“Albertans are really good at a bunch of things,” says Lisa Mueller, CEO of FutEra Power, an energy developer in Canada’s oil capital, Calgary. “But nothing more so than the business of drilling wells.”

Mueller isn’t talking about hydrocarbons. The veteran of Canada’s oil patch — she worked for petrogiant Shell and later junior energy developer Razor Energy for a decade before taking on the top job at FutEra — has her mind on geothermal.

Geothermal energy is found in the ultra-hot regions far below the earth’s surface. Temperatures of 250C and higher can be tapped by running water-filled drill-pipes through these zones and using the steam to turn electricity-generating turbines.

Lisa Mueller, CEO of Calgary-based FutEra Power. A handful of Canadian energy developers are leading a new wave of geothermal energy projects that could be a key piece in the country’s transition away from fossil fuels. (Oct. 8, 2025) Photo by: Leah Hennel / Canada’s National Observer

Mueller calls geothermal “the renewable cousin to oil and gas.”

“It’s a practical adaptation to start harnessing a zero-carbon resource by piggybacking on something Albertans already have world-class industrial expertise in,” she said. “That’s oil and gas exploration and production.”

FutEra has been working to turn that theory into practice at a pioneering project called Swan Hills, a 21-megawatt hybrid geothermal–natural gas plant located north-west of Edmonton that has been producing electricity for the grid since 2023.

Geothermal could meet Canada’s power demand “one million times over”, but not a single commercial well has been drilled. That’s about to change as new technologies bolster the business case for tapping underground heat to generate cleaner electricity A bird’s eye view of the Swan Hills geothermal project north of Edmonton, Alta. (Photo courtesy of FutEra Power)

The $49 million pilot used natural gas-fired generation as a back-up for the geothermal output “to get capital and operating costs to a place where we would attract investors,” Mueller said. “Everyone wants to do good in the world but capital needs a return.”

The expansion plan at Swan Hills envisions an industrial-scale advanced geothermal system (AGS) facility generating 100 per cent renewable power as early as 2028. And built, no less, on a site that was once an oil field and requires “no new land footprint.”

