Have you ever just sat at your desk at work and thought, “Man, if only some long-lost uncle would leave me a huuuuuge inheritance, I wouldn’t have to write any more articles”?

If you have, chances are you already have plans for the sudden RM1-10 billion from your fictional dead uncle. Loans to pay off, mansions to buy and renovate to your liking, and maybe even plans for a dramatic last Will and testament reading scene.

Or a funny one.

Or a funny one.

Sadly, real life isn’t that simple, and inheritance can be a lot more intimidating than it looks for first timers. In fact, we hadn’t even heard of the ominous term ‘probate’ until Maybank Trustees Berhad reached out to us and we came up with the Sepak Baldi Survey together.

After months of collecting data and analyzing results – and some serious reading up on laws – we’ve managed to learn a bit more about inheritance issues and how well Malaysians know them. We’ll be sharing some of these insights with you today, but first, some key stats:

A total of 1,003 respondents took the time to answer (thanks guys!)

Almost the same number of men (51%) and women (49%) answered

Most are between 18-44 years old (83.5%)

Most live in the Klang Valley (57.5%), although we have representatives from each state and overseas

Most speak English (70.1%) in a combination with Malay dialects (32.2%), Chinese dialects (30.9%), and Indian dialects (12.6%).

So with that out of the way, let’s get the ball rolling with perhaps the most shocking finding first…

1. 72% of our respondents (including us!) underestimate how long getting inheritance would take

When your conglomerate chairman father died last week and you’re still not chairman yet.

When your conglomerate chairman father died last week and you’re still not chairman yet.

When we asked how long people think it would take for their family to actually get the money if they died without a Will/Wasiat…

26% said within a month

34.8% said between 2-6 months

11.5% said a year

27.6% said more than a year

So what’s the correct answer? While circumstances may vary, the most likely answer would be more than a year, which only 27.6% got correct. And for the typical movie scene where there’s multiple mansions and cars to inherit, plus a scheming uncle trying to take the inheritance? That could take a much longer period.

Getting the money will take more time than uncle has left.

Getting the money will take more time than uncle has left.

A simplified process of what actually happens when someone passes away would look something like this:

If you have a Will/Wasiat instrument (Testate):

You name someone as executor in your Will/Wasiat. That person’s job is to take charge.

To legally act on your behalf (like touch your bank account, property, etc.), they need a Grant of Representation from the High Court (in Peninsular Malaysia and Sabah), or through Amanah Raya or District Office (in Sarawak). We’ll explain more in a later point.

Once the Grant of Representation is approved, they:

Use your estate to pay off debts first (loans, bills, taxes).

Distribute the remaining assets according to what you wrote in your Will/Wasiat.

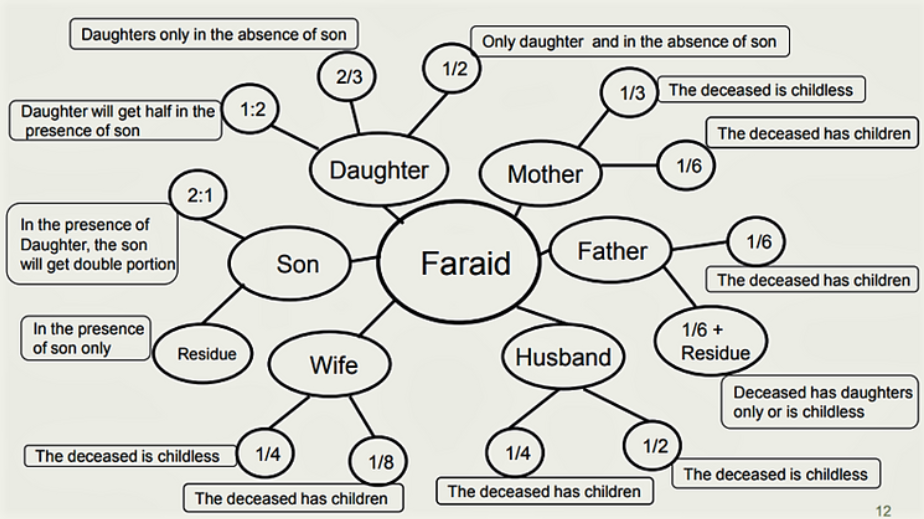

For Muslims, there are extra T&Cs due to something called Faraid, a.k.a. the Islamic inheritance laws:

With a Wasiat instrument, you can decide who gets what… but only if ALL your Faraid heirs agree.

