Ultra Wideband Anchor and Tags Market Size and Share Forecast Outlook 2025 to 2035

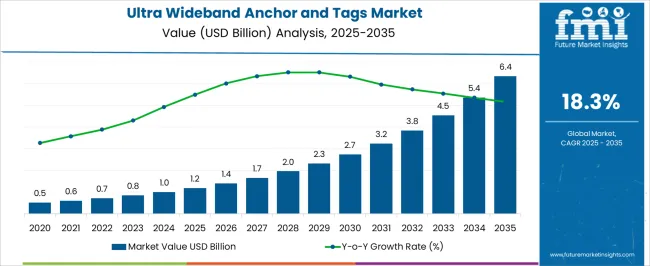

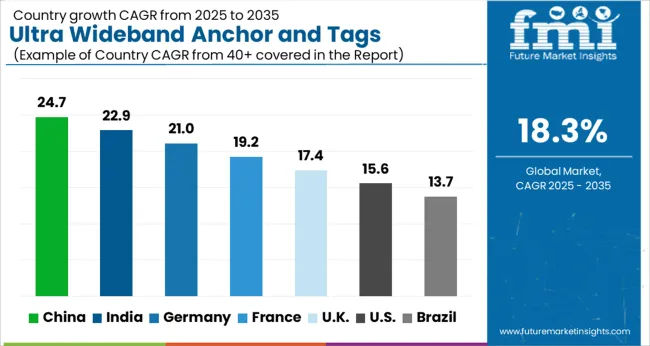

The ultra wideband (UWB) anchor and tags market is estimated at USD 1.2 billion in 2025 and is projected to reach USD 6.4 billion by 2035, advancing at a CAGR of 18.3% during the forecast period. This expansion is supported by strong adoption of UWB for precise indoor positioning, real-time asset tracking, secure access control, and location-based services across logistics, manufacturing, automotive, and consumer electronics.

Quick Stats for Ultra Wideband Anchor and Tags Market

Ultra Wideband Anchor and Tags Market Value (2025): USD 1.2 billion

Ultra Wideband Anchor and Tags Market Forecast Value (2035): USD 6.4 billion

Ultra Wideband Anchor and Tags Market Forecast CAGR: 18.3%

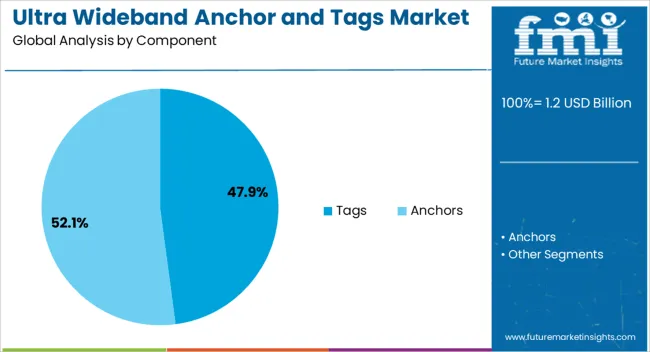

Leading Segment in Ultra Wideband Anchor and Tags Market in 2025: Tags (47.9%)

Key Growth Regions in Ultra Wideband Anchor and Tags Market: North America, Asia-Pacific, Europe

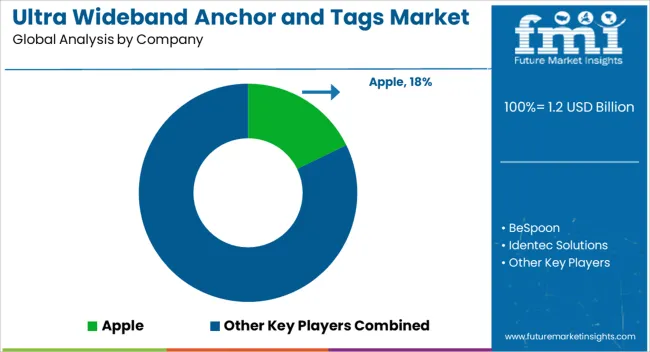

Top Key Players in Ultra Wideband Anchor and Tags Market: Apple, BeSpoon, Identec Solutions, Kinexon, NXP Semiconductors, Qorvo, Sewio Networks, STMicroelectronics, Ubisense, Zebra Technologies

