One in five Canadians say they’ve skipped paying a bill to afford groceries in the past year, according to new polling by Nanos Research for CTV News.

The survey found adults under 55 were four times more likely to put off payments for their cars, credit cards and electricity bills to buy food. Outside a grocery store in Charlottetown, shoppers said they feel the pressure.

“My phone bill, the rent, the groceries…my car insurance, the fuel,” said Almas Patel, 23, listing his monthly expenses. “It all adds up.”

His friend, Matthew Batunde, 29, echoed the sentiment.

“The more (prices) are getting higher, it’s affecting our daily bills,” he said.

Nick, 24, said he prioritizes paying his bills, but that means adjusting his shopping habits.

“I usually try to aim for as many sales as I can,” he said.

Canadians skipping bills to afford groceries: Nanos FILE: A shopper checks prices as they shop at a grocery store in Montreal, Wednesday March 27, 2024. THE CANADIAN PRESS/Christinne Muschi

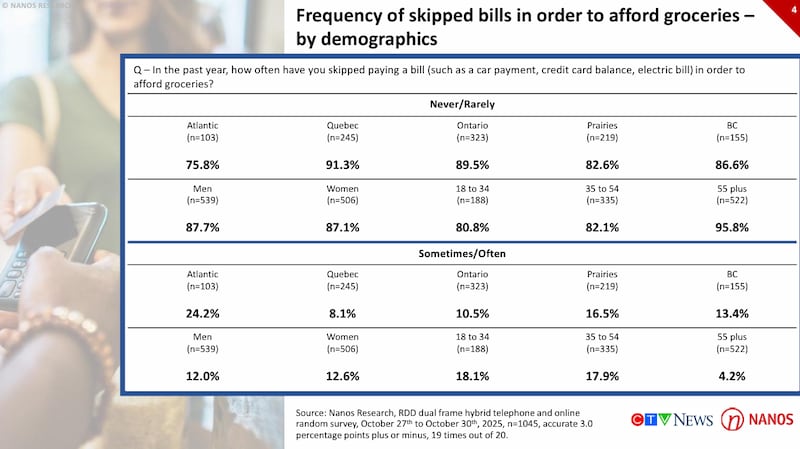

The Nanos survey found 18.1 per cent of those aged 18 to 34 said they missed a bill sometimes or often. That nearly matches the 17.9 per cent reported by those 35 to 54. The figure drops to 4.2 per cent for those 55 and older.

Inflation and high housing costs are major factors contributing to the generational divide, says chief data scientist Nik Nanos.

“It’s quite striking. I think in any other world, this would be considered an epidemic,” he said. “What’s clear is that there’s a significant proportion of Canadians that are facing those really tough choices.”

Do you have any creative ways you’ve been getting around high grocery prices? Share your story by emailing us at dotcom@bellmedia.ca with your name, general location and phone number in case we want to follow up. Your comments may be used in a story on CTV News.

Nanos adds older Canadians are more likely to have no mortgage, or a small one. They may be relying on a pension or on savings and investments, and are perhaps empty nesters.

“Those over 55 years of age, they’re just more likely to be in a secure and solid financial position,” he says. “If you’re a young person or if you’re a middle-aged person with a family, you’re probably thinking about, is rent or housing going up? And how secure one’s job might be.”

The regional breakdown also shows notable differences. In the Atlantic provinces, 24.2 per cent of respondents said they skipped a bill sometimes or often, higher than any other region. That compares with 16.5 per cent in the Prairies, 13.4 per cent in British Columbia, 10.5 per cent in Ontario and 8.1 per cent in Quebec.

Canadians skipping bills to afford groceries: Nanos This table breaks down the frequency of skipped bills in order to afford groceries, by demographic. Source: Nanos Research

Canadians skipping bills to afford groceries: Nanos This table breaks down the frequency of skipped bills in order to afford groceries, by demographic. Source: Nanos Research

It’s important to note a smaller sample size in Atlantic Canada could be influencing the numbers.

However, the data aligns with other regional research, says Joshua Smee with Food First NL. He says all four provinces have upwards of 25 per cent of people reporting themselves as food insecure, and there are economic factors at play.

“Our unemployment rate has generally been higher than the rest of the country. So there are more people struggling economically,” he says. “There might be more people relying, for example, on things like social assistance or income support.”

Smee says experts have identified how to solve this issue but Canada must move past considering it a “charity problem.” While food banks and meal programs are essential in the short term, they serve as band-aid solutions.

“The primary thing is getting more money into the pockets of the lowest-earning people,” he says, citing the Canada Child Benefit as an example. “That could include bringing up minimum wages because lots of people who are working, including full-time, are still food insecure, are still struggling to pay bills, are making those kinds of compromises.”

Men and women reported similar experiences. Among men, 12 per cent said they sometimes or often skipped a bill, compared with 12.6 per cent of women.

Methodology

Nanos conducted a random-digit dial, dual-frame (landlines and cellphones) hybrid telephone and online survey of 1,045 Canadians aged 18 and older from Oct. 27 to 30, 2025, as part of an omnibus survey. Respondents were recruited by live agents by telephone and completed the survey online. Results were statistically checked and weighted by age and gender to the latest census, and the sample was geographically stratified. The margin of error is plus or minus 3.0 percentage points, 19 times out of 20.

The research was commissioned by CTV News and conducted by Nanos Research.