Stocks roared back to life alongside gold prices with tech earnings and US inflation data due.

Wall Street pushed back toward record highs before key Q3 earnings reports

Gold prices surged anew, casting doubt on easing US-China trade tensions

US CPI data will offer a glimpse of the economy amid government shutdown

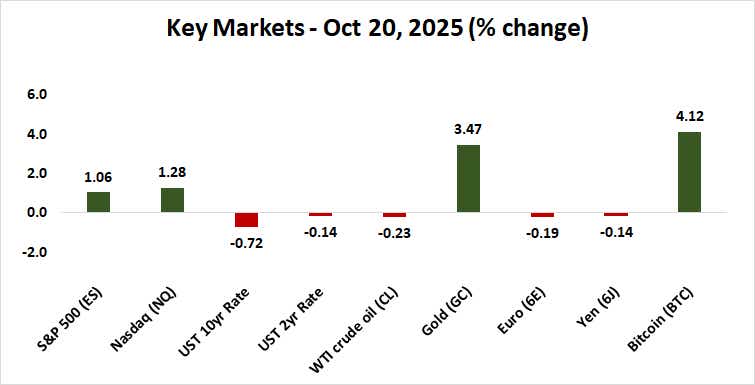

Stock markets stormed higher at the start of the trading week, seemingly shaking off the reticence that marked last week’s price action. The bellwether S&P 500 rose 1.06% while the tech-tilted Nasdaq 100 added 1.28%. Both benchmarks have now fully erased the brutal losses suffered on October 10, putting prices within a hair of record highs.

That rout was superficially linked to escalating trade tensions between the US and China, so it seemed straightforward to connect this boisterous optimism to comments downplaying the row from President Donald Trump. He confirmed that he will meet his Chinese counterpart Xi Jinping on the sidelines of a summit in South Korea next week.

Did cooling US-China trade fears really buoy the stock market?

However, markets struggled to make hay with similar efforts at walking back the flare up. Treasury Secretary Scott Bessent, US Trade Representative Jamieson Grier, and the president himself all sought to cool the temperature. “Don’t worry about China, it will all be fine,” Mr. Trump urged in a Truth Social post.

tastytrade

tastytrade

That is to say that the markets did not hear anything today that ought to have sounded novel enough for a material rethink of the situation. Moreover, gold prices shot higher, jumping 2.46% to reverse the sharp downswing ending last week’s trade and putting the metal back at record levels. That seems hardly in line with easing geopolitical risk.

In fact, gold’s relentless march higher since early September seems to reflect speculation about the implications of a multipolar world where the US and China oversee disconnected economic zones, where third countries that want to operate in both need a go-between vehicle for transactions. If tensions are easing, such demand ought to wane.

Tech earnings and US CPI inflation data are now in focus

A potent 1.1% rise for the all-important tech sector, where heavyweight Apple Inc (AAPL) posted an outsized rise of 3.94% after a favorable report about new-model iPhone sales, seems to be closer to reality. If nothing else, that might have encouraged a degree of pre-emptive repositioning ahead of this week’s flood of third-quarter earnings reports.

BLS

BLS

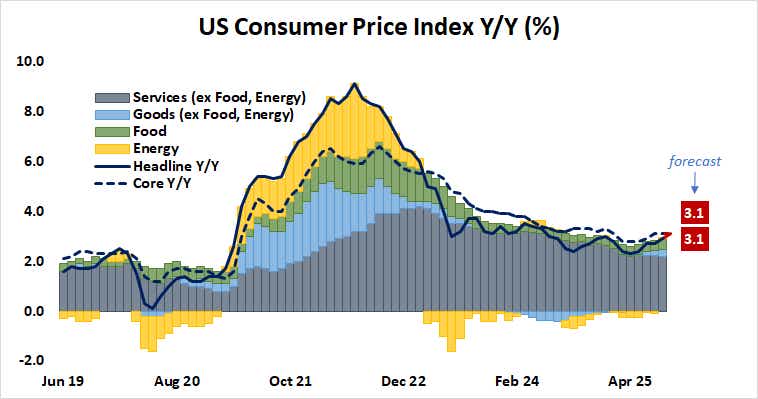

Results from market-cap stalwarts Netflix (NFLX) and Tesla (TSLA) take top billing. A rare glimpse of US economic data amid the ongoing government shutdown is also on the menu. The Bureau of Labor Statistics (BLS) will publish the consumer price index (CPI) report, offering a view of inflation trends.

The Trump administration said it would recall some furloughed workers to publish the figures because numbers from July, August, and September are used as the benchmark for the annual cost-of-living adjustment (COLA) to social security payments. It is expected to show that headline price growth hit a 16-month high at 3.1% year-on-year.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.