Ultra Wideband Anchor and Tags Market Key Takeaways

Metric

Value

Ultra Wideband Anchor and Tags Market Estimated Value in (2025 E)

USD 1.2 billion

Ultra Wideband Anchor and Tags Market Forecast Value in (2035 F)

USD 6.4 billion

Forecast CAGR (2025 to 2035)

18.3%

Why is the Ultra Wideband Anchor and Tags Market Growing?

The ultra wideband (UWB) anchor and tags market is witnessing strong growth, driven by the increasing demand for precise indoor positioning, industrial automation, and secure short-range communication. UWB’s low power consumption and centimeter-level accuracy make it highly suitable for asset tracking, personnel monitoring, and spatial awareness applications across manufacturing, logistics, healthcare, and retail.

Government interest in improving infrastructure efficiency and workplace safety has accelerated the deployment of UWB-based systems, especially in indoor environments. Additionally, the expansion of Industry 4.0 and the increasing need for real-time location systems (RTLS) in time-sensitive operations are catalyzing innovation in UWB technology.

With continued enhancements in chip design and standardization efforts, the market is positioned for sustained adoption across both industrial and consumer applications.

Segmental Analysis

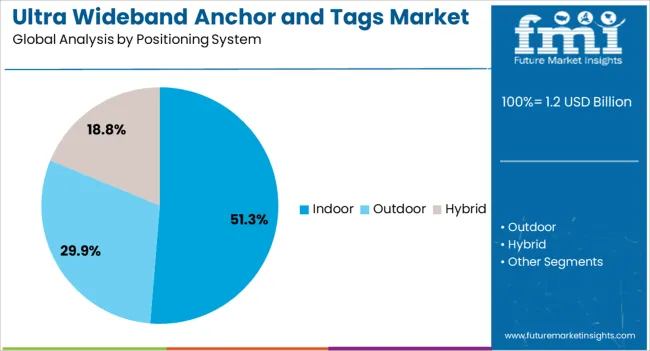

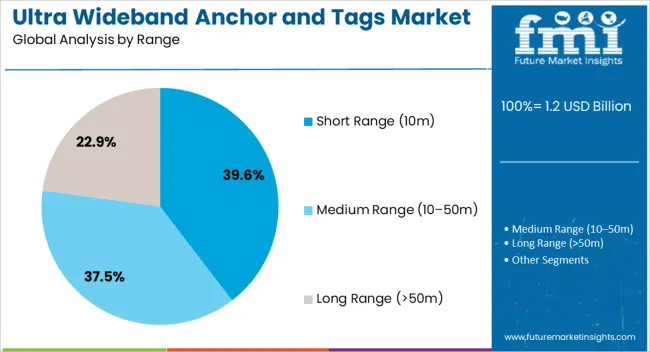

The ultra wideband anchor and tags market is segmented by component, positioning system, range, application, end user, and geographic regions. By component, ultra wideband anchor and tags market is divided into Tags and Anchors. In terms of positioning system, ultra wideband anchor and tags market is classified into Indoor, Outdoor, and Hybrid. Based on range, ultra wideband anchor and tags market is segmented into Short Range (10m), Medium Range (10–50m), and Long Range (>50m). By application, ultra wideband anchor and tags market is segmented into Asset tracking, Real-Time Location Systems (RTLS), Indoor navigation, Personnel monitoring, Access control, and Industrial automation. By end user, ultra wideband anchor and tags market is segmented into Manufacturing, Retail, Healthcare, Transportation & logistics, Automotive, Consumer electronics, Residential, Sports & entertainment, and Others. Regionally, the ultra wideband anchor and tags industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Insights into the Tags Component Segment

Tags are expected to dominate the UWB anchor and tags market with a 47.90% share by 2025. Their compact size, ease of integration into wearables and mobile assets, and affordability are driving widespread adoption.