If even one heir says “saya tak setuju”, the Faraid system applies as a dispute resolution. That heir will get their fixed share according to Faraid, and the rest can choose whether or not they want to honour the wishes in your Wasiat.

Wasiat allows giving up to ⅓ of your estate to non-Faraid people (like adopted kids, friends, charity). If you want to give more than ⅓, or adjust Faraid shares, all heirs must agree.

This is where having a trustee (like Maybank Trustees) helps. They manage and organise things professionally even if things can get out of control within the family.

But if you don’t have a Will/Wasiat (Intestate):

Your family members need to decide who applies to court to be the administrator (instead of executor).

Depending on the estate’s size or type, that person can apply for a Letter of Administration (LA) at the High Court, or a summary administration through the Amanah Raya or the Land Office for Small Estate Distribution.

Once LA is approved, same steps apply: debts cleared first, then distribution; but this time it follows intestate laws (a fixed legal formula), and not your personal wishes.

Simple right?

Lalisa did not, in fact, drop some money after seeing all those steps. GIF from GIPHY

Lalisa did not, in fact, drop some money after seeing all those steps. GIF from GIPHY

One thing’s for sure: these steps take time. Even if you have a Will/Wasiat instrument, getting a GP can take around 3-5 months, depending on whether there are complications with the Will/Wasiat, disputes among heirs, the complexity of the estate, or uncooperative beneficiaries, etc.

If you don’t have a Will/Wasiat, your family still needs to unanimously decide who will handle everything before even starting the LA process – which itself can take months, sometimes longer. Only after that does the real work begin: paying debts, collecting assets, selling assets, and slowly distributing everything to whoever’s entitled.

Of course, if you REALLY want that Kepong mansion, you can just buy it at the auction la.

Of course, if you REALLY want that Kepong mansion, you can just buy it at the auction la.

In fact, according to Maybank Trustees Berhad (MTB), the #1 reason probate (GP) or administration (LA) cases drag on forever is because… nobody actually knows what the deceased owned.

Without a proper list of assets, families end up wasting months calling banks, hunting down old investments, checking land titles, and arguing among themselves – so you can kiss your “few months” timeline goodbye. Even if you only had one bank account, the realistic estimate is 6-12 months minimum, not “immediately”.

MTB’s advice: write down your assets now, so your family isn’t stuck playing CSI: Harta Edition when you’re gone.

2. 40% of Malaysians learned the hard way that bank accounts freeze when someone dies

Artistic rendering of your bank accounts after your death.

Artistic rendering of your bank accounts after your death.

When we asked Malaysians about the biggest practical lesson they learned from losing a loved one, the top four answers are:

Always prepare a Will/Wasiat instrument (56.3%)

Bank accounts and assets freeze when somebody dies (40.2%)

Funeral costs can kill you (34.4%)

Debts do not die with the person (31.4%)

Let’s talk about that second one, because it catches almost everyone off guard.

You might think, “My spouse already gave me their ATM card,” or better yet, “We share a joint account, so I’ll still have money for rent, groceries, and cat food if anything happens”. In fact, that’s what 43.4% of our respondents think.

Unfortunately… nope.

Once the bank is officially notified of a death, the account is automatically frozen. This may apply to joint accounts too (which 15.1% of our respondents guessed correctly!), unless the account was set up with a survivorship clause.

It’s not the bank being heartless. Every bank has their own internal policies. But at the end of the day, the law is clear: if you have a Will/Wasiat, your stuff follows that. If you don’t, then it follows intestate law (the default formula).

And here’s the part that stings: accessing that money can take months, and a lot of paperwork. This writer learned the hard way too when his mother passed away, and he’s not alone; as 40% of Malaysians surveyed share the same experience.

