US markets slide after doubts about Fed cuts

The main US stock indices registered a third consecutive decline at the New York close. Investors are again questioning whether the Federal Reserve (Fed) will continue cutting rates after the precautionary comments Jerome Powell made at the start of the week. In addition, the combination of falling jobless claims and stronger-than-expected durable-goods orders reinforced the view that underlying economic strength remains intact. The final revision of gross domestic product (GDP) also came in well above estimates.

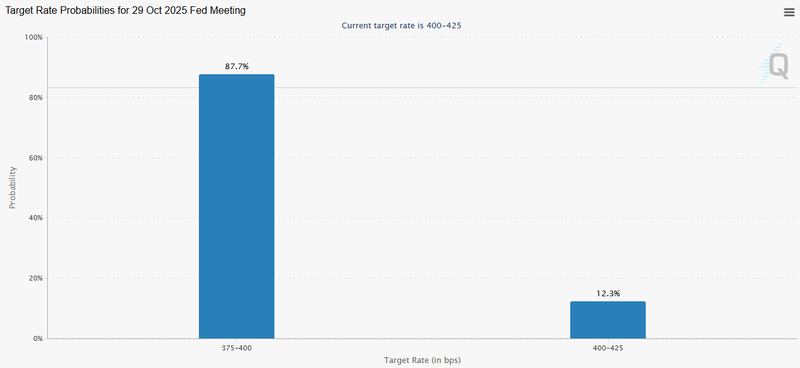

While probabilities derived from CME Group’s FedWatch still imply potential cuts for the October and December meetings, recent data have rekindled doubts about the timing and extent of monetary easing. In just a few days, FedWatch moved from above the 90% threshold for an October cut back to the 80% zone (see image below). Market focus now turns to tomorrow’s PCE inflation release.

At the close, the S&P 500 −0.50%, the Nasdaq 100 −0.43%, the Dow Jones −0.38%, and the Russell 2000 −0.98%.

Source: Image obtained from CME Group (September 25, 2025)

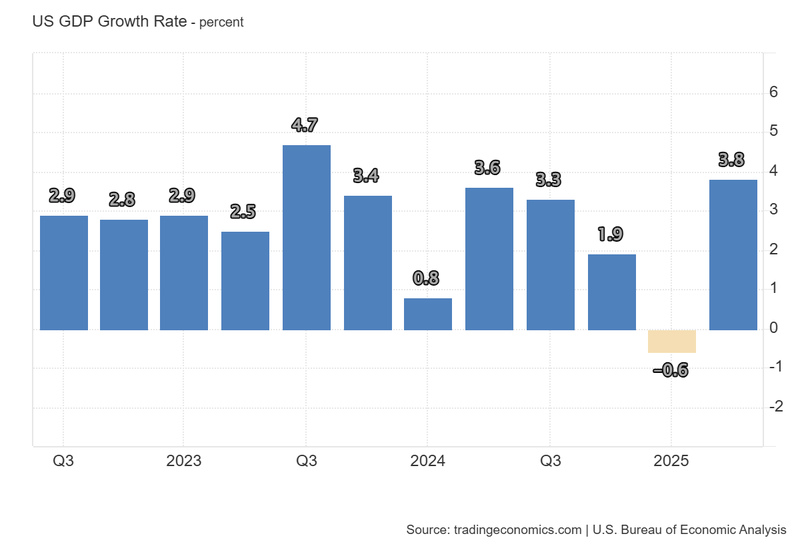

Revision of US GDP upwards; Dollar Index accelerates its momentum

Second-quarter GDP, in its final revision, was adjusted upwards—above the analyst consensus. The US economy was supported by consumption and investment, though there are signs of moderation stemming from tariffs and political uncertainty. Headline growth was updated to 3.8% (quarterly change), implying year-on-year growth of 2.1%. The surprise is notable: the second estimate had shown 3.3% growth, which was already strong; the final print further evidences the resilience of the US economy. According to Trading Economics, the largest upward revisions were in personal consumption (especially consumer spending) and fixed investment (notably intellectual property products and equipment). By contrast, government consumption was revised lower, as was the trade balance owing to weaker exports and imports—likely related to tariff implementation under the Donald Trump administration.

As a result, the Dollar Index (DXY) closed up approximately 0.65%. Since its September low (September 17), the DXY has appreciated about 1.92%. Chair Powell’s non-expansionary tone, together with stronger activity data, has likely supported the rally in the US currency.

Source: Image obtained from Trading Economics (September 25, 2025)

US jobless claims decline as durable-goods orders surprise to the upside

Initial claims for unemployment benefits fell from 232,000 to 218,000, a reduction of 14,000. Continuing claims—reflecting those who remain on benefits—also edged down by 2,000, from 1,928,000 to 1,926,000. In both cases, the figures beat expectations, as analysts had anticipated increases.

These indicators suggest a temporary easing in unemployment, though they do not imply a rebound in new hires, which have slowed materially. Various analysts attribute the deterioration in job creation to US President Donald Trump’s immigration policies rather than to underlying economic weakness, given that production, investment, and consumption indicators still exhibit strength.

Separately, durable-goods orders exceeded estimates. The analyst consensus expected a 0.5% contraction, but orders rose 2.9%. The print adds to this week’s upside surprise in new-home sales. Elevated spending on big-ticket goods and services—often associated with longer-term financial commitments—may reflect improving consumer confidence or the bringing forward of purchases amid a complex outlook.

Swiss National Bank keeps its benchmark rate unchanged

The Swiss National Bank (SNB) left its policy rate unchanged at 0%, in line with expectations. Notably, the Bank flagged US tariffs as a headwind to Swiss growth prospects for 2026 (GDP growth projected at 1%). It highlighted machinery and watchmaking as among the sectors most affected.

In market response, the Swiss franc depreciated by roughly 0.70% against the dollar, while gaining about 0.05% versus the euro. The SNB stated that a return to negative policy rates is unlikely, though it remains prepared to act if necessary.