Coal to Ethylene Glycol Catalyst Market Forecast and Outlook (2025-2035)

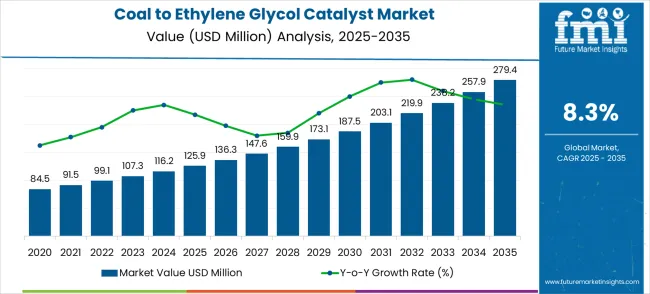

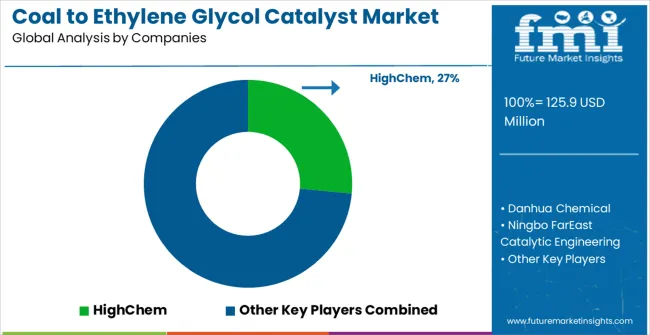

The coal to ethylene glycol catalyst market is valued at USD 125.9 million in 2025 and is projected to reach USD 279.4 million by 2035, registering a CAGR of 8.3%. The trough year in this period is 2020, with a market value of USD 84.5 million, marking the baseline for growth. Steady adoption in chemical processing and industrial applications drives consistent revenue increases, supported by demand for efficient catalysts that enhance ethylene glycol production. Early-stage growth is primarily fueled by investments in coal-based production processes and increasing focus on process optimization across key manufacturing regions.

Quick Stats for Coal to Ethylene Glycol Catalyst Market

Coal to Ethylene Glycol Catalyst Market Value (2025): USD 125.9 million

Coal to Ethylene Glycol Catalyst Market Forecast Value (2035): USD 279.4 million

Coal to Ethylene Glycol Catalyst Market Forecast CAGR: 8.3%

Leading Classification in Coal to Ethylene Glycol Catalyst Market: Copper Catalyst (54.7%)

Key Growth Regions in Coal to Ethylene Glycol Catalyst Market: Asia Pacific, North America, and Europe

Key Players in Coal to Ethylene Glycol Catalyst Market: HighChem, Danhua Chemical, Ningbo FarEast Catalytic Engineering, Shanghai Pujing Chemical, Haiso Technology, Shangqiu Guolong New Materials

Coal to Ethylene Glycol Catalyst Market Key Takeaways

Metric

Value

Estimated Value in (2025E)

USD 125.9 million

Forecast Value in (2035F)

USD 279.4 million

Forecast CAGR (2025 to 2035)

8.3%

Between 2025 and 2030, market performance shows accelerated expansion, rising from USD 125.9 million to USD 187.5 million. This period highlights rising industrial adoption and investments in advanced catalyst technologies that improve conversion efficiency and yield. Revenue increments reflect both new installations and replacement of older catalytic systems, emphasizing the importance of optimized coal-to-ethylene glycol conversion in large-scale chemical plants. During these years, the market demonstrates strong upward momentum, with incremental gains contributing significantly to overall market growth.

The peak year for the market is projected to be 2035, with a value of USD 279.4 million. From 2030 to 2035, the market climbs from USD 187.5 million to USD 279.4 million, marking the final growth phase. Expansion during this period is driven by higher adoption across mature production facilities, rising efficiency requirements, and broader integration of advanced catalyst solutions. Continuous growth in industrial applications ensures that the market remains robust, with peak performance achieved by the end of the forecast period, demonstrating the strong long-term potential of coal-to-ethylene glycol catalysts.

Why is the Coal to Ethylene Glycol Catalyst Market Growing?

Market expansion is being supported by the increasing demand for feedstock diversification in chemical production and the corresponding need for efficient catalytic technologies that can enable economic conversion of coal to ethylene glycol. Modern chemical companies are increasingly focused on alternative production routes that can provide cost advantages and supply security while maintaining product quality and environmental performance. The proven capability of advanced catalysts to deliver high conversion efficiency, selectivity, and operational stability makes them essential components of coal-to-chemicals production systems.

