Canada unveiled nearly $1.9 billion in funding for the mining sector Friday, joining allied countries in a co-ordinated push to loosen China’s grip on the metals market—including an unusual “equity-like royalty investment” to buy directly from Rio Tinto.

Canada Growth Fund’s $25 million investment to buy scandium from Rio Tinto’s Quebec plant is among the first round of 26 deals the country expects to come after the G7 meeting of energy and environment ministers in Toronto, with major support offered for rare earth and graphite companies.

Talking Points

The government announced over $1.8 billion of investments in mining companies and said it set the legal groundwork to use defence funding for mineral stockpiles, sending miners’ stocks soaring

Energy Minister Tim Hodgson said the deals are a proof of concept, as Canada and its allies use unconventional tools like “equity-like” investments

Trade tensions with the U.S. and China cast a shadow around the deals’ negotiations

Canadian officials and mining companies alike are betting that an investment blitz will cement the country as a key player in global energy and defence markets as allies seek to reduce reliance on China.

In addition to the investments, the government said it plans to use the Defence Production Act to stockpile critical minerals as it tries to advance its NATO obligations.

Share prices surged in the last hour of trading on Friday for many companies involved, including Northern Graphite, which saw shares rise over 25 per cent; UCore Rare Metals, which saw its price climb nearly 10 per cent and Nouveau Monde Graphite, which saw a 6.5 per cent bump.

