Green Tea Market Overview

The global green tea market size was valued at USD 16.26 billion in 2024 and is estimated to grow from USD 17.32 billion in 2025 to reach USD 28.83 billion by 2033, growing at a CAGR of 6.57% during the forecast period (2025–2033). The rising consumer focus on wellness and preventive health is driving the global market, as people increasingly prefer natural, antioxidant-rich beverages that support immunity, weight management, and overall lifestyle well-being.

Key Market Insights

Asia-Pacific held the largest market share, over 60% of the global green tea industry.

By Product Type, the green tea bags segment held the highest market share of over 50%.

By Flavor, the flavored segment held the highest market share of over 70%.

By Distribution Channel, the supermarkets & hypermarkets segment led the market and is expected to witness a CAGR of 6.22%.

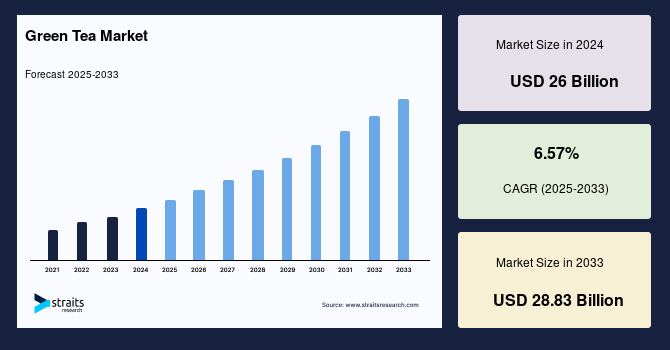

Market Size & Forecast

2024 Market Size: USD 26 billion

2033 Projected Market Size: USD 28.83 billion

CAGR (2025-2033): 6.57%

Largest market in 2024: Asia-Pacific

Fastest-growing region: North America

Green tea is a type of tea made from the unoxidized leaves of the Camellia sinensis plant, originating from China. It is minimally processed, retaining natural antioxidants called catechins, which provide numerous health benefits, including improved metabolism, heart health, and mental alertness. Known for its light, fresh flavor, it is consumed as hot, iced, or flavored beverages worldwide.

The global market for green tea is driven by the surging prevalence of lifestyle-related health issues like obesity and cardiovascular diseases, prompting consumers to choose healthier beverages. Growing disposable incomes in developing regions support demand for premium and specialty green teas. Product innovations, including flavored and herbal blends, attract new consumers. Additionally, the shift toward natural, clean-label drinks as alternatives to sodas and energy drinks further boosts green tea industry growth.

Market Trend

Expansion of Ready-To-Drink (RTD) Versions

The expansion of ready-to-drink (RTD) products in this industry is a prominent trend shaping the global green tea market. Modern consumers increasingly prefer convenient, on-the-go beverage options that align with their busy lifestyles, driving demand for RTD formats. These products combine the health benefits of this beverage with portability and ease of use, making them highly attractive to younger demographics and urban populations.

Beverage companies are innovating with flavors such as citrus, berry, and honey, as well as low-sugar and organic variants to appeal to health-conscious buyers. Additionally, the rising popularity of functional beverages is boosting the RTD version infused with added nutrients or natural ingredients. Growing availability in supermarkets, convenience stores, and online platforms further accelerates market adoption.

Market Driver

Rising Consumer Focus on Wellness and Preventive Health

The growing emphasis on wellness and preventive healthcare is a major factor driving green tea market growth. Rich in antioxidants like epigallocatechin gallate (EGCG), this beverage has been widely associated with improved metabolism, cardiovascular health, and reduced risk of chronic conditions. Health-conscious consumers are actively replacing sugary and carbonated drinks with functional alternatives that deliver long-term benefits.

For instance, a study from UC Irvine published in GeroScience in August 2025 found that combining epigallocatechin gallate (EGCG) (a key antioxidant) with nicotinamide (vitamin B3) helped restore guanosine triphosphate (GTP) levels in aging mouse brain cells. Restoring GTP improves cellular energy, reduces oxidative stress, and enhances the clearance of amyloid plaques linked to Alzheimer’s disease.

These scientific advancements further boost consumer confidence and accelerate market adoption.

Market Restraint

High Competition from Substitute Beverages

The global green tea market faces significant restraint due to intense competition from substitute beverages such as coffee, black tea, herbal teas, and energy drinks. Coffee remains a dominant choice worldwide, particularly in Western countries, due to its strong cultural acceptance and stimulating caffeine content.

Similarly, black tea continues to hold a large consumer base in traditional tea-drinking regions. Herbal infusions, marketed as caffeine-free and offering diverse health benefits, are also gaining popularity. Moreover, energy drinks attract younger demographics seeking quick energy boosts. This wide availability of substitutes often limits consumer reach, especially in markets where its taste and health benefits are less recognized.