The growing emphasis on energy security and domestic resource utilization is driving demand for coal-based chemical production technologies that can reduce dependence on petroleum feedstocks while leveraging abundant coal reserves. Industry preference for catalytic systems that can provide consistent performance, extended operating life, and process optimization capabilities is creating opportunities for advanced catalyst development. The rising influence of economic competitiveness and strategic resource utilization is also contributing to increased adoption of coal-to-chemicals technologies across different regional markets and industrial applications.

Segmental Analysis

The market is segmented by classification, application, and region. By classification, the market is divided into copper catalyst, palladium catalyst, and others. Based on application, the market is categorized into polyester and antifreeze applications. Regionally, the market is divided into Asia Pacific, North America, Europe, Latin America, and Middle East & Africa.

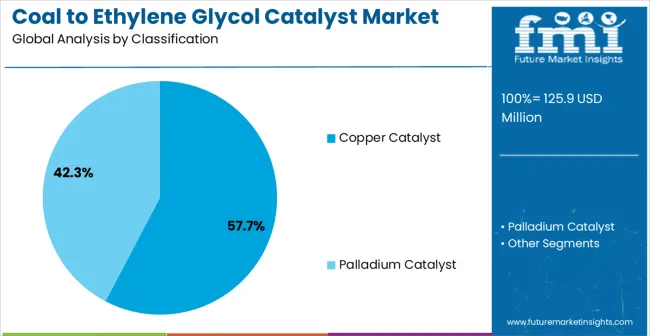

By Classification, Copper Catalyst Segment Accounts for 54.7% Market Share

The copper catalyst classification is projected to account for 54.7% of the coal to ethylene glycol catalyst market in 2025, reaffirming its position as the category’s dominant catalyst type. Process engineers increasingly recognize the superior cost-effectiveness and catalytic performance provided by copper-based catalyst systems for coal-to-ethylene glycol conversion processes. This classification addresses the most practical operational requirements while providing essential activity and selectivity characteristics. This classification forms the foundation of most commercial coal-to-ethylene glycol production facilities, as it represents the most economically viable and technically proven approach for large-scale conversion operations.

Technology development and formulation optimization continue to strengthen confidence in copper catalyst performance for industrial applications.

With increasing recognition of the importance of cost-effective conversion and operational reliability, copper catalysts align with both current economic requirements and process optimization objectives.

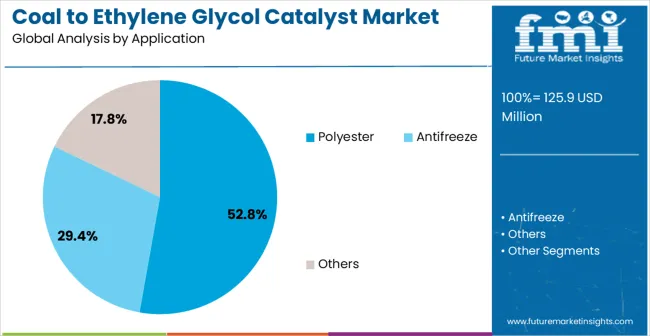

By Application, Polyester Segment Accounts for 52.8% Market Share

Polyester applications are projected to represent 52.8% of coal to ethylene glycol catalyst demand in 2025, underscoring their role as the primary application driving market development. Polyester manufacturers recognize that ethylene glycol quality and supply reliability are critical for maintaining consistent production and product quality in textile and packaging applications. Polyester applications demand reliable ethylene glycol supply and quality that coal-based production systems are uniquely positioned to support. The segment is supported by the continuous expansion of polyester production capacity requiring stable ethylene glycol supply and the growing adoption of alternative feedstock routes to ensure supply chain resilience.

Polyester manufacturing is increasingly implementing cost optimization strategies that can leverage alternative production routes while maintaining quality standards.

As understanding of polyester supply chain requirements advances, coal-to-ethylene glycol applications will continue to serve as the primary commercial driver, reinforcing their essential position within the specialty chemicals market.

What are the Drivers, Restraints, and Key Trends of the Coal to Ethylene Glycol Catalyst Market?

The coal to ethylene glycol catalyst market is advancing rapidly due to increasing demand for feedstock diversification and growing adoption of coal-to-chemicals technologies. However, the market faces challenges including environmental concerns regarding coal utilization, complex process requirements, and competition from petroleum-based routes. Innovation in catalyst design and process optimization continue to influence product development and market expansion patterns.

Expansion of Coal-to-Chemicals Industrial Complexes

The growing development of integrated coal-to-chemicals facilities is creating enhanced opportunities for coal-to-ethylene glycol catalyst integration with comprehensive chemical production complexes. Advanced industrial facilities offer integrated production capabilities that can optimize both feedstock utilization and product output across multiple chemical streams. Large-scale integration provides opportunities for advanced catalytic systems that can support both economic efficiency and operational reliability.