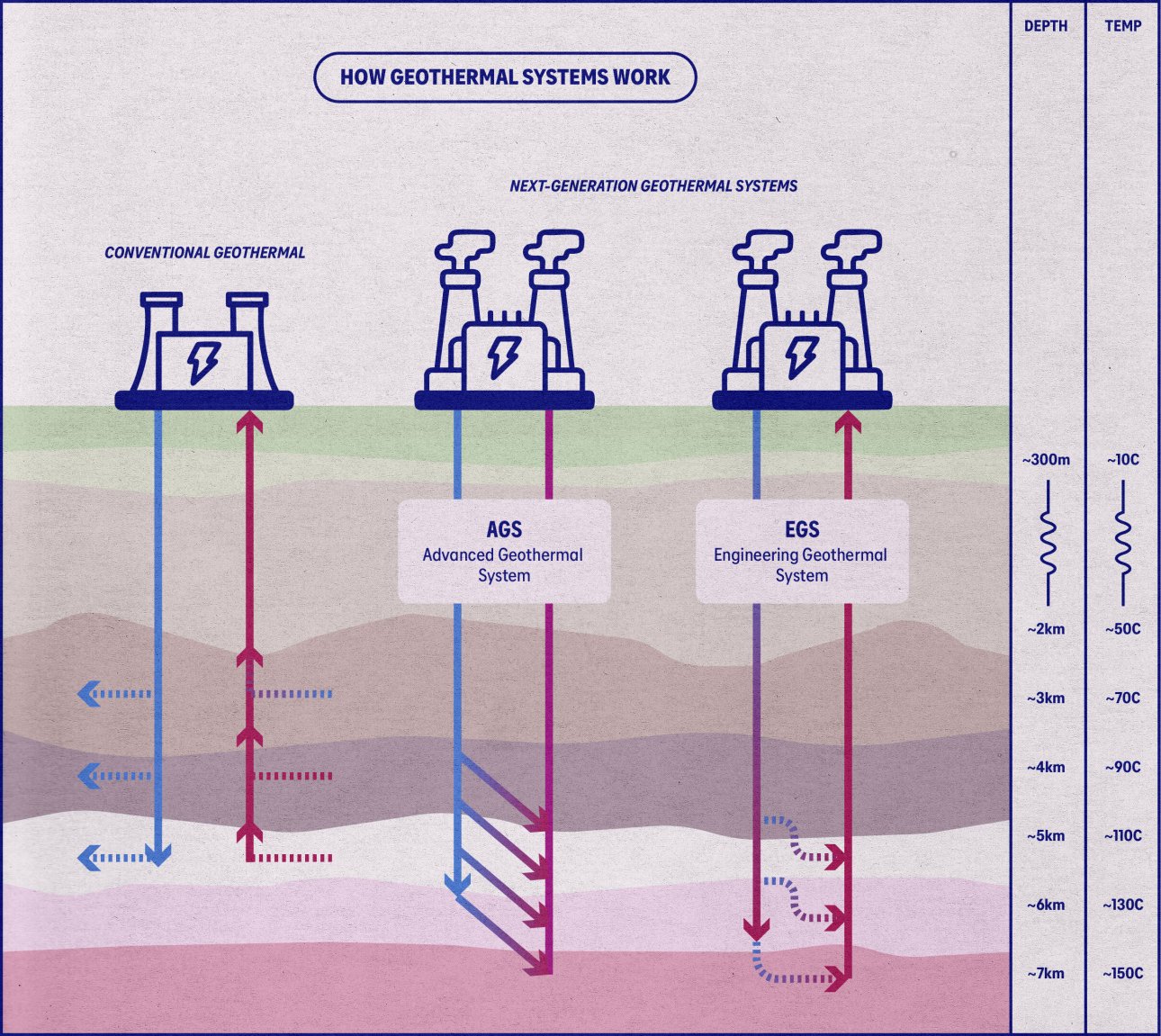

Geothermal resources are traditionally tapped by feeding drill-pipe deep into hot pockets below the earth’s surface and back up, and then running water through the pipes to heat and pressurize the fluid to turn turbines on the surface to generate electricity.

There are four emerging technologies that promise to make geothermal much cheaper.

Advanced geothermal system (AGS) is a closed-loop system that circulates fluid down into heated underground geological structures while avoiding direct contact with rock or groundwater. Unlike conventional technology, it can be used almost anywhere.

Enhanced geothermal systems (EGS) uses a fluid that is injected into hot rocks to increase permeability, a bit like fracking, to create a reservoir that can be drilled through to create a power generating system.

Geopressured geothermal systems (GGS) extracts energy from high-pressure, high-temperature reservoirs of water — generally 250°F or hotter — that contain dissolved methane using drilled-in pipework to tap the so-called HPHT resource to produce geothermal energy.

Superhot rock geothermal projects involve running drill pipe down dry rock structures found very deep underground to harness ultra-high temperatures to generate power.

Unlike shallow hydrothermal geothermal systems (conventional geothermal), which tap into existing reservoirs of hot water or steam, ultradeep geothermal systems use “next-generation” heat extraction technologies. There are two main types. Advanced geothermal systems (AGS) circulate the working fluid through closed-loop networks of connected pipe. Enhanced geothermal systems (EGS), sometimes referred to as “openloop systems”, circulate the fluid through artificially created fractures in the rock. (Cascade Institute)

Unlike shallow hydrothermal geothermal systems (conventional geothermal), which tap into existing reservoirs of hot water or steam, ultradeep geothermal systems use “next-generation” heat extraction technologies. There are two main types. Advanced geothermal systems (AGS) circulate the working fluid through closed-loop networks of connected pipe. Enhanced geothermal systems (EGS), sometimes referred to as “openloop systems”, circulate the fluid through artificially created fractures in the rock. (Cascade Institute)

“There were so many risks with the pilot — drilling, reservoir, facilities’ operation — but getting that first pilot project across the line allows us now to build the big one at a competitive cost level,” Mueller said.

The pilot project is producing at around $2.5 million per megawatt installed — “already on par” with a combined cycle natural gas plant equipped with carbon capture, utilization and storage.

