9h agoThu 9 Oct 2025 at 5:15amMarket snapshotASX 200: +0.3% to 8,969 points (live values below)Australian dollar: +0.3% at 66.07 US centsS&P 500: +0.6% to 6,753 pointsFTSE 100: +0.7% to 9,548 pointsSpot gold: flat to $US4,033/ounceBrent crude: -0.4% at $US65.97/barrelIron ore: -0.1% to $US104.10/tonneBitcoin: -0.8% at $US121,969

Prices current at around 4:15pm AEDT

Live updates from major ASX indices:

8h agoThu 9 Oct 2025 at 5:55am

That’s all for today

We’re wrapping up our markets blog for the day!

Thank you for joining us.

Don’t forget to catch The Business on ABC News at 8:44pm, after the late news on ABC TV, and any time on ABC iview.

We’ll be back tomorrow morning … until then, take care!

Loading8h agoThu 9 Oct 2025 at 5:46amACCC raises concerns over Yamaha’s proposed acquisition of Telwater

The ACCC has voiced its preliminary competition concerns with Yamaha Motor Australia’s proposed acquisition of Telwater, Australia’s largest manufacturer and supplier of aluminium trailer boats.

Market participants have told the ACCC that a Telwater aluminium trailer boat is a highly valued product for many dealers.

The watchdog said the proposed acquisition was likely to “have the effect of substantially lessening competition in the wholesale supply of outboard motors in Australia”.

ACCC Commissioner Philip Williams said:

“We are concerned that, following the acquisition, Yamaha would have the ability and incentive to link the wholesale supply of Yamaha outboard motors to Telwater aluminium trailer boats, for example, by requiring dealers of Telwater boats to also become Yamaha outboard motor dealers.

“This acquisition could make it much harder for other outboard motor suppliers to compete effectively with Yamaha, ultimately reducing the choice and competitive offerings available to consumers.”

The ACCC said it was also concerned that the merged entity could seek to reduce the access to dealers and customers by rival suppliers of trailer boats.

“Linking the wholesale supply of Yamaha outboard motors with Telwater aluminium trailer boats could limit how effectively existing and future rival wholesale suppliers of aluminium boats and outboard motors can compete post-merger,” Dr Williams said.

“This could ultimately lead to higher prices and reduced choice or quality for consumers seeking to purchase a new aluminium trailer boat or outboard motor.”

Yamaha is proposing to acquire 100% of the shares of Telwater from Bombardier Recreation Products Inc, alongside a property in Queensland used to manufacture, fit and warehouse aluminium trailer boats.

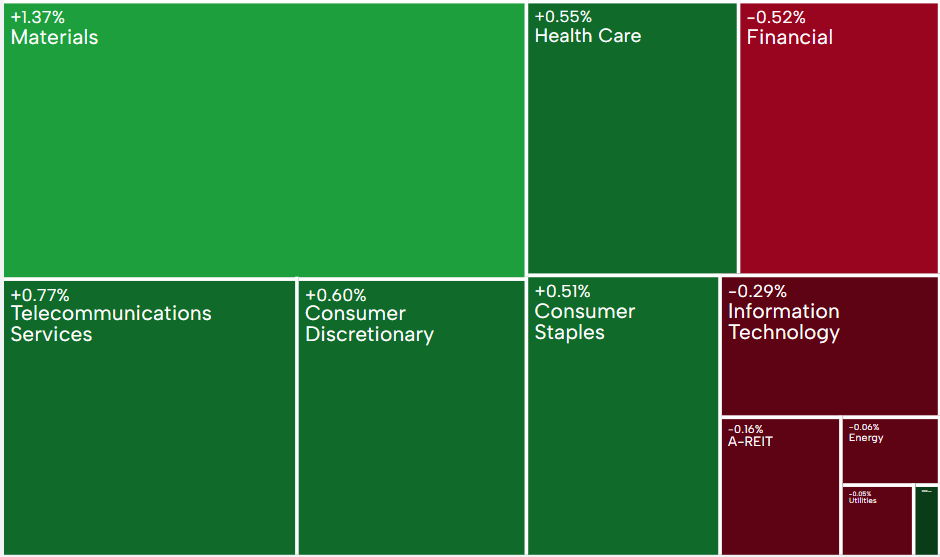

9h agoThu 9 Oct 2025 at 5:29amASX closes up

The Australian share market has finished the day high, up 0.3% at 8,969 points.

