2h agoThu 2 Oct 2025 at 9:56pmMarket snapshotASX 200 futures: Flat at 8,968 pointsAustralian dollar: Flat at 65.93 US centsS&P 500: +0.1% to 6,715 pointsNasdaq: +0.4% to 22,844 pointsFTSE: -0.2% to 9,428 pointsEuroStoxx: +0.5% to 568 pointsSpot gold: -0.2% to $US3,856/ounceBrent crude: +0.1% to $US75.64/barrelIron ore: -0.3% to $US103.65/tonneBitcoin: -0.3% to $US120,341

Prices current around 7:50am AEST.

Live updates on the major ASX indices:

2m agoFri 3 Oct 2025 at 12:20amASX pretty flat as stocks evenly split

Shortly after the open, the ASX 200 index is trading pretty flat, with 90 stocks up and 91 down.

The sector breakdown shows industrials and healthcare leading the way, while energy and financial stocks drag.

By 10:17am AEST the ASX 200 was dead flat at 8,946 points.

Top movers:

ASX 200 top movers around 10:15am AEST (LSEG)

ASX 200 top movers around 10:15am AEST (LSEG)

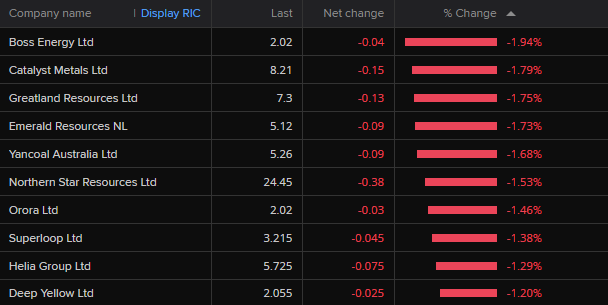

Bottom movers:

ASX 200 bottom movers around 10:15am AEST (LSEG)

ASX 200 bottom movers around 10:15am AEST (LSEG)

15m agoFri 3 Oct 2025 at 12:07am

Dan Ives typically bullish on Tesla, despite 5.1pc share price slide

Wedbush securities analyst Dan Ives is a regular on The Business, bringing his insights on the tech sector from the US.

Despite the market not liking Tesla’s third quarter sales result (its shares fell 5.1% overnight), Ives is typically upbeat.

“Tesla announced its 3Q25 delivery numbers this morning coming in at 497.1k vehicles (up 7% y/y) well above both the Street’s 447.6k vehicle estimate and the high-end of the whisper of ~480k as the company saw a solid rebound in China while seeing incremental strength in the US as TSLA benefitted from a pull-forward in demand in the US with the EV tax incentives shutting off,” he notes.

It must be said, Ives is something of a permabull on US tech, but the boom (or bubble, depending on your view) has so far played out much as he has been arguing.

For Tesla, he believes people shouldn’t get too fixated on the number of car sales anyway.

“We believe Tesla could reach a $2 trillion market cap early 2026 in a bull case scenario and $3 trillion by the end of 2026 as full scale volume production begins of the autonomous and robotics roadmap,” he writes.

“The AI valuation will start to get unlocked in the Tesla story, and we believe the march to an AI driven valuation for TSLA over the next 6-9 months has now begun in our view with FSD and autonomous penetration of Tesla’s installed base and the acceleration of Cybercab in the US representing the golden goose for Musk & Co.”

As always, these are simply the opinions of one analyst, and do not constitute any kind of financial advice.

36m agoThu 2 Oct 2025 at 11:46pm

You are reading!

Isn’t it wonderful how things are interpreted in economics. Tesla performance is criticised because they’ll ‘only’ sell some 2 million cars this year. The budget deficit in Saudi Arabia is ‘under strain’ because it could hit 2.5% of gdp (ours is over 30%). You have to wonder how some economists deal with real bad news.

– Phillip

Good morning, Phillip.

I was beginning to wonder if anyone was reading the blog today, because there were no comments until now.

When I don’t at least hear from you or Natty, I get a bit concerned!

Loading

40m agoThu 2 Oct 2025 at 11:42pm

Chinese economy stagnating against the US

A really fascinating research note out overnight from Mark Williams, the chief Asia economist at Capital Economics.

