Older Britons are being urged to not withdraw their tax-free lump sum from retirement savings early despite concerns Chancellor Rachel Reeves will launch a pension tax raid in her upcoming Autumn Budget.

New analysis from Murphy Wealth reveals that pension withdrawals have surged dramatically in light of these anxieties with 211,000 individuals accessing tax-free lump sums in the most recent tax year compared to 163,500 the previous year – a 29 per cent jump.

A Freedom of Information (FoI) request to the Financial Conduct Authority (FCA), commissioned by Murphy Wealth, found total withdrawals soared from £11.25billion to £18.1billion over the same period.

These figures indicate the typical tax-free withdrawal has climbed from £68,807 to £85,782, representing an additional £16,975 per person.

Britons are being warned to avoid making a crucial pension mistake

|

GETTY

.

The sharp increase comes as retirees rush to access their funds amid concerns about potential policy changes and new inheritance tax (IHT) rules.

Murphy Wealth’s calculations demonstrate that accessing substantial sums early in retirement could dramatically shorten how long savings last.

Their analysis examines someone earning Britain’s median salary of £37,430 who saves for four decades from age 25, contributing eight per cent annually with five per cent investment growth, accumulating £362,399 by retirement.

Should they withdraw £85,782 initially whilst drawing a “moderate” annual income of £31,700 as defined by the Pensions and Lifetime Savings Association (PLSA), their funds would be exhausted by age 74 without state pension support.

Rachel Reeves is preparing her latest Budget statement

| PA

Including full state pension benefits would extend this to 77, while avoiding the initial withdrawal entirely could stretch resources until age 84.

The rush to withdraw funds stems from two key factors affecting retirement planning decisions.

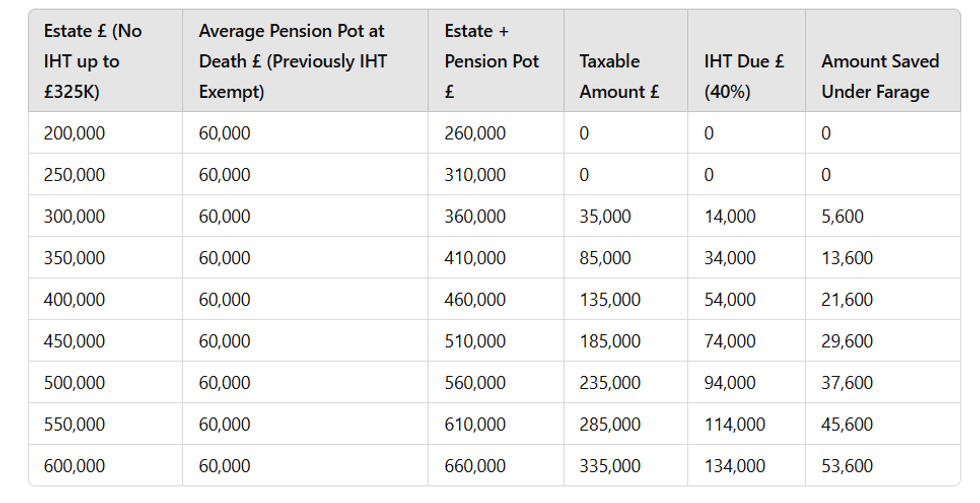

From April 2027, pensions will become subject to inheritance tax following announcements in the previous Budget, fundamentally altering estate planning strategies.

Additionally, widespread speculation suggests the Chancellor might reduce the current tax-free withdrawal allowance in November’s Budget, which presently permits 25 per cent of pension savings up to £268,275.

These anticipated changes have reportedly driven many retirees to access maximum amounts immediately rather than risk future restrictions.

The combination of confirmed inheritance tax modifications and potential Budget alterations has created unprecedented urgency among pension holders seeking to protect their accumulated wealth.

Adrian Murphy, chief executive of Murphy Wealth, explained that inheritance tax changes have “essentially reversed years of financial planning and advice” as pensions were previously passed tax-free to spouses or children.

“Now, though, more retirees are opting to spend the wealth they have built up in this wrapper, rather than letting it inflate the size of their estate and pass on a potentially large tax bill to their families,” he said.

Mr Murphy cautioned that whilst enjoying accumulated wealth is positive, sustainability remains crucial to avoid shortfalls in later retirement when care costs might arise.

He urged seeking professional guidance before making irreversible pension decisions based on speculation.

The wealth manager added: “That is an understandable decision. But, as these figures show, over the long term it can have quite serious financial implications for your retirement.

“Taking out a large tax-free lump sum may seem like a good option now, but it can significantly reduce the longevity of your retirement pot – in the two most extreme examples, by as much as a decade.”