Weekend Reading – Retirement is not an age

Well hello!

Welcome to a new Weekend Reading, suggesting that retirement is not an age, at least for me.

More on that in a bit and my inspiration for the post this week.

In recent reads you would have found on my site:

Here are more than 3 stocks and ETFs we bought so far in 2025.

3 Stocks or ETFs I Bought in 2025

And…a reminder I think you should avoid spending regrets. This includes on your beloved pets.

Weekend Reading – No Spending Regrets

Weekend Reading – Retirement is not an age

I’ve been writing about our personal finance journey, the good, the bad and the in-between for the last 16+ years here. I’m not shy about my mistakes – I’ve made a bunch! Nor, do I shy away from some of our fortunate success stories. Everything has brought me to here.

Life is for the living and the learning…

My co-workers now know I will be retiring at the end of March 2026. So do you.

I’m certainly looking forward to that date and figuring out what’s next.

I’ve thought this way for decades, since I’m retiring from my workplace career sooner than most, but to me retirement is not an age but a financial number and therefore a lifestyle decision. But I can appreciate many people don’t see it that way. For some evidence, here are some recent, verbatim comments after my announcement at work came out – although everyone seemed very happy for me at the same time which I really appreciate. I have a lot of caring co-workers who I respect back too…

Mark, what are you going to do with your time?

Geez, you’re too young to retire!

Do you think you’ll ever come back?

Do you think you’ll ever work again?

Won’t you be bored?

I don’t know all the answers to these questions…some are tough ones to answer.

But, I will be fortunate in that I will have some extra time and energy to figure it all out. 🙂

And to me, for us (since my wife is now retired), that’s exactly what retirement means to us – a lifestyle decision based on what we intend to spend (with a bit more money saved for emergencies, some extra money for buffer in a financial future we can’t see coming…)

You’ll remember this post below, and I encourage you to check it out again since this is what we intend to spend per year – it’s the foundation for our early retirement decision and not waiting until age 55 or age 60 or even later – even though working longer would mean much more money. That’s hardly everything to us. It’s not our goal in life to have more and more…

Is that annual budget too low? Too high?

We’ll find out in spring 2026.

The good news is based on recent spending patterns in 2024 and 2025 year to date, most of this income will be covered by a mix of dividends and distributions from our portfolio – cashflow from the portfolio. That spending decision may or may not be the same for you.

Our retirement income planning projections work has demonstrated that our portfolio is now projected to deliver our desired annual income per year, with 3% inflation, until age 95.

In the coming years, I will refresh that post to share some spending actuals vs. initial estimates and see how far off we might be. Our real life could be very different than living in some spreadsheet! 🙂

How do you feel about retirement or retirement income planning? Is that an age related thing? Do share.

Weekend Reading – Beyond retirement is not an age

My friend at @DivGrojourney wondered about my take on this ETF: FLVI (Franklin International Low Volatility High Dividend Index ETF).

Compelling recent performance data but there is short market history here – a huge bull market on its side – only been around since last spring 2024. Interesting geographic tilt too = >50% Europe and >30% Asia stocks.

