Prime Minister Mark Carney’s Liberal government unveiled its federal budget for 2025, and it has a heavy emphasis on investment in hopes of stimulating the economy amid political and financial uncertainty.

Finance Minister François-Philippe Champagne delivered the budget on Tuesday, Nov. 4, in the House of Commons, acknowledging the challenges, but also highlighting the opportunities for Canada.

“We will explore new markets and sell more of the best of what Canada has to offer. We will build here at home — stronger industries, nation-building infrastructures, and millions of more homes for Canadians,” he said in his remarks. “And, we will empower Canadians by making life more affordable, creating new career opportunities, and ensuring every generation can get ahead.”

@FP_Champagne/Instagram

The federal government’s plan includes “spending less” on operations so it can focus more on “strategic investment.” This means cutting public service jobs by 40,000 from their 2024 peak by 2028 to 2029.

With a $78-billion projected deficit for 2025 to 2026, the 2025 federal budget forecasts $60 billion in savings over five years.

But what does this mean for the everyday Canadian? Daily Hive spoke with tax expert and BDO Canada’s domestic tax leader, Greg London, on the hits and misses in the federal budget 2025’s proposed tax measures.

Automatic federal benefits

Mehaniq/Shutterstock

The 2025 federal budget proposes to amend the Income Tax Act to allow the Canada Revenue Agency (CRA) discretionary authority to file a tax return on behalf of low-income individuals.

The measure, initially announced in October, will kick in for the 2026 tax year. It will help more than 5.5 million low-income Canadians receive benefits and credits they’re entitled to.

London was glad to see this in the budget.

“If you really want to help out the Canadian population, there are people that sit in those really low tax brackets that leave a ton of unclaimed benefits, and it’s because they either don’t understand, or they’re not sure how to access them,” he explained.

London added that the measure includes checks and balances that would allow an individual to opt out or double-check their tax return before it is filed.

According to the budget, before filing a return on behalf of an eligible individual, the CRA would provide that person with the information it has available at the time in respect of their tax return. The person would then have 90 days to review it and submit changes to the agency.

For more information on eligibility, check out the budget’s personal income tax measures.

Axing the Goods and Services Tax for first-time homebuyers

GBJSTOCK/Shutterstock

Announced in March, this bold new policy eliminates GST on home sales up to $1 million for first-time homebuyers.

London said this measure is helpful for people trying to enter the housing market.

“For first-time homebuyers, it was just such a disincentive [to purchase a home] because everything went against them,” he explained. “They had to put a big down payment down. Housing prices are so aggressive right now, so I think it will swing it massively.”

This change is currently before Parliament as part of Bill C-4.

