ETF Market Expansion in North America

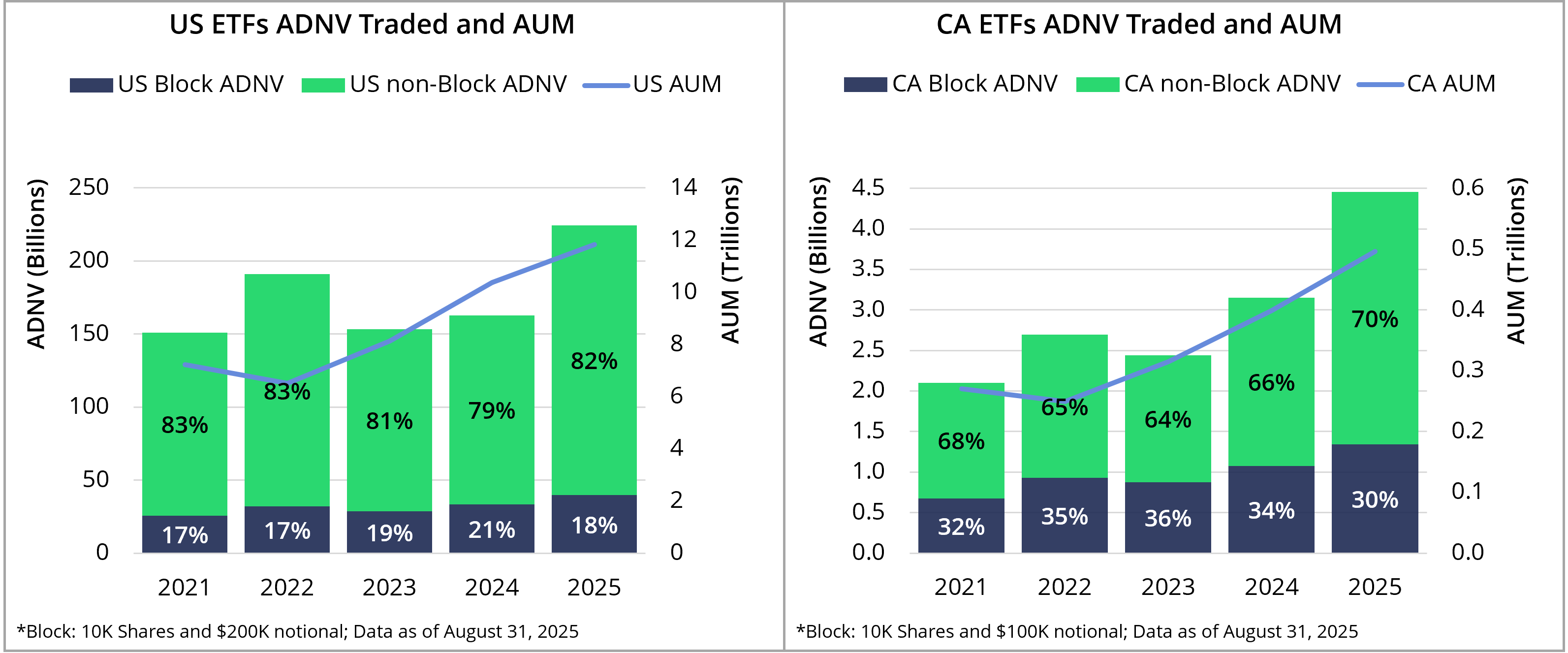

U.S.-listed Exchange Traded Funds (ETFs) account for 35% of total U.S. fund Assets Under Management (AUM) as of August 2025, illustrating a steady increase from 15% in 2014 and highlighting a broader shift toward ETFs for both tactical and strategic asset allocation. The AUM in both U.S. and Canadian markets has expanded rapidly, with a Compound Annual Growth Rate (CAGR) of approximately 24% over the past three years. Despite a brief decline in 2022, the overall trajectory remains upward, culminating in record highs by 2025 — $12.2 trillion USD in the U.S. and $0.5 trillion USD in Canada.

The Canadian ETF market outpaced the U.S. with a 40% year-over-year growth in Average Daily Notional Value (ADNV) traded compared to 32% in the U.S. Notably, in 2025, the proportion of block trades within ADNV has declined across North America, falling by 280 basis points in the U.S. and 400 basis points in Canada since 2024. This trend may signal a transition toward more frequent, smaller trades — likely due to an increase in retail participation. In this analysis, we will look at the growing ETF market in North America and how Cboe continues to provide access to ETF listings and trading for market participants.

