Market snapshot: Synchronized risk-off

Selling broadened across large-cap tokens in the Asian session. Ethereum led declines, sliding over 3% to probe the $4,000 handle. Bitcoin fell more than 1% to trade below $112,000. XRP, SOL, DOGE shed between 2.6%–3%, with Solana threatening a clean break below $200, a level watched by momentum traders.

Shutdown risk climbs to cycle highs

Shutdown risk climbs to cycle highs

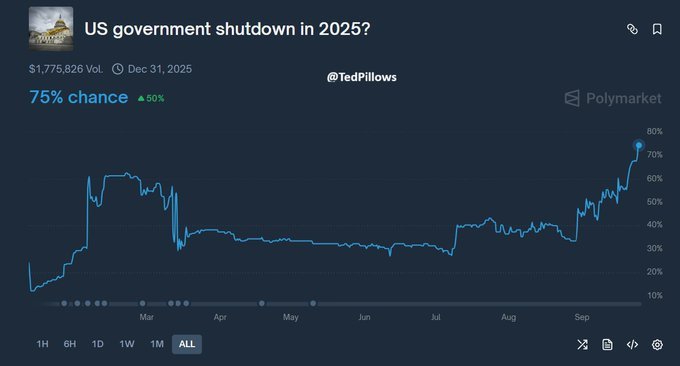

Prediction markets intensified the macro drag: on Polymarket, traders priced a 76% probability of a U.S. government shutdown by Dec 31, and 63% by Oct 1. In parallel, the Office of Management and Budget directed agencies to finalize contingency plans for staffing cuts and furloughs should Congress fail to pass funding. With full-year appropriations off the table before month-end, a continuing resolution is needed—and will require bipartisan support to clear Senate vote thresholds.

Leverage and liquidations amplify the move

Leverage and liquidations amplify the move

Beyond macro headlines, structure mattered: roughly $1.65 billion in leveraged long liquidations cascaded across venues, turning dip-buying attempts into forced selling. The stronger U.S. dollar further tightened financial conditions for risk assets, prompting allocations toward perceived havens while crypto beta de-rated.

Fed tone: Easing bias, cautious delivery

Policy continues to frame sentiment. The Fed cut 25 bps on Sept 17 and signaled the possibility of two additional cuts this year, but officials—including Chair Jerome Powell—have stressed data dependence. San Francisco Fed’s Mary Daly reiterated support for further cuts without a timetable. Traders now eye seven Fed speakers today and Friday’s PCE—the central bank’s preferred inflation gauge—for confirmation that disinflation remains on track.

Technicals and seasonality: September headwinds persist

Seasonally, September has been a weak month for crypto, and technicals leaned bearish into this week: ETH’s retest of $4,000 and SOL’s pressure near $200 leave charts vulnerable to stop-runs if macro news disappoints. That said, some desks (e.g., QCP Capital) note that contained inflation could reopen the door to additional Fed cuts, improving liquidity into Q4 and setting up a potential BTC breakout attempt if macro tailwinds align.

Regulation keeps volatility elevated

Regulatory debate in the U.S. and EU—from stricter exchange rules to AML enhancements—continues to inject headline risk. For tokens with ongoing legal overhangs, liquidity gaps can widen outsized intraday swings.

What to watch nextU.S. funding: progress (or lack thereof) on a continuing resolution; shutdown headlines will move beta.Fed speak & PCE: a softer core PCE would support the case for additional 2025 cuts and risk sentiment.Dollar index: further strength likely pressures crypto; a pullback could ease headwinds.Derivatives: funding rates, basis, and open interest; another liquidation wave would extend downside, while stabilization could enable mean reversion.Levels: BTC $110k–$112k support; ETH $4,000 pivot; SOL $200 line in the sand.

Thursday’s selloff was a macro-meets-market-structure move: rising shutdown odds, a firmer dollar, and forced deleveraging collided with crypto’s September seasonality. Near-term direction likely hinges on Washington’s funding path and Friday’s PCE. If inflation cooperates and Fed guidance stays cautiously dovish, Q4 liquidity could improve—setting the stage for relief rallies. Until then, expect headline-driven, leverage-sensitive price action and respect the key technical pivots.