We spoke to Dato’ Nor Fazlina Mohd Ghouse, CEO of Maybank Trustees Berhad, who explained why banks freeze accounts:

“When a person passes away, financial institutions may freeze their accounts to protect the monies from being released to unauthorised parties. This applies to individual account, and may include joint accounts unless there’s a survivorship clause or legal arrangements in place.”

– Dato’ Nor Fazlina Mohd Ghouse, CEO of Maybank Trustees Berhad, to CILISOS.

Dato’ Nor Fazlina Mohd Ghouse, CEO of Maybank Trustees Berhad

Dato’ Nor Fazlina Mohd Ghouse, CEO of Maybank Trustees Berhad

But here’s the good news – Maybank Trustees Berhad sees this hassle, and are working on a proposed solution to help you access your joint accounts funds with Maybank more quickly.

“The proposed solution is designed to provide immediate access to essential funds by the surviving account holder. It’s a practical solution to ease financial stress during an emotionally challenging period.

But here’s what many people don’t realise — this account isn’t just helpful after death. It also kicks in if you suddenly lose mental capacity during your lifetime. So whether it’s a tragic accident or age-related decline, this proposed solution helps ensure your loved ones aren’t left financially stuck when you’re unable to act.”

-Dato’ Nor Fazlina Mohd Ghouse, to CILISOS.

Disclaimer: Please note that the proposed solution is still a work in progress and is provided for informational purposes only. It remains subject to ongoing development, review, and relevant approvals.

And guess what? Cilisos readers get first dibs.

Maybank Trustees Berhad is opening an Early Access Pilot Program, and you can be part of it. Just click this link to learn more and set an appointment with the Maybank Trustees team. This is one way to make sure your family isn’t left stranded if something happens to you – whether you’re mentally incapacitated, or if you’ve already jalan dulu.

Sign up for the Early Access Pilot Program here

Sign up for the Early Access Pilot Program here

Because let’s be real, when something suddenly happens, access to quick cash is limited. While you’re still alive but incapacitated? Almost zero options. After you’re gone? It’s usually just EPF, insurance, or the emergency stash under your tilam.

Speaking of which…

3. Most of our respondents may get faster money… through EPF and insurance!

Our son running out of the funeral home be like

Our son running out of the funeral home be like

When asked what they’re leaving behind for their loved ones, the top three answers are:

My savings and EPF [71%]

Insurance money [51.3%]

House(s) or land [43.6%]

Interestingly, the top two answers for this question are a bit special when it comes to inheritance. While houses, land, cars, and even your rantai emas fall under the definition of your estate; EPF savings and life insurance payouts are governed by different laws altogether, meaning they won’t go through the same process.

That feeling when someone made YOU their EPF nominee.

That feeling when someone made YOU their EPF nominee.

For life insurance, the length of time depends on which company you bought the policy from. Generally though, if your death isn’t suspicious, and if your nominee(s) didn’t forget any documents or mess up while claiming, they can expect to get the money in two months or less.

EPF, on the other hand, can be a lot faster IF you’ve already nominated someone: nominees can get their entire portion within two weeks after all the required documents have been sent for processing. No court drama, no extra paperwork, just smoother sailing.

But as usual, there’s always that pesky fine print:

Muslim nominees → not automatic owners. Think of them as temporary caretakers – the money still needs to be shared according to muafakat, a.k.a. mutual agreement among one’s Faraid heirs. No agreement? Then Faraid law will masuk campur.

Non-Muslim nominees → jackpot! Your nominee actually gets the cash, and your Will won’t override it unless you change the nomination while you’re alive.

The same rule also applies for insurance or Takaful.