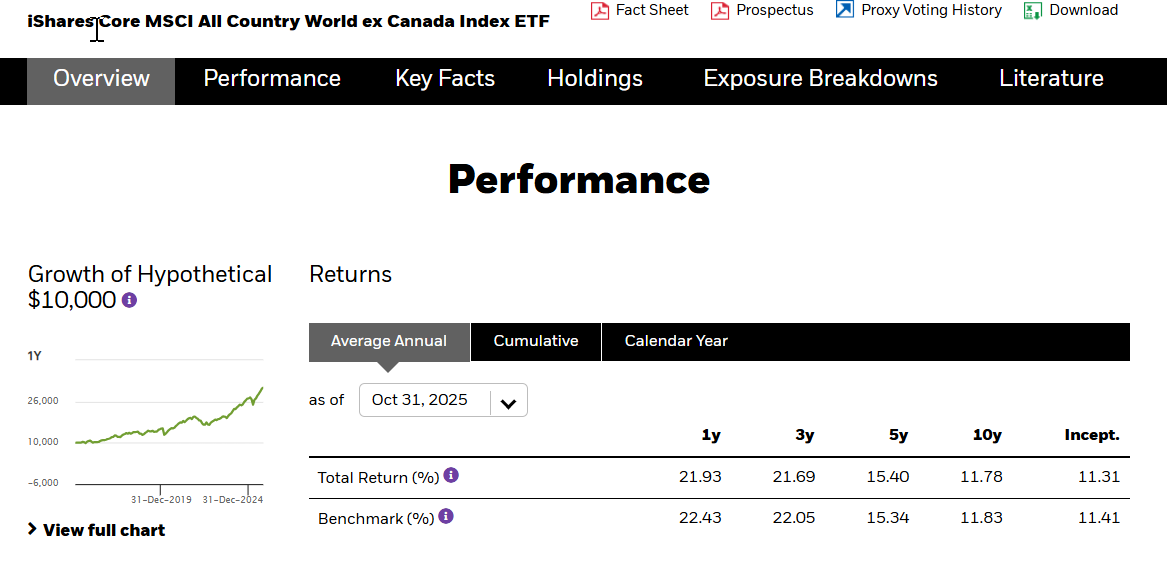

Personally, I’m biased, I like my low-cost growth ETF for ex-Canada in XAW. Boring, lazy, easy to contribute to in CDN $$ and designed to offset the bias I have had over the last 15-years to my mix of Canadian stocks that deliver growing income.

I started buying XAW in 2016.

I’ve only added more units over time leading into 2026 retirement to simplify our retirement income plan.

Nice Q&A with some friends of hybrid investing like me – Dividend Daddy is retired and travelling the world on his dividend and distribution income.

Cashflow is always king.

Interesting takes from Jon Chevreau’s site – what sort of retirement are you pursuing?

Mini-retirement – requires dedicated savings and small investments to cover a short break.Semi-retirement – requires ample savings and investments in order to scale back at work.Early retirement – requires significantly more savings and investments to leave the workforce early on your own terms. (What I have always aspired to do.) This means you do not have any government benefits like CPP or OAS to use until your 60s (like us).

It reminds me of this post on my site: Why Fat FIRE is not realistic for many unless you want to make some frugal choices throughout your 30s and 40s and/or you have a good salary coupled with a high, disciplined, sustained savings rate for investing…while avoiding financial piranhas in the process that charge you high fees.

Weekend Reading – is Fat FIRE realistic?

Over at Cashflows & Portfolios, my partner Joe and I wrote this including some items we both continue to work on ourselves as early semi-retirees. A reminder I continue to honour a 10% discount to all readers for any support with your retirement income planning projections along with a 50% discount (not a typo) to all returning DIY investors who wish to have a few projection reports refreshed after working with us. We are happy to do so of course.

7 Essential Items as part of your Retirement Planning Checklist

From my oldie but goodie collection of posts I tend to revisit…

A Wealth of Common Sense answered the question: why does the stock market go up?

“The stock market goes up over time because businesses get bigger and earn more money over time. If you own stocks, you earn a piece of that growth. The stock market also goes up over the long-term because sometimes it goes down in the short-term.

And if you think about it — the stock market has to go down. It wouldn’t offer such juicy returns if you didn’t get your face ripped off every once and a while.”

Dividend Growth Investor shared a number of companies raising their dividends of late – cash machines, including a Canadian stock he likes in his list. I own it too.

A smart list of all-in-one ETFs to consider owning. I continue to mention here that when in doubt, low-cost all-in-one indexed ETFs are a great way to invest some or all of your portfolio assets to help meet your investing goals.

You can find My Dividends thoughts here.

You can find those all-in-one thoughts on my standing My ETFs page here.

Good analysis by John Heinzl in The Globe on the Telus dividend and a potential cut coming. From John, which I fully agree with as a small shareholder in this company at the time of this post:

“With an already rich yield and a balance sheet under pressure, Telus may be wise to focus less on dividend growth and more on debt reduction and investment. Investors should view a pause or slowdown in dividend hikes not as a red flag, but as a sign of discipline.”

Sometimes, cutting the dividend is wise for a company’s overall financial health – for better long-term shareholder value.

And finally, I’ve read a few interesting articles of late about too-large RRSPs/RRIFs; RRSPs/RRIFs have lots of myths, etc. A bit clickbaity for me. Full stop: large RRSPs/RRIFs accounts balances are a great problem to have. Just like OAS clawbacks are a great problem to have in retirement. Much better than the alternative = not having a very large RRSP/RRIF balance at all.

RRSPs/RRIFs are just tools in your wealth-building toolbox like other accounts.

Happy investing towards your too-large RRSP/RRIF, too-large TFSA or any other account that might grow too large too. Nice problems. I support you!

Thanks for reading, and have a great weekend.

Mark

My name is Mark Seed – the founder, editor and owner of My Own Advisor. As my own DIY financial advisor, I’ve reached financial independence. Now, I share my lessons learned for free on this site. Find out what I did and how I reached financial independence to tailor your own path. Join the newsletter read by thousands.