Welcome to Michael Kramer’s pick of the key market events to look out for in the week beginning Monday 29 September .

The coming week’s run of economic news will be US-focused. Highlights include the purchasing managers’ index (PMI) readings from the Institute of Supply Management (ISM), offering insights into the health of the manufacturing and services sectors, and jobs data for September. Hiring in the US slowed significantly in August, with non-farm payrolls increasing by just 22,000, well below the expected 75,000.

Away from the US, the UK’s revised second-quarter GDP figures are due out on Tuesday, which could be significant given the country’s budget deficit and the emphasis on growth as a means of managing the debt burden. The initial estimate put economic growth in Q2 at 0.3%, following an increase of 0.7% in Q1. Any revision up or down could impact the pound and gilts.

Corporate earnings announcements slow to a trickle before the next wave of quarterly reports in mid-October, but there are still a few big names releasing updates in the week ahead, including Nike, Tesco, and cruise operator Carnival.

Nike Q1 earnings

Tuesday 30 September

Analysts expect Nike to report that fiscal first-quarter earnings fell 61.2% year-on-year to $0.27 a share, with revenue down 5.1% at $11bn. Gross profit margins are forecast to come in at 41.7%, down from 45.4% a year ago. Looking ahead to Q2, analysts see earnings falling 36.3% year-on-year to $0.50 a share, while revenue is expected to drop 3% to $11.9bn. Gross profit margins are forecast to tighten to 41.4% from 43.6%. The Nike share price – down 6% this year at $69.24 as of Thursday’s close – could swing 7.2% after the Q1 results, based on options market positioning.

The options market appears to be taking a bearish stance towards shares of the NYSE-listed sports apparel giant, with the largest concentration of negative options gamma at $67. This implies that Nike stock may find support around that level. However, the shares could rally from there, unless the results are weaker than expected.

The technical chart below suggests that the stock is already oversold. The relative strength index (RSI) – the purple line on the lower panel – has slipped below 30, indicating oversold conditions, while the share price itself is sitting on the lower Bollinger Band. These signals suggest that Nike might be poised for at least a short-term rebound. If the stock rallies after Tuesday’s results announcement, it could rise towards $75, where a gap remains from late August. However, downside risks are significant. The large gap down to $62 means that a break below support at $67 could trigger a steeper decline.

Nike share price, November 2024 – present

Sources: TradingView, Michael Kramer

Sources: TradingView, Michael Kramer

US September ISM data

Wednesday 1 October (manufacturing PMI)

Friday 3 October (services PMI)

Economic activity in the US manufacturing sector is expected to have improved slightly in September. Analysts expect the ISM manufacturing PMI to rise to 49.2, up from 48.7 in August, though yet another reading below 50 would mean a seventh straight month of contraction.

Meanwhile, the ISM services print is forecast to remain unchanged at 52, with a reading above 50 indicating expansion.

Although recent US economic data points have highlighted some apparent contradictions (for instance, between robust economic growth on the one hand, and weak housing and jobs data on the other), the Federal Reserve appears intent on cutting interest rates regardless. If the ISM figures come in as expected, the “pain trade” of a stronger dollar may intensify.

In this scenario, the euro is likely to be the biggest loser. EUR/USD is already breaking below an uptrend that began off the July lows, setting up a test of support at $1.165. With the RSI also breaking down and trending lower, it’s possible that the pair could fall as far as $1.147 in the foreseeable future.

EUR/USD, March 2025 – present

Sources: TradingView, Michael Kramer

Sources: TradingView, Michael Kramer

US September jobs report

Friday 3 October

Consensus estimates suggest that the US economy added 39,000 jobs in September, up from 22,000 in August. Despite the weak pace of payroll growth, the unemployment rate is forecast to remain unchanged at 4.3%, partly because there has not yet been an uptick in unemployment claims. Meanwhile, average weekly earnings are expected to have risen 0.3% month-on-month, unchanged from August.