Overall, the market had 113 stocks gaining, 15 unchanged and 72 stocks in the red.

When looking at the sectors, more sectors ended lower than higher, despite the gain in the ASX 200.

Materials at the top; up 1.7%, followed by Consumer Staples; up 0.7% and then Telecommunications Services; up 0.2%.

Financials finished at the bottom; down 0.6%, followed by Utilities; down 0.5%, and then Information Technology; down 0.3%.

Among companies, the top mover was Nickel Industries, up 8.7%, followed by Domino’s, up 7.4%.

It wasn’t a good day for Austal, down 8.3%, followed by Regis Resources, down 3.9%.

9h agoThu 9 Oct 2025 at 5:12amAsia stocks sweep to new highs while oil slips on Gaza ceasefire deal

Asian stock markets reached new highs on Thursday as investors doubled down on all things AI-related, while gold remained above $US4,000 and the dollar retained its recent substantial gains.

Oil prices dipped as geopolitical tensions eased on news that Israel and Hamas had agreed to the first phase of a ceasefire plan to end the two-year conflict.

US President Donald Trump said he might travel to Egypt this weekend to discuss further steps in the deal.

A jump in tech pushed Japan’s Nikkei up 1.5% and back near all-time peaks.

Stocks in Taiwan also climbed 1.2% to a fresh record

Chinese blue chips added 0.4% as they reopened from a week-long holiday.

Beijing also announced new restrictions on the export of rare earth minerals and equipment that have been a sticking point in trade talks with the US.

Reporting with Reuters

9h agoThu 9 Oct 2025 at 4:58amTasmanian government seeks intervention as Bell Bay Aluminium unable to secure deal

The Tasmanian government is seeking federal intervention for Rio Tinto-owned Bell Bay Aluminium (BBA) after negotiations for a new power deal stalled.

BBA has been in discussions with Hydro Tasmania for a new power deal in recent months as its current 10-year agreement expires on December 31.

The company told staff the fact that no agreement had been reached in the past 18 months was a “significant risk” given the looming deadline.

The plant in northern Tasmania employs more than 500 people.

My colleague Sandy Powell has more.

9h agoThu 9 Oct 2025 at 4:42amAlbanese’s office sought Treasury meeting about super tax, but policy has not changed

The prime minister’s office had a meeting with Treasury to ask about the government’s longstanding proposal to raise the tax on superannuation earnings.

Diane Brown, who heads Treasury’s revenue group, confirmed the PMO asked for a meeting to better understand negative feedback from stakeholders about the plan.

The tax proposal has been around for years but couldn’t be passed in the last parliament. Two major criticisms are the way it treats super earnings that have not been “realised” (e.g. an increase in an asset’s value) and whether the $3 million threshold for the tax should be indexed to inflation.

There have been some reports the PM had cold feet, hence the questions about the PMO. But Tim Ayres says there has been no change to the government’s position and that it intends to legislate the tax in the same way it tried to last term.

Brown says Treasury also hasn’t been asked to draft amendments to the bill. Has Treasury been asked to model different options? We don’t get a clear answer.

10h agoThu 9 Oct 2025 at 4:28am

Crypto exchange Gemini launches Australian arm

New York City-based cryptocurrency exchange Gemini has launched an Australian operation, expanding into the country and offering its digital currency exchange services to tap into the growing demand.

“We think that there’s enough market opportunity for us to build a local platform,” said Saad Ahmed, head of APAC at Gemini.

“We have some institutional customers from Australia, and I think that is another area where we’ve seen some growth.

“So having a team on the ground, building a business which is localised, which is optimised for Australian users… makes sense for us.”

The crypto adoption rate in the country rose to 31% as of early this year, up from 28% last year, according to the Australian Independent Reserve Cryptocurrency Index report released in February.

Gemini, led by the billionaire twins Tyler and Cameron Winklevoss, made its debut on the Nasdaq last month after raising $US425 million in an initial public offering.

The launch of Gemini’s Australian operations, named Gemini Intergalactic Australia, will allow the company to offer crypto exchange services in the country after registration with the Australian Transaction Reports and Analysis Centre (AUSTRAC) as a digital currency provider, it said in a statement.

Prior to the move, customers in Australia were able to use Gemini’s platform but were serviced through the firm’s global arm.

