Orbital Action Jigsaw Market Forecast and Outlook (2025-2035)

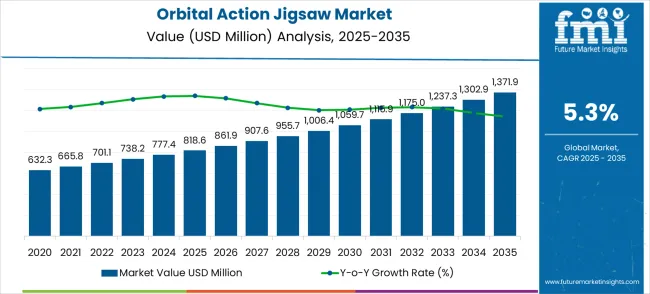

The orbital action jigsaw market, valued at USD 818.6 million in 2025 and projected to reach USD 1,371.9 million by 2035 at a CAGR of 5.3%, demonstrates a consistent upward trajectory in long-term value accumulation. From 2025 to 2030, the market grows from USD 818.6 million to approximately USD 1,006.4 million. This initial phase captures early adoption and steady expansion, as rising demand in construction, woodworking, and DIY segments drives incremental value accumulation. Annual increases during this period average 5.2–5.4%, reflecting consistent market penetration and gradual adoption of advanced jigsaw models across residential and commercial applications.

Quick Stats for Orbital Action Jigsaw Market

Orbital Action Jigsaw Market Value (2025): USD 818.6 million

Orbital Action Jigsaw Market Forecast Value (2035): USD 1,371.9 million

Orbital Action Jigsaw Market Forecast CAGR: 5.3%

Leading Application in Orbital Action Jigsaw Market: Furniture Manufacturing (46%)

Key Growth Regions in Orbital Action Jigsaw Market: China, India, and Germany

Top Key Players in Orbital Action Jigsaw Market: Metabo, Milwaukee, DeWALT, Makita, Bosch, Einhell, HiKOKI, Panasonic, Worx, FLEX, SKIL

Orbital Action Jigsaw Market Key Takeaways

Orbital Action Jigsaw Market

Value

Market Value (2025)

USD 818.6 million

Market Forecast Value (2035)

USD 1,371.9 million

Market Forecast CAGR

5.3%

Between 2030 and 2035, the market value accelerates from USD 1,006.4 million to USD 1,371.9 million, indicating stronger absolute revenue accumulation in the latter half of the forecast period. This acceleration is supported by increasing industrial and professional use, growing e-commerce distribution, and consumer preference for high-performance jigsaws. The compounding effect of sustained adoption contributes to more significant value accumulation, emphasizing the importance of strategic production scaling, marketing, and distribution investments during this period.

The long-term value accumulation curve highlights the gradual and consistent compounding of market revenues over the 2025–2035 horizon. Early years reflect steady growth, focusing on establishing market share and technological credibility, while later years capture amplified gains due to broader adoption, product innovations, and expanding end-use applications. Understanding this value accumulation pattern allows stakeholders to optimize production planning, capital allocation, and strategic partnerships to maximize returns over the full forecast period, ensuring sustainable market growth and competitive positioning in the global orbital action jigsaw segment.

Orbital Action Jigsaw Market Opportunity Pools

The orbital action jigsaw market is poised for growth, driven by rising population, DIY trends, construction activity, and technological innovation.

Pathway A – Professional & Industrial UseHigh-performance corded and cordless jigsaws for furniture manufacturing, building decoration, and construction workshops. Largest near-term opportunity: USD 0.5–0.8 billion.

Pathway B – DIY & Home ImprovementRising DIY culture and hobbyist adoption in developed markets, supported by ergonomic, easy-to-use models. Expected pool: USD 0.3–0.5 billion.

Pathway C – Cordless AdoptionBattery-powered solutions replacing corded models for convenience and mobility. Incremental pool: USD 0.2–0.4 billion.