Figure 1, Source: Cboe, Bloomberg

Trading Volume by ETFs Category

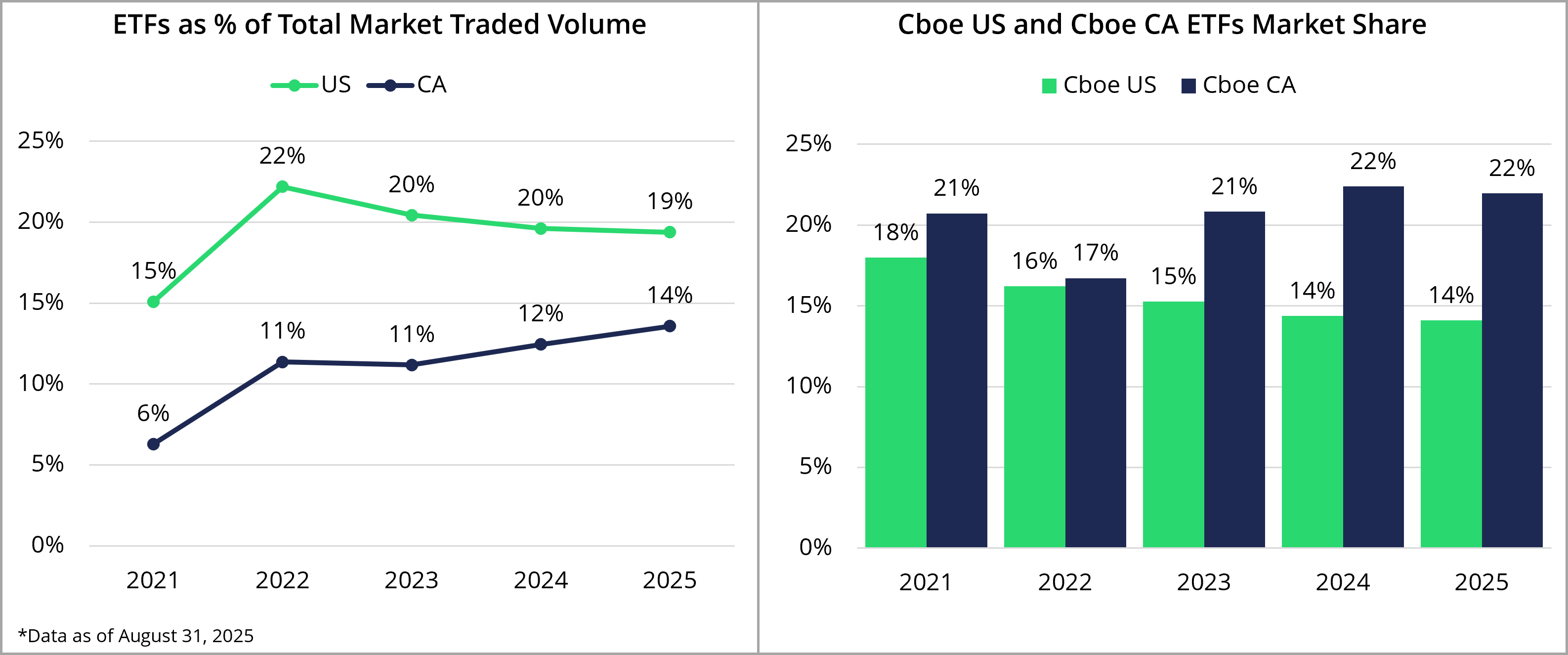

As of August 2025, U.S. ETFs are trading at an Average Daily Volume (ADV) of 3.3 billion shares, accounting for 19% of Total Consolidated Volume (TCV). Canadian ETFs reached an ADV of 160 million shares, representing 13% of TCV. While smaller in absolute terms, the Canadian market has shown a more consistent and robust growth trajectory as a percentage of TCV.