These tags serve as critical nodes in RTLS and asset-tracking systems, enabling seamless location tracking of people, tools, and goods. Demand from logistics hubs, healthcare facilities, and manufacturing plants is rising, where tags enhance safety, workflow efficiency, and real-time data insights.

Innovation in battery life, waterproofing, and hybrid functionality (such as combining RFID or Bluetooth) is making tags even more versatile and indispensable for scalable deployments.

Insights into the Indoor Positioning System Segment

Indoor positioning systems are projected to hold 51.30% of the total market share in 2025, making them the leading application area for UWB solutions. This growth is driven by the growing need for accurate navigation and asset management within closed environments such as warehouses, factories, hospitals, and commercial buildings.

Traditional technologies like Wi-Fi and Bluetooth lack the precision required for sub-meter accuracy, a gap effectively filled by UWB systems. Retailers and facility managers are leveraging indoor UWB to enhance customer experience, optimize space utilization, and improve operational flow.

As smart building ecosystems and IoT integration expand, the indoor segment will remain a key contributor to UWB market penetration.

Insights into the Short Range (10m) Segment

Short-range UWB systems typically up to 10 meters are expected to lead the market with a 39.60% share by 2025. Their low latency and high accuracy within compact spaces make them ideal for access control, proximity detection, and spatial tracking in high-density environments.

Sectors such as consumer electronics, automotive, and smart home technology are increasingly deploying short-range UWB for secure device-to-device interactions and spatial awareness functions. Use cases like keyless car entry, indoor drone navigation, and interactive gaming are expanding the relevance of this range segment.

The focus on privacy, security, and efficiency in close-range digital interactions continues to fuel innovation and demand.

What are the Drivers, Restraints, and Key Trends of the Ultra Wideband Anchor and Tags Market?

The ultra wideband anchor and tags market is expanding rapidly as enterprises seek high-precision location solutions for logistics, industrial automation, healthcare, and automotive applications. UWB technology provides centimeter-level accuracy, low latency, and interference resistance, making it superior to alternatives like Wi-Fi or Bluetooth in critical use cases. Growth is reinforced by adoption in smart factories, warehouse management, and secure access systems. Consumer electronics manufacturers are also embedding UWB chips in devices for contactless payments, device-to-device interaction, and smart home integration. Strategic collaborations between hardware producers and software platform developers are accelerating commercial deployment, while investments in R&D aim to lower costs and broaden adoption.

Increasing Demand for Real-Time Location Services

Enterprises are increasingly deploying UWB anchors and tags for asset tracking, worker safety, and inventory management. Industries such as logistics and automotive manufacturing have adopted UWB-enabled RTLS (Real-Time Location Systems) to monitor equipment, streamline workflows, and minimize downtime. Hospitals are adopting UWB to track medical assets and ensure patient safety. The technology’s ultra-precise accuracy supports critical environments where Wi-Fi or RFID solutions fall short. Expansion of industrial automation and the need for operational efficiency make UWB anchors and tags a critical investment for future-ready enterprises.

Integration into Consumer Electronics and Automotive

Consumer electronics companies are embedding UWB technology into smartphones, wearables, and smart home devices. Features such as spatial awareness, secure access, and precise file sharing are powered by UWB, enhancing user experience. In the automotive sector, UWB anchors and tags are gaining traction in smart keyless entry systems, vehicle-to-device communication, and in-car positioning. Automakers are collaborating with semiconductor firms to integrate UWB chips into connected vehicles, strengthening security and convenience. This broad adoption across end-use categories supports long-term scalability of UWB ecosystems.

