further boosting demand.

The increasing emphasis on operational efficiency and safety in industrial environments presents a long-term opportunity for Tow Tractor manufacturers. With government support, companies can focus on developing advanced technologies, such as automated towing systems and energy-efficient electric tractors, which are expected to capture significant market share in the coming years.

Key Takeaways

The Global Tow Tractor Market is expected to reach USD 3.0 Billion by 2034, growing at a CAGR of 4.5% from 2025 to 2034.

In 2024, Rider-seated Towing Tractor holds a dominant position in the By Type segment with a 48.9% share.

Electric tow tractors dominate the By Power Source segment in 2024 with a 67.3% share.

Below 5 Tons is the leading segment in the By Load Capacity analysis with a 58.1% share in 2024.

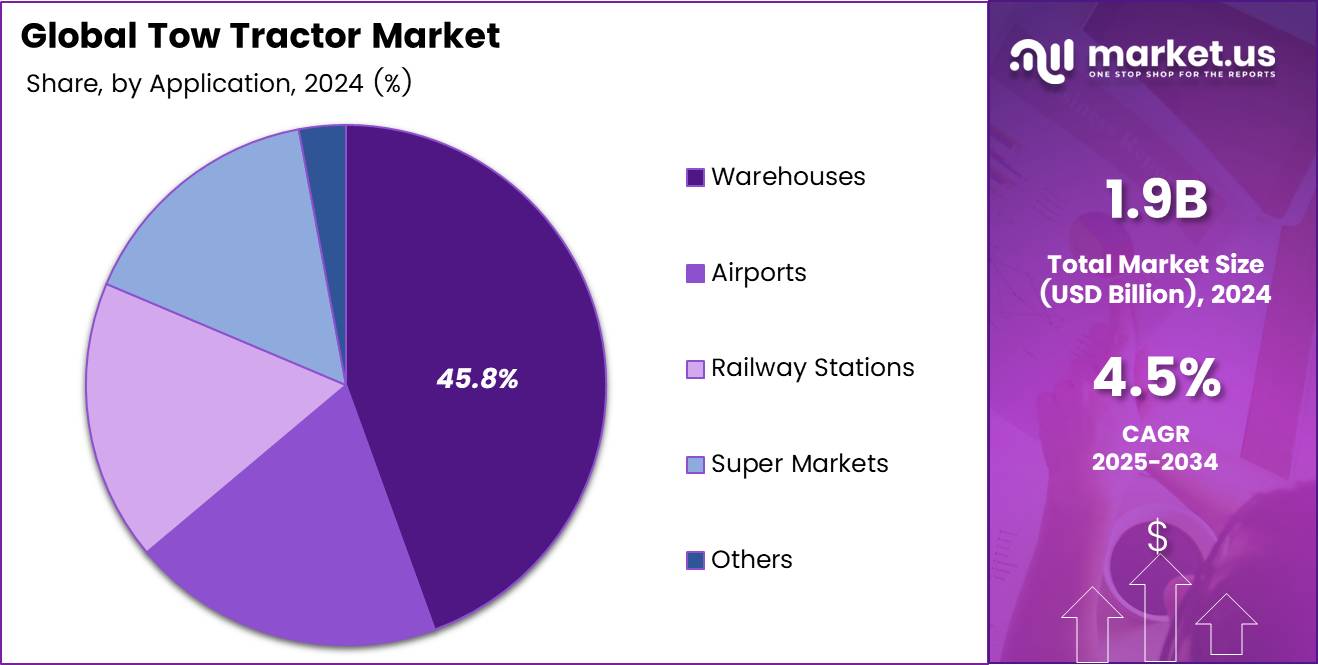

Warehouses holds the largest share of 45.8% in the By Application segment in 2024.