Figure 2, Source: Cboe

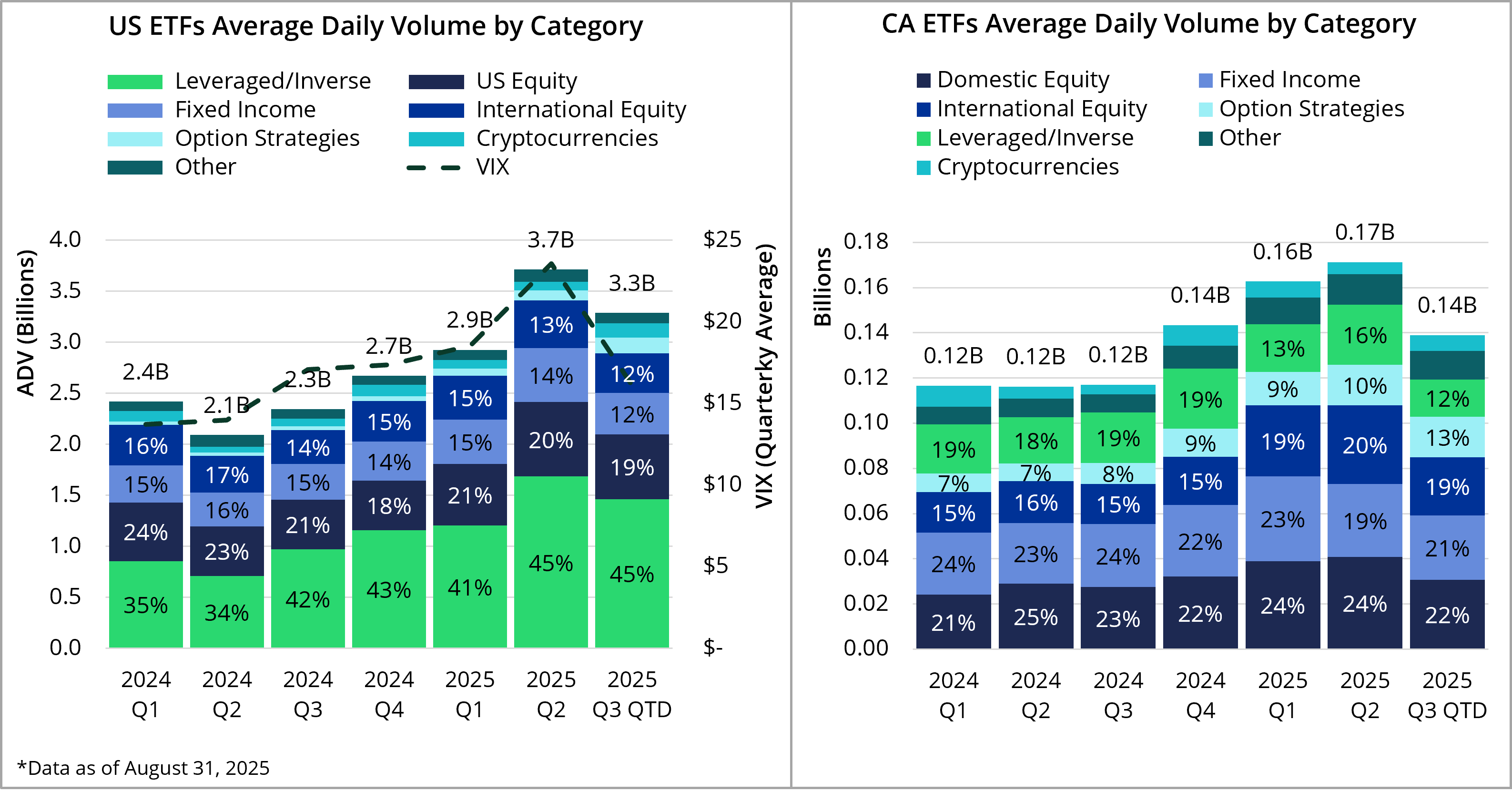

Within the U.S. ETF landscape, leveraged and inverse ETFs stand out, comprising 45% of total ETF volume in 2025. The increase likely reflects heightened demand for tactical and volatility-driven strategies, particularly in a year marked by macro uncertainty. Cboe has demonstrated stronger volume market share in leveraged and inverse ETFs at 18% compared to its overall ETF market share of 14% in U.S. Meanwhile, option strategy ETFs have seen their ADV double year-over-year, signaling increased adoption of structured outcome and yield-enhancing products.

Figure 3, Source: Cboe, Trackinsight

Canadian-listed ETFs ADV mirrors some of the trends seen in the U.S. Option strategy ETFs in the Canadian market posted a 79% year-over-year increase in ADV, closely tracking the U.S. trajectory. International equity ETFs have also gained traction, reflecting a continued growing appetite for global diversification among Canadian investors.