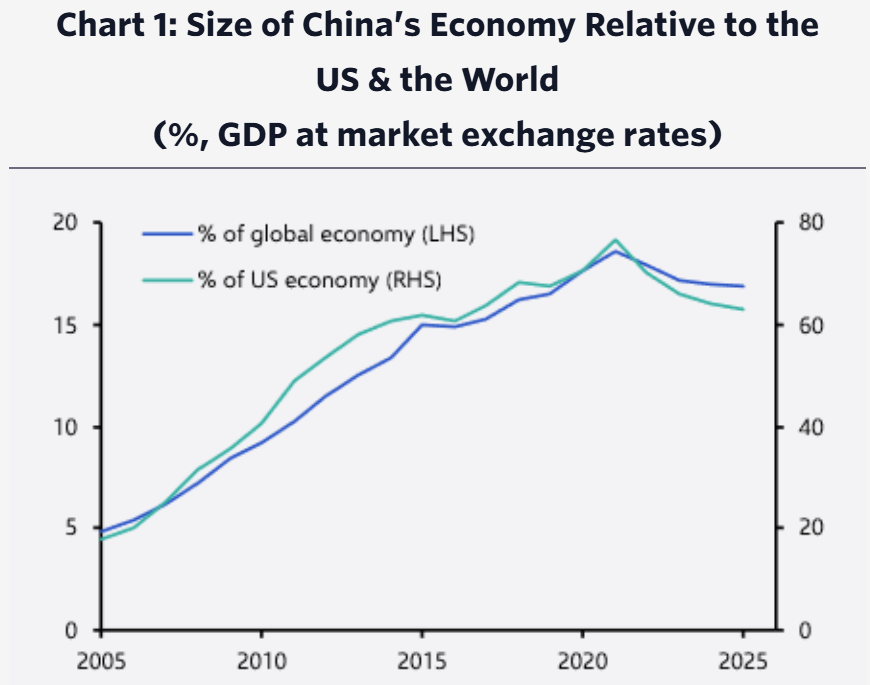

“A weak currency and sustained deflation mean that China’s economy is on course to shrink as a share of the global economy for a fourth consecutive year, when measured at market exchange rates,” he observes.

China’s economy is shrinking relative to the US and the rest of the world. (Capital Economics/IMF)

China’s economy is shrinking relative to the US and the rest of the world. (Capital Economics/IMF)

“China has gone from more than three-quarters the size of the US in 2021 to under two-thirds today. Real growth remains stronger in China than the global average. But the era in which China’s share of global output was surging has ended. This will limit China’s capacity to project economic power in the future.”

Williams says most of this is being driven by persistent deflation in China and weakness in its currency.

“Around half of China’s relative decline at market exchange rates is due to the renminbi’s depreciation against the dollar over the past few years. The rest is the result of domestic deflation: China’s official GDP deflator has been negative for 11 consecutive quarters.

“The outcome is that even though China’s economy has been growing faster in real terms, growth in the value of its output at market exchange rates has lagged the US.”

He does note that the standard of living for Chinese residents compared to their US counterparts has continued to improve.

“Purchasing power parity GDP is a better measure of living standards than GDP at market exchange rates. The IMF expects PPP per capita GDP in China to reach 33% of the US level this year, from 29% in 2021 and 23% in 2015.”