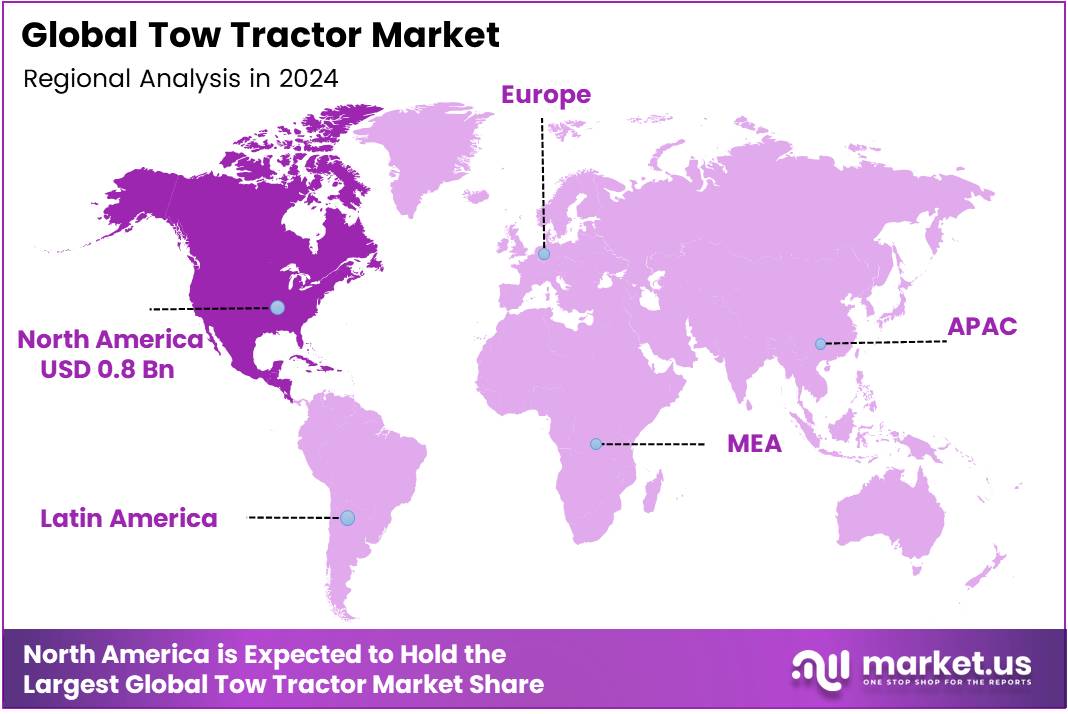

North America dominates the Tow Tractor Market with a 42.9% share, valued at USD 0.8 Billion in 2024.

By Type Analysis

Rider-seated Towing Tractor dominates with 48.9% due to its widespread availability and cost-effectiveness.

In 2024, Rider-seated Towing Tractor held a dominant market position in the By Type Analysis segment of the Tow Tractor Market, with a 48.9% share. This segment is favored for its high comfort and productivity, making it ideal for applications requiring long durations of operation. Its ergonomic design allows operators to remain seated, improving efficiency and reducing fatigue.

Stand-in Towing Tractor, while not as prevalent, contributes significantly to the market, capturing a smaller yet substantial share. Its compact design and suitability for confined spaces make it a preferred choice for certain warehouse or distribution center operations, where limited space requires a stand-in model.

Pedestrian Towing Tractor is mainly used for smaller operations with lighter loads. The market share for this type is growing as businesses focus on improving maneuverability in tight spaces. While it does not match the volume of rider-seated tractors, its adoption is steadily increasing due to cost-effectiveness and simple operation.

Others in the towing tractor segment include a variety of specialized models designed for niche applications. These tractors typically serve specific industries where particular features, such as low clearance or custom towing capacities, are required.

By Power Source Analysis

Electric dominates with 67.3% due to its growing environmental and economic benefits.

In 2024, Electric held a dominant market position in the By Power Source Analysis segment of the Tow Tractor Market, with a 67.3% share. This trend is driven by increasing environmental concerns and government incentives promoting greener technologies. Electric tow tractors are becoming increasingly popular due to their lower operating costs and minimal maintenance requirements compared to their fuel-powered counterparts.

Fuel-powered tow tractors continue to hold a significant share of the market, though their dominance is slowly declining. These tractors are still preferred in environments where charging infrastructure is limited or where longer operation times are required without interruption. Fuel-powered models are commonly used in industries with high operational demands.

Other power sources, while still present, make up a smaller portion of the market. These may include hybrid models or specialized systems that combine electric power with supplementary fuels to optimize performance in specific settings.

By Load Capacity Analysis

Below 5 Tons dominates with 58.1% due to its versatility and widespread usage across various sectors.

In 2024, Below 5 Tons held a dominant market position in the By Load Capacity Analysis segment of the Tow Tractor Market, with a 58.1% share. This segment remains the most popular due to its versatility in handling a wide range of materials across various industries, from warehouses to airports. Its lightweight nature allows for easy maneuverability in confined spaces.

The 5-10 Tons load capacity segment follows closely behind, as it caters to medium-duty applications. These tractors are increasingly being adopted in industries that require more robust towing capabilities, such as large warehouses and factories, without the need for heavy-duty equipment.

The 11-25 Tons category sees limited adoption compared to the lighter models, but it is growing in industries with heavier towing needs, such as large-scale manufacturing or heavy logistics operations. While more specialized, these tractors are essential for specific applications requiring greater weight capacity.

Above 25 Tons tractors are generally niche, serving heavy-duty industrial environments where extreme weight hauling is required. Their market share is smaller, as the need for such high-capacity models is relatively limited, but these tractors are indispensable in certain sectors like large construction sites or mining.