Pathway D – Emerging Markets ExpansionGrowing construction and furniture sectors in Asia, Latin America, and the Middle East drive demand. Opportunity pool: USD 0.3–0.5 billion.

Pathway E – Smart & Connected ToolsIntegration of IoT, app-enabled guidance, and digital safety features enhances user experience. Expected pool: USD 0.1–0.2 billion.

Pathway F – Premium Branding & CertificationsCE, ISO, and quality certifications, plus branded marketing for professional users, unlock premium pricing. Adds USD 0.1–0.2 billion.

Pathway G – Tool Bundles & Complementary ProductsCombining jigsaws with blades, guides, and maintenance kits creates value-added offerings. Pool: USD 0.1–0.2 billion.

Pathway H – Direct-to-Consumer & E-commerce ChannelsOnline platforms, subscription models, and digital storytelling connect with DIY and professional users. Smaller but disruptive pool: USD 0.05–0.1 billion.

Why is the Orbital Action Jigsaw Market Growing?

Market expansion is being supported by the rapid increase in residential and commercial construction activities worldwide and the corresponding need for precision cutting tools that provide superior cutting performance and operational mobility. Modern construction and woodworking projects rely on consistent cutting quality and operational efficiency to ensure optimal project completion including furniture manufacturing, building decoration, and custom millwork applications. Even minor cutting inefficiencies can require comprehensive project adjustments to maintain optimal quality standards and operational performance.

The growing complexity of woodworking requirements and increasing demand for high-productivity cutting solutions are driving demand for orbital action jigsaw equipment from certified manufacturers with appropriate performance capabilities and technical expertise. Construction companies and woodworking professionals are increasingly requiring documented cutting efficiency and tool reliability to maintain project quality and cost effectiveness. Industry specifications and performance standards are establishing standardized cutting procedures that require specialized tool technologies and trained operators.

Segmental Analysis

The market is segmented by product type, application, and region. By product type, the market is divided into corded, cordless. Based on application, the market is categorized into furniture manufacturing, building decoration, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

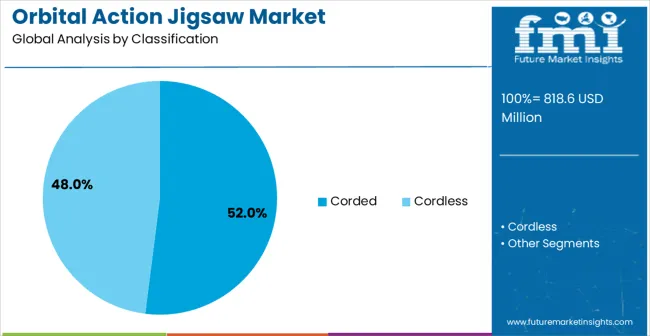

By Product Type, Corded Segment Leads 52% Market Share

The corded orbital action jigsaw segment is projected to capture 52% of the total market share in 2025, establishing its position as the leading product category. This dominance is supported by continuous power delivery and uninterrupted operation, which are essential for extended cutting sessions in professional workshops and woodworking facilities. Corded jigsaws eliminate battery runtime limitations, providing reliable performance across diverse material applications. Advanced motor technologies, variable speed controls, and precision cutting features enhance cutting efficiency, while lower initial costs compared to cordless alternatives make them attractive to budget-conscious contractors and small-scale woodworking operations. The segment benefits from established electrical infrastructure in most professional settings, ensuring dependable operation without reliance on battery charging systems. Furniture manufacturers particularly prefer corded models for high-volume and precision cutting tasks. The combination of cost-effectiveness, consistent power, and operational reliability reinforces the segment’s leadership and ensures sustained adoption in stationary and professional cutting applications.

Corded jigsaws provide consistent power, precision, and efficiency for extended professional use.

Lower initial costs and advanced motor technologies strengthen adoption among contractors and workshops.

