With another kid in tow and only a precious few weeks of Canadian summer, Yuri Tereshyn’s love of fast cars took a back seat to a new priority this year—showing his children the beauty of the Canadian outdoors. Like many parents before him, the Toronto father and automotive enthusiast found himself in the market for a minivan.

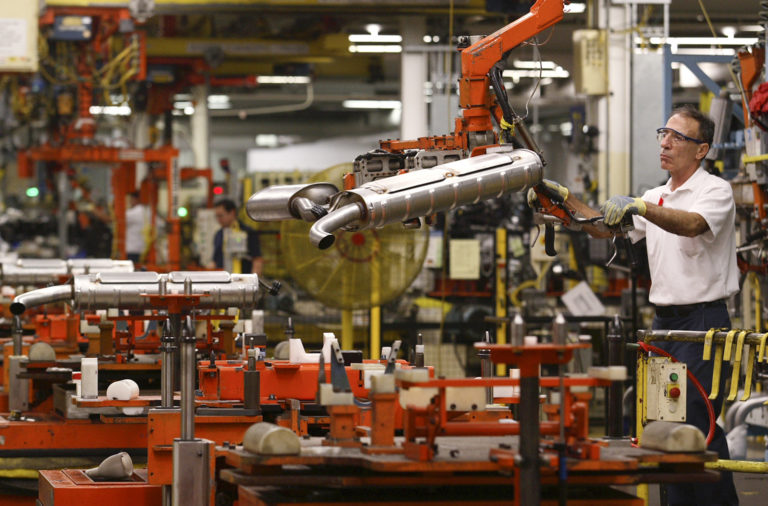

Before they were a ubiquitous Y2K symbol of suburban family life, minivans were a concept popularized by Chrysler in the 1980s and first created in Windsor, Ont., where they are still built today. The Stellantis Windsor Assembly Plant now employs nearly 4,500 workers and builds minivans like the Pacifica, Grand Caravan and Voyager for Chrysler parent company Stellantis.

Windsor’s Chrysler assembly plant became the epicentre for the company’s return to profitability in the ’80s when executive Lee Iacocca cut the ribbon on the minivan assembly line in 1983. Other automakers soon followed suit, using the models to debut new technologies like backseat TV screens and built-in vacuums.

Talking Points

Minivan sales have fallen in recent years, but they’re making a comeback as automakers reimagine retro designs and target road-trippers

The segment’s future is key for the nearly 4,500 workers who build vans at a Stellantis factory in Windsor, Ont., amid worries that automakers will shutter underperforming Canadian plants

Yet in the past few years, they seemed to disappear from roads. Tereshyn knows this better than most: he works for the car review YouTube channel The Straight Pipes, which has 1.79 million subscribers.

“Really, the views on our latest minivan review have been the lowest of any car,” said Tereshyn. His summer ended without a minivan in the driveway after he felt the models on the market were overpriced. He’s hoping to try again this fall.

Despite Tereshyn’s negative car-shopping experience, there are signs that minivans are slowly springing back to life. The question is whether it’s enough to sustain workers at the Windsor factory through a trade war. The minivan plant is Stellantis’s biggest operation in Canada, keeping its smaller casting plants and distribution centres humming. Its Brampton, Ont., plant faces an indefinite closure as of this month, while its battery plant in Windsor is still coming online.

Related Articles

By

Anita Balakrishnan and Joanna Smith

It’s just one example of the uncertainty rippling through Canada’s auto sector. Electric vehicle sales fell nearly 30 per cent year-over-year in the second quarter, as governments abandoned purchase incentives. U.S. tariffs have cost automakers billions, with several of them, including Stellantis, cutting production in Canada.

But its Windsor Assembly Plant has been a green shoot. Last month, Stellantis added a third shift back to the plant, which makes gas and hybrid minivans.

“Many people are under the impression that the minivan segment is a dying segment, and it’s actually up,” said Chrysler brand CEO Chris Feuell in an interview.

In fact, other companies are seeing a bump in the minivan market. Stellantis reported an 84 per cent year-on-year jump in Pacifica sales in the third quarter. Toyota’s Sienna hybrid also set a new Canadian sales record during the second quarter of this year.

“They need to have a rebirth that will define the brand as something other than just family haulers.”

Sales of vehicles like the Sienna are recovering from supply chain shortages during the pandemic, which coincided with its new focus on hybrid minivans, according to data provided by Toyota Canada spokesperson Philippe Crowe. Stellantis has seen more demand from rental fleets, but has also been marketing that the vehicle is made in Canada as more shoppers look to buy domestically in the face of the U.S. trade dispute.

Andrew King, managing partner of DesRosiers Automotive Consultants, said in a recent research note that there were some “unusual” patterns in Canadian car sales in the first half of this year, namely that small vans saw a sales boost after “years of declines.”

Minivans’ homely reputation may be changing as companies like Volkswagen launch new, electric models like the ID Buzz, its retro-inspired microbus rooted in a ‘60s and ‘70s aesthetic that has been lauded by designers.

A more old-school, sentimental approach may resonate with other minivan shoppers as more Canadians opt for more local trips instead of flying to the U.S., noted Jennifer Cowe, a lecturer at the University of British Columbia who studies nostalgia in media. Brands like Polaroid have survived not on the merits of the technology but on appealing to a more “quirky” customer base, she said.

“It’s reigniting these kind of earlier childhood nostalgic memories of a short vacation with my parents somewhere in Canada, just loading up the van and going,” said Cowe.

Minivans have gained a contrarian following among offbeat celebrities like Cleveland Browns quarterback Dillon Gabriel and Fast and Furious actor Sung Kang. Chrysler’s Feuell said the company is refreshing the model next year with a more “sleek” design to appeal to burgeoning customer bases like retired golfers, “pet parents” and “van life” camping enthusiasts.

For southern Ontario cities like Windsor and London, where 15.6 per cent of workers are in the manufacturing sector, Chrysler’s mission to reanimate minivan sales is more than just a matter of aesthetics. Many of the workers laid off from Stellantis’s Brampton plant are considering moving south to Windsor to take a job in the minivan factory, while other local workers are hoping to secure roles in its nearby battery factory.

Sam Fiorani, vice-president of global vehicle forecasting at AutoForecast Solutions, said that with so much political pressure on Stellantis to move production to the U.S., future Chrysler products will need to be “very popular” to maintain high volumes on Canadian assembly lines. AutoTrader data shows that while minivans are having a moment, their comparatively low levels of inventory mean they’re still the least likely vehicles to be featured on dealership lots.

“They need to have a rebirth,” Fiorani said of Chrysler, “that will define the brand as something other than just family haulers.”