By Application Analysis

Warehouses dominate with 45.8% due to their crucial role in logistics and inventory management.

In 2024, Warehouses held a dominant market position in the By Application Analysis segment of the Tow Tractor Market, with a 45.8% share. The popularity of tow tractors in warehouses is largely driven by the need for efficient internal transport solutions. These tractors help streamline operations by moving materials quickly and safely within large distribution centers, improving overall productivity.

Airports are another significant application, though they hold a smaller market share compared to warehouses. Tow tractors at airports are essential for ground support operations, particularly for towing luggage carts and other equipment across expansive terminals. The adoption of electric models is also rising here due to environmental regulations.

Railway Stations utilize tow tractors for moving heavy loads of cargo and maintenance equipment. While the market share is smaller compared to other applications, the need for reliable transport in these settings is growing steadily as rail networks expand.

Supermarkets have increasingly adopted tow tractors for managing stock in large retail spaces, though this segment’s market share is relatively minor. Tow tractors in supermarkets are primarily used for moving bulk goods from storage areas to display racks, optimizing supply chain processes.

Key Market Segments

By Type

Rider-seated Towing Tractor

Stand-in Towing Tractor

Pedestrian Towing Tractor

Others

By Power Source

By Load Capacity

Below 5 Tons

5-10 Tons

11-25 Tons

Above 25 Tons

By Application

Warehouses

Airports

Railway Stations

Super Markets

Others

Drivers

Increasing Demand for Efficient Airport Ground Support Drives Market Growth

The tow tractor market is experiencing strong growth due to rising demand for better airport ground operations. Airlines need faster and more reliable equipment to move aircraft on the ground, which increases the need for advanced tow tractors. This demand helps improve airport efficiency and reduces flight delays.

The growth of online shopping and logistics companies is also pushing the market forward. E-commerce businesses require more warehouse equipment to handle increased cargo volumes. Tow tractors play a key role in moving heavy loads in distribution centers and freight facilities.

Airport expansion projects worldwide are creating new opportunities for tow tractor manufacturers. Many airports are building new terminals and upgrading existing facilities, which requires modern ground support equipment. These infrastructure investments directly boost demand for tow tractors.

Environmental concerns are driving airports to adopt electric tow tractors instead of diesel-powered ones. Electric models produce zero emissions and operate more quietly, making them ideal for sustainable airport operations. This shift toward green technology is becoming a major market driver.

Restraints

Regulatory Hurdles Related to Emissions Control Create Market Challenges

The tow tractor market faces significant challenges from strict environmental regulations. Governments are implementing tougher emission standards that require manufacturers to invest heavily in cleaner technologies. These compliance costs can increase equipment prices and slow down market adoption.

Many companies are hesitant to adopt automated towing systems due to safety concerns and high initial costs. Traditional operators prefer manual control over automated features, limiting the growth of advanced towing technology. This resistance to change slows market innovation and modernization efforts.

The shortage of skilled operators who can handle sophisticated tow tractors creates operational difficulties. Advanced equipment requires specialized training, but finding qualified personnel is challenging. This skills gap prevents companies from fully utilizing modern towing technology and limits market expansion.

Maintenance and repair costs for complex tow tractors can be substantial, especially for smaller operators. Limited service networks in some regions make it difficult to get timely repairs. These operational challenges discourage potential buyers and restrict market growth in certain areas.

Growth Factors

Integration of AI and Automation Creates Enhanced Growth Opportunities

The integration of artificial intelligence in tow tractors presents exciting growth opportunities for the market. AI-powered systems can optimize routing, predict maintenance needs, and improve overall operational efficiency. These smart features help companies reduce costs and increase productivity significantly.

Internet of Things technology is revolutionizing tow tractor operations by enabling real-time monitoring and data collection. Smart towing solutions can track equipment performance, fuel consumption, and operator behavior. This connectivity helps fleet managers make better decisions and improve equipment utilization.

The expanding air cargo and freight handling sectors offer substantial growth potential for tow tractor manufacturers. Rising global trade and e-commerce activities increase demand for efficient cargo handling equipment. Specialized tow tractors designed for freight operations represent a growing market segment.

Government investments in airport infrastructure modernization create new market opportunities. Many countries are upgrading their aviation facilities to handle increased passenger traffic. These public investments drive demand for modern ground support equipment, including advanced tow tractors with improved capabilities.

Emerging Trends

Shift Towards Green and Sustainable Technologies Shapes Market Trends

The tow tractor market is witnessing a major shift toward environmentally friendly technologies. Companies are increasingly choosing electric and hybrid models over traditional diesel-powered equipment. This trend is driven by stricter environmental regulations and corporate sustainability goals.