Market Opportunity

Expansion in Functional Blends of this Beverage

The global market is witnessing strong growth potential through the expansion of functional blends of this beverage. Increasing consumer demand for beverages that provide added health benefits beyond basic nutrition is fueling innovation. Manufacturers are infusing this beverage with vitamins, minerals, adaptogens, probiotics, and herbal extracts to appeal to health-conscious audiences.

For instance, in February 2025, Japanese brand Teaflex introduced two new products in a dissolvable-powder format, using matcha green tea fortified with Vitamins C, B1, B2, B3, and B6. One of them is designed for fat reduction, with the format ensuring functional ingredients reach the intestines effectively.

Such product launches highlight opportunities for differentiation, premium positioning, and market expansion, particularly among urban millennials and fitness-focused consumers seeking convenient, functional beverages.

Regional Analysis

The Asia Pacific market remains highly lucrative due to the strong cultural association with tea consumption and rising health awareness. Demand for specialty and functional green teas, including matcha, is increasing among urban and younger populations. Expansion of organized retail, e-commerce platforms, and foodservice channels is enhancing market penetration. Consumers are increasingly seeking organic and premium products, driving value growth. Additionally, rising disposable incomes and a focus on preventive healthcare are boosting the market growth across the region.

India’s green tea market is witnessing robust growth owing to rising health consciousness and demand for herbal beverages. Increasing urbanization and disposable incomes drive preference for premium and flavored green teas. For instance, in June 2025, Tetley Green Tea launched two breakthrough variants: Tetley Green Tea Slim Care with L-Carnitine and Tetley Green Tea Beauty Care with Biotin, redefining green tea for the modern Indian consumer. Growing café culture and e-commerce platforms further enhance accessibility across urban India.

Japan’s green tea market remains highly mature, driven by cultural heritage and daily consumption habits. Traditional teas like Sencha, Matcha, Gyokuro, and Hojicha dominate households. Leading companies such as Ito En, Suntory, Lupicia, and Kirin Beverage innovate with ready-to-drink (RTD) green teas and flavored variants to cater to busy lifestyles. Health-focused products, including antioxidant-rich blends and matcha lattes, are increasingly popular among younger consumers.

North America Market Trends

The North American market is witnessing strong growth due to increasing health-conscious lifestyles and a shift toward natural beverages. Ready-to-drink and organic variants of this beverage are gaining popularity among millennials and urban consumers. Expansion of retail channels, including e-commerce and specialty stores, is enhancing product accessibility. The trend of functional beverages, such as green tea infused with vitamins or herbal extracts, is boosting adoption. Rising awareness about weight management and antioxidant benefits further drives consumption in this region.

The US green tea market is witnessing steady growth due to rising health-conscious consumers seeking natural beverages. Ready-to-drink and flavored variants are gaining popularity, with brands like Arizona Beverages and Honest Tea driving demand. The trend of functional beverages and wellness-oriented lifestyles, coupled with online retail expansion, is boosting market penetration across urban and suburban regions.

Canada’s green tea industry is expanding as consumers increasingly prefer organic and specialty teas. Brands such as David’s Tea and Tetley are capitalizing on this trend with flavored and functional variants of this beverage. Growing café culture and e-commerce platforms are further driving accessibility, while Canadian consumers’ focus on antioxidants and wellness beverages supports steady market growth.

Product Type Insights

The green tea bags segment dominated the market due to its convenience and ease of use, appealing to busy consumers seeking a quick brewing option. Its widespread availability in retail stores and affordability compared to loose-leaf tea have further boosted adoption. Additionally, innovations in bag designs, such as pyramid-shaped and biodegradable tea bags, have enhanced the brewing experience, attracting health-conscious consumers who prefer a standardized, mess-free portion, making these bags a preferred choice globally.

Flavor Insights

The flavored segment led the market, driven by consumer demand for unique taste experiences. Flavored variants such as jasmine, mint, lemon, and berry-infused green teas cater to diverse palates and encourage regular consumption. These products also appeal to younger consumers and health-conscious individuals seeking enjoyable alternatives to traditional teas. Continuous product innovations, coupled with marketing campaigns emphasizing taste and wellness benefits, have reinforced the popularity of flavored ones globally.

End-Use Industry Insights

Supermarkets and hypermarkets emerged as the dominant distribution channel, offering a wide product variety and easy accessibility for consumers. These outlets provide a one-stop shopping experience, where customers can choose from multiple brands, flavors, and packaging formats. Attractive promotions, loyalty programs, and shelf displays further enhance consumer engagement. The organized retail infrastructure and strategic store placements allow this product to reach a broad audience, including first-time buyers and regular consumers, driving significant sales growth in this segment.

Company Market Share

Companies in the global market are focusing on product innovation, sustainability, and expanding distribution channels to enhance their market share. They are introducing functional blends, flavored variants, and ready-to-drink options to cater to evolving consumer preferences. Emphasizing ethical sourcing and eco-friendly packaging aligns with the growing demand for sustainable practices. Strategic partnerships and online retail expansion are being leveraged to reach a broader audience and increase accessibility. These initiatives aim to strengthen brand presence and drive market growth.

