Stay informed with free updates

Simply sign up to the US equities myFT Digest — delivered directly to your inbox.

US technology stocks sold off as worries mounted over high valuations for artificial intelligence companies and investors braced themselves for earnings later this week from industry titan Nvidia.

The tech-heavy Nasdaq Composite closed down 1.2 per cent after a day of choppy trading, while the broader S&P 500 slipped 0.8 per cent.

Companies at the centre of this year’s AI boom were among the biggest fallers on Wall Street. Chipmaker Nvidia dropped 2.8 per cent, while Microsoft fell 2.7 per cent and Amazon declined 4.4 per cent.

Stock markets globally have risen sharply this year, but the rally has stalled as a growing number of investors warn lofty valuations of leading US AI companies are becoming detached from the fundamentals.

“There’s no question, we’re getting to a more late-cycle stage [of the market rally],” said Johanna Kyrklund, group chief investment officer at Schroders, pointing to “extended valuations” and a “frothy, somewhat bubble environment”.

“We still have exposure to these stocks,” Kyrklund said, but added: “I wouldn’t advocate a passive exposure to this [AI] space at the moment.”

Since September, Amazon, Alphabet, Meta and Oracle have issued a combined $81bn of debt to fund the build-out of AI data centres, according to Bank of America calculations.

But traders are increasingly circumspect about Big Tech’s investment spree and are no longer “blindly rewarding” the hyperscalers’ huge spending commitments, said Charlie McElligott, a strategist at Nomura.

A closely watched survey of fund managers on Tuesday showed a majority of investors think companies are overinvesting — the first time this has been a majority view in data going back to 2005.

“Concerns are mounting over the sheer scale of AI-related capital expenditure and whether monetisation and productivity gains can keep pace,” said Daniel White, head of global equities at M&G, pointing to some estimates putting AI capex at about $7tn of cumulative spending by 2030.

Daniel Pinto, vice-chair of JPMorgan Chase, flagged the risk of a possible market “correction” for some of the Big Tech companies ploughing vast sums into building AI data centres.

“To justify these valuations, you are considering a level of productivity that will happen, but it may not happen as fast as the market is pricing,” Pinto told a Bloomberg conference.

Investors said Nvidia’s earnings announcement, due on Wednesday, would be a crucial moment for markets. Peter Thiel’s hedge fund, Thiel Macro, dropped its entire exposure to Nvidia in the third quarter, according to recent filings that gave a snapshot of holdings at the end of September.

“The renewed sell-off in US tech stocks puts even more of a spotlight on the earnings report of AI bellwether Nvidia,” said Jonas Goltermann, deputy chief markets economist at Capital Economics. “It will set the tone for the wider tech sector over the coming few weeks into the year-end.”

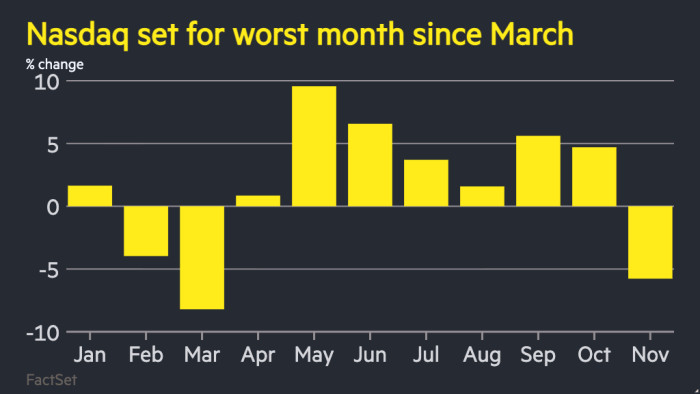

The Nasdaq has fallen more than 5 per cent in November, putting it on track for its first monthly drop since March.

The Vix index, Wall Street’s so-called fear gauge, jumped 11 per cent on Tuesday to a high of 25, above its long-term average.

Some Asian markets opened lower on Wednesday with Korea’s tech heavy Kospi down 0.4 per cent after falling 3.3 per cent a day earlier. Hong Kong’s Hang Seng index opened up 0.1 per cent after falling 1.7 per cent on Tuesday.

Futures trading in European indices pointed to a small rebound later after the Stoxx Europe 600 and Germany’s Dax each closed about 1.8 per cent lower on Tuesday.

Investors will also be watching the September US jobs report on Thursday, which was delayed by the longest shutdown of the federal government.

The December Federal Reserve decision is now on a knife-edge, with traders divided 50-50 about whether the US central bank will cut or hold interest rates, compared with expectations a month ago that a cut was nearly assured.

Higher rates tend to be negative for fast-growing companies.

The market moves came as Home Depot warned economic uncertainty was weighing on its sales. The retailer’s shares slid 6 per cent.

Government bonds rallied as investors moved away from riskier assets. The yield on the 10-year US Treasury fell 0.02 percentage points to 4.12 per cent. Yields move inversely to prices.