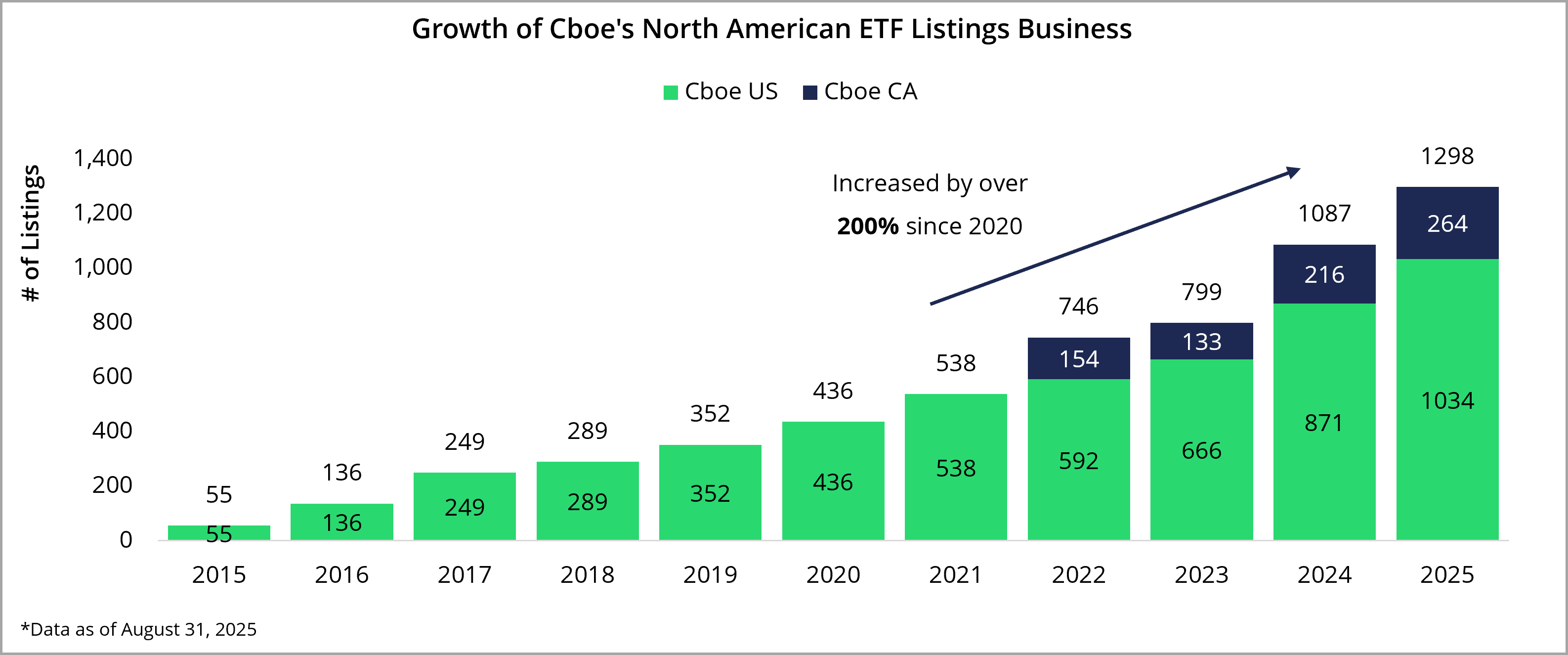

Listings Growth and Wins

This momentum is not limited to trading activity – it has also remained a key area of focus for issuers over the past year where leveraged and option-based ETFs have shown the most consistent growth in new listings across North America in 2025.