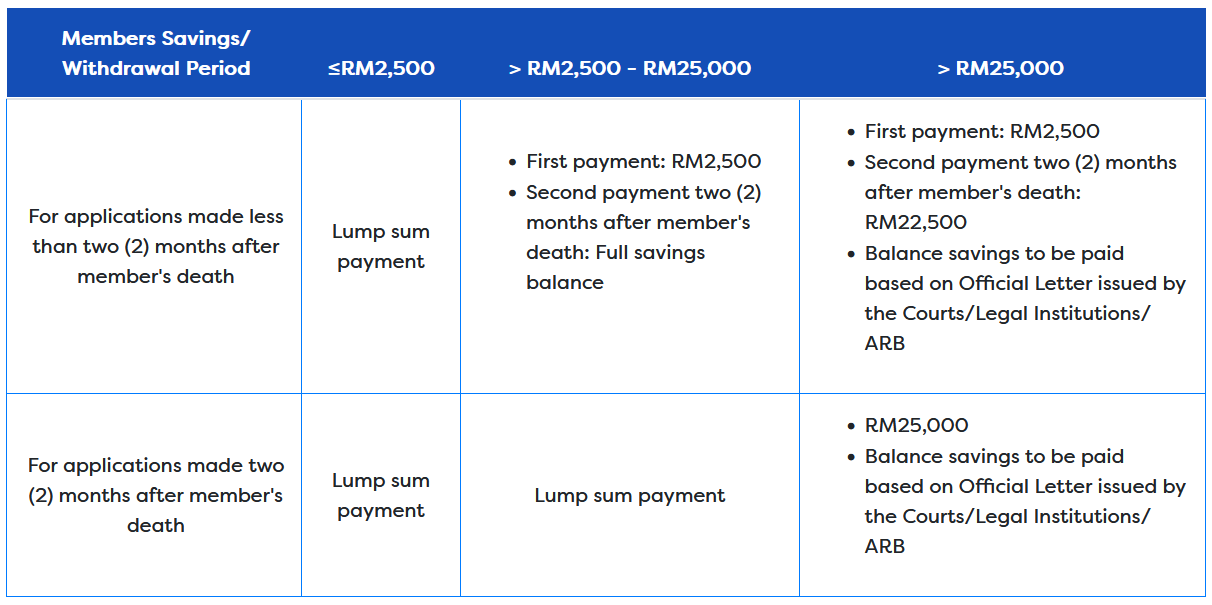

If you haven’t named someone as a nominee, the process is a bit longer and complicated, and depends on both how much money you have left in your EPF as well as when your next-of-kin decides to withdraw.

Timeline for non-nominees. Image from EPF.

Timeline for non-nominees. Image from EPF.

Now here’s the kicker: our survey found that only 42% of Malaysians have actually made these nominations for their EPF or insurance/Takaful. Translation? More than half are leaving their families with unnecessary red tape!

Moral of the story: Go check your nominations + your Will/Wasiat. If not, your money might not go where you thought it would.

If you’re a nominee, on the other hand, you should know that…

4. Inheritance is not free!

Not just because your dad owed Davy Jones, either.

Not just because your dad owed Davy Jones, either.

When we asked people what are the most mafan things about inheritance, the most popular answers are:

The confusing laws and paperwork [62.5%]

Long legal process (i.e. probate) [60.4%]

That it actually takes a long time for my loved ones to get my harta [45.1%]

Family fighting over that harta only accounts for 15% of answers, because let’s face it, fighting the red tapes is even harder! Not only will you need to go through long legal processes that we talked about earlier, but doing that will also cost you more money.

For example, say someone leaves you a house.

Unlike this house, real houses – like all movable and immovable assets – fall under the Small Estates (Distribution) Act 1955. If the value of any asset in the estate (either movable or immovable or both) is below RM5 million, it falls under the Small Estate category.

Unlike this house, real houses – like all movable and immovable assets – fall under the Small Estates (Distribution) Act 1955. If the value of any asset in the estate (either movable or immovable or both) is below RM5 million, it falls under the Small Estate category.

If said person leaves you that house without a Will/Wasiat, you can’t just move in and buat macam rumah sendiri. The property still needs official approval before you can legally transfer or sell it. How mafan it gets depends on the size of the estate:

Small Estate (≤ RM5 million, including cash + house): Apply to the Land Office for a Distribution Order. For movable estates less than RM600k, some people apply for Letters of Administration (LA) through Amanah Raya (Public Trustee) instead, but this follows their own fee scale.

