On September 30, 2025, ASP Isotopes Inc. announced it received a purchase order from a U.S.-based customer to supply enriched Barium-137, a key material for ion-trap quantum computing, with delivery expected in the first quarter of 2026. This order underscores ASP Isotopes’ growing importance in the quantum technology supply chain, highlighting the emerging commercial demand for critical isotope materials. We’ll explore how the crucial role of enriched Barium-137 in scalable quantum computing shapes ASP Isotopes’ broader investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is ASP Isotopes’ Investment Narrative?

For someone considering ASP Isotopes, the big picture requires belief in the company’s ability to become a crucial supplier for next-generation technologies like quantum computing and advanced nuclear fuels. The recent Barium-137 order highlights real commercial traction but remains a single event, not a full transformation of short-term catalysts. The most immediate catalyst is the company’s potential to land more sizable orders and convert its partnerships, especially in quantum technologies and nuclear energy, into recurring revenue streams. However, with continued heavy losses (US$75.06 million net loss last quarter), limited revenue, and some management uncertainty due to the CEO’s temporary leave, the business is still highly speculative. The news strengthens ASP’s narrative around growth potential, but doesn’t materially change the central risks around profitability, dilution and execution over the next few quarters.

On the other hand, ongoing share dilution and losses remain risks investors need to watch closely.

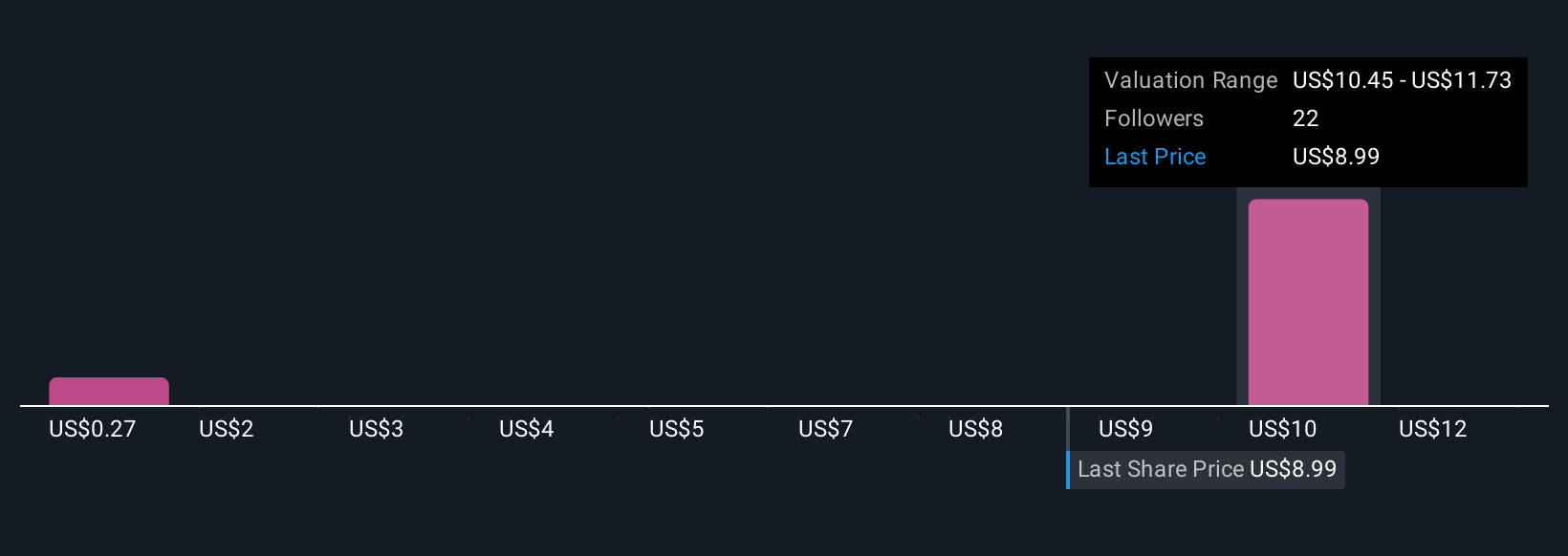

Our valuation report unveils the possibility ASP Isotopes’ shares may be trading at a premium.Exploring Other Perspectives ASPI Community Fair Values as at Oct 2025 Simply Wall St Community fair value estimates for ASP Isotopes range from US$0.27 to US$13 across 9 distinct assessments. While some expect extremely low or high future values, the latest quantum computing client order may influence how upcoming orders and management changes shape the next phase. Explore these different viewpoints as investor expectations continue to shift.

ASPI Community Fair Values as at Oct 2025 Simply Wall St Community fair value estimates for ASP Isotopes range from US$0.27 to US$13 across 9 distinct assessments. While some expect extremely low or high future values, the latest quantum computing client order may influence how upcoming orders and management changes shape the next phase. Explore these different viewpoints as investor expectations continue to shift.

Explore 9 other fair value estimates on ASP Isotopes – why the stock might be worth less than half the current price!

Build Your Own ASP Isotopes Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com