Environmental and Regulatory Considerations Limiting Growth

The coal to ethylene glycol process faces scrutiny due to environmental concerns, including carbon emissions, wastewater generation, and energy-intensive operations. Regulatory frameworks in some regions impose strict emission standards and process restrictions, which can increase operational costs and impact catalyst adoption. Companies are increasingly required to implement emission control technologies and monitor compliance during production. Environmental and regulatory challenges limit expansion in certain markets, prompting manufacturers to invest in cleaner and more efficient catalyst systems to meet sustainability and safety standards while maintaining production efficiency.

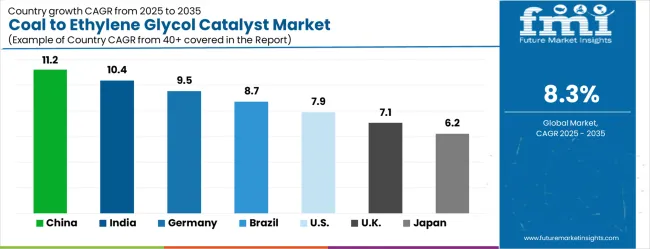

Analysis of Coal to Ethylene Glycol Catalyst Market by Key Country

Country

CAGR (2025-2035)

China

11.2%

India

10.4%

Germany

9.5%

Brazil

8.7%

USA

7.9%

UK

7.1%

Japan

6.2%

The coal to ethylene glycol catalyst market is experiencing robust growth globally, with China leading at an 11.2% CAGR through 2035, driven by massive coal-to-chemicals industry development, government support for coal utilization technologies, and extensive deployment of ethylene glycol production facilities. India follows at 10.4%, supported by growing chemical industry expansion, increasing focus on domestic feedstock utilization, and expanding coal-to-chemicals project development. Germany shows growth at 9.5%, emphasizing chemical technology excellence and advanced catalyst development. Brazil records 8.7% growth, focusing on expanding chemical industry and growing interest in alternative feedstock routes. The USA shows 7.9% growth, representing steady investment in coal-to-chemicals technologies and catalyst innovation.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Coal to Ethylene Glycol Catalyst Market Analysis in China

China is advancing rapidly in coal-to-chemicals technology, fueling strong adoption of ethylene glycol catalysts with a projected CAGR of 11.2% through 2035. Expansion of coal-based chemical facilities and supportive government initiatives are creating significant opportunities for catalyst suppliers. The country’s extensive coal reserves and growing chemical production infrastructure are promoting high-volume deployment of advanced catalytic systems. Leading domestic and international companies are establishing integrated research, manufacturing, and distribution facilities to meet rising demand for efficient coal-to-ethylene glycol conversion processes. Industry focus is on achieving high productivity, process optimization, and cost-effective chemical output across major production regions, while regulatory frameworks encourage innovation and adoption of cutting-edge catalyst technologies.

Government programs supporting coal-to-chemicals expansion accelerate catalyst adoption throughout industrial zones.

Large-scale ethylene glycol production drives deployment of advanced catalytic systems across manufacturing facilities.

Demand for Coal to Ethylene Glycol Catalyst in India

India is witnessing significant growth in coal-to-chemicals projects, generating robust demand for ethylene glycol catalysts at a CAGR of 10.4% through 2035. Increasing coal utilization for chemical production and ongoing investments in industrial infrastructure are promoting adoption of advanced catalyst technologies. The country’s developing chemical sector, combined with international technology partnerships, is enhancing domestic capability for coal-to-ethylene glycol conversion. Catalyst suppliers are focusing on providing efficient, high-performance systems to improve process reliability and output quality. Government incentives and project financing initiatives are facilitating large-scale deployment of catalytic technologies, while research collaborations support performance optimization and continuous improvement. Industry efforts emphasize integration of innovative catalytic processes to support India’s growing chemical manufacturing needs.

Expansion of coal-to-chemicals projects drives catalyst utilization across chemical production sectors.

Government focus on resource utilization and chemical technology adoption increases demand for high-performance catalysts.

Coal to Ethylene Glycol Catalyst Market Outlook in Germany

Chemical industry in Germany is capitalizing on expertise in catalyst development, supporting projected growth at a CAGR of 9.5% through 2035 for coal-to-ethylene glycol catalysts. Precision chemical engineering and technological innovation underpin strong demand for high-performance catalytic systems. German manufacturers prioritize process optimization, efficiency, and compliance with rigorous industrial standards, while research institutions provide continuous technical advancement. Collaborative initiatives between chemical companies and catalyst providers ensure superior performance and reliability of conversion processes. Adoption of sophisticated catalytic systems enables energy-efficient production and minimizes operational risks. Germany’s market focus includes advancing catalyst materials, improving process outcomes, and maintaining technological leadership in coal-based chemical production.