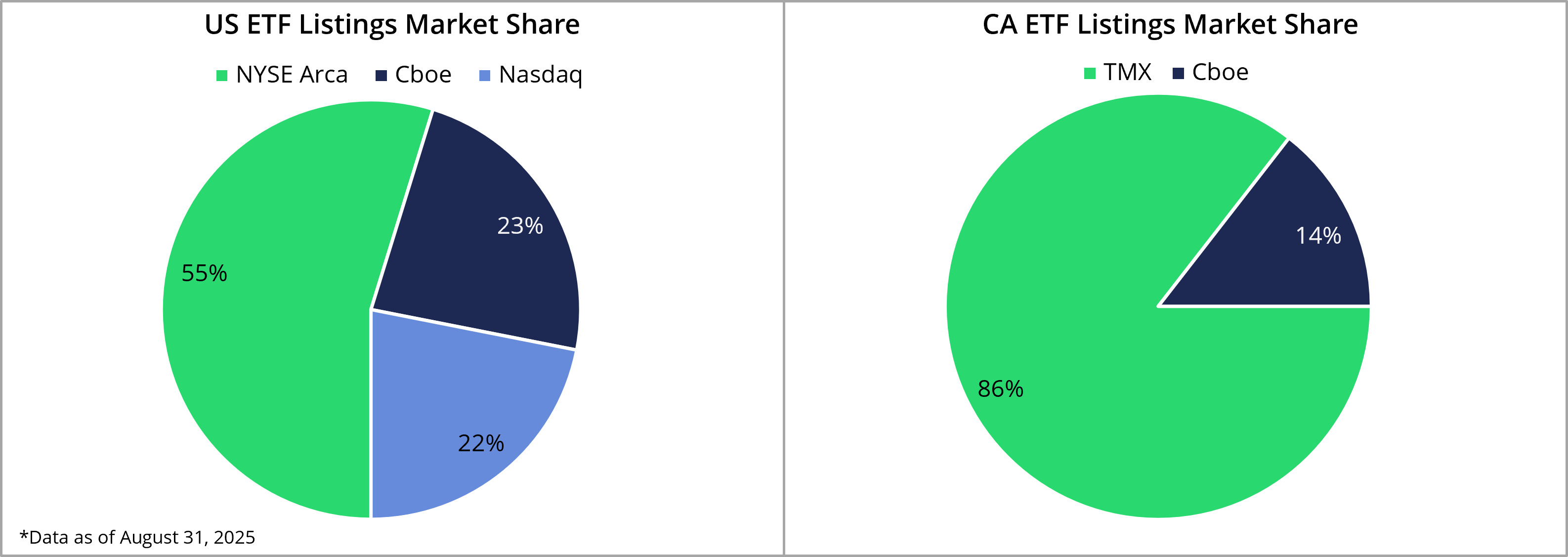

Cboe continues to be a leading venue for new ETF launches and now lists over 1,000 ETFs (1,034 as of August 31, 2025) in the U.S., representing 200% growth since 2020, compared with an 87% increase in the overall U.S. ETF market during the same period. Year-to-date, Cboe has captured approximately 23% of the total U.S. ETF listings market share – ranking second among listing exchanges, ahead of Nasdaq (around 22%) and behind New York Stock Exchange (NYSE) Arca (around 55%). Cboe’s deep expertise in options-based strategies has been a key driver of success for options-based ETFs, where it holds a 59% listing market share, as well as for other innovative structures.

The innovation story extends north of the border as issuers have leaned into new strategies in Canada as well. Notably, Cboe Canada introduced the country’s first ETFs utilizing zero-days-to-expiration (0DTE) options and launched Canada’s first domestic single-stock ETF lineup. Today, Cboe Canada is home to more than 260 ETFs and more than 130 Canadian Depositary Receipts (CDRs), underscoring its growing role as a hub for creative product development.