Ito En Ltd. is a leading Japanese beverage company founded in 1966 and headquartered in Tokyo. Renowned for pioneering the bottled green tea category, it introduced Japan’s first canned tea in 1984. Its flagship brand, Oi Ocha, is the top-selling beverage in Japan, commanding a significant market share. Ito En has expanded globally, with subsidiaries in the U.S., Europe, and Asia, offering a diverse range of products including loose-leaf teas, tea bags, powders, and ready-to-drink beverages. The company is also known for its innovative approach to preserving tea freshness and promoting health-conscious consumption.

In March 2025, Ito En launched specialty bottles of their Oi Ocha green tea in the US tied to Shohei Ohtani and the MLB season. This is more of a branding/marketing launch, but reflects how these beverage brands are using collaborations & limited editions to differentiate.

List of key players in Green Tea Market

Tata Consumer Products

Unilever PLC

Associated British Foods PLC

The Coca-Cola Company

Nestlé S.A.

Ito En Ltd.

Kirin Holdings Company Limited

Arizona Beverage Company

AMOREPACIFIC Corporation

Twinings (Diageo PLC)

Bigelow Tea Company

Teavana (Starbucks Corporation)

Lipton

Barry’s Tea

Yogi Tea

Recent Development

In September 2025, The Tea Research Association (TRA), India, launched a decaffeinated green tea powder aimed at catering to health-conscious consumers. Positioned as a rival to Japanese matcha, the product offers similar taste and functional benefits without caffeine, targeting both domestic and international markets, and marking a significant innovation in India’s specialty tea segment.

In August 2025, Clean Jeju Green Tea Cooperative recently launched “Sumang” Hojicha, a roasted green tea variety, expanding its premium offerings. The launch highlights rising consumer interest in diverse green tea flavors and specialty products. By introducing Hojicha, the cooperative aims to cater to global demand for authentic, differentiated tea experiences while strengthening Jeju’s position in premium tea markets.

In July 2025, Ippodo Tea has launched its “New Harvest Matcha 2025”, a limited-edition seasonal blend featuring fresh shincha-style qualities. The product is characterized by a vivid green color, verdant fragrance, mellow sweetness, and subtle bitterness. This release highlights growing consumer demand for premium matcha offerings and strengthens Ippodo’s positioning in the global specialty tea market.

Report Scope

Report Metric

Details

Market Size in 2024

USD 26 Billion

Market Size in 2025

USD 17.32 Billion

Market Size in 2033

USD 28.83 Billion

CAGR

6.57% (2025-2033)

Base Year for Estimation 2024

Historical Data2021-2023

Forecast Period2025-2033

Report Coverage

Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends

Segments Covered

By Product Type,

By Flavor / Variant,

By Distribution Channel,

By Region.

Geographies Covered

North America,

Europe,

APAC,

Middle East and Africa,

LATAM,

Countries Covered

U.S.,

Canada,

U.K.,

Germany,

France,

Spain,

Italy,

Russia,

Nordic,

Benelux,

China,

Korea,

Japan,

India,

Australia,

Taiwan,

South East Asia,

UAE,

Turkey,

Saudi Arabia,

South Africa,

Egypt,

Nigeria,

Brazil,

Mexico,

Argentina,

Chile,

Colombia,

Explore more data points, trends and opportunities Download Free Sample Report

Green Tea Market Segmentations

By Product Type (2021-2033)

Loose Leaf Green Tea

Green Tea Bags

Ready-to-Drink (RTD) Green Tea

Powdered Green Tea/Matcha

By Flavor / Variant (2021-2033)

By Distribution Channel (2021-2033)

Supermarkets & Hypermarkets

Specialty Stores

Online Retail/E-commerce

Convenience Stores

Others

By Region (2021-2033)

North America

Europe

APAC

Middle East and Africa

LATAM

Frequently Asked Questions (FAQs)

The global green tea market size was valued at USD 16.26 billion in 2024 and is estimated to grow from USD 17.32 billion in 2025 to reach USD 28.83 billion by 2033, growing at a CAGR of 6.57% during the forecast period (2025–2033).

Rising consumer focus on wellness and preventive health is anticipated to boost market growth.

Asia Pacific region has the largest share of the market.

The key players operating the market include Tata Consumer Products, Unilever PLC, Associated British Foods PLC, The Coca-Cola Company, Nestlé S.A., Ito En Ltd., Kirin Holdings Company Limited, Arizona Beverage Company, AMOREPACIFIC Corporation, Twinings (Diageo PLC), Bigelow Tea Company, Teavana (Starbucks Corporation), Lipton, Barry’s Tea, Yogi Tea

Green tea bags dominated the market with a share of 50% in 2024.