Expertise in catalyst development supports investment in advanced chemical systems.

Collaboration between industry and research institutions enhances process optimization and performance.

Coal to Ethylene Glycol Catalyst Market Growth in Brazil

Chemical industry in Brazil is increasingly leveraging coal-based chemical production, driving projected catalyst market growth at a CAGR of 8.7% through 2035. Expansion of industrial infrastructure and adoption of modern manufacturing processes support high-performance ethylene glycol conversion technologies. Coal utilization strategies combined with technological modernization enable domestic chemical producers to diversify feedstock sources and improve competitiveness. Partnerships with international catalyst companies facilitate knowledge transfer and adoption of advanced systems. Industry efforts are concentrated on maximizing efficiency, optimizing conversion rates, and supporting domestic production goals. Regulatory and policy frameworks encourage sustainable deployment of catalytic technologies while promoting process reliability and technological advancement across chemical manufacturing facilities nationwide.

Expansion of chemical sector and feedstock diversification increases catalyst adoption.

Collaboration with international technology providers supports domestic process advancement.

Coal to Ethylene Glycol Catalyst Market Dynamics in the United States

The United States chemical sector is emphasizing innovation-driven growth in coal-to-ethylene glycol catalysts, projected at a CAGR of 7.9% through 2035. Advanced research programs and well-established industrial infrastructure are supporting adoption of sophisticated catalytic technologies. Chemical manufacturers are investing in high-performance systems for energy-efficient conversion, operational reliability, and enhanced production output. Strategic partnerships between industrial players and research organizations are driving continuous improvements in catalyst performance and process optimization. The USA market prioritizes integration of cutting-edge catalytic systems with existing production facilities while ensuring scalability, compliance with safety standards, and technological leadership in coal-to-chemicals processes.

Industry leadership and innovation programs advance adoption of high-performance catalytic systems.

Research collaboration and technology development improve process efficiency and output quality.

Coal to Ethylene Glycol Catalyst Market Outlook in the United Kingdom

The United Kingdom chemical industry is focusing on technological advancement and alternative production routes, supporting coal-to-ethylene glycol catalyst growth at a CAGR of 7.1% through 2035. Emphasis on process efficiency, innovation, and high-performance catalytic systems is encouraging broader adoption across chemical manufacturing facilities. British companies are integrating modern catalysts into coal-based chemical conversion operations to optimize output, reduce energy consumption, and enhance operational performance. Investment in research and development programs, combined with government support for advanced chemical technologies, is fostering continuous improvements. Industry trends highlight precision engineering, sustainable conversion practices, and deployment of sophisticated catalyst solutions to maintain competitiveness within the European chemical sector.

Technology development programs support systematic adoption of advanced catalytic systems.

Innovation funding and process optimization initiatives enhance chemical production capabilities.

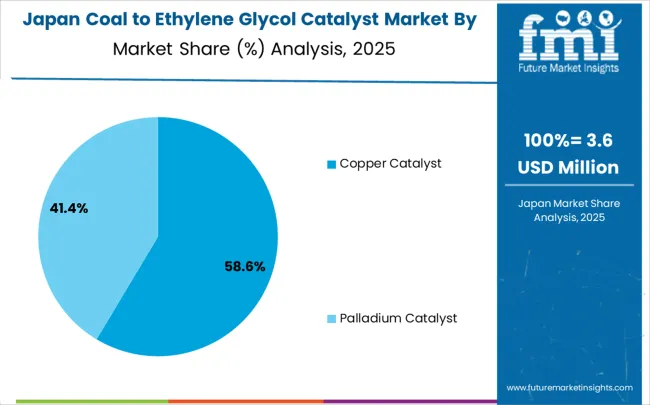

Coal to Ethylene Glycol Catalyst Market Demand in Japan

Precision chemical sector in Japan is advancing coal-to-ethylene glycol catalyst adoption with projected CAGR of 6.2% through 2035. Emphasis on high-precision engineering and technology-driven chemical production is driving demand for advanced catalytic systems. Japanese manufacturers focus on achieving consistent output quality, process reliability, and energy-efficient coal conversion. Collaborative research initiatives and integration of cutting-edge catalyst technologies ensure continuous performance improvement and process optimization. Market efforts target development of superior catalytic materials, operational excellence, and industrial scalability. Policy support, combined with industrial R&D programs, reinforces Japan’s commitment to technological leadership, enabling the deployment of sophisticated coal-to-ethylene glycol catalysts across domestic chemical production facilities.