Bigger or more complex estate: Say hello to the High Court, where there’s more paperwork, higher legal fees, and way longer wait times, all just to get Letters of Administration.

For Muslims: You’ll also need a Faraid Certificate to figure out who the rightful heirs are before anything can be distributed.

Now, if the person left a Will or Wasiat, things are way smoother. You still need a Grant of Probate (GP), but the process is faster, less stressful, and cheaper. Plus, you’ll already have a named executor to handle everything, which makes the whole process much smoother.

Of course, this is just the TL;DR version. Real-life situations can get way more complicated depending on your assets and family drama.

The cost of owning multiple high end properties.

The cost of owning multiple high end properties.

And here’s the thing: according to Maybank, a proper Will or Wasiat instrument in Malaysia can cost as low as RM298. But… just because you have one, doesn’t mean your harta will magically distribute itself. Someone (a.k.a. your executor) still has to step in to actually do the work.

Their job? Collect your assets, pay off debts, cancel credit cards, settle loans… only then can they start distributing whatever’s left. From our survey, most Malaysians would hand this responsibility to:

The spouse (57.5%)

A corporate entity (13.8%)

Their closest friend (11.1%)

But it’s not as straightforward as it sounds. In reality, before the executor even starts, families are often already arguing about who gets the house, the car, or the cash. Which means your “chosen one” isn’t just handling the paperwork, they’re also handling family drama.

And if that executor is your spouse or best friend? They’re juggling grief and the chaos of court forms, frozen accounts, and maybe even your abang ipar demanding the Proton Saga. Heavy stuff for someone who never signed up to be a lawyer.

When your BFF named you as their executor to mess with you one last time. GIF from GIPHY

When your BFF named you as their executor to mess with you one last time. GIF from GIPHY

That’s why it’s a good idea to appoint a corporate executor like Maybank Trustees. They do this day in, day out. No drama, no berat sebelah to anyone, no tears – just proper estate management and administration, with a Will or Wasiat instrument starting from only RM1,080.

So yeah, getting an inheritance can cost a lot of money, time AND drama, unless you plan ahead. Plus, that’s not even the only reason you should plan ahead, because…

5. A lot of Malaysians have their own preferences for leaving inheritance, but… it’s not always that easy

Nothing but headaches!

Nothing but headaches!

Let’s say you have a lot of money to leave behind, and a bunch of people to leave it behind to. Would you rather spread it equally, or give more to who you think deserves it more? When we asked our respondents that question, the top three answers are

I’ll be fair and leave equally (36.4%)

I’ll give more to people I like more (25.4%)

I’ll give more to the less financially secure (21.1%)

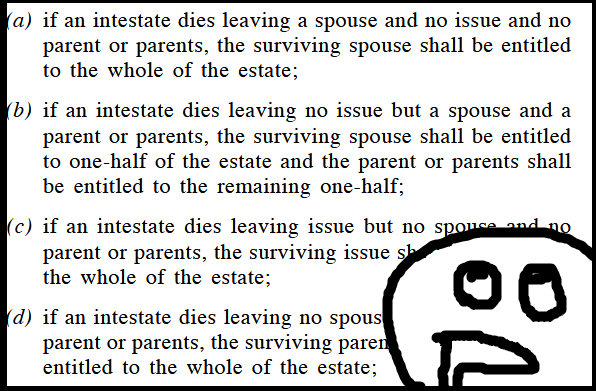

If you’re a non-Muslim, it is possible to leave your money whichever way you choose by writing a Will. But if you die without one (aka intestate), then sorry boss… your harta gets split automatically under the Distribution Act 1958 (if you’re in Peninsular Malaysia & Sarawak) or the Intestate Succession Ordinance 1960 (if you’re in Sabah).

In other words: no Will = the law decides who gets what. Here’s a sample breakdown straight from the Distribution Act 1958:

It goes on for a few more lines. Read the full version here.

It goes on for a few more lines. Read the full version here.

Basically, the law already has a “default formula” for who gets what. Under Section 6 of the Distribution Act, your next-of-kin have fixed shares depending on who’s still around. For example: if you die without a Will and leave behind kids + parents (but no spouse), your parents will always get ⅓ and your kids will share the remaining ⅔.