Reporting with Reuters

10h agoThu 9 Oct 2025 at 4:20am

Market snapshotASX 200: +0.1% to 8,959 points (live values below)Australian dollar: +0.3% at 66.03 US centsS&P 500: +0.6% to 6,753 pointsNasdaq: +1.1% to 23,043 pointsFTSE 100: +0.7% to 9,548 pointsSpot gold: +0.1%% to $US4,033/ounceBrent crude: -0.5% at $US65.91/barrelIron ore: -0.1% to $US104.05/tonneBitcoin: -0.7% at $US122,040

Prices current at around 3:19pm AEDT

Live updates from major ASX indices:

10h agoThu 9 Oct 2025 at 4:04amAussie retail investors buy the dip in healthcare stocks in Q3: analyst

Australian retail investors flocked to buy shares in healthcare stocks, such as UnitedHealth and weight-loss medicine producer Novo Nordisk, in Q3, according to the latest report from trading and investing platform eToro.

Josh Gilbert, market analyst at eToro, said:

“A 75% jump in holders for UnitedHealth shows that investors see long-term value in the healthcare giant that’s got the largest share of the trillion-dollar global healthcare market, even after a turbulent year.

“That backing has been prudent, with shares up more than 40% from their lows in August.”

The report has also found that the most prominent sector in the quarter’s ‘top risers’ list was semiconductor manufacturers, with five out of the top 20 companies producing the chips powering the AI revolution.

Coming in fourth place in the Q3 ‘top risers’ list, Broadcom had a 23% increase in Aussie holders this quarter, it said.

Mr Gilbert said the AI boom was in full swing, and semiconductors were the backbone of that very boom.

“Aussie investors aren’t missing a beat here, spotting the longer-term opportunity and backing the biggest names that are building the infrastructure behind AI.

“More than ever this year, we’ve seen these companies delivering with earnings upgrades, new products and innovation, showing this isn’t just hype.”

10h agoThu 9 Oct 2025 at 3:41am

1414 Degrees soars on getting silicon nanoparticle tech license

Energy storage company 1414 Degrees’s shares have surged by 27% to $0.061 following the acquisition of an exclusive global licence for silicon nanoparticle technology for use in lithium-ion battery anodes.

Executive chairman Kevin Moriarty said the technology could overcome the key limitations of silicon anodes — volume expansion

and instability.

The company has also raised about $1.2 million through a placement.

11h agoThu 9 Oct 2025 at 3:26am

HSBC proposes to privatise Hong Kong’s Hang Seng Bank for $US13.6b

HSBC has said it plans to privatise Hong Kong’s Hang Seng Bank after its majority held subsidiary has come under fire for its performance and exposure to faltering property markets in the city and mainland China.

HSBC will offer HK$155 ($US19.9) per share, valuing the deal at about HK$106.1 billion ($13.63 billion) for the purchase of the 36.5% of shares not already owned by HSBC.

In a statement to the Hong Kong Stock Exchange, HSBC said the offer was made at a 30.3% premium to Hang Seng Bank’s closing price on Wednesday.

The offer price could be adjusted for any dividends, except the 2025 third interim dividend, according to the statement.

“The privatisation exercise represents a significant investment into Hong Kong,” HSBC said.

“It represents HSBC’s strong conviction in Hong Kong’s future as a leading global financial centre and super-connector between international markets and Mainland China.”

Hang Seng Bank has reported rising bad loans over the last few years due to its relatively high exposure to the Hong Kong and mainland Chinese property markets.

Impaired loans reached 6.1% of its gross loans as of end-2024, up sharply from 2.8% at the end of 2023.

Reuters last year reported that due to worries about a potential rise in bad loans amid growing economic headwinds and the property sector crisis in China, HSBC in early 2024 started planning to tighten risk management at Hang Seng Bank.

Privatisation schemes are commonly used in Hong Kong to streamline corporate structures and reduce the costs associated with maintaining a public listing.

The offer price is final, HSBC said, adding that it does not reserve the right to revise it.

Reporting with Reuters

11h agoThu 9 Oct 2025 at 3:03amASX up with materials sector best performing

The ASX 200 is up, gaining 16.20 points to 8,963.80.

The top five movers are:

Capstone Copper, +7.2%Nickel Industries, +6%Domino’s, +5.2%Sandfire Resources, +5.1%Sims Ltd, +5%

The bottom five movers are:

Austal, -6.7%Regis Resources, -5.2%Catapult Sports, -3.6%Elders, -2.7%Megaport Ltd, -2.5%

Six of 11 sectors are higher along with the ASX 200.