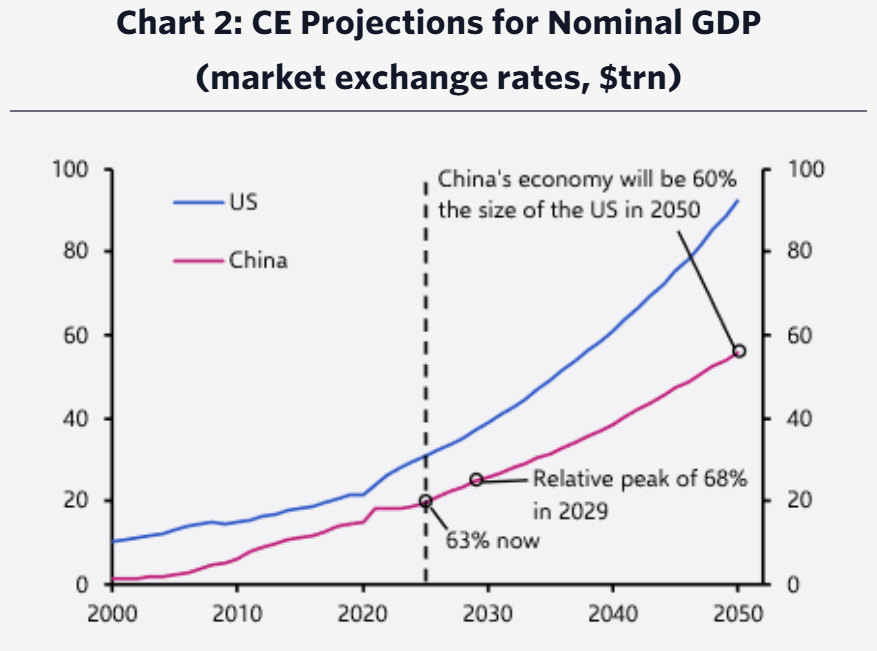

However, Williams says the long-term outlook for the Chinese economy is for a continued slowdown towards growth rates more typical of existing developed economies.

“Our longstanding forecast is that weaker productivity growth and demographic decline will slow China ‘s real growth rate to 2% by 2030 (China’s workforce is likely to be 8% smaller in 2040 than it is today, and the US workforce 5% bigger),” he argues.

“One consequence is that, while China climbed from 11% to 63% the size of the US between 2000 and 2025, on our projections, China will reach 2050 no bigger relative to the US than it is today.”

China’s economy is expected to keep slowing into the next decade and beyond. (Capital Economics)1h agoThu 2 Oct 2025 at 11:03pmCrude oil prices plunge more than 9pc in a week

China’s economy is expected to keep slowing into the next decade and beyond. (Capital Economics)1h agoThu 2 Oct 2025 at 11:03pmCrude oil prices plunge more than 9pc in a week

Over the past week, Brent crude oil prices have dropped from more than $US70 a barrel to just $US64.11 this morning.

This comes ahead of an OPEC+ meeting this weekend, where the major oil producers are expected to agree to production increases.

“This weekend’s OPEC+ meeting is likely to see the group agree to a further unwinding of oil production cuts in November, with some suggestions it could be one of the most aggressive moves yet,” writes James Swanston, the senior Middle East and North Africa economist at Capital Economics.

“Capacity constraints in many non-Gulf members mean that any hike is unlikely to be fully realised, but, even so, it would reinforce our view that a period of lower oil prices lies in store in 2026.

“There are already signs that this year’s drop in oil prices this year is straining budget positions in some countries, with Saudi’s deficit now projected to be more than double what was targeted.”

1h agoThu 2 Oct 2025 at 10:45pm

Fed officials see jobs market as stable despite 14-year low in September hiring

Some interesting observations from Westpac’s Imre Speizer in his regular morning note:

“Challenger reported US job layoffs in September declined -31.9k to 54.1k, bringing the year-to-date total to 946.4k — highest since 2020. The government sector is leading this category with 289k.

“Employers announced plans to hire 117.3k — the weakest September since 2011.”

But it seems some Federal Open Market Committee (FOMC) members are not at all concerned.

“FOMC member [and Chicago Federal Reserve president Austan] Goolsbee said new data produced by his staff suggests the labour market remains stable: ‘I think it indicates some steadiness in the labour market and I think the underlying economy is still growing pretty solidly’.

“[Federal Reserve Bank of Dallas president Lorie] Logan said the risks to inflation remain more prominent than the threat of higher unemployment: ‘I’m seeing that inflation is running above our 2% current target’, adding that she expects tariffs to move inflation higher in coming months.”

Logan is not currently a voting member of the FOMC, which sets US interest rates, but will become one next year.

2h agoThu 2 Oct 2025 at 10:22pmBitcoin on a fresh run higher above $US120,000

As it sometimes does, the Bitcoin price has snuck quite a bit higher.

When I was reading a colleague’s story around this time last week, it was roughly $US110,000 per coin. This morning it’s $US120,382.

Pepperstone’s Chris Weston says the rise has coincided with a small decline in gold prices off record highs.

“Crypto has stolen the spotlight from precious metals,” he writes.

“While I would hesitate to suggest traders are switching from gold to Bitcoin, the crypto scene is running hot once more.

“The percentage moves on the day aren’t as prolific as during recent liquidation swings, but price persistence is notable, with Bitcoin closing higher for a seventh straight day.”

As Chris’s email disclaimer notes, his comments are to be considered a “marketing communication”, not financial advice.

2h agoThu 2 Oct 2025 at 10:10pm

US shutdown stops jobs data, interrupts travel plans

The US government shutdown is having immediate effects.

On markets, the immediate concern is a lack of timely data about the US economy.