“Geothermal’s superpower is about the incremental, market-changing gains which we as an oil and gas province can lead on because we know so much about resource production,” Mueller said. “Oil and gas and geothermal in many regards have the same challenges.”

Brink of a global breakout: IEA

Globally, geothermal appears to be nearing its industrial breakout as the world ramps up its decarbonization push — and Big Tech wakes up to the potential for steady geothermal power to fuel its hyperscale data centres.

Big tech is in a scramble to build AI data centres that are not reliant on evermore overtaxed grids as they need 24/7 power and nothing but. They are seeing a clear fit with geothermal.

Much quicker than nuclear to build, and more reliable than wind and solar, geothermal generates baseload — it is always ‘on.’ Precisely what hyperscale data centres, which can need 100 megawatts-plus of power — similar to a small city — demand.

Artist rendering of the proposed 100 MW geothermal project for Meta Platforms. (Source: Sage Geosystems)

Artist rendering of the proposed 100 MW geothermal project for Meta Platforms. (Source: Sage Geosystems)

In the last year, several notable deals have been struck to power data centres with geothermal energy.

Google finalized a 118.5 MW power deal for a data centre in Nevada with Fervo Energy, a fast-growing US start-up, while Facebook-owner Meta Platforms signed a 100 MW “partnership” with Sage Geosystems, as well as a 150 MW power supply agreement with XGS Energy for a data centre in New Mexico.

Data centres and geothermal are a perfect power couple, according to Rhodium, a market intelligence firm. “Geothermal could economically meet up to 64 per cent of expected demand growth by the early 2030s,” it said in a recent study.

If data centres were built in areas with the “best geothermal resource,” the resource could meet “all projected data center demand growth at prices 31-45 per cent lower,” Rhodium said.