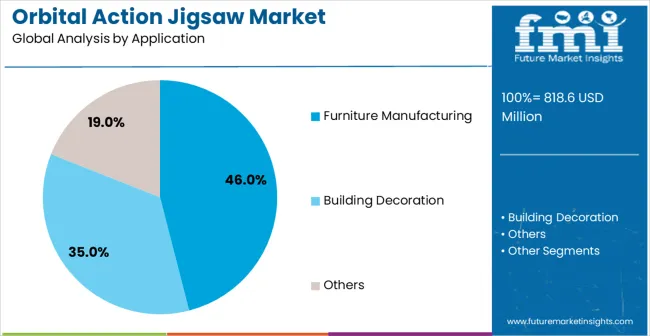

By Application, Furniture Manufacturing Segment Accounts for 46% Market Share

The furniture manufacturing segment is expected to represent 46% of orbital action jigsaw demand in 2025, making it the largest application sector. Demand is driven by the furniture industry’s need for precision cutting and efficient material processing across solid wood, engineered lumber, and composite panels. Orbital action jigsaws are favored for intricate curved cuts and detailed shaping operations that traditional tools cannot perform efficiently. The segment benefits from the furniture industry’s focus on customization, design flexibility, and quality standards, which require versatile cutting solutions. Modern production facilities integrate orbital jigsaws into both rough cutting and precision finishing workflows, enabling efficient operations while maintaining premium surface quality. Growth in modular furniture, artisanal woodworking, and space-efficient designs further supports demand for specialized cutting capabilities. The combination of operational efficiency, precision performance, and design adaptability ensures that furniture manufacturing remains the dominant driver for orbital action jigsaw adoption.

Precision cutting and versatility are critical for furniture production and artisanal applications.

Modular designs and customization trends drive specialized jigsaw demand.

What are the Drivers, Restraints, and Key Trends of the Orbital Action Jigsaw Market?

The Orbital Action Jigsaw market is advancing steadily due to increasing construction activity and growing recognition of cordless tool advantages over traditional corded alternatives. However, the market faces challenges including higher initial equipment costs compared to basic jigsaws, need for battery management systems, and varying performance requirements across different cutting applications. Performance optimization efforts and battery technology advancement programs continue to influence tool development and market adoption patterns.

Advancement of Cordless Battery Technologies

The growing development of advanced lithium-ion battery systems is enabling higher power output with improved runtime characteristics and reduced charging times. Enhanced battery technologies and optimized power management systems provide superior cutting performance while maintaining operational convenience requirements. These technologies are particularly valuable for professional contractors who require reliable tool performance that can support extensive cutting operations with consistent results.

Integration of Precision Cutting Features

Modern orbital action jigsaw manufacturers are incorporating advanced cutting control systems and ergonomic design improvements that enhance operator precision and tool effectiveness. Integration of variable orbital settings and optimized blade guidance systems enables superior cutting results and comprehensive material processing capabilities. Advanced tool features support operation in diverse cutting environments while meeting various performance requirements and operational specifications.

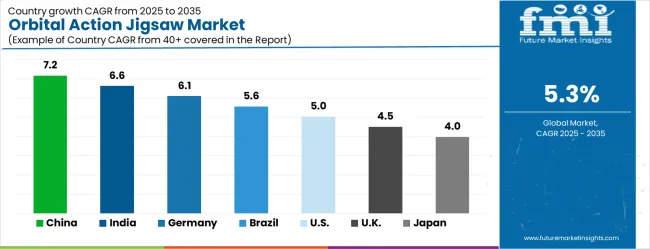

Analysis of Orbital Action Jigsaw Market by Key Country

Country

CAGR (2025-2035)