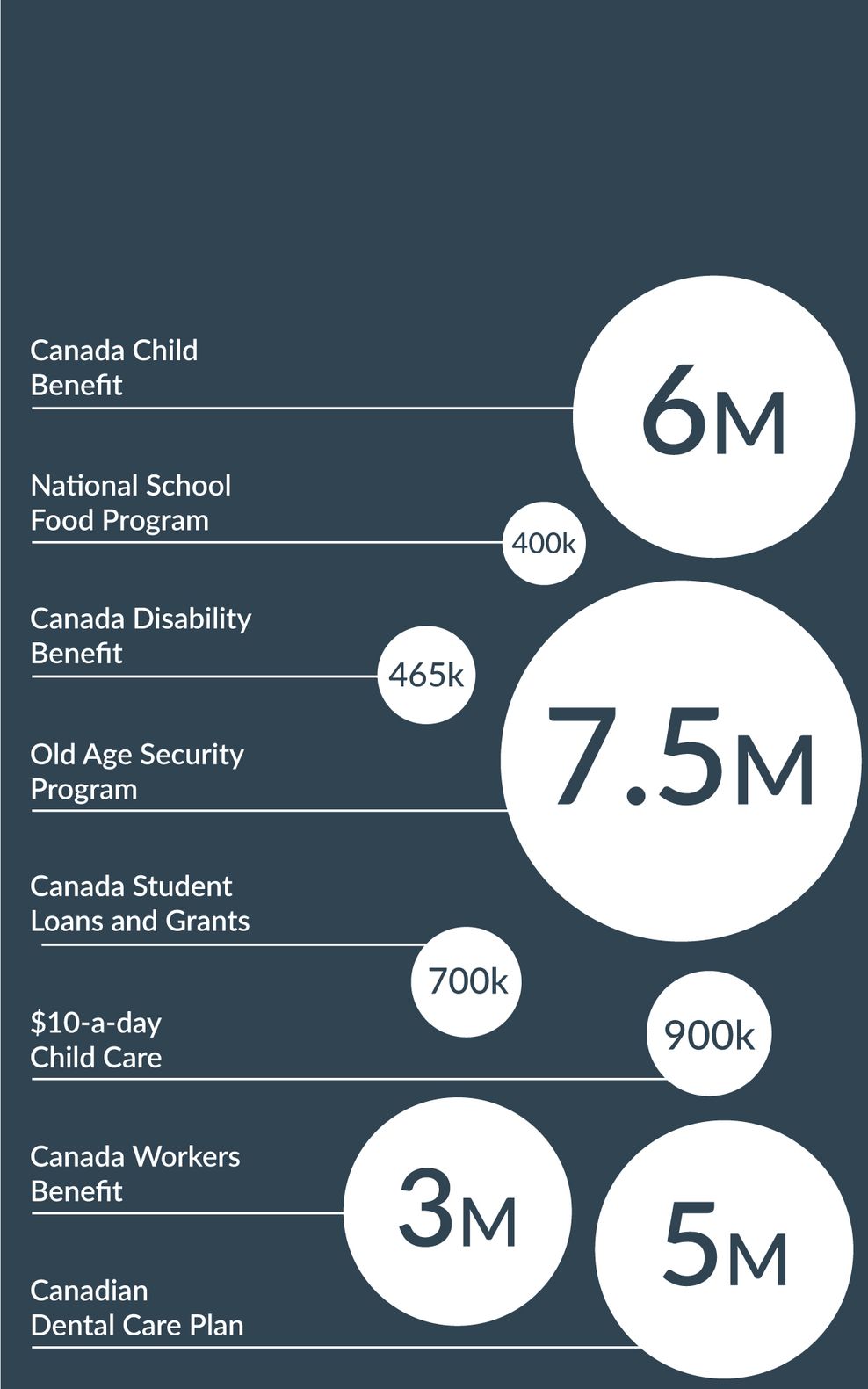

No cuts to tax credits and benefits

The government has pledged to protect social programs implemented under former prime minister Justin Trudeau’s government.

This includes tax credits and benefits like the Canada Child Benefit, Canada Disability Benefit, Old Age Security, Canada Workers Benefit and the Canadian Dental Care Plan.

The figure below shows how many Canadians rely on these programs.

Government of Canada

Business incentives

A significant part of the Canadian government’s plan is investing in “protecting our sovereignty,” which includes building a strong economy.

London said this is why there are a lot of proposed incentives and credits in the budget to increase home-grown productivity.

One is the Productivity Super-Deduction, which is a set of “enhanced tax incentives” covering all new capital investment that allows businesses to write off a larger share of the cost of these investments right away.

London explained that this essentially allows companies involved in manufacturing and processing to write off purchases like buildings and equipment as soon as they acquire them.

“It’s going to stimulate,” he said. “Hopefully, companies may be making investment decisions that otherwise they might not have made.”

Another plus the tax expert found in the federal budget for businesses is the enhancement of the Scientific Research and Experimental Development tax incentives (SR&ED).

The government has proposed to increase the annual amount of money businesses can spend in order to earn enhanced credits from $3 million to $4.5 million.

“That will certainly enhance companies’ abilities to get credits back on the dollars they spend on research and development, and keep some of that in Canada, versus moving it out,” explained London.

The tax expert said these measures are particularly important amid the trade war, especially with “so much turmoil” in the United States, a country that he said we used to look to for stability.

“I think Carney is trying to make us more self-sufficient. Keep everything here, keep people here, keep production here,” explained London.

Federal budget 2025 tax misses

@FP_Champagne/Shutterstock

London said he was expecting to see certain measures on the revenue side that didn’t show up in the budget. This includes possible taxes on high-income earners and corporations.

“If anything, there was an elimination, and you could see that Carney was rolling back some of Trudeau’s measures,” he said.

The tax expert said he was particularly surprised that the budget plans to cut the luxury tax on aircraft and vessels, and the underused housing tax. These measures were implemented in the Trudeau era and targeted wealthier Canadians.

“I think they want to keep the high-income earners in Canada, and I think they want to increase productivity,” London explained. “To do that, you need businesses that are producing goods here and the high-income earners staying here and not running for the hills and going to more tax-friendly jurisdictions.”

London added that the middle-class tax cut, implemented in July, won’t “massively change affordability for everyday Canadians.”

He noted, however, that overall, the budget was built around the future.

“I’ll be honest, I was proud of the measures taken,” said London. “I know it’s hard on the deficit side, but one of the things that I personally worried about with the last decade in Canada is that we were very focused on short-term and not focused on long-term.”

He said the results won’t be visible overnight.

“As much as people don’t want to hear that, and they’ll say, ‘Well, I need to know what’s going to help me say, Tuesday or Wednesday,’ I do like the investing, because that’s how we’ll have long-term sustained success in Canada.”

The proposed budget still needs to pass the confidence vote the week of Nov. 17.