Materials is the best performing sector, gaining 1.4% and 2.9% over the past five days.

(ASX)

(ASX)

12h agoThu 9 Oct 2025 at 2:37am

New draft law to regulate payment service providers released

The Australian Treasury has released an exposure draft of legislation, aiming to lay the foundations for a new regulatory framework for payment service providers.

According to the Treasury, the draft legislation delivers:

A core licensing regime that will set clearer obligations on payment service providers that perform specific functions;A graduated regulatory framework for stored value facilities like prepaid accounts, stablecoin issuers, or wallets that hold customer funds.

Another tranche of legislation would be consulted on next year, the Treasury said.

The Australian Banking Association (ABA) has welcomed the release of the exposure draft legislation.

ABA CEO Simon Birmingham said the proposed reforms represent another important step towards ensuring Australia’s payments system remains safe, secure, and fit for purpose.

“Australians now have access to a range of payment options and no matter how they choose to pay, they should be afforded the same consumer protections,” Mr Birmingham said.

“Banks have called for a core licensing regime for some time and welcome the clearer obligations on payment service providers that will be delivered with these reforms.

“These reforms will help to ensure our regulatory framework continues to deliver a world-class payments system across the entire economy.

The exposure draft legislation and explanatory material can be found on the Treasury website.

Submissions will remain open until November 6, 2025.

12h agoThu 9 Oct 2025 at 2:15amElders to finalise Delta Agribusiness merger subject to divestments

The corporate watchdog ACCC says it will “not oppose” Elders’s proposed acquisition of Delta Agribusiness, provided Elders agrees to divest six Delta stores in Western Australia.

Elders and Delta both supply rural merchandise such as agricultural chemicals, seed, fertiliser, animal health products and related services, such as agronomy services, through their retail networks.

Both companies also supply rural merchandise at the wholesale level.

ACCC deputy chair Mick Keogh said a review closely considered the likely effect of the proposed acquisition on competition in each local area where both Elders and Delta have a retail store.

“The nature of competition in the retail supply of rural merchandise is more localised than is the case in other retail sectors, partly due to the differences in farming in different local areas, and the importance of local relationships,” Mr Keogh said.

“Following an in-depth review, we were concerned that the proposed acquisition would be likely to substantially lessen competition in several local areas in Western Australia.”

To address these concerns, Elders has agreed to divest six Delta stores in Western Australia, and the ACCC has accepted their undertaking.

The watchdog has also concluded that the proposed acquisition is unlikely to substantially lessen competition in the retail supply of rural merchandise in other local areas where both Elders and Delta own retail stores.

Elders’s share prices were $7.12, down by 2.9% at around 1:15pm AEST.

12h agoThu 9 Oct 2025 at 1:52am

Telstra denies being hacked in cyber extortion bid

A Telstra Spokesman has confirmed that there is no data leak of its users after assessment.

The telecommunications company’s statement follows the addition of its name to a notorious criminal group’s list of companies exposed in a wide-ranging attack, as reported earlier by the AFR.

Here is what Telstra has said:

“We’re aware that a malicious actor has listed what it claims is Telstra data online and we have investigated.

Based on our assessment, the data has been scraped from publicly available sources and does not originate from Telstra systems.

No passwords, banking details or personal identification data such as driver’s licence or Medicare numbers are included.”

The spokesman also says that the data the group threatened to leak appears to have been extracted from publicly available Reverse Australia databases, quoting the AFR.

13h agoThu 9 Oct 2025 at 1:34am

Market snapshotASX 200: +0.4% to 8,981 points (live values below)Australian dollar: +0.2% at 65.97 US centsS&P 500: +0.6% to 6,753 pointsNasdaq: +1.1% to 23,043 pointsFTSE 100: +0.7% to 9,548 pointsEuroStoxx 600: +0.8% to 573 pointsSpot gold: +0.2% to $US4,031/ounceBrent crude: -0.6% at $US65.88/barrelIron ore: -0.5% to $US103.65/tonneBitcoin: -0.4% at $US122,495

Prices current at around 12:31pm AEDT

Live updates from major ASX indices:

13h agoThu 9 Oct 2025 at 1:21amANZ announces new executive appointments

A few changes in the executive ranks at ANZ — chief executive Nuno Matos announced the appointments in a statement to the ASX.