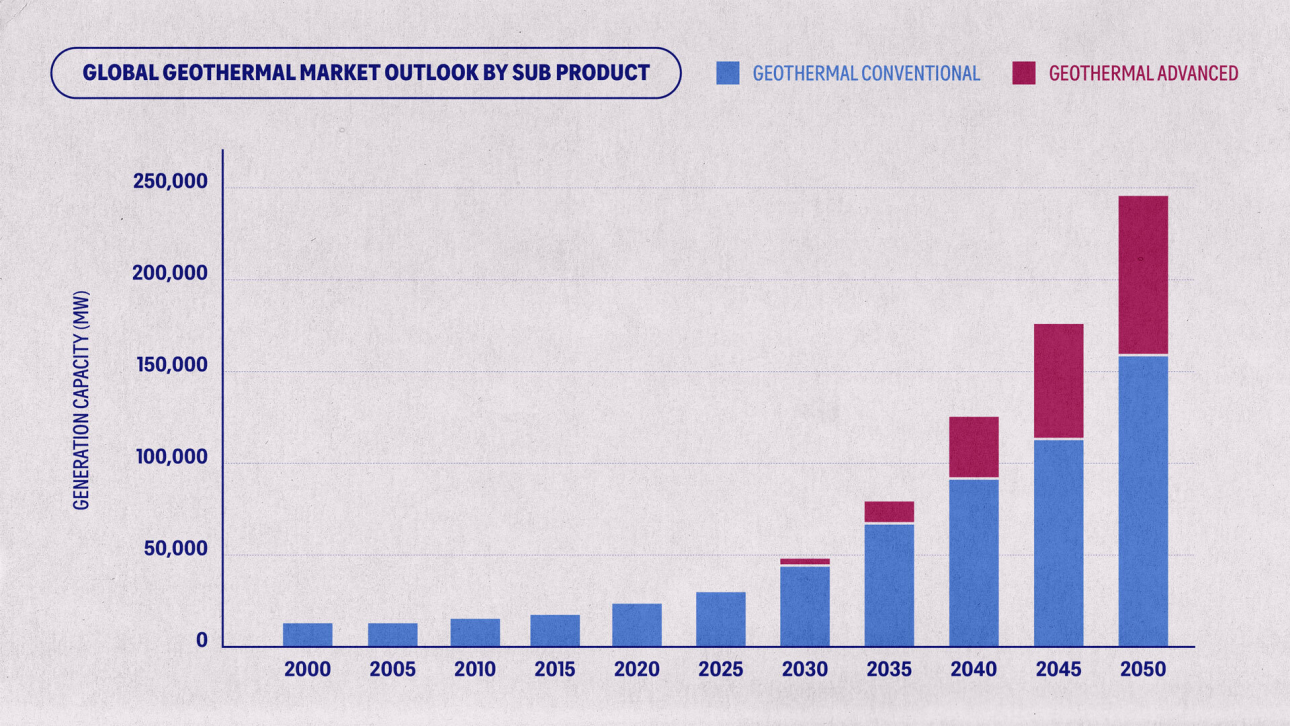

Even before adding the power needs of future data sites, the International Energy Agency forecast the sector would meet up to 15 per cent of worldwide demand growth between now and 2050, with as much as 800,000 MW of new capacity. That’s enough to meet the electricity “needs of the US and India together,” the IEA said.

Canada’s geothermal potential remains hard to put precise numbers to, but one thing is certain: it is vast.

The last major resource assessment, carried out by the Geological Survey of Canada in 2012, estimated that geothermal could meet the country’s power consumption “one million times over.”

“Key innovations in next-gen geothermal have the potential to completely change power systems across Canada.” (Peter Massie, Cascade Institute)

“Key innovations in next-gen geothermal have the potential to completely change power systems across Canada.” (Peter Massie, Cascade Institute)

That survey only scoped out 40 per cent of Canada’s geothermal resource — “a fraction of our potential” even with the technologies of the day, said Peter Massie, director of the Geothermal Energy Office at the Cascade Institute, a research think-tank.

Cascade built a first-of-its-kind data set to get a clearer idea of geothermal’s prospects. It concluded that a range of technological innovations developed in the past decade — almost exclusively the inventions of former oil and gas engineers — have radically changed the economics of geothermal, particularly in Western Canada, he said.

“We’ve estimated costs for enhanced geothermal projects in Canada to start assessing the impact of other next-generation technologies,” Massie said.

“What we discovered was that geothermal could be much cheaper than gas” produced without CCS, he added.

By Cascade’s calculations, the cost of geothermal could fall quickly from today’s $85-145/MWh to as low as $33/MWh in the coming years, compared to $77/Mh for natural gas, according to Navius, a data portal. Geothermal is already competitive in BC and could be soon across Western Canada as technologies advance, he said.

“Key innovations in next-gen geothermal have the potential to completely change power systems across Canada,” Massie said.

In Western Canada, projects are “co-located with grids that are fossil dependent, like Alberta, or in need of new sources of capacity and energy, as in BC’s case,” he added.

New technologies taking shape

Projects using enhanced geothermal and advanced geothermal systems — such as the expansion at FutEra’s Swan Hills project — are garnering fresh attention in the energy industry.

Eavor Loop, an 8 MW geothermal demonstrator project, under construction outside the city of Geretsried, southwest of Munich, Germany. (Photo courtesy of Eavor Technologies)

Calgary-based Eavor Technologies — like FutEra the brainchild of former oil players — can take a great deal of credit for boosting the profile of geothermal energy.

The start-up has raised $750 million in equity investments to date from global energy producers and venture capital funds for its Eavor Loop geothermal concept. It links two vertical “oil and gas inspired” wells to a number of horizontal multilateral ones to create a closed-sealed “radiator-like” system. In June, Eavor added a further $140 million investment from the Canada Growth Fund.

The first large-scale Eavor Loop isn’t being built in Canada, but in Germany.

“The problem we faced in developing our concept was the price-tag. No venture capital firm or institutional investor was going to touch it. So, like any good startup we stacked several grants and even money from an angel investor to build our pilot.” (Jeanine Vany, Eavor Technologies)

“The problem we faced in developing our concept was the price-tag. No venture capital firm or institutional investor was going to touch it. So, like any good startup we stacked several grants and even money from an angel investor to build our pilot.” (Jeanine Vany, Eavor Technologies)

Currently in the final stages of construction outside the city of Geretsried, southwest of Munich, the 8 MW demonstrator is a testimony to the “potential of Canadian-born geothermal technology abroad – and at home,” said Jeanine Vany, one of Eavor’s co-founders.

