Zeno Mercer, senior research analyst at VettaFi, joins BNN Bloomberg to share his Hot Picks in robotics.

The AI and robotics sector is seeing renewed momentum as automation accelerates across industries and supply chains diversify. Analysts expect companies with exposure to both robotics and semiconductors to benefit from the next phase of industrial transformation.

BNN Bloomberg spoke with Zeno Mercer, head of robotics and AI research at VettaFi, about his top stock picks in the sector, including Hon Hai Precision Industry, Infineon and Teradyne.

Key TakeawaysThe AI and robotics sector is gaining momentum as automation spreads across manufacturing and supply chains.Hon Hai Precision Industry is diversifying beyond Apple into EVs, servers and medical robotics while expanding outside China.Infineon is positioned to benefit from energy-efficient power chips used in AI data centres and electric vehicles.Teradyne is rebounding from a cyclical slowdown with exposure to semiconductor testing and factory automation.Global reshoring and electrification are driving new investment opportunities in robotics and advanced manufacturing.  Zeno Mercer, head of robotics and AI research at VettaFi Zeno Mercer, head of robotics and AI research at VettaFi

Zeno Mercer, head of robotics and AI research at VettaFi Zeno Mercer, head of robotics and AI research at VettaFi

Read the full transcript below:

ROGER: Time now for our Hot Picks. Our next guest focuses on the AI and robotics sector. Here to give us his hot picks is Zeno Mercer, head of robotics and AI research at VettaFi. Zeno, thanks very much for joining us.

ZENO: Thanks for having me. How are you doing?

ROGER: I’m good. Let’s get right into it. Foxconn is a name probably everybody recognizes, but it trades under a different name, doesn’t it?

ZENO: Yeah, it trades under Hon Hai, based in Taiwan. A lot of people know it for its relationship with Apple as a blue-chip manufacturer of iPhones. Over the past several years, though, it’s been expanding into additional blue-chip opportunities in the world of physical automation and control — essentially, building and assembling increasingly complex products.

They’ve made strong progress adding new customers, segments and opportunities, expanding beyond consumer electronics and iPhones into electric vehicles, Nvidia servers and even hospital robots. That’s created a much larger addressable market and improved margins as the product mix shifts to higher-value offerings.

They’re also expanding geographically. As supply chains become more diversified, Hon Hai is growing beyond China into India, Vietnam, Mexico and other regions to strengthen manufacturing resilience. Sales are growing, margins are improving, and yet the stock still trades at relatively muted valuations — around half forward enterprise value to sales and roughly 15 to 17 times forward earnings.

So when you think about these robotics and automation players, they haven’t seen the same kind of investor hype that many AI or data-centre names have experienced.

ROGER: You’d think they’d go hand in hand, though, wouldn’t they?

ZENO: They do. The opportunity is only improving as AI begins to have more impact on systems design — creation, control and robotics. There are still around 400 million people working in manufacturing globally, so there’s a lot of room for further automation.

ROGER: Any concerns that it’s all moving too fast?

ZENO: It actually seems quite well managed. They’re expanding both geographically and by product segment, which reduces risk from customer or regional concentration. It’s a strong setup. A comparable Canadian name would be Celestica, which is also benefiting from electrification and AI-driven demand.

ROGER: Let’s move on to the next pick. Hon Hai finished up 3.5 per cent in Asia. Tell us about Infineon.

ZENO: At the end of the day, it all comes down to physics and power. AI is increasingly about controlling atoms with bits — robotics, in other words. That depends on power: how it’s generated, transmitted and used in data centres and powertrains.

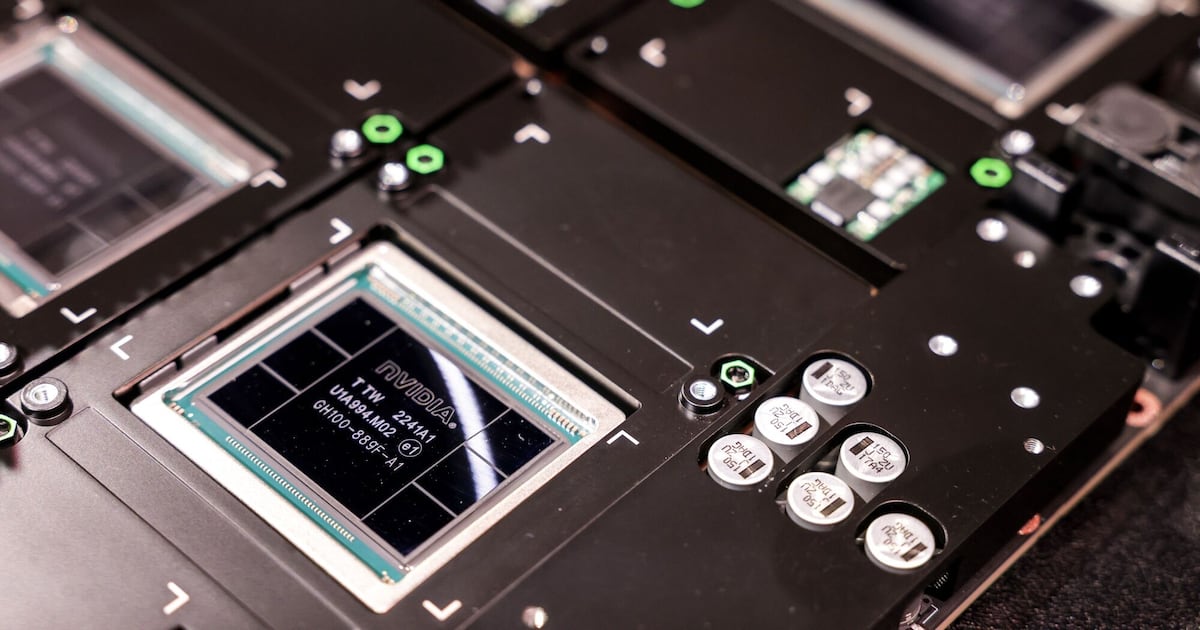

Infineon offers a great window into that world, with exposure to both AI and robotics. They’ve partnered with Nvidia to help power next-generation, high-voltage data centres that need more energy efficiency. They also produce proprietary wide bandgap semiconductor solutions — silicon carbide and gallium nitride — used in automotive powertrains and controls. Tesla is a customer, and they’re building deeper relationships with companies like Nvidia.

ROGER: I’ll jump in there so we can get your last pick before we run out of time — Teradyne.

ZENO: Teradyne sits at the intersection of semiconductors and robotics. At Robo Global and VettaFi, we like companies with exposure to both. Teradyne works on chip inspection for increasingly advanced wafers and system designs, with customers like Nvidia, AMD, Apple and Taiwan Semiconductor.

They’re coming out of a cyclical downturn tied to capital spending cuts, but now we’re seeing signs of recovery and new market opportunities emerging. We like companies like Teradyne that have multiple revenue drivers and aren’t overly reliant on one customer or industry.

ROGER: Perfect. Zeno, we’ll end it there. Thanks very much for joining us.

ZENO: Thank you.

ROGER: Zeno Mercer is head of robotics and AI research at VettaFi.

DISCLOSUREPERSONALFAMILYPORTFOLIO/FUND2317 TPENNNIFX ETRNNNTER NASDAQNNN

—

This BNN Bloomberg summary and transcript of the Oct. 22, 2025 interview with Zeno Mercer are published with the assistance of AI. Original research, interview questions and added context was created by BNN Bloomberg journalists. An editor also reviewed this material before it was published to ensure its accuracy and adherence with BNN Bloomberg editorial policies and standards.