China

7.2%

India

6.6%

Germany

6.1%

Brazil

5.6%

United States

5%

United Kingdom

4.5%

Japan

4%

The orbital action jigsaw market is growing steadily, with distinct regional clusters driving demand. China leads at a 7.2% CAGR through 2035, supported by rapid infrastructure development, urban construction projects, and widespread adoption of professional cutting tools, with high-demand regions concentrated in industrial and metropolitan hubs. India follows at 6.6%, fueled by rising residential construction activity, increased awareness of advanced tool technologies, and clustered demand around emerging urban centers where DIY and professional users overlap. Germany grows at 6.1%, driven by established woodworking and construction infrastructure, with high adoption of precision tools among grouped professional users. Overall, the market reflects clear patterns of clustered growth, where industrial expansion, construction activity, and tool sophistication intersect to shape regional demand dynamics.

China Leads Global Market Growth with Manufacturing Expansion

Revenue from orbital action jigsaws in China is projected to grow at a CAGR of 7.2% through 2035, driven by rapid expansion of industrial manufacturing and construction activities. The country’s growing demand for precision woodworking and metal fabrication tools is creating significant opportunities for professional and DIY segments. Manufacturers are establishing comprehensive production and distribution networks to support increasing adoption in workshops and construction sites. Government initiatives to modernize industrial facilities and support advanced tool utilization are further promoting market penetration. Rising demand for ergonomic, durable, and high-performance jigsaws is facilitating innovation in design and technology, enhancing productivity and safety for end users.

Industrial modernization and construction expansion drive tool adoption.

Manufacturers focus on durable, ergonomic, and high-performance jigsaw designs.

India Demonstrates Strong Market Potential with Construction Growth

Revenue from orbital action jigsaws in India is projected to expand at a CAGR of 6.6% through 2035, supported by growing construction and manufacturing infrastructure development. Increasing DIY awareness and workshop modernization programs are creating demand for precision cutting tools. Manufacturers and distributors are implementing localized production and support networks to meet rising requirements from industrial and residential construction sectors. Market growth is being bolstered by product innovations that combine safety, efficiency, and user-friendly designs. Professional training and technical support initiatives are enabling effective tool utilization, while expanding end-user education is supporting adoption in both industrial and DIY applications across urban and semi-urban areas.

Construction and manufacturing growth drive precision tool adoption.

Technical support and user-friendly designs enhance market penetration.

Germany Focuses on Precision Engineering and Tool Performance

Demand for orbital action jigsaws in Germany is projected to grow at a CAGR of 6.1% through 2035, supported by the country’s emphasis on high-precision engineering and professional-grade power tools. German manufacturers and workshops prioritize superior quality, safety, and durability in cutting tools. The market is characterized by integration of advanced motor technology, adjustable orbital action, and ergonomic designs. Investments in R&D are driving innovation to meet stringent industrial standards and user expectations. Professional training programs and certification initiatives ensure optimal utilization of orbital action jigsaws, enhancing operational efficiency, safety, and long-term tool performance across industrial, woodworking, and DIY segments in Germany.

Precision engineering standards drive adoption of advanced tool features.

R&D and professional training enhance operational efficiency and safety.

Brazil Maintains Steady Growth with Industrial and Residential Demand

Revenue from orbital action jigsaws in Brazil is projected to grow at a CAGR of 5.6% through 2035, driven by expanding construction, furniture, and manufacturing sectors. Industrial workshops and residential DIY users are increasingly adopting advanced cutting tools with ergonomic features and improved durability. Manufacturers are investing in distribution and service networks to ensure product availability and after-sales support across major urban and regional markets. Market growth is supported by modernization initiatives in industrial facilities and growing awareness of high-performance tools among craftsmen and DIY enthusiasts. Product innovation emphasizes precision cutting, orbital motion optimization, and safety features tailored to professional and home users.

Construction and industrial demand drives adoption of ergonomic jigsaws.

Manufacturers focus on distribution, service networks, and safety features.

