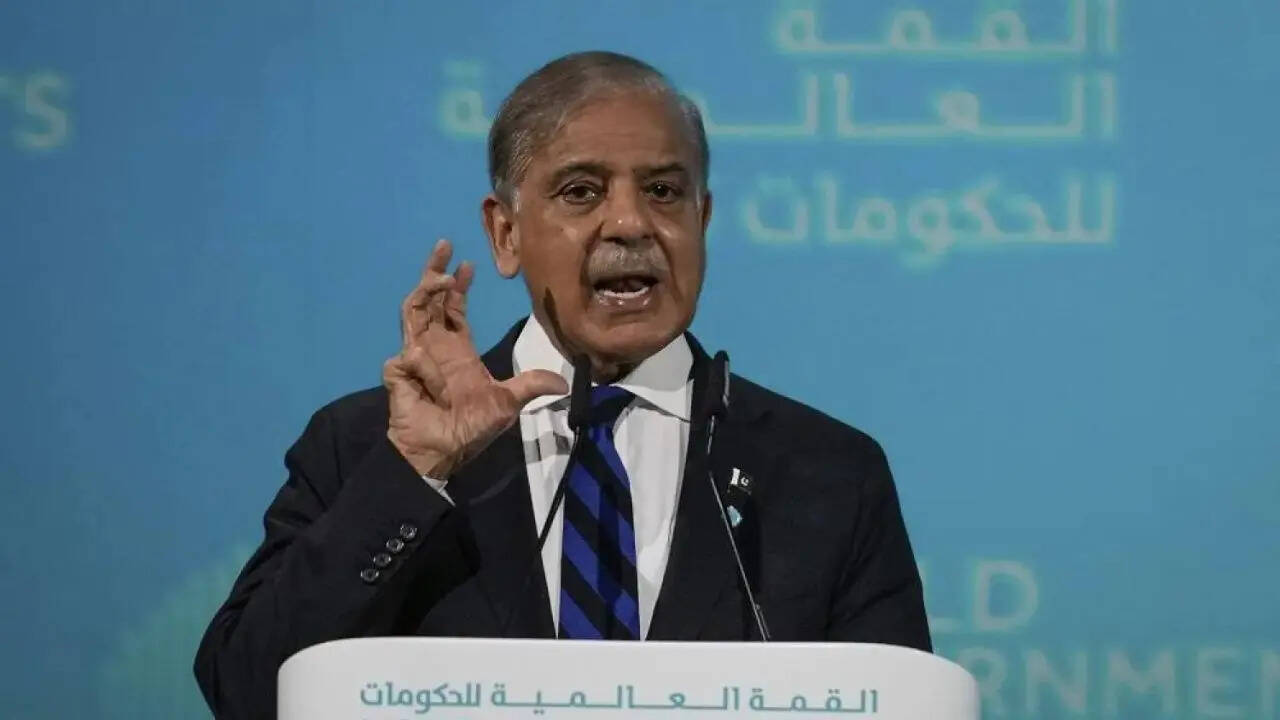

Pictured: Pakistan PM Shehbaz Sharif (Image: AP/File). Pakistan secured a record 26.7 billion in foreign loans in FY2024, with half used to refinance old debt, reflecting its increasing reliance on external borrowing.

Pakistan’s foreign loan burden continues to rise steeply, with fresh data revealing that nearly half of the record $26.7 billion borrowed in the last fiscal year was used not for development, but simply to repay old debt. According to a PTI report, approximately 50% of these foreign borrowings comprised refinancing of existing loans—a troubling indicator of Pakistan’s deepening reliance on external support to stay financially afloat.

As per the report which quotes The Express Tribune, the country’s official foreign exchange reserves—reported at $14.5 billion by end-June—are built largely on rollovers, new borrowings, and refinanced loans, showing how little of the funds are actually available for meaningful economic growth.

While total disbursements increased only marginally from the previous fiscal year, just $3.4 billion, or roughly 13% of the total, went toward project financing, according to Pakistan’s Ministry of Economic Affairs.

This small allocation, PTI reported, reflects the severity of Pakistan’s repayment challenges. As most of the borrowing supports budgetary gaps and reserves, “neither of which generate funds for debt servicing,” the economic risk continues to mount.

According to the Ministry of Finance, the country’s debt-to-GDP ratio and gross financing requirements as a proportion of GDP have already breached sustainable thresholds. Officials have flagged that “when gross financing requirements exceed 15% of GDP, it indicates an unsustainable position.” Current trends suggest Pakistan is likely to remain above this critical level for at least three more years, the Ministry’s earlier estimates warned.

The data compiled by the Ministry of Economic Affairs, the Ministry of Finance, and the State Bank of Pakistan revealed that $11.9 billion was booked in federal government accounts—$1.2 billion higher than last year.

Among the key lenders, the International Monetary Fund (IMF) provided $2.1 billion, while a significant $12.7 billion came from cash deposit rollovers by countries including Saudi Arabia, China, the UAE, and Kuwait. These rollovers remain vital, as “Pakistan is unable to repay”, with Saudi Arabia alone holding $5 billion in deposits at 4% interest, rolled over annually.

China has $4 billion in deposits, charging over 6% interest, and also provided an additional $484 million in guaranteed loans, used largely for asset acquisitions, the PTI report said.

The United Arab Emirates (UAE) holds $3 billion in deposits, while the government raised $4.3 billion in commercial loans—largely refinanced Chinese loans and new borrowings backed by Asian Development Bank (ADB) guarantees.

The ADB itself provided $2.1 billion in new loans, exceeding Pakistan’s target by $500 million. Contributions from multilateral lenders totaled $6.9 billion, including $1.7 billion from the World Bank—which fell short of the planned allocation by $300 million and provided no fresh budget support for the ongoing fiscal period.

The Islamic Development Bank released $716 million, while Saudi Arabia extended $200 million in oil financing at a steep 6% interest, marking it as one of the costlier components of the borrowing mix.

Despite the rising need for external funds, Pakistan failed to access global capital markets last year. The government’s plans to raise $1 billion via Eurobonds and Panda bonds fell through. As PTI noted, “due to Pakistan’s poor credit rating at junk level,” the country remains shut out from international markets and is left facing high interest rates on both commercial loans and cash deposits.

The IMF’s own projections assume a continued rollover of the $12.7 billion in deposits to maintain external sector stability—a fact that raises further concerns about long-term sustainability.

As Pakistan continues borrowing just to repay what it already owes, economists warn that its debt trap is not only deepening, but also eroding its financial independence.