Challenges of Cost and Infrastructure Requirements

Despite its advantages, UWB adoption is constrained by high deployment costs, need for specialized infrastructure, and interoperability challenges. Anchors and tags require coordinated installation for accurate positioning, which limits scalability in cost-sensitive environments. Compatibility with existing Wi-Fi, BLE, or 5G networks is also a challenge, slowing mass adoption. Smaller enterprises may find upfront investment restrictive, keeping adoption limited to large-scale organizations. Without standardization and cost reduction, market penetration into smaller and emerging sectors will remain gradual.

Analysis of Ultra Wideband Anchor and Tags Market By Key Countries

Country

CAGR

China

24.7%

India

22.9%

Germany

21.0%

France

19.2%

UK

17.4%

USA

15.6%

Brazil

13.7%

Sales Outlook for UWB Anchor and Tags Market in China

Growth in the UWB anchor and tags market in China has been recorded at a CAGR of 24.7%, supported by extensive deployment across logistics, industrial automation, and smart manufacturing clusters. Local semiconductor firms have expanded UWB chip production to serve domestic demand in consumer electronics and industrial IoT ecosystems. Government initiatives promoting smart cities and advanced logistics networks are fostering large-scale adoption of real-time location systems. Automotive OEMs are accelerating UWB adoption in keyless entry and vehicle communication systems. The market benefits from expanding e-commerce, which demands high-accuracy warehouse tracking solutions. Collaborations between hardware suppliers and telecom operators are shaping China into a central hub for UWB development.

Automotive OEMs deploy UWB for keyless entry and smart vehicles

E-commerce and logistics hubs integrate UWB RTLS for efficiency

Domestic chipmakers scale UWB production for electronics and IoT

Sales Outlook for UWB Anchor and Tags Market in India

Expansion in the UWB anchor and tags market in India is advancing at a CAGR of 22.9%, driven by logistics growth, warehouse modernization, and healthcare digitalization. Technology adoption has gained momentum with industrial corridors emphasizing automation and real-time asset tracking. Hospitals and smart infrastructure projects are increasingly relying on UWB solutions for patient monitoring, equipment tracking, and safety management. Consumer electronics brands are beginning to embed UWB features into smartphones and wearables targeted at urban consumers. The rise of 5G networks and IoT penetration is accelerating integration of UWB in industrial and commercial applications. Local startups and global vendors are forming alliances to create cost-effective UWB-enabled solutions for small and medium businesses.

Healthcare providers adopt UWB for safety and equipment monitoring

5G deployment supports UWB-based IoT expansion

Startups partner with global players to provide cost-effective tags

Sales Outlook for UWB Anchor and Tags Market in Germany

Germany’s UWB anchor and tags market is growing at a CAGR of 21.0%, anchored by industrial automation and advanced automotive integration. Manufacturing hubs are prioritizing high-precision RTLS for robotics, assembly lines, and safety systems. German automakers are embedding UWB-based keyless entry and in-vehicle location systems to strengthen security. Logistics firms rely on UWB-enabled solutions for warehouse efficiency, asset utilization, and real-time monitoring. Industrial IoT initiatives across smart factories are strengthening the role of UWB in connected infrastructure. Collaboration between UWB chipmakers and European software providers is enhancing interoperability and system integration. The market benefits from strong regulatory support for digital industrial transformation.

German automakers advance UWB in smart mobility and security

Logistics firms optimize warehouses with UWB anchors and tags

Industry 4.0 initiatives expand UWB-based industrial automation

Sales Outlook for UWB Anchor and Tags Market in France

France’s UWB anchor and tags market is advancing at a CAGR of 19.2%, backed by adoption in healthcare, logistics, and aerospace. Hospitals are integrating UWB solutions for patient safety and equipment tracking, while logistics providers deploy UWB RTLS to enhance inventory control and minimize loss. Aerospace and defense companies have embraced UWB for mission-critical communication and precision positioning systems. Consumer electronics manufacturers are introducing UWB-enabled devices for smart homes and secure peer-to-peer applications. Strategic partnerships between telecom operators and UWB hardware firms are accelerating adoption in connected infrastructure projects. Demand is also rising in urban mobility initiatives, where UWB enhances security and location accuracy in transportation systems.