United States Emphasizes Innovation and Professional Applications

Demand for orbital action jigsaws in the U.S. is projected to grow at a CAGR of 5% through 2035, supported by industrial workshops, home improvement markets, and professional craftsmanship. The country’s advanced manufacturing infrastructure and DIY culture are driving adoption of ergonomic, durable, and high-precision tools. Manufacturers are implementing advanced production technologies and expanding distribution channels to meet diverse industrial and residential requirements. Innovation focuses on enhanced orbital action settings, motor efficiency, and dust management systems. Professional training programs and technical workshops ensure proper tool utilization, improving safety and cutting precision for both industrial operators and DIY users across North America.

Industrial infrastructure and DIY culture support high-precision tool adoption.

Innovation in orbital action, motor efficiency, and dust management drives usage.

United Kingdom Focuses on Quality Standards and Tool Reliability

Revenue from orbital action jigsaws in the U.K. is projected to grow at a CAGR of 4.5% through 2035, driven by construction, woodworking, and DIY sector growth. Professional workshops and residential users are increasingly demanding reliable, ergonomic, and precise cutting tools. Manufacturers are implementing high-quality standards, distribution networks, and after-sales support to ensure market penetration. Market adoption is enhanced by product innovations that optimize orbital action, motor efficiency, and user comfort. Training initiatives and technical guidance programs are enabling effective utilization across professional and home environments, supporting safe, high-quality cutting performance in U.K. industrial and residential applications.

Construction and woodworking sectors drive reliable tool adoption.

Product innovations and training initiatives enhance user comfort and safety.

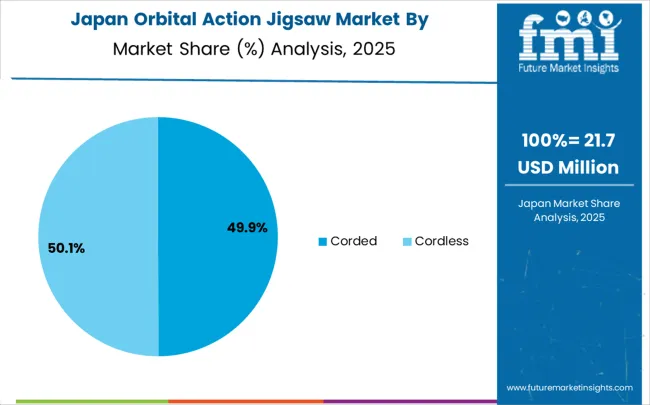

Japan Demonstrates Focus on Precision and Technological Innovation

Demand for orbital action jigsaws in Japan is projected to grow at a CAGR of 4% through 2035, supported by precision manufacturing, industrial workshops, and advanced DIY markets. Japanese users prioritize cutting accuracy, ergonomics, and long-term tool reliability. Manufacturers are integrating advanced motor technologies, orbital action adjustments, and dust extraction systems to meet strict industrial and home-use standards. Market growth is reinforced by professional workshops adopting high-performance tools, coupled with innovation initiatives to enhance efficiency and safety. Technical training programs and support networks are strengthening adoption across industrial and consumer applications, ensuring optimized performance, precision, and compliance with Japanese quality expectations.

Precision manufacturing and DIY demand drive high-performance tool adoption.

Advanced motor and orbital action features improve cutting efficiency and safety.

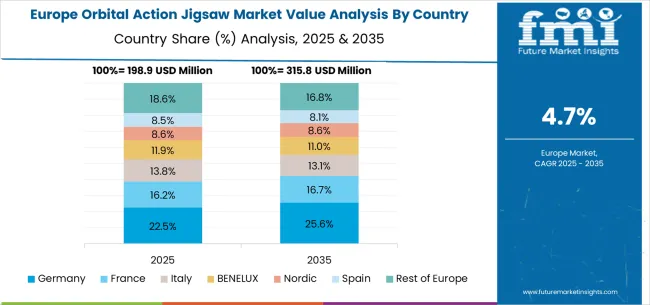

Europe Market Split by Country

The orbital action jigsaw market in Europe is projected to grow from USD 186.2 million in 2025 to USD 289.4 million by 2035, registering a CAGR of 4.5% over the forecast period. Germany is expected to remain the largest national market with 28.3% market share in 2025, easing slightly to 27.8% by 2035, supported by strong premium tool demand and advanced woodworking infrastructure. The United Kingdom follows with 21.5% in 2025, rising to 22.1% by 2035 as professional construction applications and renovation activity accelerate across diverse building sectors.