“The shutdown’s impact was immediately felt in economic data releases, with no weekly jobless claims or factory orders published,” notes NAB’s senior FX strategist Rodrigo Catril.

“Instead, private sector reports took centre stage. Challenger data showed a 25.8% year-on-year drop in September job cuts, but hiring plans also fell sharply, reinforcing the prevailing narrative of low hiring and low firing in the US. Revelio Labs’ proxy for non-farm payrolls suggested 60k jobs created in September, above consensus, but with a lower correlation to official NFP figures.

“With the shutdown ongoing, Friday’s payrolls report is unlikely to be released, leaving markets to interpret patchy signals.”

While traders and economists are bemoaning a lack of data, tourists to the US are upset that many of the attractions they wanted to visit are closed.

The ABC’s national tourism reporter, Kristy Sexton-McGrath, spoke to some disappointed Aussies travelling in the US.

2h agoThu 2 Oct 2025 at 9:49pmOpen AI hits $US500 billion valuation

Reuters has reported that OpenAI, the company behind ChatGPT, has reached a valuation of $US500 billion, following a deal in which current and former employees sold roughly $US6.6 billion worth of shares, according to a source the financial news service spoke with.

This represents a bump up from its current valuation of $US300 billion, underscoring OpenAI’s rapid gains in both users and revenue.

According to Reuters, as part of the deal, OpenAI employees sold shares to a consortium of investors including Thrive Capital, SoftBank, Dragoneer Investment Group, Abu Dhabi’s MGX and T. Rowe Price, according to the source, who spoke on the condition of anonymity as they were not authorised to speak to the media.

Reuters markets columnist Jamie McGeever had some interesting observations about the new valuation of the private (not share market-listed) company.

“OpenAI, the company behind ChatGPT, has reached a valuation of $500 billion following a recent share sale, making it the most valuable private company in the world. That’s up sharply from its current valuation of $300 billion. Where next? $1 trillion?

“It’s a landmark moment, but raises familiar questions about whether the AI boom is a bubble. AI-related capex spending in the US is soaring, but a lot is on imports, so it is actually an offset to GDP growth. And the bar for future returns is high. But as long as the music is playing, investors will keep dancing.”

Loading3h agoThu 2 Oct 2025 at 9:22pmTech and miners lead US stocks higher

Good morning, and welcome to another day on the markets.

It’s another session, and another record for US stocks.

The S&P 500 edged up just 0.1% to 6,715 points, while the Nasdaq made a more convincing high, rising 0.4% to 22,844 points.

Miners (+1%) and tech (+0.4%) led the way on Wall Street’s benchmark index.

Tech was partly boosted by hopes that the US government shutdown would knock about 0.1 percentage point off US economic growth every week it drags on, and thus force the Federal Reserve’s hand into more aggressive rate cuts.

Remember, a lot of big tech may be domiciled in the US, but its customer base is global.

So far at least, the prospect of falling US interest rates appears to boost valuations more than stagnating US growth hurts them.

Notable gains included Coinbase (+7.5%), Robinhood Markets (+4.7%), Block (+4.7%) and Intel (+3.8%).

They were offset by some big-name losses, most notably Tesla, which slumped 5.1% to $436, joined by fellow automaker General Motors (-3.2%).

Despite the overall gains on Wall Street, the local market looks set to open flat, with the ASX 200 futures down just 4 points to 8,968 points.

The Aussie dollar has also eased back to 65.93 US cents.

Stay around for today’s blog as we try and make sense of the mayhem around us.

Loading

ASX 200 futures: Flat at 8,968 pointsAustralian dollar: Flat at 65.93 US centsS&P 500: +0.1% to 6,715 pointsNasdaq: +0.4% to 22,844 pointsFTSE: -0.2% to 9,428 pointsEuroStoxx: +0.5% to 568 pointsSpot gold: -0.2% to $US3,856/ounceBrent crude: +0.1% to $US75.64/barrelIron ore: -0.3% to $US103.65/tonneBitcoin: -0.3% to $US120,341

ASX 200 futures: Flat at 8,968 pointsAustralian dollar: Flat at 65.93 US centsS&P 500: +0.1% to 6,715 pointsNasdaq: +0.4% to 22,844 pointsFTSE: -0.2% to 9,428 pointsEuroStoxx: +0.5% to 568 pointsSpot gold: -0.2% to $US3,856/ounceBrent crude: +0.1% to $US75.64/barrelIron ore: -0.3% to $US103.65/tonneBitcoin: -0.3% to $US120,341