Pedro Rodeia — Group Executive Australia RetailChristine Palmer — Group Chief Risk Officer

Donald Patra — Group Chief Information Officer

All three will report to Mr Matos and are external hires.

Mr Rodeia will begin in mid November, coming from McKinsey & Co, Ms Palmer will begin on December 1, from Santander UK and Mr Patra starts in late November, joining from HSBC.

“I am very pleased to appoint three world-class executives to these critical roles,” Mr Matos said.

The major bank has faced scrutiny in the past month, after revealing plans to axe 3,500 jobs and 1,000 contractors over the next year, as part of a restructure.

13h agoThu 9 Oct 2025 at 1:08amSuper sector welcomes getting money — with complications

Superannuation sector’s peak body ASFA has understandably welcomed the ‘Payday Super Bill’, which is introduced into the House of Representatives today.

As discussed, the laws will make sure employers pay super alongside wages each pay cycle instead of quarterly as currently required.

Here’s ASFA CEO Mary Delahunty:

“Payday Super is a simple but powerful reform that will boost the retirement savings of every Australian employee and help address the problem of unpaid super. Australians have been waiting three years for this policy to become law. It’s a hugely popular reform, with 80% of Australians polling in favour of it.”

Pour one out for the ExcelBunnies crunching the data

But it’s not all puppies and rainbows.

The change will greatly increase the administrative load on the super industry. That’s because funds will need to process and invest super contributions up to twelve times as frequently as they did before.

(Given the way compound interest works, getting the money earlier will lead to bigger balances and returns for workers.)

“The higher transaction volumes that will flow once Payday Super begins have required years of behind-the-scenes work to get our systems ready. We’re at the point now where we’re confident the sector will handle this major shift cleanly and efficiently.

Ms Delahunty said the process had been “one of the best Australian examples of an entire industry cooperating towards a positive change in recent years.”

OK, back to the $$$.

Here’s what ASFA says. And it shows the magic of compounded, when we’re talking about getting money just weeks or months earlier.

The earlier super payments are invested in an employee’s super fund, the longer the money enjoys compounding returns. For a 25-year-old on an average wage, receiving super fortnightly rather than quarterly will mean they are $5,000 better off in retirement.

Ms Delahunty again:

“Super belongs to the employee who has earned it, as soon as they’ve earned it. In many cases, though, the money is held in an employer’s bank account for months, earning interest for the employer instead of the employee. It’s an unfair situation; Payday Super will correct it.”

It will also help with the problem of unpaid or underpaid super, because people will be on it faster.

The ATO estimates that more than $5 billion in super that is owed to Aussie workers goes unpaid each year.

With my colleague Adelaide Miller, we’ve written about this big problem … and how the ATO doesn’t seem particularly interested..

13h agoThu 9 Oct 2025 at 12:58amAustralia’s rental market stabilising amid rising costs

Domain says Australia’s rental market is stabilising, but cities like Brisbane and Darwin continue to see rent increases driven by infrastructure, investment, and job growth.

Domain chief economist Nicola Powell told The Business tenants have reached their “affordability ceiling” and simply can’t afford to pay more.

Loading…

The property listings group’s September quarterly report shows house rents across the country’s combined capitals have remained stable for five consecutive quarters.

For the first time in six years, Sydney’s house rents did not rise in this period, with the median price holding at a record high of $780 per week over the September quarter.

Read more from reporters Sarah Richards and Jessica van Vonderen:

ASX 200: +0.3% to 8,969 points (live values below)Australian dollar: +0.3% at 66.07 US centsS&P 500: +0.6% to 6,753 pointsFTSE 100: +0.7% to 9,548 pointsSpot gold: flat to $US4,033/ounceBrent crude: -0.4% at $US65.97/barrelIron ore: -0.1% to $US104.10/tonneBitcoin: -0.8% at $US121,969

ASX 200: +0.3% to 8,969 points (live values below)Australian dollar: +0.3% at 66.07 US centsS&P 500: +0.6% to 6,753 pointsFTSE 100: +0.7% to 9,548 pointsSpot gold: flat to $US4,033/ounceBrent crude: -0.4% at $US65.97/barrelIron ore: -0.1% to $US104.10/tonneBitcoin: -0.8% at $US121,969