Advanced chemical engineering capabilities drive adoption of high-precision catalysts.

Collaboration and technology standards ensure process efficiency and industrial scalability.

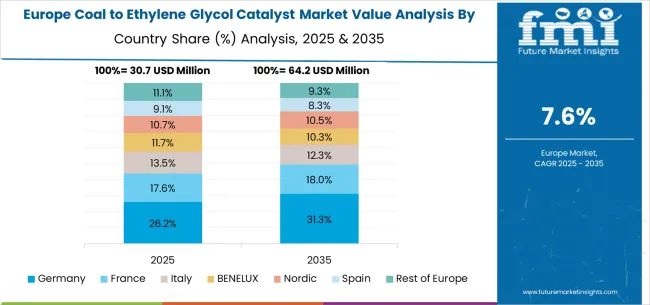

Europe Market Split by Country

The coal to ethylene glycol catalyst market in Europe is projected to grow from USD 30.7 million in 2025 to USD 64.2 million by 2035, registering a CAGR of 7.6% over the forecast period. Germany will continue to lead, increasing from 26.2% in 2025 to 31.3% by 2035, supported by its strong chemical industries, catalyst development infrastructure, and advanced R&D programs. France will hold 17.6% in 2025, growing slightly to 18.0% by 2035, driven by chemical industry expansion and adoption of catalyst conversion technologies. Italy is projected to contribute 12.4% in 2025, holding steady at 12.6% by 2035, reflecting stable demand across industrial chemical applications.

The BENELUX region will account for 11.7% in 2025, easing to 10.8% by 2035, due to gradual consolidation of specialty catalyst operations. The Nordic countries will represent 10.7% in 2025, softening slightly to 10.2% by 2035, reflecting slower but steady adoption in green chemical conversion technologies. Spain will capture 9.1% in 2025, increasing marginally to 9.2% by 2035, underpinned by expansion in chemical manufacturing hubs. Meanwhile, the Rest of Europe will decline from 11.1% in 2025 to 9.3% by 2035, as growth remains concentrated in Western and Central Europe’s larger chemical clusters.

Competitive Landscape of Coal to Ethylene Glycol Catalyst Market

The coal to ethylene glycol catalyst market is characterized by competition among specialized catalyst manufacturers, established chemical technology companies, and innovative catalytic technology providers. Companies are investing in advanced catalyst formulation, process optimization, strategic partnerships, and technical support to deliver high-performance, reliable, and cost-effective coal-to-ethylene glycol catalyst solutions. Technology development, performance optimization, and customer support strategies are central to strengthening competitive advantages and market presence.

HighChem leads the market with significant expertise in catalyst technologies, offering comprehensive coal-to-ethylene glycol catalyst solutions with focus on performance optimization and industrial applications. Danhua Chemical provides established chemical technology capabilities with emphasis on coal-based chemical production and process integration. Ningbo FarEast Catalytic Engineering focuses on specialized catalytic engineering solutions with comprehensive catalyst development expertise. Shanghai Pujing Chemical delivers advanced catalyst technologies with strong focus on chemical conversion applications.

Haiso Technology operates with focus on catalyst innovation and comprehensive chemical process technologies. Shangqiu Guolong New Materials specializes in advanced materials and catalyst technologies with emphasis on chemical production applications. These companies provide diverse technological approaches and specialized expertise to enhance overall market development and catalytic technology advancement.

Key Players in the Coal to Ethylene Glycol Catalyst Market

HighChem

Danhua Chemical

Ningbo FarEast Catalytic Engineering

Shanghai Pujing Chemical

Haiso Technology

Shangqiu Guolong New Materials

Scope of the Report

Items

Values

Quantitative Units (2025)

USD 125.9 million

Classification

Copper Catalyst, Palladium Catalyst, Others

Application

Polyester, Antifreeze

Regions Covered

Asia Pacific, North America, Europe, Latin America, Middle East & Africa

Countries Covered

China, India, Germany, Brazil, United States, United Kingdom, Japan and 40+ countries

Key Companies Profiled

HighChem, Danhua Chemical, Ningbo FarEast Catalytic Engineering, Shanghai Pujing Chemical, Haiso Technology, Shangqiu Guolong New Materials

Additional Attributes

Dollar sales by catalyst type and application, regional adoption trends, competitive landscape, chemical industry partnerships, integration with production processes, innovations in catalyst formulation and process optimization, performance analysis, and conversion efficiency optimization strategies