For Muslims, if you have a Wasiat and everyone’s cool with your pesanan (like who gets what), then boleh jalan je terus with what you wrote. No drama, everyone agrees, and the estate is distributed according to your Wasiat instrument.

But if even one Faraid heir says “Aku tak setuju!”, the Faraid automatically kicks in as the dispute resolution tool, meaning the estate will be distributed according to the fixed shares already set aside via Faraid to heirs like parents, spouse, children and so on.

Wah. Img by Malaysian Financial Planning Council, taken from iProperty.

Wah. Img by Malaysian Financial Planning Council, taken from iProperty.

Here’s the interesting part: through a Wasiat instrument and as prescribed by the hukum, Muslims are allowed to give up to ⅓ of their estate to non-Faraid beneficiaries – like adopted kids, besties, or charity (amal jariah). Wanna leave something to your loyal friend or the animal shelter you love? That’s where this portion comes in. But if you want to give more than ⅓, you’ll need consent from all your Faraid heirs. No consent, no deal.

Moral of the story: if you don’t write a Will or Wasiat, your estate may not go where you intended – it’ll follow the law.

So yeah, if you want to take control of your legacy…

It’s never too early to start planning your own death affairs

Watch your back!

Watch your back!

While a lot of our respondents are planning to write their Will/Wasiat after a big life event…

After having enough stuff to leave behind [44.6%]

After death is certain [15.5%]

After I get married [14.4%]

After I have children [12.2%]

After a health scare [8.6%]

…it definitely wouldn’t hurt to get a head start in understanding inheritance laws and making preparations early.

Which is why local financial institutions that specialize in these matters, like Maybank Trustees Berhad (MTB), want to help Malaysians prepare for this seemingly taboo topic of their exit.

“Let’s be real – estate planning isn’t just for orang kaya. It’s about making things easier for your loved ones when you’re no longer around. And it doesn’t have to be complicated. Everything starts with a proper Will or Wasiat instrument- that’s the most basic, most important first step. No Will, no clarity… just confusion, arguments, and stress for the people you leave behind.

At Maybank Trustees Berhad, our goal is to humanise this whole process — make it less intimidating, more affordable, and actually useful for everyday Malaysians. We’re here to help you plan with confidence, clarity, and a lot of care.”

Dato’ Nor Fazlina Mohd Ghouse, CEO of Maybank Trustees Berhad

If there’s a takeaway to this article, it’s that inheritance stuff is a lot more complicated than it looks like at first glance, so it’s probably best to not wait until you’re dying to start thinking about it.

Before we bid adieu… Maybank Trustees is offering 20% off for Cilisos readers on all packages for their Will and Wasiat Writing Services* from now til 30 November 2025. You can find out more by checking out this website!

Click here to find out more. *Applies to all packages where Maybank Trustees is the appointed executor. T&C Apply.

Click here to find out more. *Applies to all packages where Maybank Trustees is the appointed executor. T&C Apply.

As usual, as thanks for reading this article to the very end, here are some interesting stats from the survey that we didn’t include above.

Most common shocking secrets among respondents include having nasty stuff in their browser history (29.3%), secretly being broke (28.7%), and not being religious (22.5%).

Freedom from bills and responsibilities top the list (40.1%) of things to look forward to when you die. Tough life, huh?

Who do Malaysians trust most to handle their stuff when they’re gone? It’s their spouse or partner, at 57.5%.

Not achieving anything in life is our most popular regret (37.7%), beating out not being in a fulfilling relationship (24.4%) and saving too much money (22%).

When it comes to family members fighting for harta, the most popular suspects among our respondents are their spouse/partner (20.6%), their mom (15.6%), and their random aunt/uncle (14.7%).

Business partners (3.4%) and the government or religious authorities (3.5%) are the least trusted entities to handle inheritance.

A business empire (5.5%) is the least likely thing to leave behind among our respondents.

Only 8.1% of our respondents won’t have any regrets if they were to die when answering the survey.