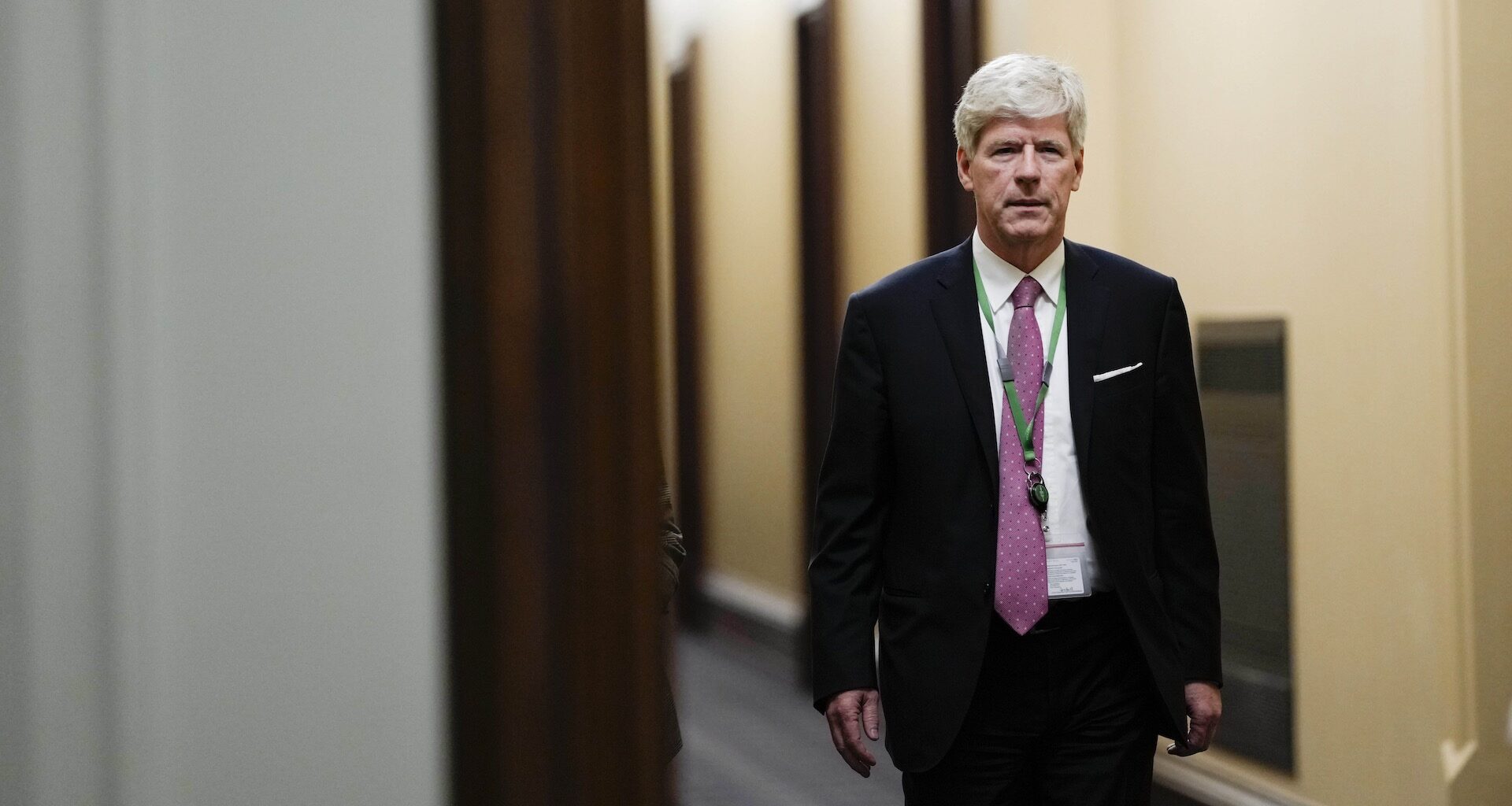

Energy Minister Tim Hodgson said the deals, which involve nine countries, are a “proof of concept” that Canada can lead the global “buyers’ club” even as a smaller country.

Related Articles

Trade tensions cast a long shadow over the week’s talks, with U.S. officials telling reporters that the increased co-operation with Canada on critical minerals comes despite “friction” slowing progress on other cross-border energy issues like the Keystone XL pipeline.

Both Canadian and American officials said that Russia’s invasion of Ukraine was a topic of deep discussion with their G7 counterparts. Ukrainian engineers will be part of a team helping develop a graphite-related technology in Quebec, a project that was awarded $14.1 million in Canadian government funding.

Graphite and rare earths are used for consumer products like electric vehicles, but also for defence applications like radar suppression and fighter jets, respectively.

Friday’s funding announcement is a small chunk of the nearly $30 billion in total mineral investments that the Canadian Climate Institute recommends Canada make by 2040. But it’s not insignificant for the country’s mining sector, where capital spending for the industry is expected to reach about $16.5 billion this year, but hit a decade-low of $9 billion in 2017.

The vast majority of the deals drew on existing funding pools, like the Canada Infrastructure Bank, Export Development Canada, Canada Growth Fund and the National Research Council. Canada also struck mineral purchase agreements with other G7 governments, including France and Germany, and multinationals like Japan’s Panasonic. Other firms committed to traditional foreign direct investments, with Norway’s Vianode pledging to build a $2 billion graphite factory in St. Thomas, Ont.

But “equity-like” investments like the one in Rio Tinto signal that the Canadian government is shifting its strategy, mirroring Washington’s growing practice of taking equity stakes in miners. Earlier this week, Hodgson hinted that the Canadian government was willing to consider a wider range of financing structures. Canada Growth Fund Investment Management CEO Yannick Beaudoin said the fund’s unique mandate lets it use more “innovative transaction structures” in its agreement with Rio Tinto, which grants it access to the plant’s expanded capacity of nine tonnes of scandium per year.

On Friday, Hodgson also said that many of the new deals include safeguards against commodity price crashes, adding that the government is also working with Teck Resources to help it set such price floors so it can make more “niche” minerals.

Though the U.S. and China reached an agreement this week in their dispute over rare earth materials, U.S. Energy Secretary Chris Wright said there was “frankly no disagreement” among G7 countries that they need to continue to invest in domestic mines to offset China’s outsized market power.

“China, frankly, used non-market practices to squish the rest of the industry, rest of the world, out of manufacturing those products,” said Wright in a press conference. “Everybody sees that now—across the G7 and across a broader group than that—we’re going to have to intervene.”

Prime Minister Mark Carney said Friday that Canada is approaching its own turning point in its relationship with China, which has been boxed out of Canadian mining investments for several years. Matthew Holmes, chief of public policy at the Canadian Chamber of Commerce, said that China could bring some interesting contributions to the discussion on critical minerals, but Canadian companies will still need the types of support announced this week to stay competitive.

“The big message I’m hearing from industry is that they can’t make good decisions for their business,” said Holmes, “and the progress announced today is helpful.”