Hospitals deploy UWB for patient monitoring and asset tracking

Aerospace sector adopts UWB for mission-critical positioning

Smart home devices integrate UWB for secure peer-to-peer use

Sales Outlook for UWB Anchor and Tags Market in the UK

The UWB anchor and tags market in the UK is growing at a CAGR of 17.4%, supported by smart city projects, transport modernization, and rising demand in consumer electronics. Logistics providers are investing in UWB RTLS solutions to optimize supply chain operations across regional distribution hubs. Consumer electronics brands are expanding the availability of UWB-enabled smartphones and connected devices. Government-backed smart mobility and healthcare digitalization initiatives are encouraging the deployment of UWB anchors and tags in hospitals, transport, and security systems. The UK’s emphasis on secure access systems in financial and corporate environments is also fueling demand for UWB applications.

Smart mobility projects integrate UWB anchors for transport safety

Consumer electronics adopt UWB for connected devices

Logistics firms enhance supply chain tracking with UWB

Sales Outlook for UWB Anchor and Tags Market in the USA

The UWB anchor and tags market in the USA is recording a CAGR of 15.6%, with adoption led by consumer electronics, automotive, and industrial automation sectors. Leading smartphone and wearable manufacturers have embedded UWB chips, driving mainstream consumer adoption. Automotive OEMs are using UWB in smart keyless entry and autonomous vehicle systems. Warehouses and manufacturing plants are adopting UWB RTLS for inventory and workflow optimization. Healthcare facilities are deploying UWB to improve patient care and reduce equipment loss. Startups and established players are expanding UWB integration into IoT platforms, creating new opportunities in smart homes and enterprise security. Regulatory support for connected technologies reinforces growth momentum.

Consumer electronics expand with UWB-enabled smartphones and wearables

Automotive OEMs integrate UWB for security and autonomy

Healthcare facilities adopt UWB for asset monitoring and safety

Competitive Landscape of Ultra Wideband Anchor and Tags Market

The UWB anchor and tags market is highly competitive, with established technology firms and startups pushing innovation. Companies differentiate through advanced chipsets, energy-efficient designs, and integration with software platforms for analytics and AI-driven insights. Leading players are pursuing partnerships with automotive OEMs, healthcare providers, and industrial operators to expand deployment. Branding focuses on reliability, accuracy, and seamless integration into IoT ecosystems. This competitive dynamic drives continuous R&D and commercialization, ensuring UWB anchors and tags gain traction across multiple sectors in the coming years.

Key Players in the Ultra Wideband Anchor and Tags Market

Apple

BeSpoon

Identec Solutions

Kinexon

NXP Semiconductors

Qorvo

Sewio Networks

STMicroelectronics

Ubisense

Zebra Technologies

Scope of the Report

Item

Value

Quantitative Units

USD 1.2 Billion

Component

Tags and Anchors

Positioning System

Indoor, Outdoor, and Hybrid

Range

Short Range (10m), Medium Range (10–50m), and Long Range (>50m)

Application

Asset tracking, Real-Time Location Systems (RTLS), Indoor navigation, Personnel monitoring, Access control, and Industrial automation

End User

Manufacturing, Retail, Healthcare, Transportation & logistics, Automotive, Consumer electronics, Residential, Sports & entertainment, and Others

Regions Covered

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

Country Covered

United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa

Key Companies Profiled

Apple, BeSpoon, Identec Solutions, Kinexon, NXP Semiconductors, Qorvo, Sewio Networks, STMicroelectronics, Ubisense, and Zebra Technologies

Additional Attributes

Dollar sales vary by product type, including UWB anchors and tags; by application, such as asset tracking, indoor navigation, personnel monitoring, and industrial automation; by end-use industry, spanning logistics, healthcare, manufacturing, and retail; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by demand for precise real-time location systems, industrial IoT adoption, and smart building technologies.