Development of autonomous tow tractors represents a significant technological advancement in the market. Self-driving tow vehicles can operate without human intervention, reducing labor costs and improving safety. While still in early stages, this technology shows promising potential for future market growth.

There is growing demand for multi-functional tow vehicles that can perform various tasks beyond basic towing. Modern tow tractors often include features like lifting capabilities, cargo handling attachments, and versatile coupling systems. This versatility makes them more attractive to operators seeking cost-effective solutions.

Companies are focusing on reducing operational costs and fuel consumption through improved tow tractor designs. Manufacturers are developing more fuel-efficient engines, lightweight materials, and energy-saving technologies. These improvements help operators lower their total cost of ownership while maintaining productivity levels.

Regional Analysis

North America Dominates the Tow Tractor Market with a Market Share of 42.9%, Valued at USD 0.8 Billion

In 2024, North America holds a dominant share of 42.9%, valued at USD 0.8 Billion in the Tow Tractor market. The region’s robust demand for efficient airport ground support and a growing emphasis on electric vehicles are key drivers of market growth. Additionally, infrastructure expansion, particularly in airports and logistics centers, has led to increasing investments in tow tractor solutions.

Europe Tow Tractor Market Trends

Europe continues to be a strong contender in the Tow Tractor market, with growth driven by the increasing adoption of electric tow tractors for sustainability. The region benefits from significant investments in airport infrastructure and renovation projects, which stimulate the demand for high-efficiency material handling equipment. The growing logistics sector further supports this expansion.

Asia Pacific Tow Tractor Market Trends

Asia Pacific’s Tow Tractor market is projected to grow rapidly, fueled by the region’s ongoing urbanization and infrastructure development. Increased demand from the expanding e-commerce and logistics industries has led to a surge in the need for reliable ground support equipment. Furthermore, the rise of airport renovation projects across key Asian markets contributes to this growth.

Middle East and Africa Tow Tractor Market Trends

The Middle East and Africa Tow Tractor market is characterized by gradual growth, supported by the rising demand for efficient logistics operations in airports and industrial sectors. The region’s strategic location as a transit hub for global freight is also expected to drive the adoption of tow tractors, with increasing investments in airport infrastructure.

Latin America Tow Tractor Market Trends

Latin America is witnessing steady growth in the Tow Tractor market, driven by the expansion of airport facilities and the logistics industry. The region’s increasing focus on sustainability has boosted the demand for electric tow tractors. However, slower adoption rates in comparison to other regions present challenges that may limit the market’s overall pace of growth.

Key Regions and Countries

North America

Europe

Germany

France

The UK

Spain

Italy

Rest of Europe

Asia Pacific

China

Japan

South Korea

India

Australia

Rest of APAC

Latin America

Brazil

Mexico

Rest of Latin America

Middle East & Africa

GCC

South Africa

Rest of MEA

Key Tow Tractor Company Insights

Toyota Material Handling, Inc. continues to be a significant player in the tow tractor market, leveraging its extensive experience in material handling solutions. The company focuses on integrating advanced technologies and automation into its products to enhance operational efficiency and meet the evolving demands of industries such as logistics and warehousing.

Jungheinrich AG is recognized for its innovative approach to material handling equipment. The company emphasizes the development of energy-efficient and automated tow tractors, aligning with the industry’s shift towards sustainability and smart logistics solutions.

KION Group AG has a strong presence in the global market, offering a range of tow tractors designed for various industrial applications. The company’s commitment to technological advancements and customer-centric solutions positions it as a key competitor in the industry.

Crown Equipment Corporation is known for its durable and reliable tow tractors. The company continues to innovate, focusing on ergonomic designs and energy-efficient technologies to meet the diverse needs of its global customer base.

These companies are at the forefront of the tow tractor market, driving growth through innovation and adaptation to industry trends.

Top Key Players in the Market

Toyota Material Handling, Inc.

Jungheinrich AG

KION Group AG

Crown Equipment Corporation

Taylor-Dunn

Motrec International Inc.

TLD Group

Clark Material Handling Company

Alke’ S.r.l.

Hyster-Yale Group, Inc.

Recent Developments

In September 2025, Norea Capital announced the acquisition of Motrec International, expanding its portfolio within the airport ground support equipment (GSE) market and reinforcing its position in the electric vehicle sector.

In September 2025, CSI Leasing acquired a majority stake in Aeroservicios USA, a strategic move aimed at enhancing its ground support equipment capabilities, particularly in the Latin American market.

In September 2024, the acquisition of AUSA was completed, with the company now being part of JLG Industries, significantly broadening JLG’s product offering in the GSE sector.

In April 2024, OMG Industry finalized its acquisition of definitive ownership of the Fiora brand and assets, strengthening its product portfolio and market presence in the industrial equipment space.

Report Scope