The lead-off project, which could be expanded to 200 MW, points to the impact Canadian-born geothermal technology could have in providing energy independence in regions with no access to oil, natural gas or other sources of power, she said. But like other startups, a big challenge was locking in financing.

“The problem we faced in developing our concept was the price-tag. No venture capital firm or institutional investor was going to touch it,” Vany said.

“So, like any good startup we stacked several [provincial and federal] grants and even money from an angel investor to build our pilot.”

‘Too great…to be left in the ground’

Eavor’s project in Germany — backed by the EU’s European Innovation Fund and expandable to 200 MW — is a “direct scale-up of that baby prototype” hatched in Alberta in 2019. Vany said.

Germany was chosen over Canada for two main reasons which remain hurdles in Eavor’s home market. One, a regulatory environment supportive of building geothermal, and the other, a 30-year clean electricity feed-in tariff.

The latter is a government policy that encourages renewable energy by providing producers with a guaranteed price for their electricity which is sold to the grid.

Alberta didn’t offer these incentives at the time. “Wish they had,” Vany said. “Still, our story all started with the Canadian government taking a bet on us.”

The Canada Growth Fund’s long-game support is the type of “patient capital” needed to spur broad-scale deployment of geothermal in Canada, Vany said, noting government backing now could foster export markets for home-grown technology in the future.

“We have it all here: the technology, the expertise, the people, the pipe,” she said. “Geothermal is too good a resource, too great an economic opportunity, to be left in the ground.”

Geologists assessing the geothermal potential on Mount Meager near the Whistler ski resort in the BC Rockies. (Photo courtesy of Meager Creek Development Corp)

Geologists assessing the geothermal potential on Mount Meager near the Whistler ski resort in the BC Rockies. (Photo courtesy of Meager Creek Development Corp)

Geothermal ‘magic mountain’

Alongside AGS and EGS technologies, geopressured geothermal systems are also being developed, including one project that is soldiering ahead in the BC Rockies.

The long-explored Mount Meager project, which aims to run turbines using heat from rocks deep in the earth, is located north of Vancouver not far from the Whistler ski resort — at a site in the Lil’wat First Nation that translates as “Burnt Face Place.”

The 32 MW development in the Garibaldi volcanic belt has seen numerous exploration wells drilled into super-hot 650C reservoirs over the past decades.

Recent drilling into more shallow areas has shown “technically viable” temperatures of over 250C that could be used to produce vast volumes of electricity, according to Richard Hawker, president of project developer Meager Creek Development Corp.

Drilling operations at the Mount Meager geothermal project which aims to run turbines using heat from rocks deep in the earth. (Photo courtesy of Meager Creek Development Corp)

Drilling operations at the Mount Meager geothermal project which aims to run turbines using heat from rocks deep in the earth. (Photo courtesy of Meager Creek Development Corp)

Advances in geopressured technology could finally greenlight the project at a time of rising demand for clean energy as the BC government seeks to replace fossil fuels with electricity and low-carbon power, he said.

“Clean electricity is going to be one of the Achilles’ heels of the government’s energy transition plan and this geothermal resource should start resonating sooner rather than later as a solution to this problem,” Hawker said.

“Clean electricity is going to be one of the Achilles’ heels of the government’s energy transition plan and this geothermal resource should start resonating sooner rather than later as a solution to this problem.” (Richard Hawker, Meager Creek Development Corp)

“Clean electricity is going to be one of the Achilles’ heels of the government’s energy transition plan and this geothermal resource should start resonating sooner rather than later as a solution to this problem.” (Richard Hawker, Meager Creek Development Corp)

“This mountain has been studied for more than 50 years and tens of millions of dollars invested,” he said. “But now we are very confident we can put the wells in that can bring this project into being.”

A policy signal from the provincial utility is key now, said the former oil and gas driller who ran a deep geothermal project in Japan in the early 1990s “with Canadian rigs, drilling technology, crews, Canadian everything.”

There might be a virtue in necessity. BC Hydro is under pressure to add reliable ‘baseload’ electricity supply to meet fast-rising demand on its grid — which had to import over 13,000 gigawatt-hours of power last year from independent power producers. Geothermal fits the bill.