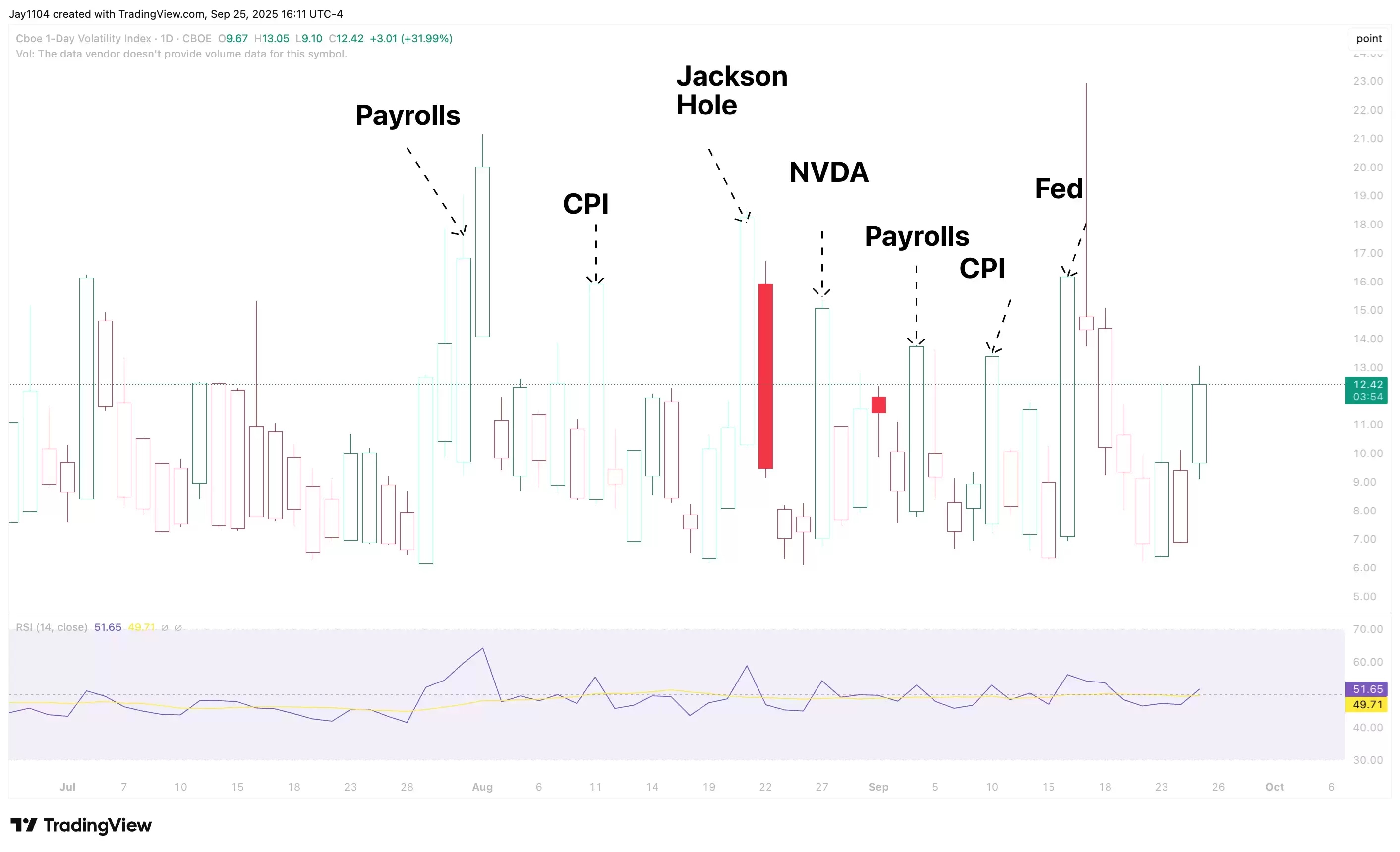

The US jobs report has been anything but predictable in recent months. As a result, implied volatility is likely to be extremely elevated going into the release. This has been a recurring pattern lately, with implied volatility – as measured by the CBOE 1-Day Volatility Index [VIX1D] – rising the day before the non-farm payrolls report, then collapsing once the data is published. This suggests that – unless the jobs report is a complete disaster – US equities could rally on Friday as volatility resets and hedges from the previous day are unwound.

Vix 1-day volatility index, July 2025 – present

Sources: TradingView, Michael Kramer

Sources: TradingView, Michael Kramer

Major upcoming economic announcements and scheduled US and UK company reports include:

Monday 29 September

• Eurozone: September business climate, September consumer confidence index

• Japan: August retail trade

• US: August pending home sales

• Results : Carnival (Q3), Jefferies Financial (Q3)

Tuesday 30 September

• Australia: Reserve Bank of Australia interest rate decision

• China: September National Bureau of Statistics purchasing managers’ index (PMI) data, September RatingDog (formerly Caixin) PMI data

• Germany: August retail sales, September consumer price index (CPI)

• Japan: Q3 Tankan large manufacturing index

• UK: Q2 gross domestic product (GDP)

• Results: AG Barr (HY), Close Brothers (FY), Nike (Q1), Paychex (Q1)

Wednesday 1 October

• Eurozone: September harmonised CPI

• US: September ADP employment change, September ISM manufacturing PMI

• Results: Acuity (Q4), Conagra Brands (Q1), RPM International (Q1)

Thursday 2 October

• Australia: August trade balance

• Switzerland: September CPI

• Results: Tesco (HY)

Friday 3 October

• US: September jobs report (including non-farm payrolls and average hourly earnings), September ISM services PMI

• Results: JD Wetherspoon (FY)

Note: While we check all dates carefully to ensure that they are correct at the time of writing, the above announcements are subject to change.

Find your flow: four principles for trading in the zone

Find your flow: four principles for trading in the zone

Learn about the four trading principles of preparation, psychology, strategy, and intuition, and gain key trading insights from some of the world’s top investors.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.