In September 2025, Adobe announced the launch of its new iPhone version of Adobe Premiere, offering free precision video editing with AI-powered tools and millions of creative assets, as well as paid upgrades for storage and generative credits. This mobile expansion positions Adobe to engage a new generation of creators and enables seamless editing across devices, reflecting broader shifts towards mobile-first, AI-assisted content creation in the digital media landscape. We’ll explore how Adobe’s forward-looking mobile and AI initiatives could influence its future revenue and user engagement outlook.

Trump’s oil boom is here – pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Adobe Investment Narrative Recap

To be comfortable owning Adobe stock, investors need conviction in Adobe’s continued innovation and successful expansion into mobile and AI-powered creative tools. The recent Adobe Premiere iPhone launch furthers this strategy but does not materially shift the most significant short-term drivers, such as Creative Cloud subscription momentum, or the greatest risk, which is intensifying competition from rivals in both AI and digital media. For now, this product launch primarily strengthens Adobe’s cross-platform ecosystem, with little impact on the immediate outlook for revenue or competitive threats.

Among recent company announcements, Adobe’s September guidance maintained expectations for annual revenue between US$23.65 billion and US$23.70 billion, providing investors with a steady outlook as the company continues rolling out new AI and mobile experiences. This consistent financial forecast helps frame the Premiere mobile app’s potential, reinforcing Adobe’s position in mobile-first content creation amid ongoing challenges.

Yet, unlike the consensus view, investors should be aware that increased investment demands from keeping pace with rapid AI and mobile advances could lead to…

Read the full narrative on Adobe (it’s free!)

Adobe’s outlook anticipates $29.3 billion in revenue and $8.7 billion in earnings by 2028. This is based on a 9.0% annual revenue growth rate and an earnings increase of $1.8 billion from the current $6.9 billion.

Uncover how Adobe’s forecasts yield a $456.18 fair value, a 31% upside to its current price.

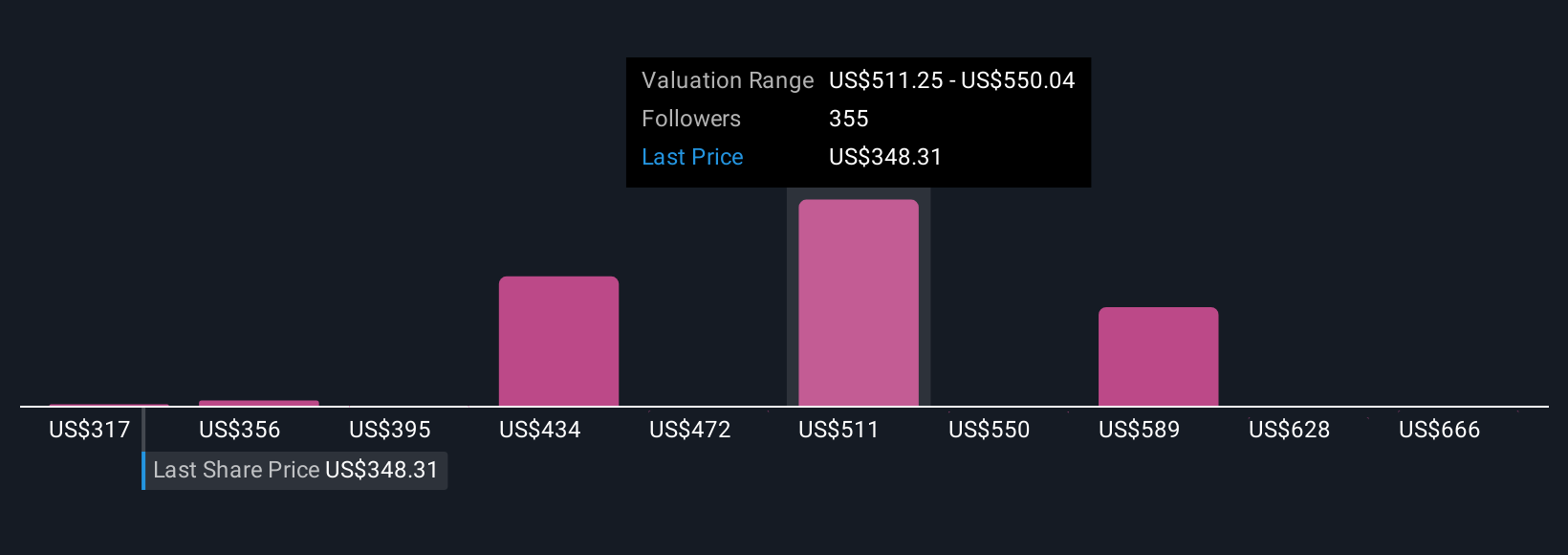

Exploring Other Perspectives ADBE Community Fair Values as at Oct 2025

ADBE Community Fair Values as at Oct 2025

Some analysts believe Adobe’s AI bets could double its AI-related business in 2025 and foresee revenue climbing to US$31.2 billion by 2028. Their optimism highlights just how much opinions can differ, especially as new product launches like Premiere on iPhone may reshape both opportunity and risk. Consider what’s possible if Adobe moves faster or slower on AI than anyone expected.

Explore 99 other fair value estimates on Adobe – why the stock might be worth over 2x more than the current price!

Build Your Own Adobe Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

A great starting point for your Adobe research is our analysis highlighting 4 key rewards that could impact your investment decision.Our free Adobe research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Adobe’s overall financial health at a glance.Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com