France accounts for 16.2% in 2025, dipping modestly to 15.8% by 2035 amid growing focus on cordless tool adoption and construction modernization. Italy holds 13.4% in 2025, remaining near 13.1% by 2035 as furniture manufacturing and traditional woodworking sectors continue steady jigsaw adoption. Spain represents 8.7% in 2025, increasing to 9.2% by 2035 with growing construction activity and professional tool implementation. BENELUX countries contribute 5.9% in 2025, slightly easing to 5.7% by 2035, while the remainder of Europe (Eastern Europe, Nordic, and other markets) collectively rises from 6.0% in 2025 to 6.3% by 2035, reflecting accelerating construction modernization in emerging European markets versus mature adoption rates in established Western European construction sectors.

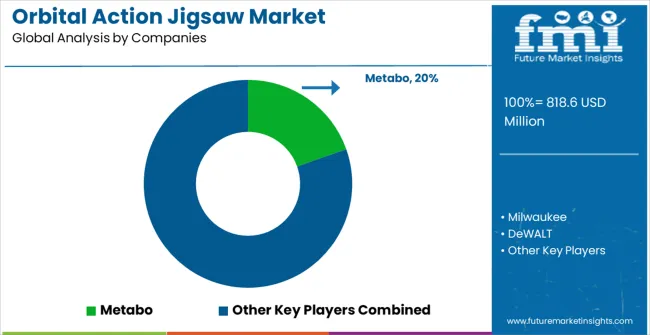

Competitive Landscape of Orbital Action Jigsaw Market

The Orbital Action Jigsaw market is defined by competition among specialized power tool manufacturers, construction equipment companies, and professional tool solution providers. Companies are investing in advanced orbital action mechanism development, battery technology optimization, ergonomic design improvements, and comprehensive service capabilities to deliver reliable, efficient, and cost-effective cutting solutions.

Metabo offers comprehensive orbital action jigsaw solutions with established manufacturing expertise and professional-grade tool capabilities. Milwaukee provides specialized cutting equipment with focus on performance reliability and operational efficiency. DeWALT delivers cost-effective cutting solutions with emphasis on accessibility and user-friendly operation. Makita specializes in cordless tool technology with advanced battery system integration.

Bosch offers professional-grade cutting equipment with comprehensive service support capabilities. Einhell, HiKOKI, Panasonic, Worx, FLEX, and SKIL offer specialized manufacturing expertise, tool reliability, and comprehensive product development across global and regional market segments.

Key Players in the Orbital Action Jigsaw Market

Metabo

Milwaukee

DeWALT

Makita

Bosch

Einhell

HiKOKI

Panasonic

Worx

FLEX

SKIL

Scope of the Report

Item

Value

Quantitative Units

USD 818.6 million

Product Type

Corded, Cordless, Others

Application

Furniture Manufacturing, Building Decoration, Others

Regions Covered

North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa

Country Covered

China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries

Key Companies Profiled

Metabo, Milwaukee, DeWALT, Makita, Bosch, Einhell, HiKOKI, Panasonic, Worx, FLEX, SKIL

Additional Attributes

Dollar sales by product type and application segment, regional demand trends across major construction markets, competitive landscape with established tool manufacturers and emerging technology providers, customer preferences for different cutting capabilities and power options, integration with professional construction workflows and woodworking protocols, innovations in orbital action mechanism efficiency and battery technology advancements, and adoption of ergonomic design features with enhanced cutting performance capabilities for improved operational workflows.