Figure 4, Source: Cboe

Figure 5, Source: Cboe, Trackinsight

Increased Retail Participation

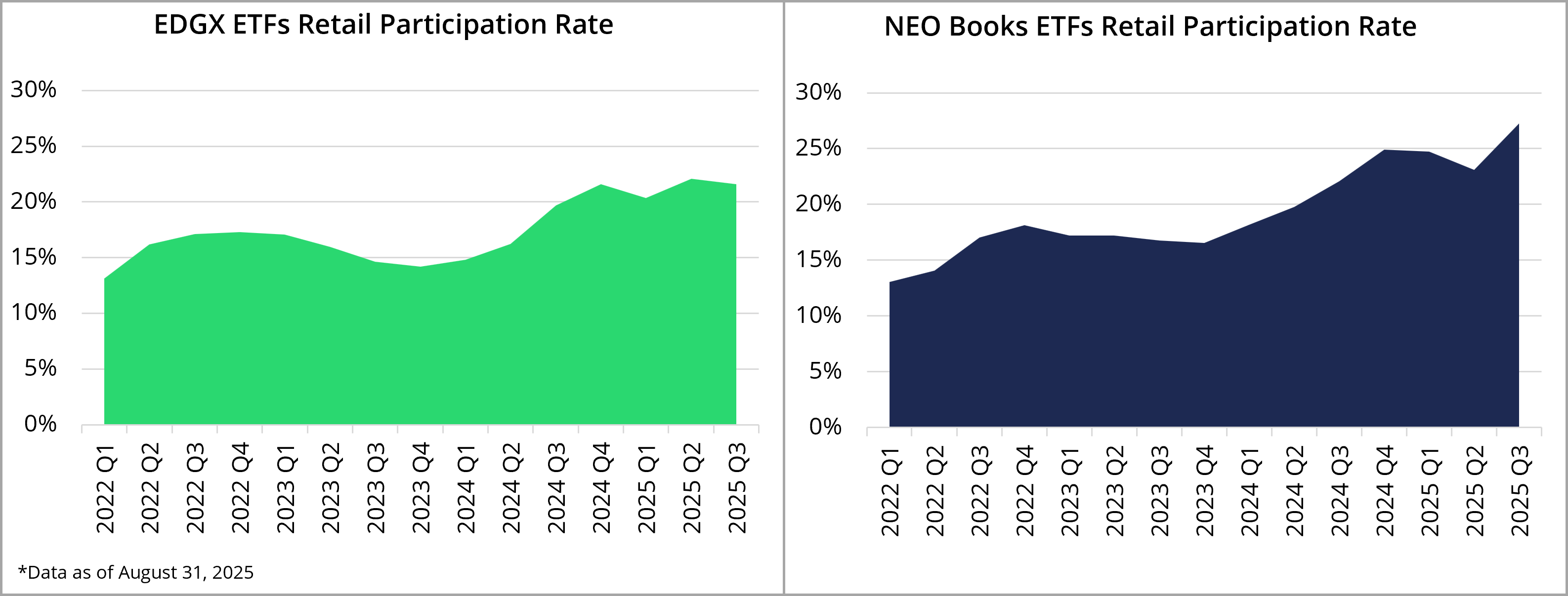

Non-block trades and leveraged ETFs have grown as a proportion of overall ETF activity in recent years. We examined retail participation rates on Cboe EDGX® Equities Exchange (EDGX) and Cboe Canada’s NEO-L, NEO-N, and NEO-D books as a proxy for retail investor engagement. Over the past few years, retail traders have shown a continued growing interest in ETFs.

On Cboe EDGX, retail participation in ETFs rose from approximately 15% in the first quarter of 2022 to nearly 22% by the third quarter of 2025. EDGX showed steady growth despite some drawdowns between 2023 and 2024. EDGX remains a preferred venue for retail-driven flow thanks to its Retail Priority program, which provides enhanced queue priority for retail orders and premium rebates that reward retail liquidity provision, making it a key market for investors targeting retail engagement.

When broken down by category, option strategy ETFs and leveraged ETFs attracted the highest retail engagement, reaching approximately 27% and 32% participation, respectively.

A similar pattern is observed on NEO-L, NEO-N, and NEO-D, where retail participation climbed from 13% to 27% over the same period, suggesting a more accelerated adoption curve in the Canadian market. Cboe Canada’s NEO books also feature active retail-focused pricing models, with retail activity accounting for 42.4% executed volume of active-take ETFs year-to-date in 2025.