“We believe that BC Hydro needs more firm power,” BC Energy and Climate Solutions Minister Adrian Dix said in June. “That could be hydro power. That could [be] things such as geothermal power.”

“Next-generation geothermal…holds transformative potential to make geothermal energy accessible worldwide, unlocking previously untapped resources.” (Annick Adjei, Wood MacKenzie)

“Next-generation geothermal…holds transformative potential to make geothermal energy accessible worldwide, unlocking previously untapped resources.” (Annick Adjei, Wood MacKenzie)

The BC government has identified 16 geothermal development sites as part of its energy diversification strategy.

The six “most likely prospects” have a total estimated power capacity of more than 1,000 MW and could generate almost 9,000 GWh a year.

Investors interested, but…

Investors are taking a closer look at geothermal as new technologies enter the market, said Annick Adjei, an analyst at Wood Mackenzie, a market intelligence firm.

“Next-generation geothermal — AGS, EGS, GGS, Super Hot Rock — holds transformative potential to make geothermal energy accessible worldwide, unlocking previously untapped resources,” she said, pointing to some US$2.2 billion in investment in the last year in geothermal startups via a mix of financing options.

This chart shows the potential growth in the geothermal market by 2050. (Source: Wood MacKenzie)

This chart shows the potential growth in the geothermal market by 2050. (Source: Wood MacKenzie)

The largest capital raising was by Houston-based Fervo Energy, which secured nearly $1 billion in financing.

Private capital interest in geothermal appears to be turning over a new leaf after decades of lukewarm interest in the sector. That could make it easier for Canadian projects to raise funds, said Dan Phillipson, managing partner at Deep Energy Capital, a London, UK-based infrastructure investor.

“There is a major shift underway,” he said of investors’ interest, although the sector has to overcome several challenges.

“The capital is there. In Canada, the policy isn’t yet.” (Dan Phillipson, Deep Energy Capital)

“The capital is there. In Canada, the policy isn’t yet.” (Dan Phillipson, Deep Energy Capital)

Project timelines are the main hurdle. Currently, it can take 15-plus years to get a geothermal project to start production. Industry leaders think that can be cut to under five years — similar to a wind or solar project.

Cost is another. Project development prices are dropping due to innovative drilling and other technologies, including digital options. But the perceived risk profile for geothermal is still “pretty high,” Phillipson said.

Supportive renewable power policies, like those offered in Europe, and long-term power purchasing agreements would strengthen the business case for geothermal, he said.

Steady, transparent production and cost profiles with “attractive returns from an asset that will not be stranded — like oil or gas in the long-term might — that is appealing to investors with large pools of capital,” he said.

Market-driven insurance for investors or government support through policy changes would ease the project risk for investors, Phillipson said.

“That way, their funding will come with the knowledge there is a backstop,” he said.

“It will encourage them to invest because they are protected against the biggest risks. That is geological subsurface risk and technology risk.”

In Germany, insurer Munich RE offers special underwriting terms for geothermal projects. The UK government sets floor and ceiling prices for generation from renewable power projects to reduce developer risk.

The big pivot that Phillipson expects to change geothermal fortunes is the sector’s repackaging as infrastructure rather than technology. This could entice investors to accept the big “ticket size” investment needed for such projects due to the “much longer” terms of return.

“The capital is there. In Canada, the policy isn’t yet,” he said.

Greening ‘drill, baby, drill’

US President Donald Trump’s “drill, baby, drill” rallying cry to North America’s oil and gas industry could, ironically, also be a clarion call for Canada’s emerging geothermal sector.

Geothermal depends heavily on drilling expertise from places such as Alberta, where the fossil fuel industry continues to shed jobs. Advocates for the “other” drilling-based energy sector — geothermal — have long promised and appear close to starting on a path to supercharge North America’s energy transition.

“Geothermal will have its day,” Mueller said, noting that Canada could begin to fully harness its wind and solar energy if the country’s grids were backed up by “secure, reliable and soon to be affordable” geothermal sites.

“Alberta, and Canada, should be well ahead in the geothermal race,” she said. “We have the technology and the talent. We just need to get drilling.”

“We have the technology and the talent. We just need to get drilling.” (Lisa Mueller, FutEra Power)