Figure 6, Source: Cboe

Market Quality of Cboe-listed ETFs

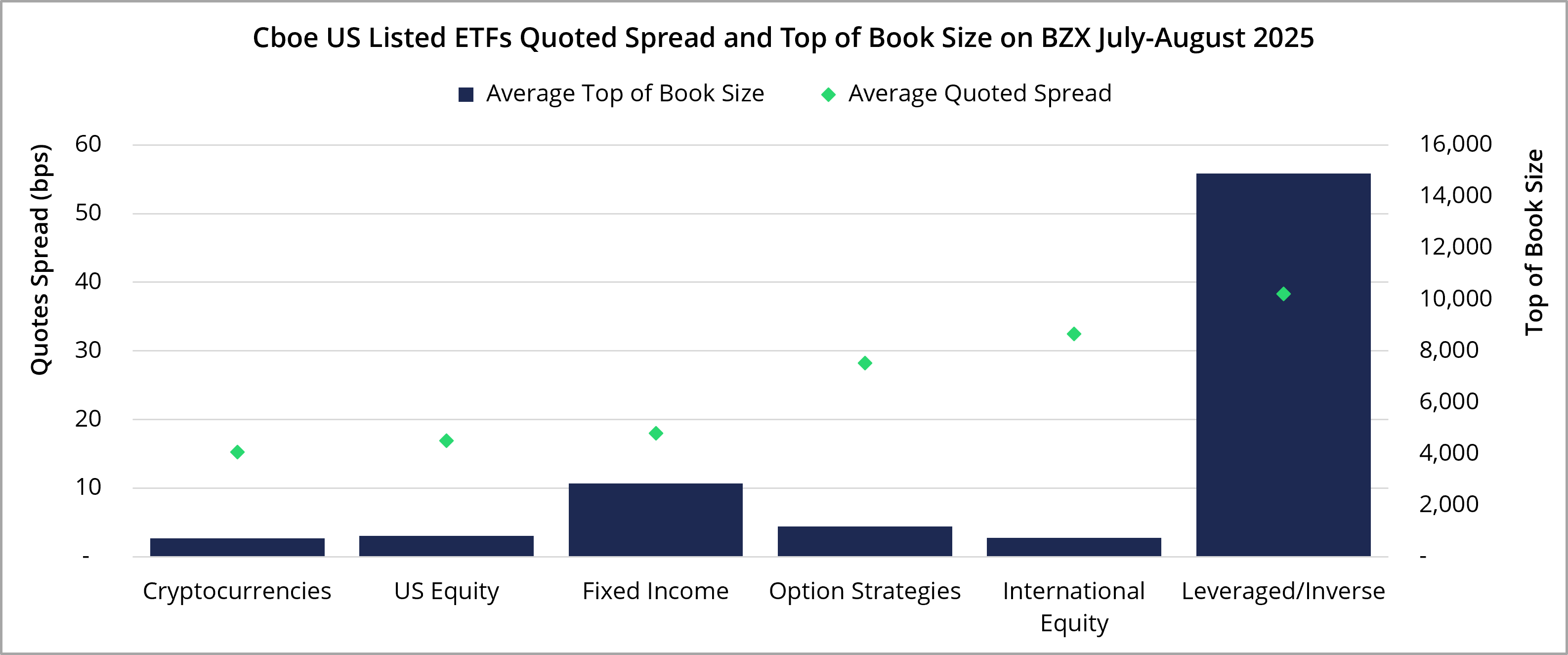

As ETF trading volumes and product diversity continue to grow, market quality metrics — such as quoted spreads and top-of-book (TOB) size — remain critical indicators of execution efficiency and liquidity access.

In July and August of 2025, average quoted spreads on Cboe U.S.-listed equity, fixed income, and cryptocurrency ETFs held near 20 basis points, reflecting relatively tight markets for core exposures. Leveraged and inverse ETFs showed the deepest top-of-book liquidity, averaging more than 10,000 shares despite wider spreads and underscoring strong displayed depth even in higher volatility products. Option strategy and international equity ETFs sat in the mid-range, with spreads in the 30-35 basis points zone and top-of-book sizes near 1,000 shares, signaling healthy liquidity across more specialized strategies.

Figure 7, Source: Cboe, Trackinsight

Supporting the ETF Market and Trading Community

The ETF market continues to expand rapidly as issuers introduce more sophisticated strategies and add alternative exposures. AUM and ADNV traded have risen across key segments.

Cboe remains a leader in ETF listings and trading. Cboe is committed to delivering greater access, choices, and efficiency for investors across North America and around the globe, offering strong market share, meaningful retail participation, and a proven track record of innovative listings solutions.

As always, please reach out to a member of our North American Cash Equities Team with any questions or to learn more about how Cboe can support your ETF trading strategies. To learn more about ETF listings on Cboe, contact [email protected] or learn more here.

There are important risks associated with transacting in any of the Cboe Company products discussed here. Before engaging in any transactions in those products, it is important for market participants to carefully review the disclosures and disclaimers contained at: https://www.cboe.com/us_disclaimers/. These products are complex and are suitable only for sophisticated market participants. In certain jurisdictions, Cboe Company products are only permitted for investment professionals, certified sophisticated investors, or high net worth corporations and associations. These products involve the risk of loss, which can be substantial and, depending on the type of product, can exceed the amount of money deposited in establishing the position. Market participants should put at risk only funds that they can afford to lose without affecting their lifestyle. © 2025 Cboe Exchange, Inc. All Rights Reserved.